What are the Odds? Diamond Hands Lead the Way

Investors have grown uneasy over the past few weeks as stock and bond markets have swung in both directions. Although last week’s jobs report confirmed that the economy is recovering steadily and the new $1.9 billion stimulus package will provide even greater support, there are fears that something will go wrong.

Rising rates and a steepening yield curve could mean that the economy will overheat, sparking runaway inflation and forcing the Fed to “pull the plug” sooner than expected, all of which may be bad for both stocks and bonds. On the other hand, rising rates could simply be the result of a recovering economy which is good for stocks in the long run. The tension between these two views helps create uncertainty.

Is this déjà vu? There is always a sense that “this could be the big one” – a correction or crash that makes it seem foolish to have ever been optimistic, even though the odds may be in your favor over the long run. This is why a major hurdle to achieving financial goals is not about modeling interest rates or Fibonacci sequences, – it’s overcoming one’s own behavioral and cognitive biases.

Diamond Hands

If you’ve got “diamond hands,” you’re mentally ready to hold a position or portfolio for the end goal, despite the potential risk, headwinds and losses. If you’ve got “paper hands,” you exit a position, or fold early on because the heat of the situation might be too much to stomach.

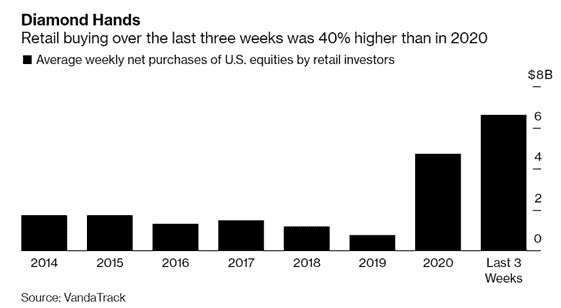

None of the recent market volatility and relentless headline news has made any loss of appetite for retail investors the past few months to “fold” or cash out. In fact, retail stock market buying over the last three weeks was 40% higher than in all of 2020. The diamond emojis all over WallStreetBets on Reddit may be providing positive karma and euphoria for retail investors.

As stocks swooned over the last three weeks, retail investors snapped up an average of $6.6 billion in U.S. equities each week, according to data from VandaTrack, an arm of Vanda Research that monitors retail flows in the U.S. market. That’s up from an average $4.7 billion in net weekly purchases in 2020.

What are the Odds?

Casino games do not have good odds for players. There’s a reason for the phrase, “the house always wins.” Every casino game is designed to give the house a better edge. The odds of winning any of the most popular casino games in Vegas from roulette, slots, craps to blackjack average only about 50%. You can enjoy a casino and accept that it will cost you some money to be there. Likewise, you’ll spend money if you go to an amusement park.

Lottery odds are quite worse, though Americans spend about $72B on Lottery Tickets every year. More than a third of people believe winning the lottery is the only way they will ever retire comfortably. But the odds of winning either the Powerball or Mega Millions are roughly 1 in 292.2 million and 1 in 302.5 million, respectively.

Things That Are More Likely Than Winning the Lottery include; Car accident: 106 to one, Falling out of bed: 2 million to one, Lightning strike: 1.2 million to one, Dog attack: 118,776 to one, Shark attack: 3.75 million to one. Turns out swimming with the sharks is safer than petting a dog, driving your car, or sleeping in your bed.

Focus on Years Not Weeks

Stock market odds look even better- over time. The key for long-term investors is that the stock market tends to rise over long periods of time even if it can swing wildly in the short run. How can this be if there are almost as many down days as up? The fact that markets are up slightly more than 50% of days provides compounding over time. Even when the market is volatile, returns tend to be positive over time as illustrated below.

After the great run up the latter half of 2020, The stock market has fallen 20 days this year but has also risen 23 days, close to the slightly-better-than 50/50 average across history. Thus, there is often a disconnect between perception and reality when it comes to market behavior.

Like many things, the power of compounding works slowly over time and positive returns over any individual day, month or year are never guaranteed. Market pullbacks and corrections may grab attention and headlines, but it is the slow building of wealth in the face of never-ending market fear that works in investors’ favor over the course of years and decades.

While there are valid market concerns around interest rates, valuations, Fed action and the growing Federal debt near $28 Trillion dollars, the bottom line is that the economy is still recovering. Businesses small and large are seeing their top-line numbers improve and are rebuilding their balance sheets. Patience, discipline and perspective are needed as this plays out. Below are three charts that put these market moves in context.

