Consumer Behavior as America Reopens

The whole planet seems a bit surreal like a sci-fi movie with a good portion of the world’s 7.8 Billion population having been quarantined for over two months, with businesses and families forced to change and adapt to new ways of work, living and retirement.

Many Tech companies benefiting from “sheltering in place” mandates have been profitable this year through the man-made Bear market, helping us to efficiently order groceries, attend fitness classes, check up on friends, market our small business, bill clients and attend virtual work meetings almost simultaneously.

Human /tech amalgamation powered by data, quants and deep learning may permanently change our daily routines and behavior after America opens forever with potentially millions of people continuing to work from home, to “zooming” into college classes, doctor appointments and sales meetings, to virtual cocktail hours and even baby showers.

As a positive outcome to this pandemic, we may be gaining “time” (and family time) back into or lives, as well as being a bit more environmentally friendly by driving and traveling less. Those returning to the workplace from Wall Street banks to Michigan automotive plants (with greatly different constraints), corporations are working swiftly to implement new work and safety procedures.

Small Business Post Quarantine

Essential small businesses like podiatry or dentist offices with a backlog of demand, may quickly rebound once the quarantine ends while taking new measures to protect both employees and patients. Small business owners, especially those in the retail and hospitality space are going through a more difficult seismic shift with new- government mandated opening requirements, along with shoppers’ concerns being reshaped from the pandemic.

Most retailers face a very uncertain future to get past this 2020 man-made bear market, but one thing is quite clear: the long and ongoing shift to an “internet-based” business model and a greater focus to online branding, advertising and sales will accelerate. Consumer habits and the shift to online shopping were already changing the competition and landscape before the lock down, led by Amazon and their fleet of “Prime” delivery trucks seeming to be everywhere.

Some local business owners we have talked to in Boca Raton (pictured) have quickly adapted to the COVID-19 quarantine by implementing new ways to safely meet with clients including curbside service, while focusing more time and resources to advance their online sales and marketing to adapt to consumers’ changing behavior.

Other more traditional brick-and-mortar retailers that were late to the online game and have been losing ground for years to rivals may need to revisit their strategy quickly. Without a strong internet presence, retailers struggling with the pandemic are unlikely to survive in the long run.

Consumer Spending

In the U.S., consumer spending is the backbone of the economy, constituting over two-thirds (70%) of our $20 trillion GDP. This includes spending on all goods and services, large and small. In normal times, many factors affect the level of consumer purchases including consumer confidence, the job market, household net worth, inflation, the stock market and more. Of the various components of GDP, consumer spending has been the most stable over the past decade at a time when government spending has fluctuated, business spending has been low, and the country has been a net importer of goods.

