Mid-Year Outlook and Fed Policy- The Waiting is the Hardest Part

You take it on faith, you take it to the heart, The waiting is the hardest part. -Tom Petty

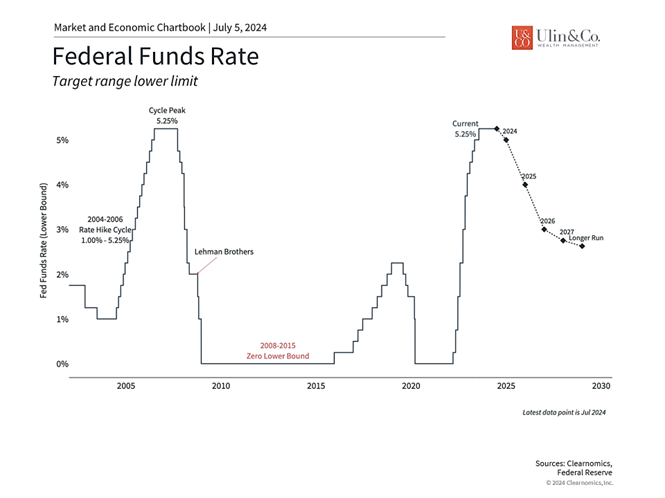

The Fed policy has held rates in the range of 5.25% to 5.5% for almost a year, helping to finally cool off inflation. CPI has dropped from the high of 9.1% June 2022 down to 3% this month, the first time at this level in three years.

Fed Chair Jerome Powell’s recent testimony suggested the Fed is inching closer to cutting interest rates this year. Powell stated that the Fed has made “considerable progress” toward its goal of defeating the worst inflation spike in four decades. As a result, the probability of the Fed cutting interest rates in September spiked from 70% on Tuesday up to 90% on Friday.

With 30-year mortgage rates near 7.5%, home equity and student loan rates 9%, maximum APR on credit cards 28%, and SBA loans averaging between 12%-15%, many individuals and small business owners are getting impatient waiting for the Fed to start cutting rates. As famously stated by rocker Tom Petty, “The waiting is the hardest part.” Still, there could be more head fakes to come, as we saw in Q1 with CPI creeping up from 3.1% to 3.5% by March leading to both a stock and bond drop in April.

Jon here. Should you be popping bottles and celebrating the optimistic rate cut odds news? Not quite just yet. The Fed is still a whole percentage point off from its 2% CPI goal. Getting down to 2% will take more effort than the past 6.1% deceleration to 3%. We have discussed more than a few times that the economy does not appear to need any rate cuts this year, and there are significant risks of the Fed moving too soon. Anything unexpected from an oil/energy price spike to a semiconductor chip supply side crises from a potential war with either Iran or China could be the spark to ignite inflation again back up again.

Another concern more so than China now facing the heat of a banking/real estate crisis that began over a decade ago – are new concerns on Trump’s plans for 10% tariffs on China and other imports, along with his promise to deport millions of migrant workers that would fuel inflation higher. Dubbed the “Trump trade” by some in the bond market, the 10-year Treasury yield shot up about 20 basis points to almost 4.5% in the wake of President Joe Biden’s weak debate performance on June 27, helping also to elevate Trumps lead in the polls.

Looking Ahead

As we enter the second half of the year, it’s key to maintain perspective on the major events that have driven markets. Despite ongoing economic uncertainty, the stock market has experienced a strong rally as investors anticipate the first Fed rate cut and the rally in ai stocks resumes. During the first six months of the year, the S&P 500 index gained nearly15% and the DJIA index 4.8%. The overall bond market was roughly flat to negative on the year, continuing to put stress on balanced portfolios for a third year in a row.

In the latter half of 2024, diversified investors face several nuanced risks, both optical and unknown, that could impact the markets and or their portfolios through future economic incidents or by human error. In this week’s newsletter we focus to discuss how to perceive and navigate through these situations while developing a more nuanced, all-weather portfolio strategy, both tactical and strategic, to help drive your nest egg through evolving weather conditions.

An “optical investment risk” refers to hazards that are more about perception than reality, often leading investors to make decisions based on appearances and opinions rather than facts and fundamental analysis. Unknown events are often described as “black swan” events after the fact. The black swan theory is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight bias.

Now is not the time for long term investors of any age to “throw out the baby with the bathwater” on their diversified strategy out of impatience and dive deep into mostly tech stocks from FOMO (fear of missing out) or to instead cash out completely due to fear and uncertainty. In many cases, fear and greed can be a larger detriment to investing success than actual market volatility.

Media Noise

The never ending 24-hour news cycle powered by the financial media pundits like the wizard of oz, is an optical risk that can create a lot of “noise” that affects investors’ perceptions. Sensational headlines and short-term market movements driven further by ai and the quants can lead to impulsive “human” decision-making like when watching the weather channel report on the path of a Cat-5 hurricane.

Reacting to market noise can cause investors to buy high and sell low at exactly the wrong time while following the madness of the crowd, undermining long-term investment strategies. Media-driven hype or fear can distort the perceived value of investments whether jumping in (or out) of an individual stock, crypto currency, sector, or any asset for that matter.

