Bitcoin, Gold & the Dollar Through Turbulence

Speculative assets gained momentum with the onset of the pandemic through the crazy-covid spending frenzy, fueled by too much cash, liquidity, and crypto in the system. Hot alternatives were all the rage more so than Bitcoin, such as high-end collector watches, jewelry, gold, numismatic coins, collector cars, fine art, fine-wine, and even music right

Many of these unorthodox investment moves not only bestow the pleasures of tangible ownership like kicking the tires on a new car but aren’t tied to the ups and downs of capital markets, crypto or real estate. While these speculative assets may be suitable for a small portion of your net worth, consider you can’t shop at a grocery or retail store, put gas in your car, or pay your podiatry bill with a diamond or a South African Krugerrand gold coin.

According to a recent Gallup survey, nearly 50% of people in the U.S. are now worried about the safety of money in banks. This is added fuel to the fire in addition to the ongoing panic from the great inflation bear market and the upcoming debt ceiling debacle. Recent events may be chipping away at many investors’ patience and confidence to perhaps now buy a Rolex, some crypto, a gold bar and a couple bottles of red fine wine due to fear and uncertainty and not greed.

Bitcoin to Gold

Bitcoin is a faith-based currency on the blockchain with no regulation or government backing, which may be some of the appeal. While there may be some traction among businesses to accept crypto as payment, only a sliver of small to large companies participate. Bitcoin is not going to topple the dollar anytime soon. Bitcoin was originally dubbed as “digital gold” because it had a low correlation with stocks, making it useful for storing value and hedging inflation, though this did not seem to be the case over the past year.

A wave of investors, weary from bitcoin’s wild swings, are showing symptoms of the same contagion that gripped pharaohs and pirates: gold fever. In an about face, a recent WSJ headline noted, “How to Buy Gold’ hits a google record as crypto investors chase world’s oldest asset.” The old-school precious metal has new allure for younger generations seeking a respite from the cryptocurrency roller coaster and older investors seeking shelter from stocks.

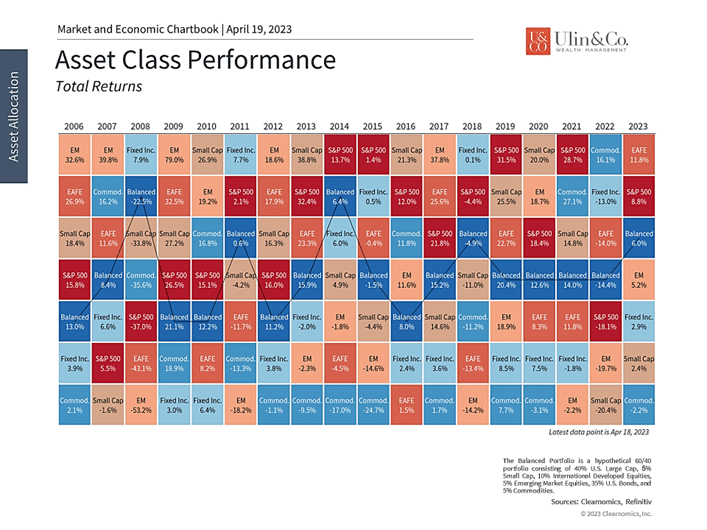

What’s most amazing Is that investors are buying gold at a premium, are still a bit caught up in the crypto-craze, and not seeing the value of buying stocks at a discount – inside or outside their employer retirement account. As the fear hedge and inflation hedge “shine” of gold wears off, you may end up with losses over time, as we saw the gold index get cut almost in half between 2011 and 2012.

The U.S. Dollar is Alive and Well

For many, the value of the U.S. dollar is viewed as a barometer of the country’s importance on the global stage. Many worry that the dollar could lose this status through poor U.S. policies or from competing currencies such as the renminbi.

To borrow Mark Twain’s legendary line, reports of the dollar’s death are greatly exaggerated. While the role of the dollar has declined by some measures over the past two decades, fears of the dollar’s downfall, or replacement, are not news or happening anytime soon. The official motto of the United States coined in 1956 was “In God We Trust” denoting that the political and economic prosperity of our nation is in God’s hands.

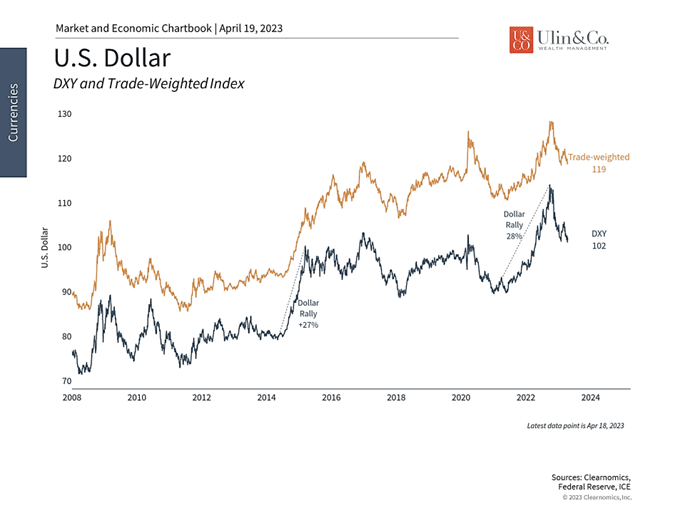

The dollar remains strong over time

In the 1980s, it was feared that the yen would overtake the dollar as the Japanese economy boomed. Since the 2000s, it has been feared that the euro or the Chinese renminbi would become a new global reserve currency. More recently, some expected cryptocurrencies such as Bitcoin to quickly upend the dollar-based system. Despite numerous challenges to the dollar and concerns over U.S. fiscal and monetary policies, none of these scenarios have yet occurred.