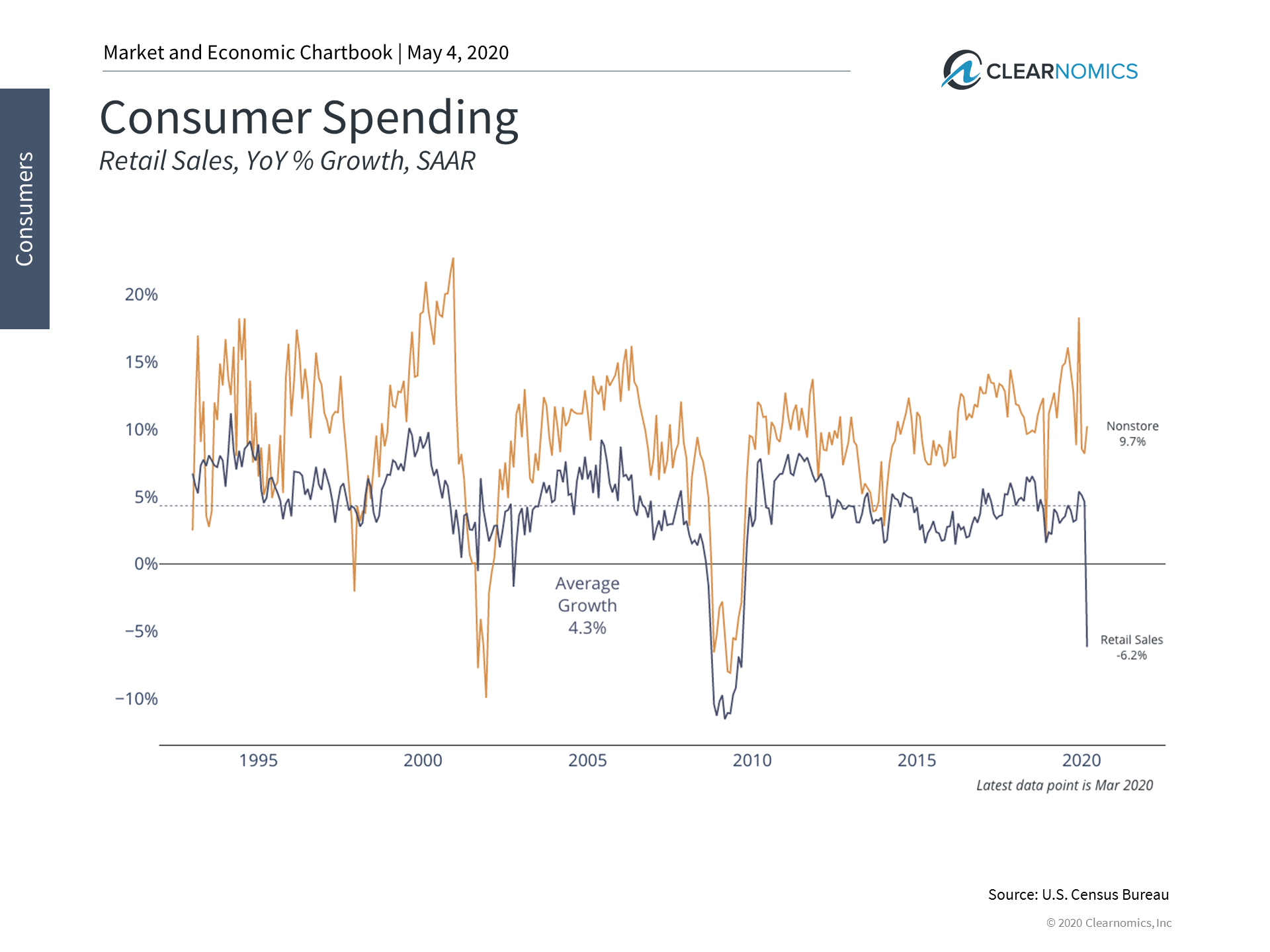

However, it should come as no surprise that the economic shutdown due to the coronavirus has resulted in plummeting consumer spending. Not only are some consumers unwilling to spend due to economic and stock market uncertainty, but for the first time, the nationwide lockdown means that many are barred from doing so. Some substitution of spending has taken place, e.g. from restaurants to grocery stores or from in-store to online, but this doesn’t begin to make up for the overall decline. For instance, after growing an average of 4% per year, there are signs that retail sales shrank by 6.2% in March.

3 Factors to Consumer Activity

Given the importance of consumer activity, there are three considerations when it comes to the broader economy once the country begins to reopen.

