3 Factors Driving Stocks Through the COVID-19 Bear Market

The U.S. markets have steadily climbed a virtual “wall of worry” over the past couple of months through the COVID-19 bear market’s vicious repercussions while baffling financial experts and investors along the way.

Markets have previously brushed off geopolitical events, but the behavior gap between the markets and world events today is unprecedented, while on the cusp of a recession.

Historic unemployment and plummeting GDP numbers amidst the backdrop of a global pandemic and quarantine, along with racial injustice and protests, makes it feel worse than some of the remnants of the ’30 era depression and 60’s racial discontent combined.

Crashes are driven by panic and crowd behavior in as much as by underlying economic fundamentals. It’s important for investors to contemplate short- and long-term factors that can drive markets through perilous conditions and uncertainty.

A stock’s price is theoretically derived from the present value of future earnings six to 12 months in the future. The stock market does not care about catastrophic news from last month nor from next month. In the short term, optimistic headlines seem to be canceling out negative news, while keeping the stock market buoyant. A year of bad earnings under a discounted cash flow model can be minimized as long as they bounce back the next year.

We do not diminish the pain and suffering from COVID-19 mortality to astonishing unemployment numbers and falling GDP. Yet, if you believe that America will reopen, jobs will return and a vaccine for COVID-19 will be found by mid-2021, buying “low” into the “bear-abyss” while employing a diversified portfolio based on your goals and appetite for risk could be highly beneficial in the long run.

As we discussed in our blog “Buy in May,” if seasons behaved like the bear and bull markets of recent decades, there would be beautiful weather 11 months out of the year. This is why its critical for long term investors to stay the course and not derail their money and long term plans by taking swift, short term action with their savings by cashing out or buying complicated, illiquid investments as a hedge.

Three Drivers for Stocks

The stock market seems unshaken as signs of a deep coronavirus recession pile higher and governors are not rushing to fully lift the national quarantine. As quickly as the S&P 500 spun out of its 11-year bull run near Valentine’s Day, down near 35% in March from its high, it soared out of bear-market territory (into a new bull market?) and surged 29% in just over three weeks through April.

Analysts forecasting results for individual companies expect S&P 500 profits to decline 18% this year, according to FactSet, a stark reversal from their call at the beginning of the year for 9.2% growth. That estimate has continued to drop in recent weeks as first-quarter results have trickled in from about 55% of the companies in the index.

The following are three potential drivers for stocks to continue forward through gloomy economic forecasts and bleak data.

1 Optimism

In our opinion, optimistic institutional and retail investors are buying stocks while helping to drive up prices. The stock market is rising partially because perhaps they believe much of the current negative news may be “priced in,” the COVID-19 will not have a “second wave” and a vaccine will be discovered and approved.

Many may believe that America will “reopen” with much of the millions of unemployed getting absorbed back into the workforce system faster than past crash casualties- from the airlines and cruise lines to hotels and hospitality (hardest hit industries). This will lead Americans to resume consuming goods and services, a main driver (70%) to stocks and the economy as we discussed in consumer behavior.

2 Fed Intervention

The Federal Reserve’s “play book” with the Coronavirus Aid, Relief, and Economic Security (CARES) to help ensure the public health crisis will not translate to a financial market collapse has also helped to maintain if not elevate stock prices.

Their actions have been unprecedented, like putting out a house fire with Niagara Falls by rapidly plugging a $6 trillion dollar “leak” and loss of revenue and income.

In the past few months, they utilized both new and old programs to help keep liquidity high and credit flowing where it’s needed. Simply put, the Fed is trying to ensure that credit continues to flow to households and businesses during this difficult time and that the financial system doesn’t amplify the shock to the economy.

In March the Fed approved to infuse $5 trillion into money markets, slashed interest rate close to zero, created lending programs for small employers, households, and large businesses. “Unlimited” QE (quantitative easing) or the purchases of Treasury bonds and mortgage-backed securities added additional liquidity to the crashing markets so that credit can continue to flow.

Other measures by the Fed included temporarily relaxing regulatory banking requirements for lending, direct lending to major corporate employers, direct lending to state and municipal governments and loans to small- and mid-sized businesses on April 9th through the Small Business Administration’s Paycheck Protection Program (PPP).

3 Interest Rates

One of the far-reaching impacts of the nationwide shutdown due to the novel coronavirus has been on interest rates. The sudden slowdown in economic growth, the Fed’s emergency monetary policy, low inflation, and longer-term growth trends have collectively pushed Treasury yields down while helping to boost stock valuations along with influencing spending, borrowing and refinancing, as our observation.

