Impact of War on Wall Street and the Economy

After a historically strong start to the year, crude and treasury yields recently popped up due to geopolitical and inflation risks, while the S&P 500 and Nasdaq indices ripped down near 5% this month cutting their gains in half. Any further downdraft led down by more than a few of the Mag-7 stocks may spook investors. Meta got crushed this week after Zuck’s $40B ai spending announcement with “Meta Llama 3,” the company’s new answer to OpenAI’s ChatGP

While innovation in any industry can cause a stock or sector to rip up on the news, it will take time for the applications and eventual profits from these concepts to bake into a stocks price. Many times, headlines can move the markets in the short run more so than earnings reports, whether pricing in the cost or benefits of innovation, Fed rate cuts or the effects of war.

Geopolitical Tensions

The headline you can’t avoid today on most news and media channels involves the Israel/ Hamas war that has been taking place around the Gaza Strip since October 7th, punctuated with Iran and Israel now attacking each other for the first time in history. It’s hard not to consider how implications of war may affect the stock market with Iran now taking center stage in this conflict while bringing back PTSD memories of the Iraq war and direct U.S. involvement between March 2003 and the end of 2011.

Concerns around geopolitical tensions in the Middle East, oil prices, lingering inflation and other issues have led to the market decline, pushing the VIX (fear) index of stock market volatility to its highest level in six months. In times of market stress, it’s important for investors to maintain their perspective on the critical issues and not overreact to headlines.

These latest developments only add to concerns around the world. Russia’s invasion of Ukraine and the attack on Israel by Hamas only a year and a half later have already destabilized Eastern Europe and the Middle East while putting pressure on oil prices. Without diminishing the tragic loss of life and destruction from these conflicts, investors must weigh how such events might impact the global economy, markets, and their portfolios.

The Market Impact of War

Geopolitical headlines can be alarming to investors since they are unlike the typical flow of business and market news. These events are difficult to analyze, and their outcomes are challenging to predict since they depend on the actions of individuals and groups with complex histories and motivations. At the same time, similar to our reports on market outcomes based on U.S. President elections, in most instances the current business cycle dictates the path of the stock market more so than the incumbent President, political party in control, or geopolitical events at that point in time.

The outbreak or anticipation of war can lead to a sharp sell-off in stocks. At the same time, investors may move towards traditionally safer assets like gold, bonds, or currencies perceived as safe havens. Despite the initial negative reaction, stock markets have remarkably shown resilience over time. Indeed, they often quickly recover as the situation stabilizes or as the scope of the conflict becomes clearer.

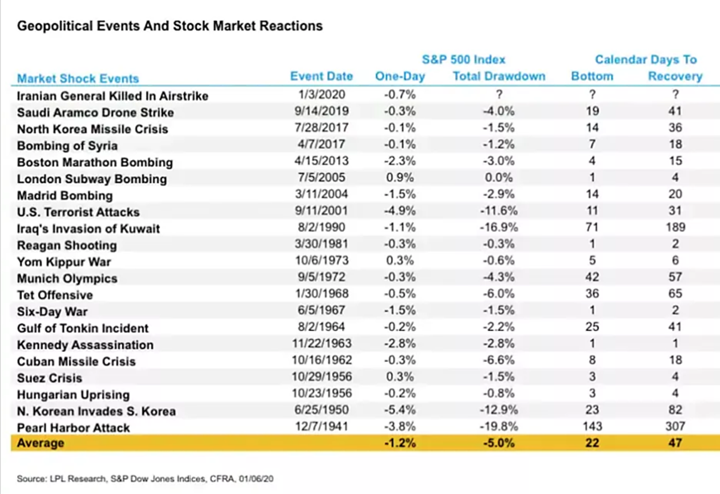

The accompanying chart by LPL Financial highlights market returns following major geopolitical events this century. Surprisingly, the average drawdown of 21 major geopolitical events including major wars going back to the Pearl Harbor attack of 1941, was only 5% – with an average market recovery of only 47 days, with the markets up a year later in most instances.