We have discussed many times over past newsletters that investing for retirement should not look like or feel like investing in a table game in Vegas, but more of a slow and steady process. Make sure to follow reliable and balanced sources of financial news and information and avoid making decisions based solely on media headlines, message boards or water-cooler talk.

Tech Concentration

The impressive performance of certain technology stocks, like NVIDIA as a headline zinger, has led some investors to become over- concentrated in this sector. Overexposure to one stock or sector increases the risk of significant losses if there’s a market correction or sector-specific downturn.

While technology stocks have driven substantial gains, their high valuations can be volatile. An overconcentrated portfolio lacks diversification, exposing investors to unnecessary risks that could derail long-term financial goals. We have discussed setting concentration limits. Ensure no single stock or sector constitutes more than 5% of the portfolio. Rebalance periodically to maintain this discipline. Also consider diversifying within the technology sector by investing in a mix of growth and value tech stocks, as well as different sub-sectors from data centers to software. Also don’t forget to include other growth sectors. look for growth opportunities in other sectors like healthcare, renewable energy, and consumer goods to balance tech exposure.

Second Half Insights and Fed Policy

This strong performance for the first half of this year may have caught some investors off guard while others may not have been properly positioned to take advantage of the upswing across many asset classes. This is because market sentiment can often turn on a dime, especially when there is so much investor and media focus on short-term events. For example, the recession that was anticipated at the beginning of the year has not yet occurred and there are signs that inflation, which ran hotter than expected for a few months, is beginning to improve.

Of course, the market’s focus will now shift toward major events in the second half of the year. Perhaps the most notable is the upcoming presidential election. As investors prepare to cast their ballots in November, they will also wonder what each political party could mean for their portfolios and financial plans. Investors will also watch the timing and number of Fed rate cuts closely since lower rates are generally positive for both stocks and bonds.

While the outcome of these events is uncertain and introduces new risks, the first half of the year is a reminder that overreacting to day-to-day headlines, at the expense of long-term underlying trends, can often result in poor investment decisions. History shows that it’s important to separate our personal feelings around politics from our financial decisions in order to stay invested, diversified, and disciplined. Consider the following points to help keep your brain and portfolio in the game.

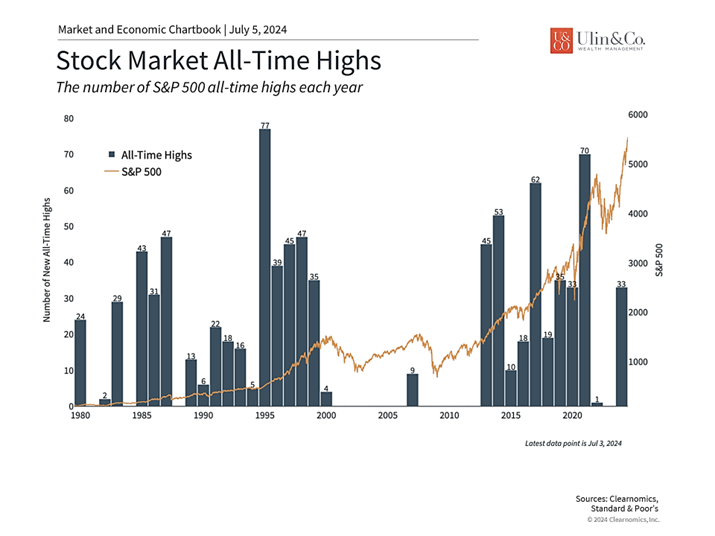

1. The market continues to reach new all-time highs

On its way to a nearly 15% gain in the first half of the year, the S&P 500 has achieved over 30 new all-time highs. While this is positive, it can also make many investors nervous. When the market is in uncharted territory, it’s easy to worry that it may be “due for a pullback.”

The reality is that price swings are an unavoidable part of investing and the market will certainly pull back at some point. However, the timing of these declines is difficult if not impossible to predict. At the same time, major stock market indices will naturally spend a significant amount of time near record levels during bull markets, as shown in the accompanying chart. Trying to time the market tends to be counterproductive for this reason.

This year, artificial intelligence stocks – particularly Nvidia – have contributed greatly to market returns with the Information Technology and Communication Services sectors gaining 28.2% and 26.7%, respectively. However, other sectors have more recently begun to benefit as well with Energy, Financials, Utilities, and Consumer Staples all experiencing rallies of around 10%. All told, 10 of the 11 sectors are positive on the year. While it’s unclear where large-cap technology stocks may go from here, staying diversified allows investors to benefit from a wide variety of sectors.

2. With inflation cooling, the Fed is on track to cut rates later this year

Investors have been anticipating the first rate cut of the cycle since the beginning of the year. This has not only driven returns, but is one reason markets have swung so much when new economic data has caused expectations to shift.

