Don Quixote, Investing and Stock Market Valuations

The rule of thumb to “invest your age in bonds” went out with the baby and the bathwater over the past decade as many retirees are generally taking on more risk with their nest-eggs in balanced portfolios just to match the returns of their five year, 5% CDs from 2007.

Gen X and boomer investors are often surprised that many of our retired clients are staying the course with a good amount of equities in their portfolios to combat the decay of inflation and taxes over time, all while in the face of rising stock valuations, falling interest rates, tariff wars and an aging bull market.

“Don’t put all your eggs in one basket.”

This phrase was said to be first used in the novel “Don Quixote” from the most influential work of literature from the Spanish Golden Age, where it was written “It is the part of a wise man to keep himself today for tomorrow, and not venture all his eggs in one basket.”

Diversification is the closest technique utilized by disciplined investors to not put all their eggs in one basket while placing significantly less emphasis on stock selection or market timing and bailing out at exactly the wrong time.

The S&P 500 closed last Friday above 3,000 for the first time in history. A number of factors have pushed stocks higher this year including easy monetary policy by the Fed, progress with U.S.-China trade talks, and relatively stable U.S. economic data. With the U.S. stock market now up 20% year-to-date, it’s important for investors to have proper expectations not just over the remaining six months, but over the next several years.

For many investors, the foundation of disciplined portfolio management should be rooted in fundamentals and valuations. After all, in the eleventh year of this historic bull market, there are few cheaply valued asset classes around the globe. As we’ve seen over the past year, even minor surprises can result in significant short-term uncertainty. Focusing on what actually drives long run returns is more important than ever.

It’s a basic principle of investing that valuations are the most important predictors of long-run returns.

While there are no guarantees in investing, buying stocks when they’re cheap has historically increased the odds of success. The opposite, of course, is also true: buying stocks when they’re expensive often results in lower long-run returns. In both cases, investors must be willing to stomach market volatility.

Thus, there’s good and bad news for those investors concerned about where we are in the market cycle. The bad news is that stock market valuations have not been cheap for some time. Earlier this cycle – i.e. from 2009 to almost 2015 – both accelerating earnings growth and recovering valuations propelled markets higher.

At this point, measures such as the S&P 500’s price-to-earnings ratio are above average, with both prices rising and earnings decelerating. This doesn’t imply the end of the cycle, nor does it suggest that a pullback is imminent. It does suggest that expected returns could be more moderate going forward.

However, the good news is that while valuations aren’t cheap, they are nowhere near “bubble” territory. The current market P/E of 17x (i.e. investors are paying $17 today for $1 of future earnings) pales in comparison to the early 2000’s when it peaked at nearly 25x. In other words, valuations aren’t anchored to their averages over short and medium time frames. Additionally, valuations differ significantly across investment styles, sectors and geographies.

So, while no one should invest with the expectations that market valuations will revisit their tech bubble peaks, investors should focus on valuation measures in their portfolio decisions. Below are three charts that highlight this important investment discussion.