Some events, such as 9/11, changed the world order and had long-lasting effects, even though it was primarily the dot-com bust that led to poor market performance. Other events, such as the recent war in Ukraine, resulted in higher oil prices which affected inflation and monetary policy over the past year.

While today’s conflicts will be closely watched as protesting war is moving across college campuses, investors ought to avoid passing judgment with their portfolios. In the long run, markets tend to recover and perform well primarily because business cycles are what matter over years and decades, despite the events that take place over weeks and months.

Case Study on Wars

The 2003 Iraq war provides an interesting case study in how wars, despite their massive scale and geopolitical ramifications, might not have a direct and immediate impact on the U.S. economy and stock market in the same way that traditional economic cycles do, even if we are directly involved in combat. Here’s how it played out.

1 Economic Cycle vs. War Impact: Economic cycles are driven by factors like consumer spending, investment, employment levels, and monetary policy. While wars can certainly influence these factors indirectly, they often don’t create the same kind of immediate shock to the economy as, say, a recession or a sudden change in interest rates. In the case of the 2003 Iraq war, the U.S. economy was already in the early stages of recovery from the dot-com bubble burst and the subsequent recession. The war didn’t dramatically alter the trajectory of this recovery, although it did have longer-term implications for government spending, deficits, and geopolitical stability.

2 War as a Business Opportunity: The movie “War Dogs” sheds light on the less-discussed aspect of war: the immense business opportunities it presents, especially for private contractors and suppliers. War is indeed a multi-billion-dollar industry, with companies involved in defense contracting, logistics, security, and reconstruction benefiting financially from conflict. This influx of money can stimulate certain sectors of the economy, create jobs, and boost production levels, particularly in industries related to defense and security. In the aftermath of the 2003 Iraq war, there was a surge in contracts awarded to private companies for various services ranging from construction to security operations.

3 Inflationary Pressures: However, while war can stimulate economic activity and drive growth in specific sectors, it can also contribute to inflationary pressures. Increased government spending on defense and reconstruction projects can lead to higher demand for resources, materials, and labor, potentially driving up prices across the economy. Additionally, disruptions to global supply chains, particularly in regions directly affected by conflict, can further exacerbate inflationary pressures by limiting the availability of certain goods and commodities.

4 Oil Prices and Geopolitical Risks: One of the most significant ways in which war can impact the U.S. economy is through its effect on oil prices. As we discussed in our client meetings as a potential “black swan” event, direct conflict between Israel and Iran, two major players in the Middle East, could disrupt oil supplies and send prices soaring. If the USA gets involved will be even more magnified. This would have a direct impact on inflation in the United States, as higher oil prices translate into increased costs for transportation, manufacturing, and consumer goods. In the past, geopolitical tensions in the Middle East have led to spikes in oil prices, which have contributed to inflationary pressures and slowed economic growth.

Overall Cost and Impact of War on Wall Street and Beyond

Even after most troops had withdrawn from Iraq in 2011, costs of the war and other US war-related efforts continued to accumulate. The $2 trillion price tag on US war in Iraq was only a fraction of the total spending for those counter-terrorism efforts. The entire post-9/11 wars cost the USA an estimated $8 trillion. (Brown University Analysis) The figures include funding appropriated for the war, with veteran care alone costing $1 trillion on the back side. Other contributing factors include State Department/USAID operations, Homeland Security spending and interest on incurred debt.

Jon here. As we continue to chew over in many newsletters, the United States has doubled its debt past $32 Trillion over the past 8 years and is heading to $47 Trillion in just the next four years (2028) per the usdebtclock. Whether war, printing money, or loan forgiveness, the bigger issue for the United States – is that we are on a path of financial troubles as our debt snowballs up and actions will have to be taken that will affect all future generations of Americans.

The bottom line? While wars like the 2003 Iraq war may not directly affect the U.S. economy and stock market in the same way as traditional economic cycles, the they can still have significant implications for economic activity, inflation, and geopolitical stability. The Impact of War on Wall Street is both surprising and interesting. War serves as a complex and multifaceted phenomenon, simultaneously presenting both opportunities and challenges for economies around the world. Understanding these dynamics is crucial for policymakers, investors, and businesses navigating the complexities of a globalized and interconnected world

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.