4 Rules to Investing Through a Racing Recovery

There is no such thing as a free lunch. As with many things in life, investing is often about managing risk and expectations on the economy, markets and portfolio returns. Yet many times we get impatient and take quick, immediate action with our savings more based on emotions, headlines, or friends euphoric posts on social media, than on logic.

Keeping our brains calm, quiet and disciplined can be challenging since strong market gains and solid economic growth can fuel even greater and eventually unrealistic expectations and greed. At the same time, long-term investors understand that temporary market pullbacks and economic slowdowns are unavoidable. Successful long-term investing is truly a marathon not a sprint.

Not all Stocks Succeed

Many individuals with minimal investing experience aiming to “get rich quick” trading “meme-worthy” cryptocurrencies and individual stocks right from their smart-phones should heed the maxim of Caveat Emptor, the Latin phrase meaning “let the buyer beware.”

When selecting individual securities from new IPO’s to established companies, consider that many stocks underperform or fail miserably over time. Even during the past decade marked by an almost uninterrupted Obama/Trump bull market, the average stock did not excel.

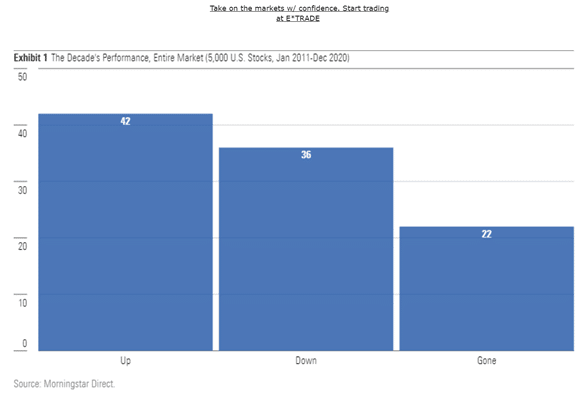

Morningstar recently evaluated the results of publicly traded U.S. equities over the past decade concluding in December 2020. The chart below shows the percentage of the 5,000 biggest U.S. stocks that: 1) ended the 10 years with a gain, 2) recorded a loss, or 3) disappeared from existence.

You may be greatly shocked to learn that although the main U.S. Stock Index enjoyed a 13.90% annualized gain for the decade, only 42% of individual equities finished in the black. Nearly as many (36%) posted 10-year losses. The final 22% vanished.

While Warren Buffet was famously quoted as saying to “only buy something that you’d be perfectly happy to hold if the market shut down for 10 years,” trying to make money by picking individual stocks for the short term (flip) or long term (buy and hold) is not an easy task. This demonstrates that staying the course with some stocks (or cryptos) can end up burning you like a bad day in Vegas.

At least the odds of winning any of the most popular casino games in Vegas from roulette, slots, craps to blackjack average near 50%. You can enjoy a casino and accept that it will cost you some money to be there. Likewise, you’ll spend money if you go to an amusement park.

Jon here. As we have mentioned in many past blogs my favorite 4 investment rules or “Ulinism’s”: (1) don’t invest more than 5% to 10% of your liquid net worth in one asset/crypto or other idea (2) don’t invest in something you don’t completely understand “down to the paperclips” (3) diversify your savings according to your risk tolerance and investor policy statement (don’t put it all on black or red) (4) don’t invest in something where you can’t accept (or afford) a 100% loss. By the time you read a headline about a “red-hot” stock/crypto/property/ asset that made huge returns, smart money that bought low (and early) is already selling out their shares to turn a profit.

Managing Market Expectations

Today, after a swift economic rebound and stock market rally out of the 2020 pandemic shutdown, there are certainly high expectations across the entire investment landscape. For instance, last week’s jobs report severely missed economist projections. It showed that 266,000 jobs were created in April when consensus forecasts were for one million, while the unemployment rate ticked up slightly to 6.1% when many expected it to fall to 5.8%. (see below)

The glass-half-empty view is that the economy is not nearly as robust as many had hoped. After months of stellar economic reports – some showing the fastest growth in decades – investors have come to expect business activity and the stock market to grow at a feverish pace. If growth is weaker than anticipated, this could mean that corporate earnings expectations are too lofty and stock valuations are even more expensive than they already appear to be.

All of this is certainly possible after an extended bull run. However, there is also a simple glass-half-full view: over one million new jobs were created in just two months. During the last economic cycle this would have taken nearly six months to achieve. Just a year ago, during the depths of the economic lockdown, it was unclear whether jobs would return at all – or if there would be irreparable damage to the economy. The pace of the recovery has helped to minimize the damage. This is true even if one month’s jobs report failed to meet expectations.