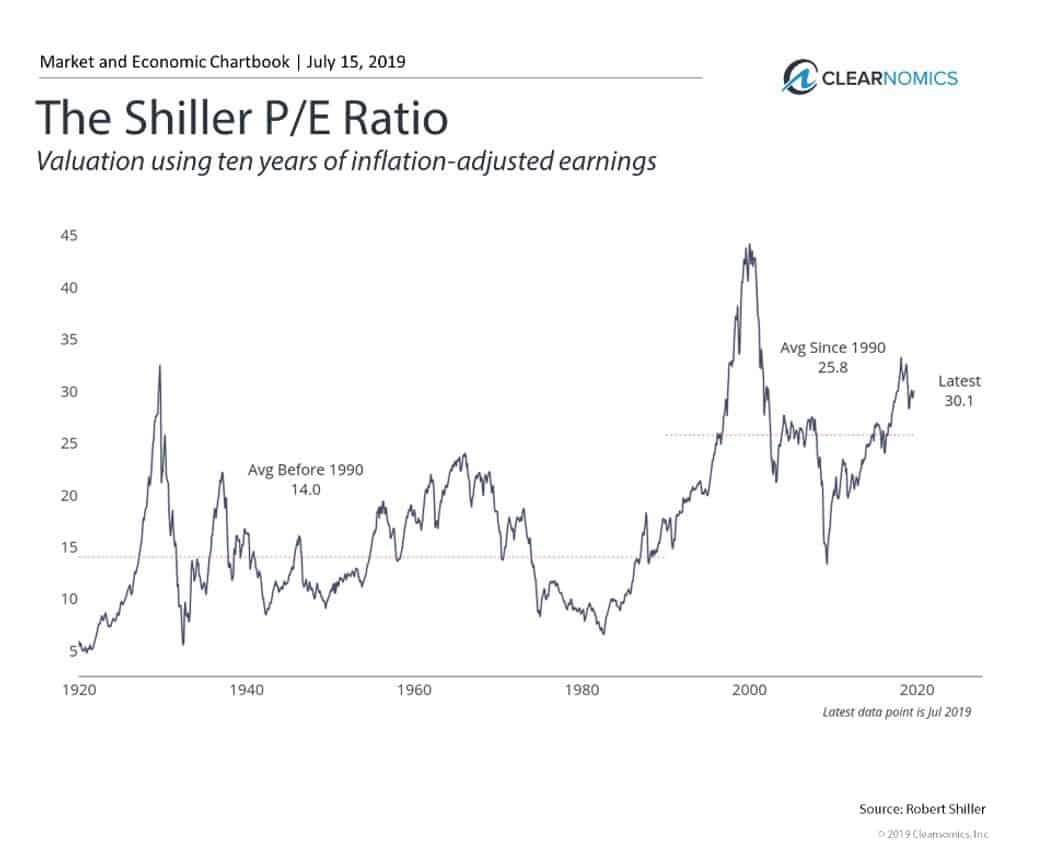

1. All-time market highs have pushed valuations higher

Stock market valuations across measures such as price-to-earnings, price-to-book, price-to-cash flow, and more, have not been cheap for some time. Not only have stock market prices risen considerably over the past few years, but earnings growth has decelerated. For many investors, this simply means setting proper expectations around future returns.

The Shiller P/E ratio above is a commonly cited measure of long-run valuations. However, interpreting this measure is not so simple. Comparing today’s valuation level of 30.1 to the historical average since the 19th century suggests that the stock market is in a bubble of epic proportions.

However, using this comparison also suggests that the stock market has been overvalued since 2009. An investor making decisions based on this simple measure would have missed the entire bull market.

Taking averages over multiple periods shows that the market is indeed overvalued, but not nearly at the levels seen during the late 1990’s and early 2000’s. This is consistent with many other valuation measures including more traditional P/E ratios.

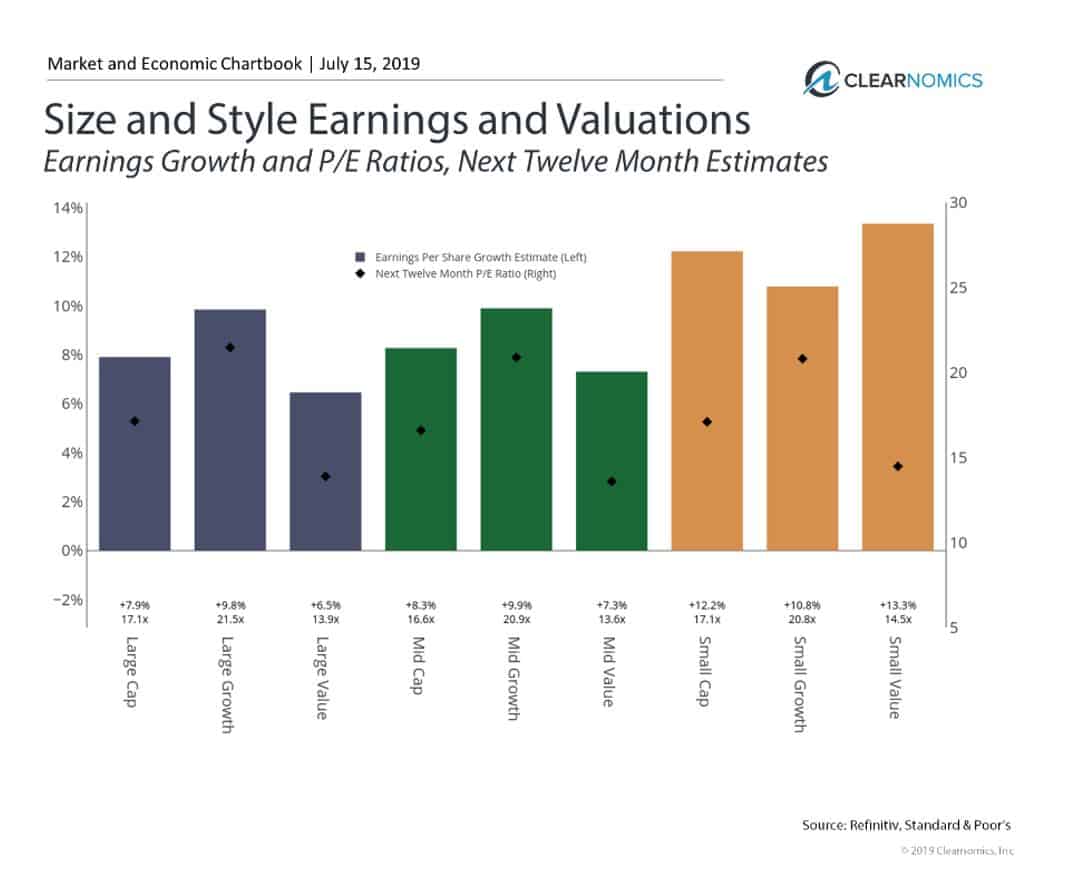

2. Valuations differ across investment size and style categories

Although we often focus on large cap stocks as a proxy for the total market, not all parts of the market are equally expensive. Diversifying across size and style buckets is one-way investors can avoid the most expensive parts of the market.