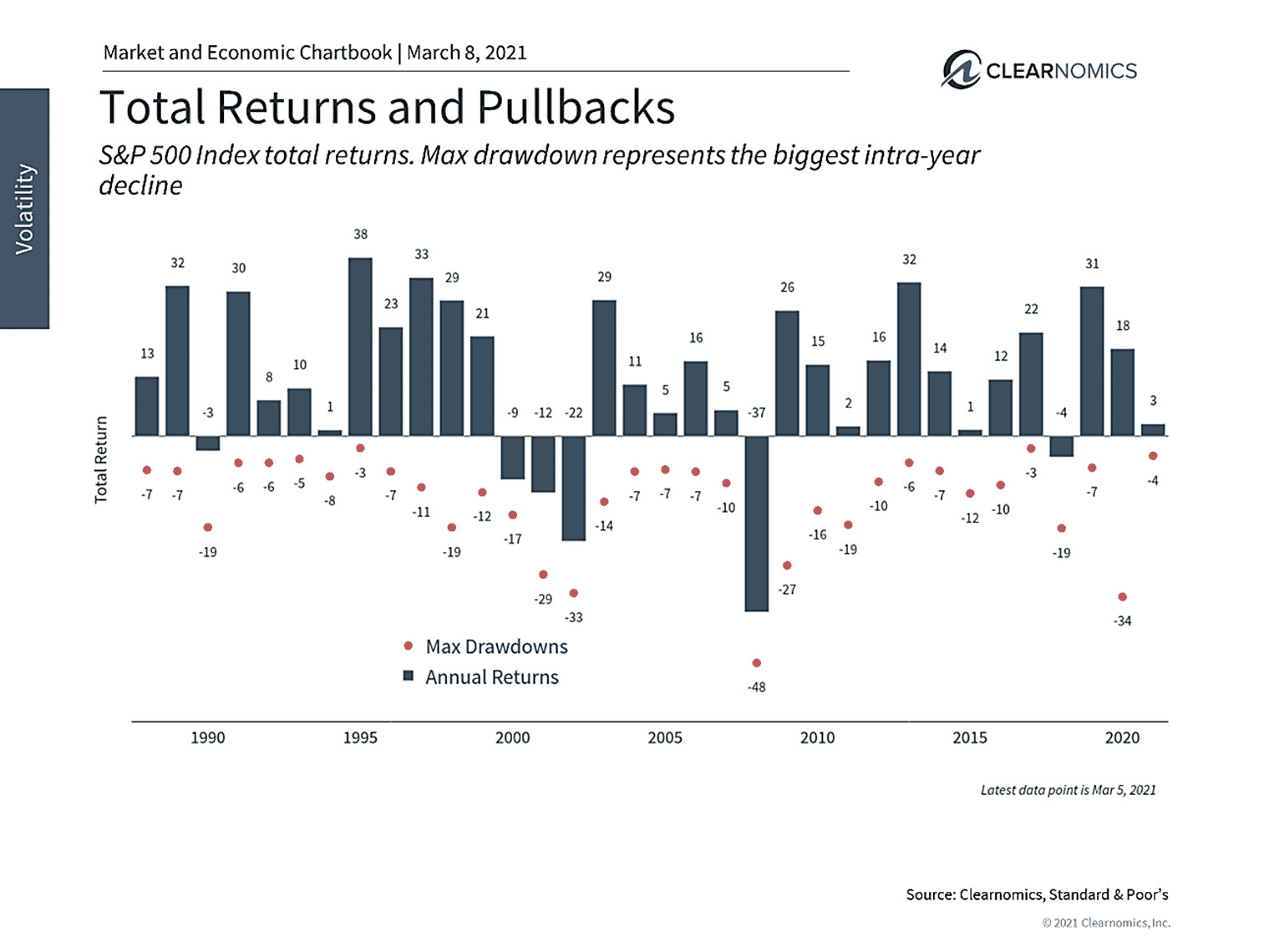

1 Despite daily swings, the worst stock market pullback this year has only been 4%

Although there has been much attention on daily market movements – with several moves larger than 1% over the past few weeks – the truth is that the largest pullback has been about 4%. This has been followed by several large gains too. Just remember that the average year experiences a pullback of about 15%, even though the majority of years end up positive.

