Navigating a Hawkish Fed, Pesky Inflation and Market Volatility

Irrational exuberance refers to investor enthusiasm that drives asset prices higher than those assets fundamentals justify. Crowd behavior as well as AI “the quants” can quickly move markets when least expected. The term was popularized by past Fed chair Alan Greenspan in a 1996 speech, “The Challenge of Central Banking in a Democratic Society.”

Mr Market’s enthusiasm and hope of Fed rate cuts drove a broad-based “everything rally” last November through April 1st, 2024, of nearly 25% gains by the S&P 500 index despite high rates and persistent inflation. Most understood that cutting rates too quickly by the Fed may invoke ‘70’s inflation era problems, while cutting too late may result in a hard landing. Whether a “higher for longer” mantra by the Fed can help get the pesky and stubborn inflation numbers down to 2% anytime in the next year or two may be difficult in the scope of a strong consumer and rising energy prices as an offset of the two ongoing wars.

Markets Go Up and Down

Jon here. While I have said all along last fall that six rate cuts by the Fed seemed a bit absurd with lingering inflation, the projection of two or three cuts, otherwise “no cuts,” seems more probable for this year. This is causing investors to question the market’s next move while triggering a slight increase of incoming calls from clients concerned over new headlines after the recent pullback.

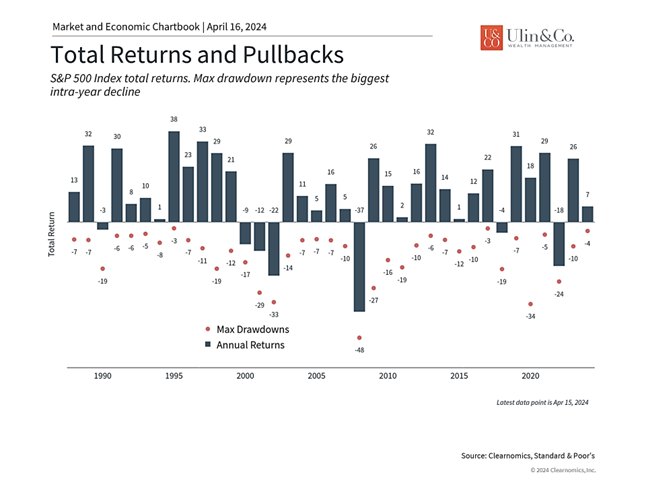

The recent near 5% pullback of the S&P 500 index this month still leaves near 20% gains on the table since last October’s correction, and near 7% gains since the bear market incepted January 2022 over the past couple years. Markets go up and down- not in a straight line. Whether the markets went from oversold to overbought between 2022 and 2023, the recent pull back is not overly unexpected, nor overly painful, as the new news from the more hawkish “higher for longer” Fed gets priced in.

What we have learned from the recent market reactions to the Fed is that investors and stocks don’t care overly what the Fed says or does, as long as they don’t’ start hiking rates. We discussed in many past newsletters, stocks and the economy are now much more dependent on profitability and corporate earnings growth driven by the consumer, more so that Fed actions.

Recent data illustrates the U.S. economy advanced at a vigorous pace through the first quarter with GDP estimated to have grown by 2.9% on an annualized basis, according to Tuesday’s reading on the Atlanta Fed’s GDPNow tracker. Investors should focus less on the Fed fighting inflation and more on corporate earnings driven by a strong consumer and jobs market. Below we’ll cover a bit more on stubborn inflation and the price of volatility.

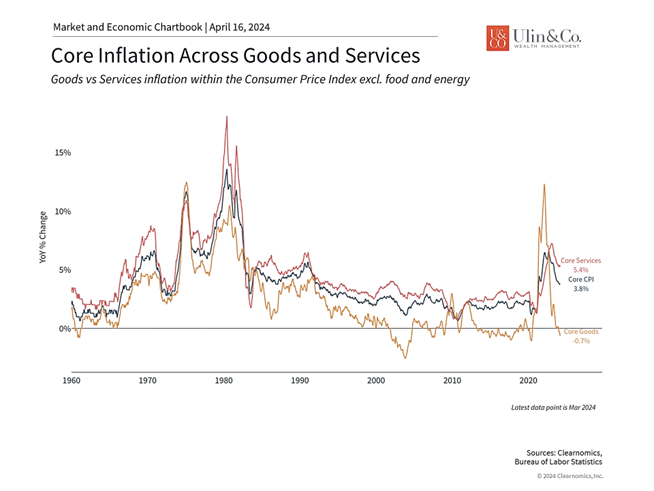

Stubborn inflation has markets rethinking the number of rate cuts

Many measures of inflation have proven to be more stubborn than economists had hoped. The latest Consumer Price Index (CPI) report for March showed that headline inflation remained hotter than anticipated at 3.5% year-over-year, while core inflation, which excludes food and energy prices, rose 3.8%. Rising shelter costs, i.e., the cost of renting and owning a home (nearly 45% of CPI) are a large reason inflation has not cooled as quickly. It will take a bit longer for high rents and near 8% mortgage rates to sink in and eventually cool off since many Americans did refinance their mortgages down to ultra-low rates over the past decade before the historic rate hike program began.

Combined with stronger-than-expected recent job market data, many investors now anticipate that the Fed may cut rates more slowly this year – or not at all. The Fed’s economic projections have suggested all along that it might cut rates three times this year. Market expectations, however, have swung 180 degrees since the start of the year when some believed the Fed could begin cutting rates in March or earlier.

As always, it’s important for investors to keep these expectations in perspective. What matters for long-term investing is the direction of policy and not the exact timing or magnitude of rate cuts. There are still risks to the Fed’s outlook and the monthly inflation numbers, especially if oil prices rise further due to geopolitical conflicts. However, even if this were to occur, inflation is far more manageable today and no longer requires an emergency monetary response.

Investors should always be prepared for market volatility

Finally, investors should keep the level of market volatility in perspective as well. While the recent market decline is the largest since the start of the year, this follows a near 10% total return in the first quarter. Since last October when the market began to rally, the S&P 500 has gained near 27% including dividends. Since the bear market bottom in 2022, the market has gained over 40%.

The accompanying chart shows that the average year experiences significant pullbacks and that this year’s has been small by comparison. Despite these short-term challenges, markets tend to recover and often end on positive notes. This is why maintaining a diversified portfolio can help minimize short-term risk and increase the odds of financial success over time, regardless of whether markets are volatile due to the economy, the Fed, geopolitics, or other factors.

The bottom line? Markets have struggled at the start of the second quarter due to changing expectations around the Fed and escalating geopolitical tensions. Staying level-headed and keeping these events in perspective are still the best ways to achieve long-term financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Advisory services offered through NewEdge Advisors, LLC, a registered investment adviser.