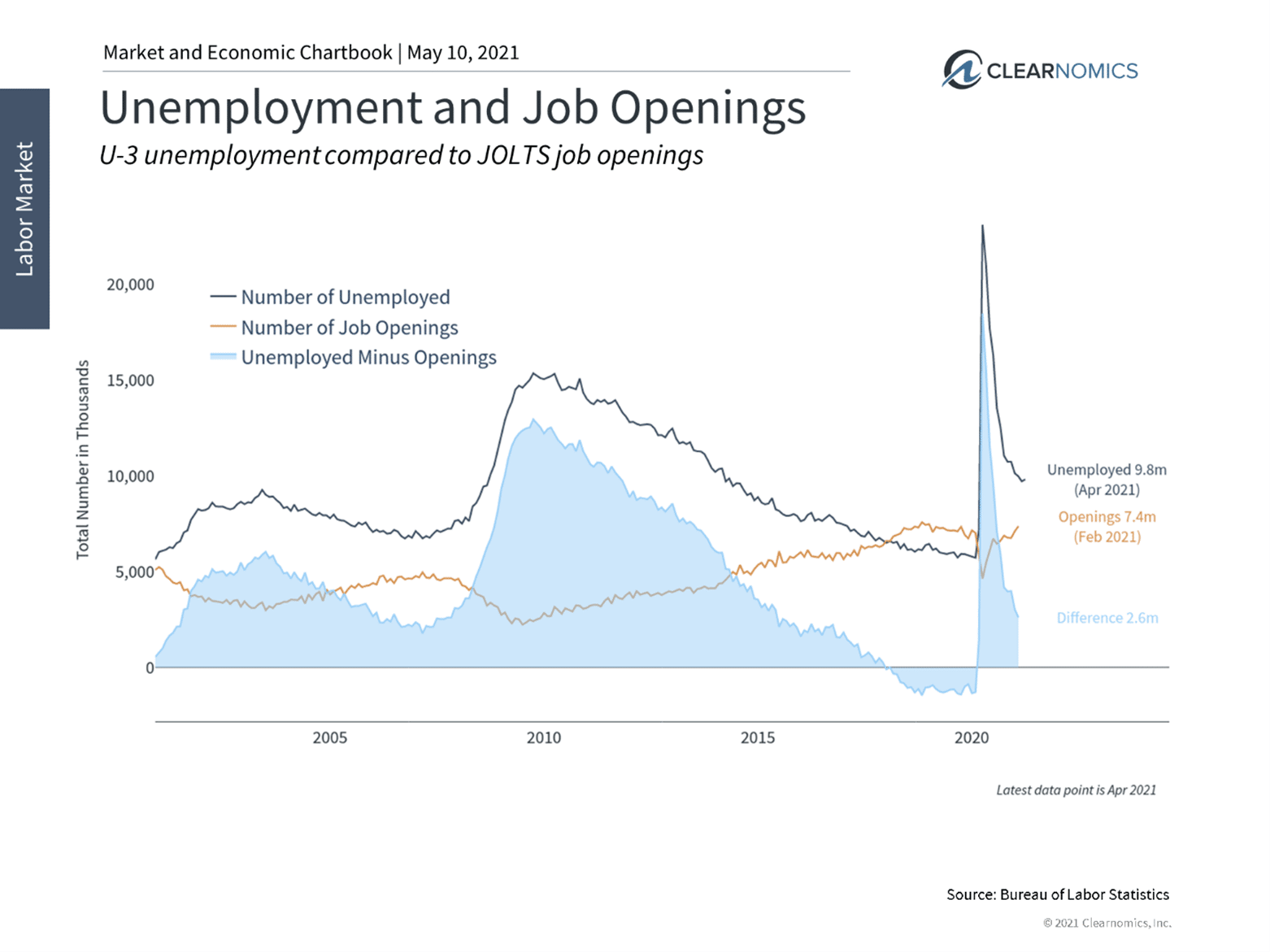

This does not mean valuations close to dot-com era levels are justified or that investors should expect a straight-line recovery. While jobs should continue to return as business activity accelerates, there are also long-term structural challenges. For instance, with 9.8 million unemployed Americans and at least 7.4 million job openings, there is clearly a mismatch between hiring needs and the skills of available workers. In addition, the significant fiscal relief to workers (enhanced unemployment benefits and relief checks) coupled with some people still concerned about COVID risks, has kept many people off the workforce, or seeking jobs in alternate industries.