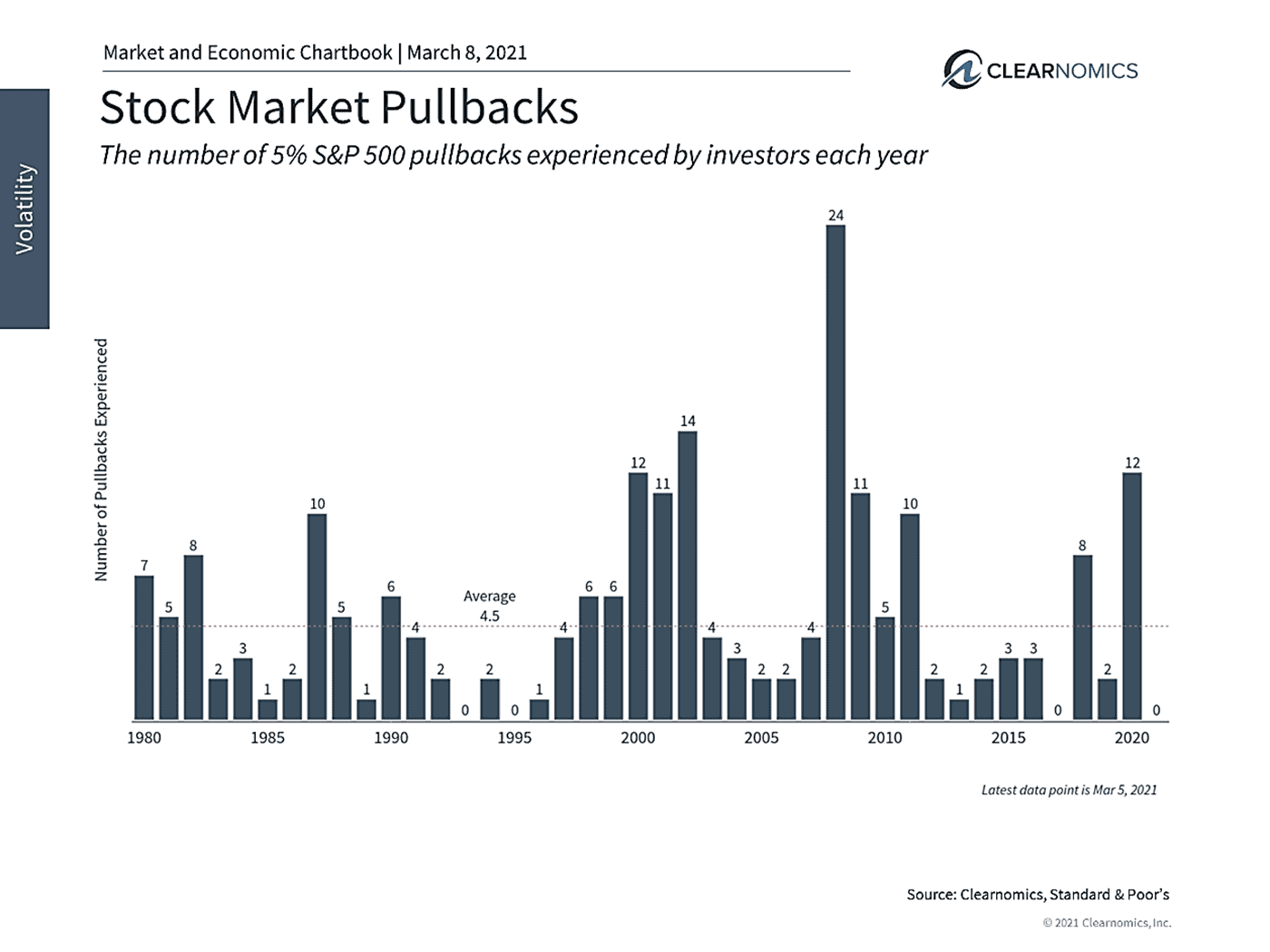

2 The average year has many 5% pullbacks

From a behavioral perspective, investors experience many 5% pullbacks in any given year. With tons of retail investors standing ready to buy any dip, it seems like declines have grown shallower and shallower. The S&P 500 has gone without a 5% pullback since early November, or 83 straight days, the longest streak in a year.