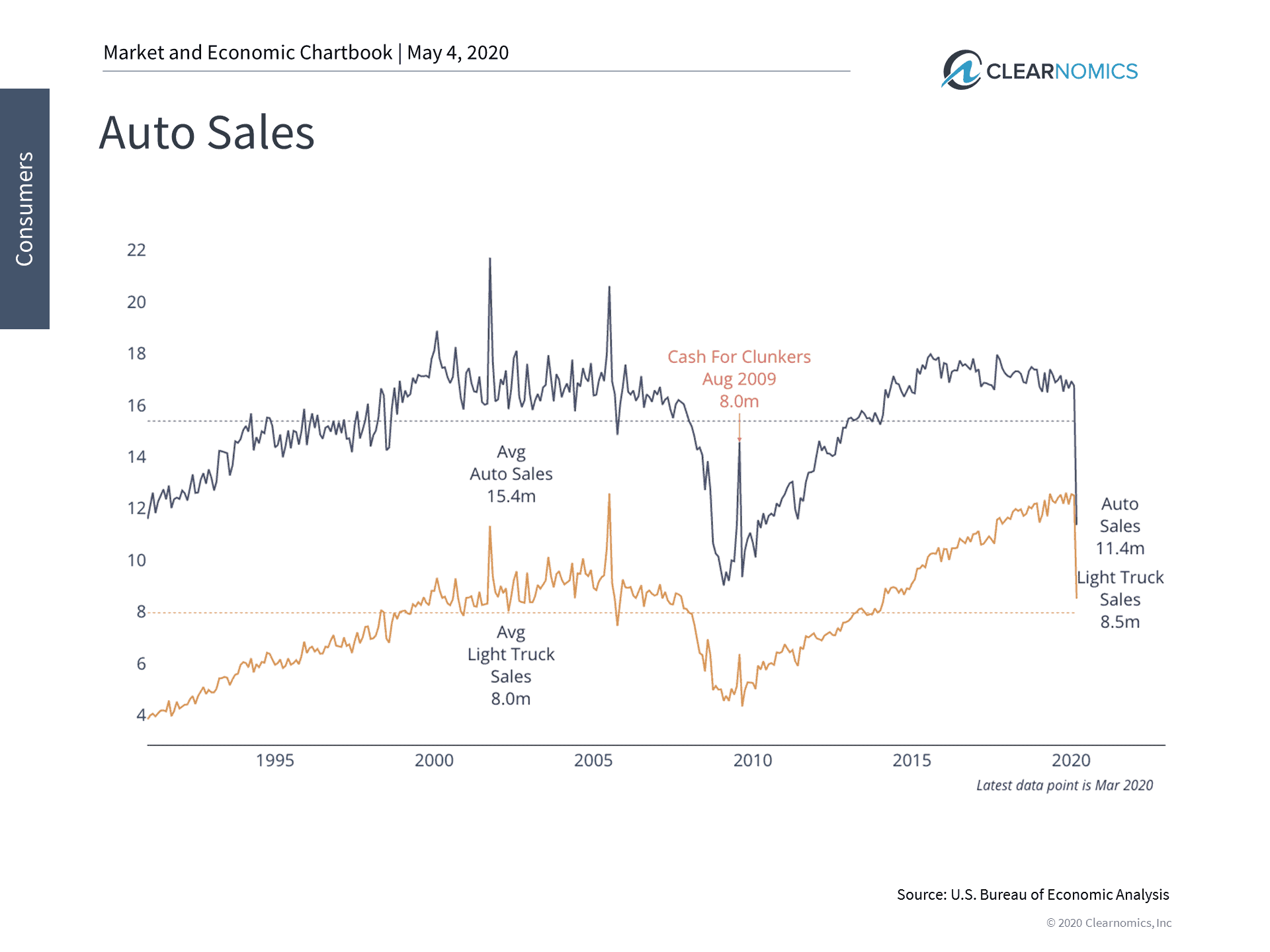

First, while some portion of this spending is likely to be lost forever, especially when it comes to dining out, some purchases may simply be delayed. New automobiles, for instance, will be needed regardless of whether they can be pushed back a few months. The same is true of other durable goods and household necessities which can only be fixed with duct tape for so long.