For instance, the underperformance of value stocks has resulted in much lower valuations. Large cap value is priced at a significant discount to all other style categories, despite comparable earnings growth expectations. Mid cap and small cap value stocks are also priced at valuations similar to large cap stocks, but with higher expected growth. Thus, the ability to look across size and style categories can create attractive opportunities for diversified investors.

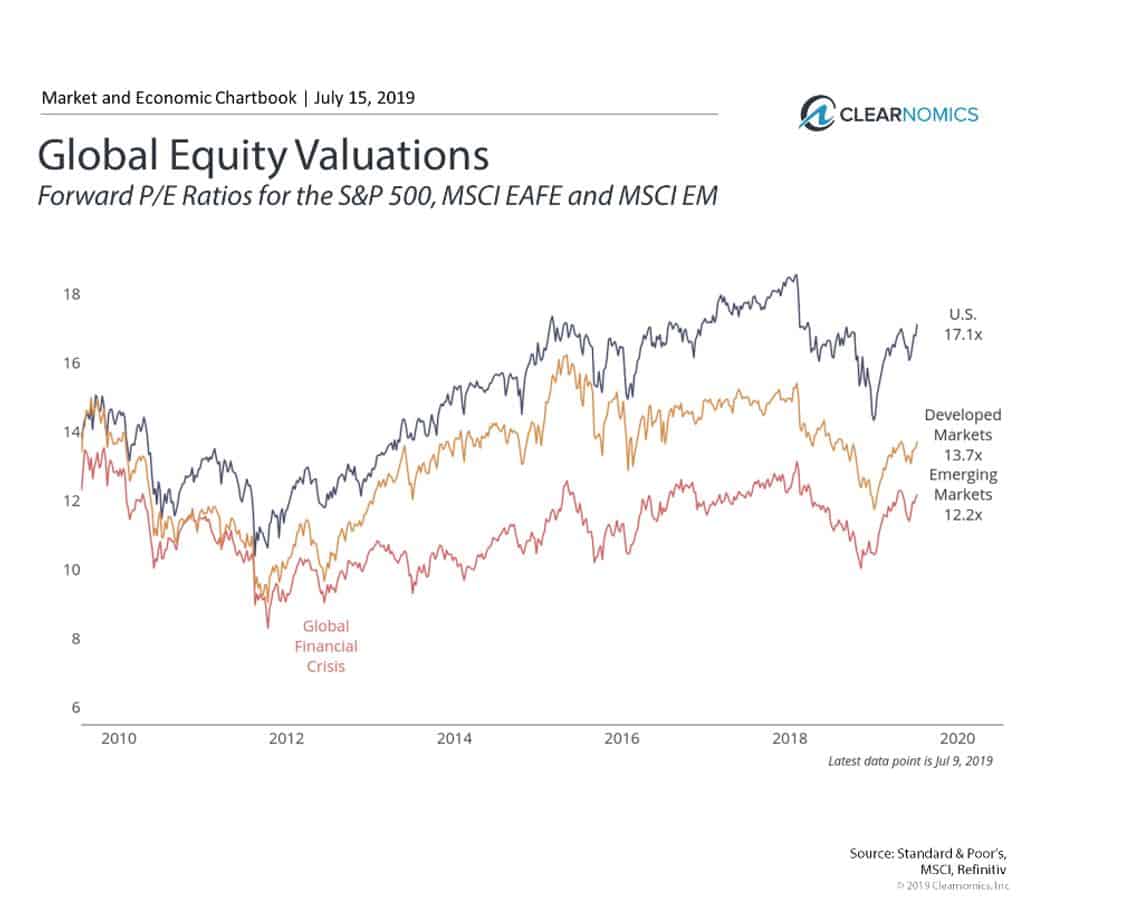

3. Other regions may be more attractively priced

Valuations also differ significantly across global regions. As this bull market cycle matures, it’s more important than ever for investors to stay internationally diversified. While the U.S. has outperformed other parts of the world for many years, it’s unlikely that this will always be the case, especially as U.S. stocks grow more expensive.

The bottom line for investors? Valuations are no longer cheap across the stock market. Investors should remain disciplined and diversified while setting proper expectations for future returns.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.