The accompanying chart shows the possible path of the federal funds rate based on the Fed’s latest projections. At its last meeting, the Fed cited strong job gains and low unemployment as indicators of solid economic activity but emphasized that “inflation has eased over the past year but remains elevated.” Fortunately, the latest inflation data in May showed a significant deceleration that has preserved the possibility of a rate cut this year.

Many of the additional rate cuts that investors previously expected have simply been pushed into next year and will depend on the economic data over the next six months. Regardless of the exact timing and path of Fed rate cuts, these projections represent a reversal of the emergency monetary policy actions that began in early 2022.

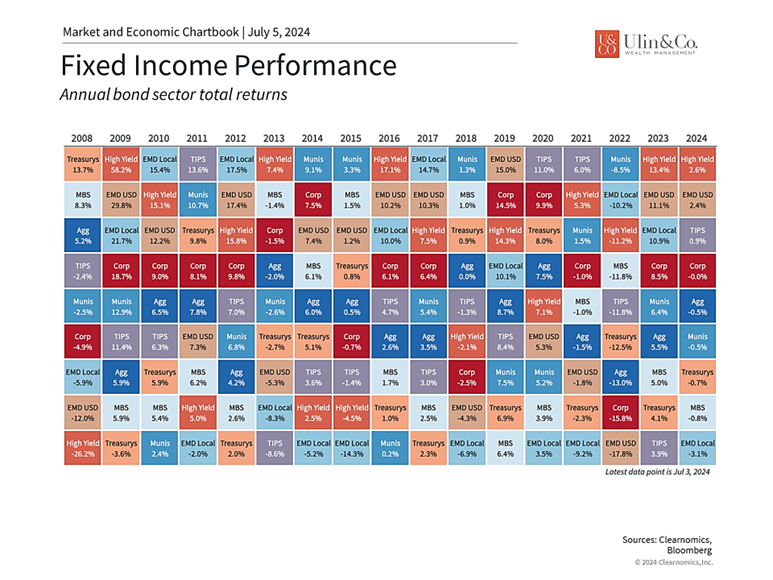

3. Steadier rates support the bond market

The path of interest rates has been highly uncertain over the past few years due to inflation, economic growth, and the Fed. Higher rates have defied the expectations of investors and economists, creating a challenging environment for the bond market, since rising rates push down bond prices.

After hotter-than-expected readings in the first quarter of the year, the latest Consumer Price Index data showed no change in overall prices in May for the first time in almost two years. Core CPI rose 0.2% in May, or 3.4% year-over-year, a healthy deceleration from the previous month’s 3.6% pace. Other data, such as the Personal Consumption Expenditures index that the Fed favors, and the Producer Price Index, have shown similar patterns.

These developments, along with new Fed guidance, have pushed rates lower in recent days, supporting bond prices. The Bloomberg U.S. Aggregate Bond Index, a measure of the overall bond market, is nearly flat on the year after declining as much as 4% in April. This is in sharp contrast to 2022 when bonds fell into a bear market during the historic jump in interest rates, before stabilizing and rebounding in 2023.

4. Many investors remain on the sidelines in cash

In times of market uncertainty, investors often seek the safety of cash. This has been true over the past several years as markets have swung due to the pandemic, geopolitical events, Fed rate hikes, inflation, gridlock in Washington, technology trends, and more. Additionally, interest rates on cash are at their highest levels in decades, making it appear that there are attractive “risk-free” returns.

While cash is important, it can become problematic when investors hold too much cash. This is because cash is not truly risk-free for two important reasons. First, inflation quietly erodes the purchasing power of cash over time. So even if yields appear to be high, the real value of your money could decline. Second, the prospects for cash will only worsen if and when the Fed does begin to cut rates. Investors would be forced to reinvest their cash either at lower interest rates or in stocks and bonds whose prices would most likely have already risen.

It’s unbelievable there is still almost $6 Trillion dollars in cash sitting on the sidelines. (see chart) When (not if) the Fed starts lowering rates- this big amount of cash will be like a powder keg for the stock market as investors shift back into dividend paying stocks and bonds.

5. The presidential election is heating up

Coverage of the presidential election is heating up. While elections are an essential way for Americans to help shape the direction of the country as citizens, voters and taxpayers, it’s important to vote at the ballot box and not with investment portfolios.

History shows that markets can perform well under both major political parties. As the accompanying chart shows, the economy and stock market have grown over decades regardless of who was in the White House. What mattered more across these periods were the ups and downs of the business cycle.

Of course, politics can impact taxes, trade, industrial activity, regulations, and more. However, not only do policy changes tend to be incremental, but also the exact timing and effects are often overestimated. Thus, it’s important to focus less on day-to-day election poll results and more on the long-term economic and market trends. Ideally, investors concerned about the impact of specific policies on their financial plans should speak with a trusted financial advisor.

The bottom line? Investors should keep these five factors in mind as we head into the summer and Fed policy around rate cuts evolves. As always, it’s important to maintain a long-term perspective to achieve investing goals. Working with a trusted financial advisor can help you navigate through an uncertain future and be prepared for changes in the economy and stock market through the rest of 2024.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not en-sure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please con-sult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publica-tion as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.