Don’t Run with the Bulls Just Yet

While the Running of the Bulls event and festivals will be back in action at the top of July in Pamplona Spain, don’t get too excited to run with the bulls on Wall Street just yet from some of the headlines promoting a “new” bull market has arrived this month.

Investors are running out of patience over the 18-month bear market that just won’t go back to hibernation, while avidly listening to the financial news and media experts that just can’t seem to pin down if we are in a new bull market, or instead at the tipping point of a major recession. This is all enough to make your head spin without going back in time with your DeLorean to the 80’s Volcker- inflation and resulting crash debacle period to analyze past market cycles and Fed intervention results.

Should you bail out of your balanced, boring portfolio and instead split your savings between popular high yield money markets, gold, crypto and hot tech stocks that are now getting a bit “bubblicious” from the artificial intelligence and ChatGPT tools craze? The short answer is no. We remind long-term investors if they want thrills and excitement to keep a small “Vegas” trading account on the side, or perhaps actually go to Vegas. Investing for a two- or three-decade retirement should involve a disciplined, diversified, and patient approach.

Bears and Bulls

Despite record low investor sentiment, some investors are cheering the S&P 500 rising more than 20% above the stock market low set on Oct. 12, 2022, as one definition of the start to a new bull market. Yet, for many other investors including our team, two things are required for a new S&P 500 bull market to be proclaimed. First, the index must rise 20% above its prior bear market low. Second, the index must reach an all-new time high, which it has not.

The bear is not quite out of the woods just yet to give the “all clear” sign despite many positive economic indicators including strong employment numbers and consumer spending, though both are trending down a bit. Consider market breadth where nearly half the stocks in the S&P 500 index are in negative territory while only a handful of mega-cap tech stocks are supporting the markets on their shoulders.

This may come then as no surprise that the (price weighted) DJIA Index is only treading near 2% vs the (market cap weighted) tech-heavy S&P 500 Index near 13% YTD. Still, the current situation should not be confused with the dotcom bubble and bust, as we have discussed the similarities and differences in past articles. It will take some time for the pattern of the overbought to now oversold market to balance out.

VIX Signals

The VIX (fear index), trending near 13 this week, is at a historical low not seen since 2019 before the pandemic crash pushed it up to near 66 by March of 2020. The VIX is based on the implied volatility of S&P 500 Index options and is used to gauge market sentiment and see how fearful, or uncertain, the market is.

Jon here. Consider that economists were created to make weather forecasters look good, and no one owns a working crystal ball. Perhaps with a bit more ballast than a crystal ball or crazy-8 ball, the CBOE Volatility Index (VIX) may have just priced out the risk of a U.S. recession as minimal investors are betting against the stock market from failing.

Still, we can give economists their say. The World Economic Forum (WEF) recent poll of economists indicated that respondents were split evenly down the middle, (50/50) on the chance of an impending recession. This is actually a great improvement from the 70% recession prediction tallied in January, despite the recent banking crisis, lingering inflation, an inverted yield curve, elevated interest rates and a slowing economy. Perhaps they are considering a less hawkish, and more patient Fed not leading us down the road to a great 80’s -type recession.

Rolling Down and Rolling Up

While we may not have had an official recession (even from the top of 2021 decline) as coined by the National Bureau of Economic Research, there have been different sectors rolling over through their own mini recessions the past 18 months, including real estate and banks/financial sectors leading the way. While the Fed has been trying to crush job openings and employment in general, that may not greatly come to fruition. People are spending money and buying new houses despite lingering high inflation, interest and mortgage rates.

Strong Stock Market Returns

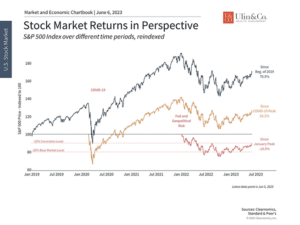

Despite all the amazing economic and financial problems combined with negative headlines this year, the stock market has made significant year-to-date gains. (chart). This is further evidence that markets often defy expectations and can rebound when it’s least expected, especially when investors are overly focused on short-term events.