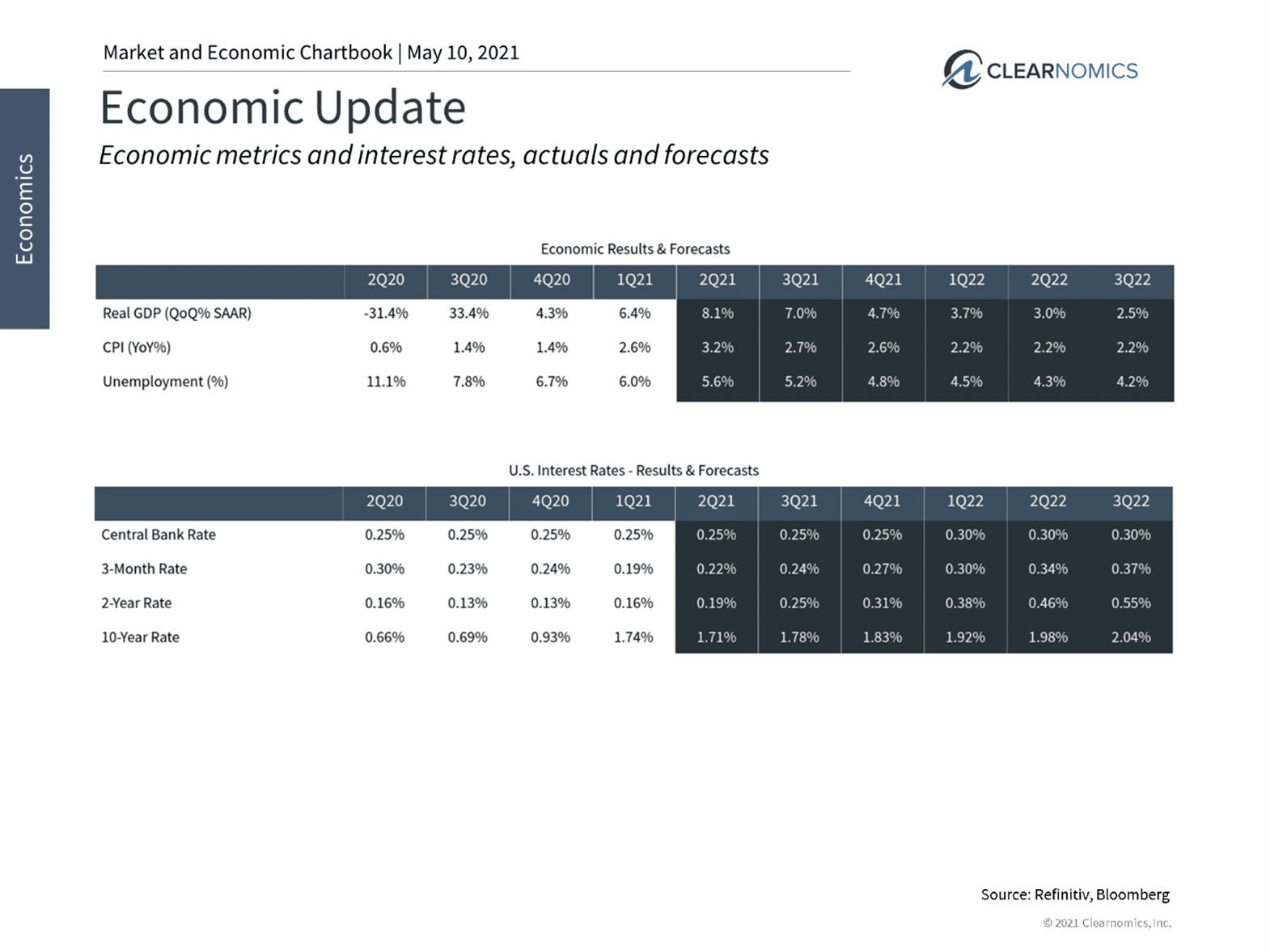

At the moment, economists expect that growth will accelerate this quarter and remain hot in the second half of the year. This includes inflation running above 3% for some time and unemployment falling below 5% before the end of the year. This could be more than enough to restore corporate earnings to pre-pandemic levels, justifying some of the market rebound over the past year. (see below) Below are three charts that help to put economic and market expectations in perspective.

1 There are millions of job openings despite high unemployment

At the moment, there are over 9.8 million Americans unemployed even though job openings are close to historic highs. Not only does it take time to vet and hire workers, but there may be a mismatch between the skills and backgrounds that businesses need and available candidates. This is not just in sectors such as tech but is true across the board from truckers to warehouse workers. Naturally, this places a speed limit on hiring activity that is separate from the natural economic recovery.

2 Economists expect record growth through the rest of the year

Inflation could rise above 3% for some time and unemployment could fall below 5% by the end of 2021. Of course, these projections are speculative given the historic nature of the economic environment, especially with record levels of government and central bank stimulus.

Not all stocks succeed overtime

U.S. Stock Index enjoyed a 13.90% annualized gain for the decade, only 42% of individual equities finished in the black. Nearly as many (36%) posted 10-year losses. The final 22% vanished.

The bottom line? Investors ought to remain balanced and maintain a clear perspective on their own expectations and that of the broader market without taking an emphasis on market timing or selecting individual crypto or stocks on the lion’s share of their savings. While it’s fine to hope for the best, diversified portfolios are meant to also prepare for the worst. After all, the point of investing isn’t to succeed over months or quarters, but to achieve financial goals over years and decades.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.