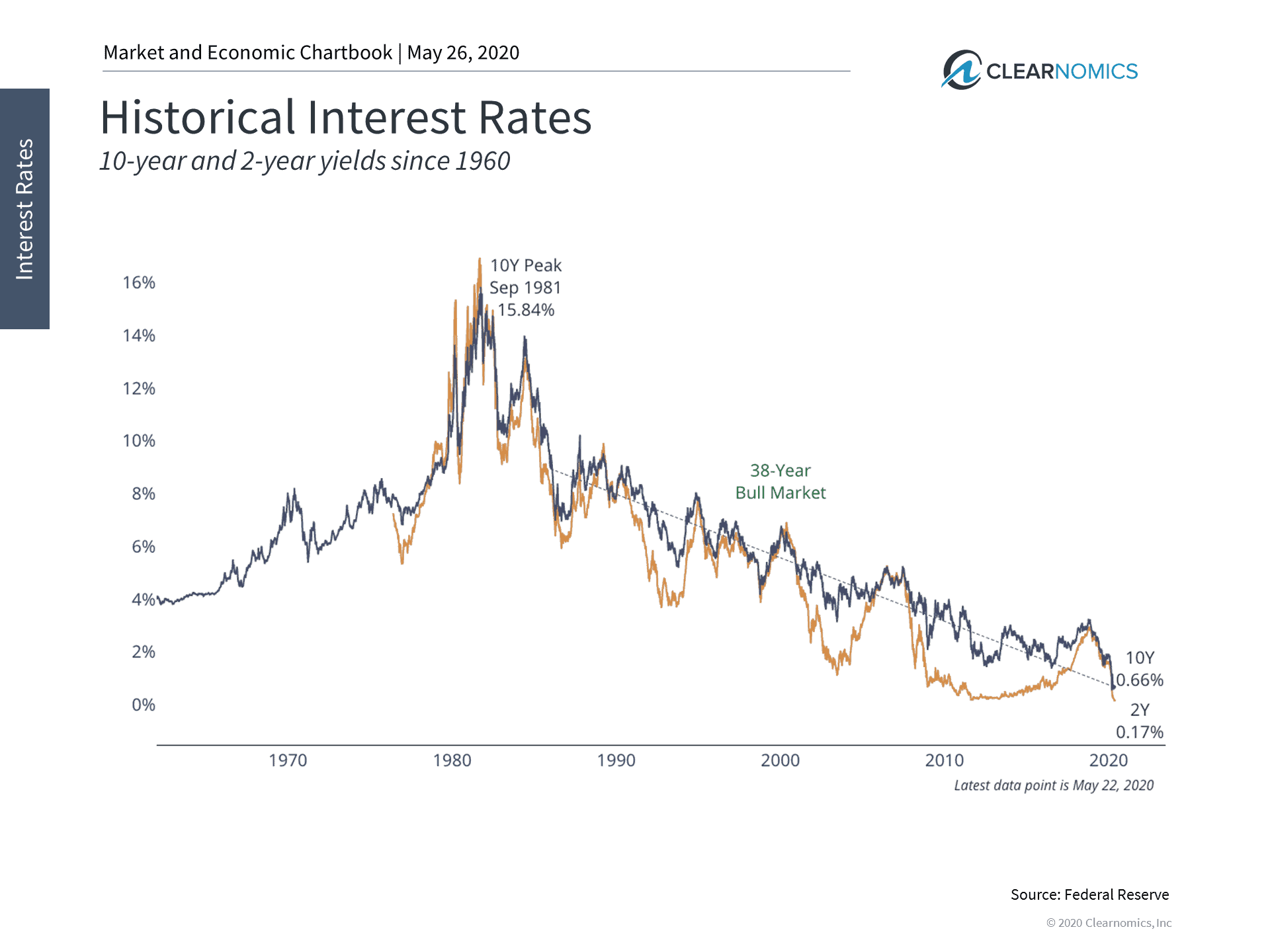

U.S interest rates as benchmarked by the 10 Year Treasury rate are hovering near a historical low near .65 basis point today- since the highs (near 16%!) back in the early 80’s when then President Reagan took office (see chart below.) The Fed slashing rates down near zero is a tactic to also help ensure liquidity and lending from Wall Street to main street – as well as encouraging investors to seek yield from higher risk (stock) assets.

In response, demand for stocks should not come as a shock as institutional investors to retirees alike have very little choices left for yield. Retirees requiring a 4% distribution bogey to pay their bills while keeping up with inflation and taxes may have trouble meeting this goal from CD’s, money markets, treasuries and investment grade bonds. Many established large cap companies with strong balance sheets are providing dividend yields near 3%.

The competition between stocks and bonds: When Treasury and high-grade bond yields are low, stocks become more attractive both in terms of their dividend yields and the reduced opportunity cost of holding risky assets. Although there are many trends to tease out, market valuations were certainly elevated at the onset of the COVID-19 crisis.