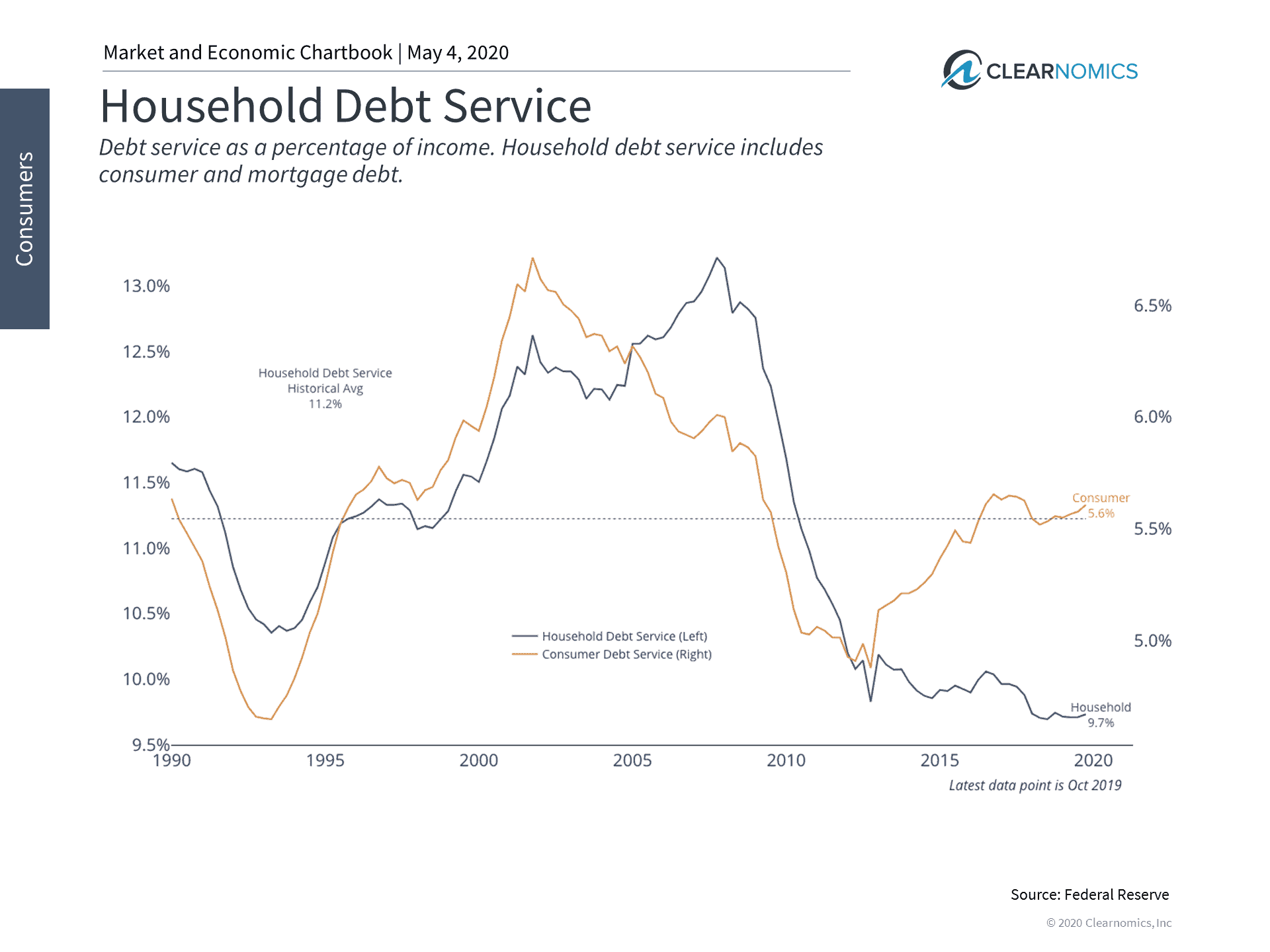

Second, consumers will only make up delayed purchases if they are in a financial position to do so once the economy reopens. Fortunately, average household debt levels are much lower this cycle than in the past, making it more likely that many can weather this crisis. (see below) This is especially true when low mortgage rates are taken into consideration.

Of course, not all households are created equal which is why government support, including via the CARES act, has been important. However, like the economy as a whole, the average American consumer was in a healthy position entering the crisis. Overall household net worth exceeded $118 trillion according to the Federal Reserve’s last estimate, unemployment was near 50-year lows and wages were rising faster than inflation.