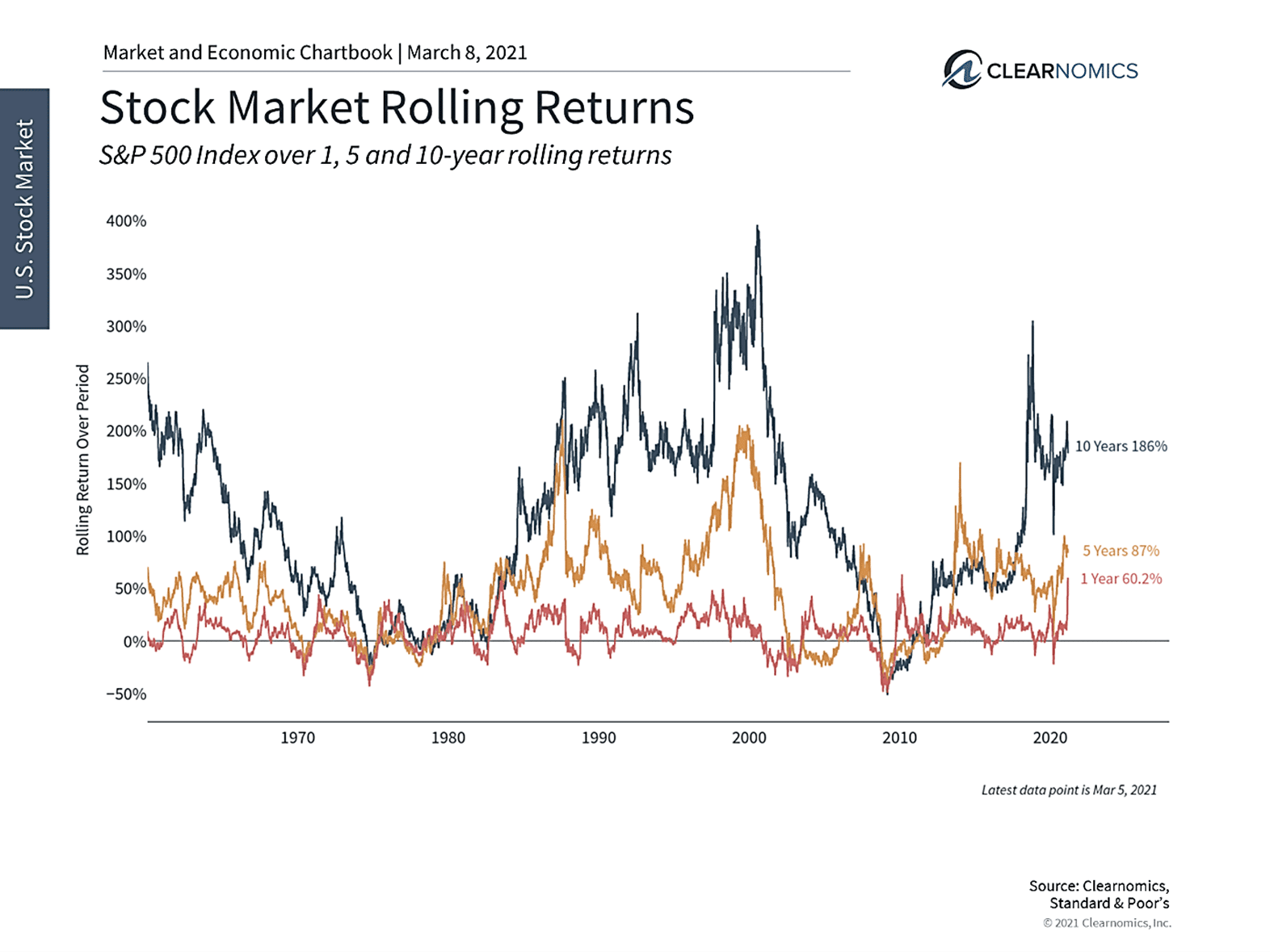

3 Focusing on longer time frames is the key to success

Staying invested over long periods of time is still the most important investment principal. Although there are always reasons to be concerned, staying focused over years and decades is what allows investors to build their savings into wealth.

The bottom line? Although there are legitimate short-term concerns over several parts of the market, staying focused on long-term goals while maintaining a diversified approach is the best course of action for many investors.

As we discussed this week in Market Watch, managing your portfolio to help meet your retirement and other long-term goals while assessing risk, should not involve emotions, darts, tarot cards or luck, like playing a roulette wheel in Vegas where the ‘odds are on the house. It should involve a scientific approach to determining your willingness and ability to tolerate risk while taking control of your own results and financial future.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.