While the dollar’s importance should not be taken for granted, it’s important to have a broader perspective on why it remains the world’s reserve currency. The value of any major currency reflects a wide array of global economic trends and, as a medium of exchange, permeates every part of the global economy. The dollar plays a central role in this dynamic.

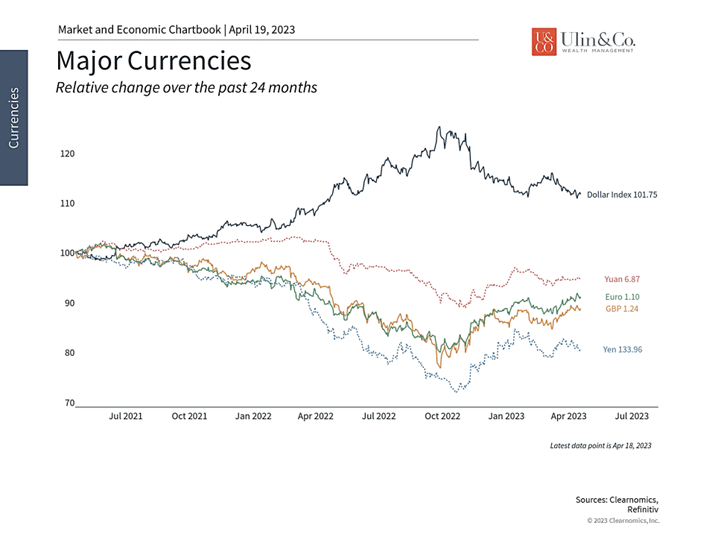

According to the IMF, the dollar made up 58% of the world’s currency reserves held by central banks at the end of 2022. The next largest share was held by the euro at 20%, followed by the yen and British pound at 6% and 5%, respectively. The Chinese renminbi’s trails far behind at only 2.7%.

The dollar reached parity with the Euro

These numbers put into perspective the latest headlines around several emerging market countries, known collectively as the BRICS nations, that plan to increase competition with the dollar. These countries, of which China is the largest, established the Shanghai-based New Development Bank in 2014 as an alternative to the World Bank and the IMF. While this may help reduce these countries’ reliance on the dollar in some areas of trade and in foreign debt, it does not solve the underlying need for a currency that is stable and trusted globally.

A case in point is that during times of stress, investors often flock to the dollar as a safe haven asset. Even as inflation began to rise in 2021, which would normally weaken a currency, the dollar rallied due to the robust U.S. economic recovery compared to the rest of the world and the prudent tightening of monetary policy by the Fed. The dollar even reached parity with the euro last year for the first time since 2002. So, while the rise of China in the geopolitical and economic spheres should not be underestimated, this does not mean that the dollar will be supplanted overnight.

While Americans do benefit from a trusted dollar, what’s important is that the dollar is trusted globally because of the vibrancy and strength of the U.S. economy. After all, the dollar is not backed by gold but by the “full faith and credit” of the U.S. government. Thus, the dollar reflects expectations around the prudent management of the economy, geopolitical issues, inflation concerns, and many other factors.

3 ways the value of the dollar will impact portfolios

First, the importance of the dollar doesn’t tell the whole story since having a currency that is too strong can be problematic if it makes U.S. goods and services more expensive to the rest of the world. In other words, a stronger dollar can make it more difficult for U.S. companies to compete abroad, reducing profitability.

Around 2015, a surging U.S. dollar resulted in an “earnings recession,” driven also by the fact that the share of international revenue for U.S. companies has increased over time. Thus, having the dollar at a sensible level is often better than a dollar that is too strong. Fortunately, the dollar has backed away from its recent peaks with the dollar index (DXY) declining from around 114 to 102 in recent months.

A weaker dollar is a tailwind for international investments

Second, just as a dollar that is too strong may not be ideal for global corporations, it can also act as a drag on foreign investment returns by U.S. investors. In general, currencies can add an additional layer of complexity to international investing that doesn’t exist when buying and selling domestic stocks. When the dollar strengthens, international investments lose value for dollar-based investors since they are made in foreign currencies which become weaker.

This dynamic hurt foreign returns last year alongside many other challenges. Fortunately, it’s the direction and not the level that matters, and the weakening dollar has helped to push international returns higher this year. The MSCI EAFE index of developed market stocks, for instance, has generated a total return of 11.6% in dollar terms so far this year while the MSCI EM index of emerging market stocks has returned 5.2%. A falling dollar is a tailwind for these international indices.

Third, fiat currencies – i.e., currencies not backed by gold – are only trusted to the extent that their countries maintain appropriate fiscal and monetary policies. Thus, an important driver of the dollar rally last year was the Fed’s rate hikes in response to inflation alongside the shrinking money supply. Conversely, the expected pause in Fed rate hikes later this year is one important reason the dollar may be weaker in the coming months. This could help support corporate profitability as well as investor returns.

The bottom line? There will always be concerns around the dollar’s place in the global economy with predictions of gold, bitcoin or other new currencies taking the lead. Investors should maintain a broader perspective on why the dollar plays such an important role and focus instead on how the dollar impacts the economy and returns.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us below

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.