Although the economy is beginning to reopen, there could continue to be pressure on interest rates. There will no doubt be more terrible backward-looking economic numbers in the coming months. Additionally, many government bond yields in other parts of the world – are still in negative territory. Translation: don’t expect roaring inflation or rates anytime soon.

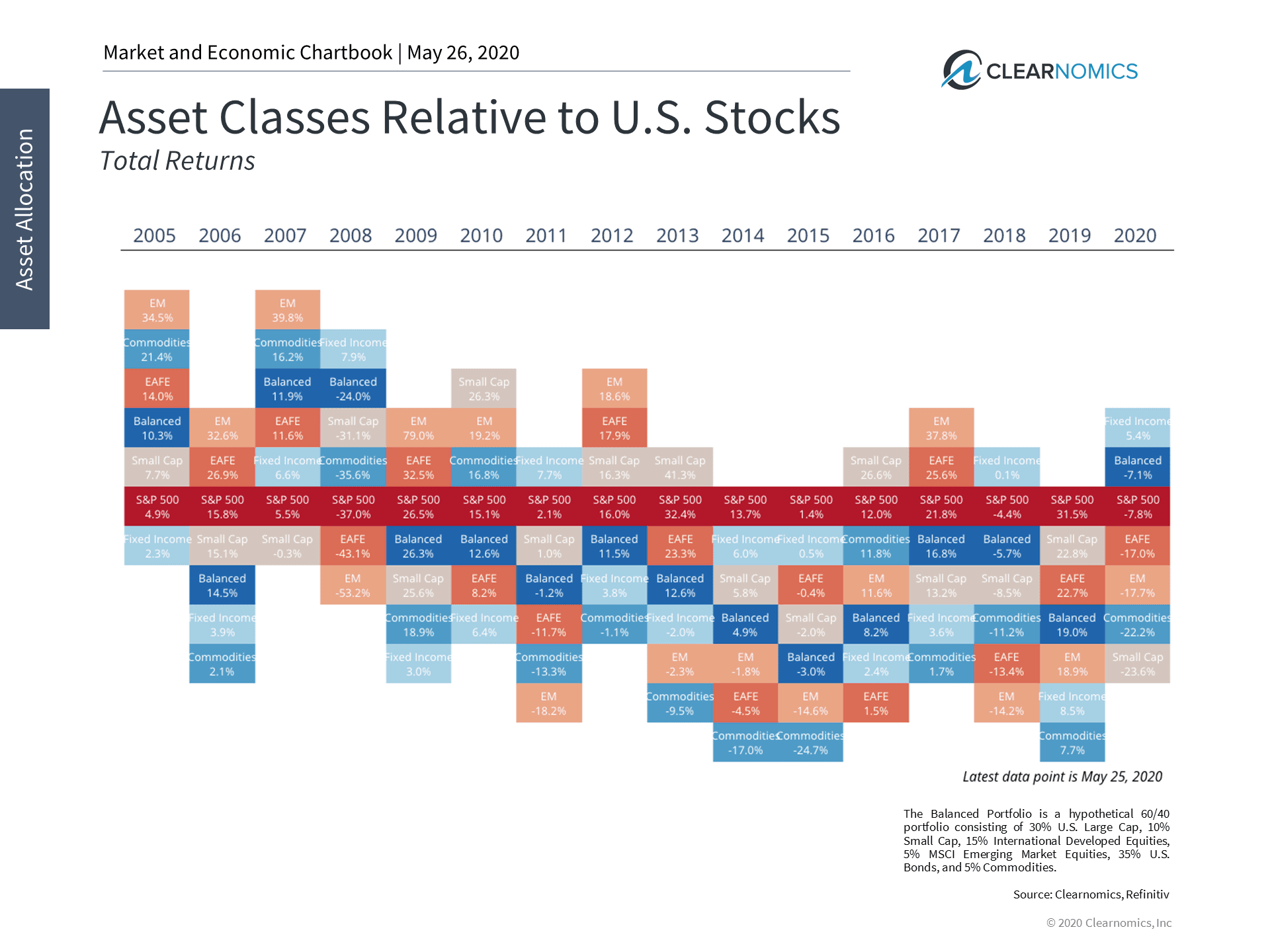

For long-term investors, it’s important to stay diversified as economic uncertainty continues. This is because the flip side of falling interest rates has been the bonus of rising fixed income prices (see below.) Thus, even when the asset class generates little income, bonds still help to stabilize portfolios when inclement weather hits, just as they have done throughout this year.