Investor sentiment tends to swing from one extreme to the other. At the start of the year, many investors and economists were certain there would be a recession within months that would result in higher unemployment and Fed rate cuts.

Markets have made considerable gains over the past few years

As we approach the second half of the year, no recession has yet materialized, and many economic trends have surprised to the upside. Headline inflation measures have improved although core inflation remains stubborn. Interest rates have stabilized. These factors have helped tech stocks rebound, especially in areas related to artificial intelligence while popular sectors from last year like energy are in the red.

Despite the strong market gains this year, it’s unlikely that investors feel comfortable in the current environment. There is always something new to worry about, a concept often referred to as the “wall of worry.” The wall never shrinks – new building blocks are continually added as investor focus and media coverage shift to the next set of worries.

A focus on day-to-day headlines naturally leads investors to have a glass-half-empty view. After all, current events tend to dwell on unexpected negative events, rather than on the steadier, less noticeable progress that drives stock market returns over years and decades. Today, this short-termism reminds investors that major indices are still in the red when compared to last year’s all-time highs, and that many thorny market and economic issues are still unresolved.

This is why it’s often important to view the market with a broader perspective. The glass-half-full view, which is much more appropriate for long-term investors, is that many of these issues are slowly improving. As a result, the market has risen 21% from last year’s market bottom, and 71% since the beginning of 2019, despite all of the intervening events. (chart) These are figures that everyday investors would likely be unaware of if they only followed the day-to-day headlines.

The economy continues to grow despite recession fears

Of course, this is not to say that markets only go up or that there is never anything to worry about. Instead, these facts are a reminder for investors to stay disciplined, in both good and bad markets, and to stick with their financial plans. Just as pilots often remind passengers to keep their seatbelts fastened even when the air is calm, periods of positive market performance are the best times for investors to stay balanced and prepare for future uncertainty.

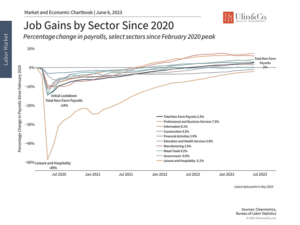

The latest data confirm that the economy is doing better than many feared just a few months ago. Despite what economic theory would predict, Fed rate hikes have had little impact on the labor market so far. The recent jobs report showed that 339,000 new positions were created last month, many more than forecasted. Unemployment did tick up to 3.7%, but it has been fluctuating around these levels since last August. What’s more, recent data also show an increase in the number of job openings back above 10 million across the country. Thus, despite recession concerns and shocks such as tech layoffs and the failure of a few mid-sized banks, there are still 1.7 job openings for each unemployed person.

Getting invested is often better than trying to time the market

Other issues that have been on investors’ minds have also been resolved, if only temporarily. The latest debt ceiling bill was signed into law after months of posturing and last-minute negotiations. While many of these same issues will re-emerge in the future during budget talks and again after the next presidential election, the worst-case scenario of a government debt default has been averted. Similarly, the banking crisis has stabilized after the failure and acquisition of First Republic Bank over a month ago. While the situation is ongoing, broad financial contagion has not occurred. These events have given investors some much-needed breathing room.

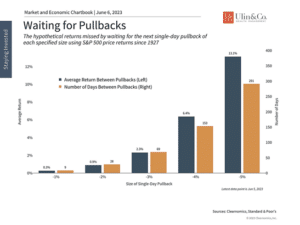

The fact that there are risks for investors to navigate is not only normal, but is always the case. The truth is that there are always reasons to be concerned when it comes to the economy and world events. However, this is also why investors are rewarded in the long run. As the accompanying chart shows, getting or staying invested, rather than trying to wait for the next big pullback, is the best approach. Investors should not let news headlines and constant uncertainty jeopardize their financial plans.

The bottom line? The stock market has performed well this year despite ongoing market and economic challenges. This is further reason for investors to focus on the long run and stick to their financial plan and asset management strategy. Still, don’t run with the bulls just yet (or get overly enthusiastic) even though the S&P 500 has advanced more than 20% since the low set last October.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.