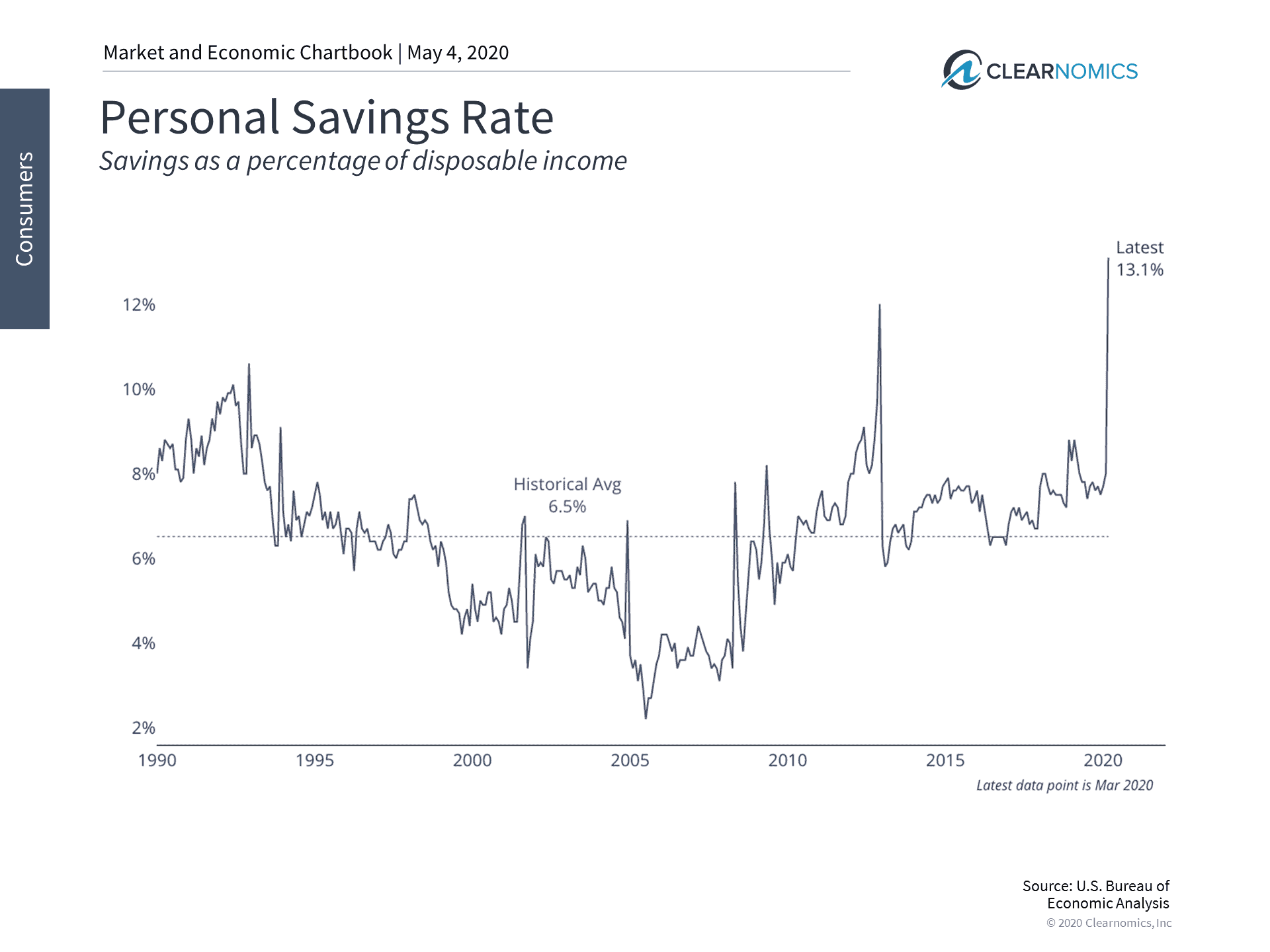

Third, the silver lining, to the extent there is one, is that household savings rates have skyrocketed to 40-year highs over the past several weeks. (see below) This is the obvious flip side to a lack of spending – for those receiving paychecks, more will be kept as cash and investments. Additionally, for those who are in a position to borrow and spend, interest rates will likely remain low for quite some time, with the 10-year Treasury yield currently hovering around 0.6% and the 30-year mortgage rate under 3.5% nationwide.

Thus, those who were ready to make larger purchases before this crisis may find it even more attractive to do so in the coming months. While the consumer spending and retail sales numbers may be worrisome, some will likely make catch-up purchases once the economy reopens. Investors with a long-term perspective should see through the current decline to better understand the future of the economy. Below are four charts that help to put the state of the U.S. consumer in perspective.

1. Consumer spending has plummeted

As expected, retail sales have plunged due to the nationwide shutdown from the coronavirus. Non-store sales (i.e. online retailers) have held up better than brick-and-mortar stores, although this may change as new data become available. Overall, consumers have cut back on discretionary spending due to an inability to shop and a reduced willingness to do so given the economic environment.

2. Spending on large durable goods have fallen as well

This is also true of larger purchases, including cars and trucks. However, these purchases are different since many Americans need cars even if they are able to delay these purchases by a few months. The same is true of household appliances and other durable goods.

3. Households are in a better debt position than in the past

Fortunately, households are in a better debt position than in the past. Overall household debt service (the amount spent paying down debt) has remained relatively low. This is in no small part due to lower interest rates for mortgages. Excluding mortgages, overall consumer debt service (the orange line in the chart above) has increased, but is still lower than during the mid-2000s.

4. Savings rates have skyrocketed in recent weeks

Unsurprisingly, personal savings rates have jumped due to the lack of spending. On average, this means that some consumers will be in a better financial position once the economy reopens and may potentially make up for some postponed purchases.

The bottom line? Consumer behavior and spending habits may be forever changed by the COVID-19 bear market and quarantine. While consumer spending may start moving the economy forward once America reopens, small business owners may need to revisit their online marketing and sales strategy to compete and survive.

Long-term investors should continue to focus on these economic fundamentals as the crisis and ensuing recession evolves. They should focus on remaining disciplined and ensuring their balanced portfolios match their long-term financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.