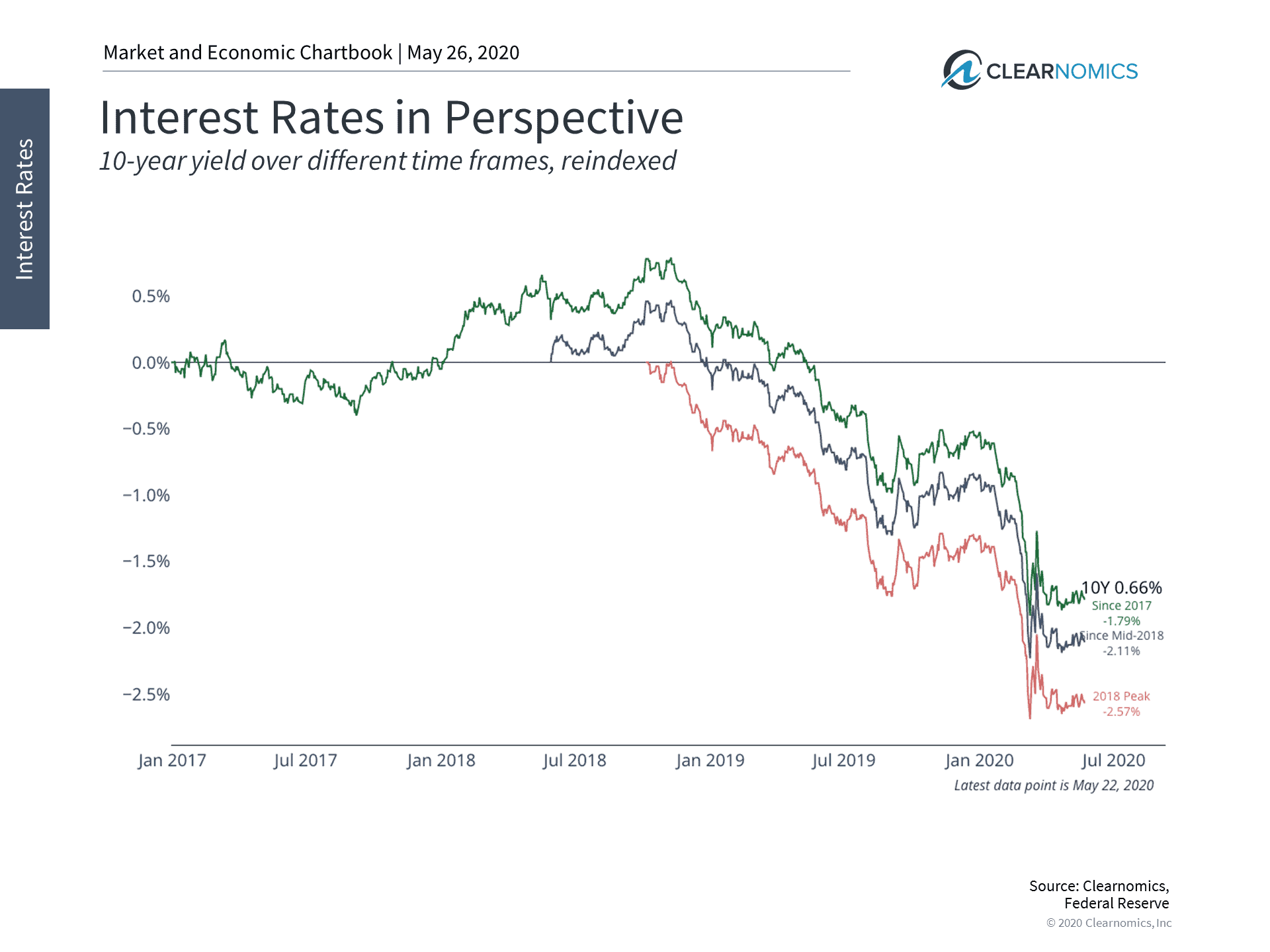

Below are three charts that help to put historically low interest rates in perspective.

Interest rates are at historic lows

Interest rates have been declining over the past 40 years. However, many of the factors that have affected rates over the past few decades are related to longer-term trends such as slowing growth, demographics, a glut of savings, technology, and more.

Rates have plummeted since late 2018

More recently, interest rates have plunged to new historic lows as the economic shutdown from the novel coronavirus has rattled markets. Rates began this decline during the market volatility of late 2018. Over this period, the 10-year Treasury yield has fallen by nearly 2.6%.

In the near-term, low rates, if they are available to borrowers, could help the economy as it reopens.

Bonds have helped to stabilize diversified portfolios

Although government and high-grade bond yields have generated little portfolio income for investors over the past decade, they have still helped to stabilize portfolios. There is no better proof of this than this year. Diversified bonds are outperforming other asset classes and have helped support balanced portfolios.

You can see the divergence in asset classes (above) with the bond index up over 5% YTD and small caps down over 23% YTD. Developing and executing a strategic- diversified “all weather” portfolio is key.

The bottom line? Interest rates are near historic lows which could boost the economy over time. Investors should continue to be diversified with stocks and bonds to navigate economic uncertainty.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us .

Diversification does not ensure a profit or protect against losses

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.