Will the Bull Market Celebrate Its 11th Anniversary in 2020?

“The underlying principles of sound investing should not alter from decade to decade, but the application of these principles must be adapted to changes in the financial mechanisms & climate.” -Ben Graham

The “most hated” Obama-Trump bull market is well over 10 years old (since March 9th 2009) and has deftly surpassed the 9 1/2-year bull-run record of the 90’s. With the average bull-run lasting about 54 months, investor’s irrational exuberance has led to irrational anxiety.

This should come as no surprise as numerous investors have unpleasant memories of the 2008-2009 “great recession” where many lost their jobs, homes and a good portion of their life-savings. Will the bull begrudgingly make it to (and past) its 11th anniversary in 2020?

Many of the issues driving market uncertainty are ones that have rattled the market for well over a year. Rising tariffs and the threat of a protracted trade war are, unfortunately, not likely to be resolved any time soon. But at the same time, this also doesn’t justify significant long-term concern or short term dramatic portfolio shifts for disciplined investors.

The most important lens through which investors should view their portfolios is the business cycle – specifically, that we’re later in the cycle and that volatility should increase over time. The historical average decline that the S&P 500 experiences each year is about -13% (JP Morgan Guide). Is this time different?

Before you grab the cake and champagne in 2020, consider the following superstitions & realities.

Superstitions

Ten rhymes with bogeymen. Whether you think the -19.8% bloodbath in 2018 and sudden, record breaking (10%+) rebound in the first quarter of 2019 was a dead cat bounce, an anomaly or a sign that a “black swan” may be lurking around the corner, the number 10 may have something to with it.

Consider that the word ‘decimate’ stems from the number 10 (to reduce by a 10th.) This can be traced back to ancient Rome where the killing of one in ten soldiers was the punishment for mutiny.

Even more ominous, the Number 10 is seldom used in Chinese culture because it is considered a “full” number. Chinese culture values moderation, meaning too much can be just as bad as not enough. They also believe in cycles… whatever goes up will go down. If you reach the peak, you will only decline. Number 10 is a peak number, so reaching 10 is not a good thing.

On a positive note, Ten also rhymes with Zen. Zen is slang for feeling peaceful and relaxed. Zen is a Japanese word derived from the Sanskrit term dhyana, meaning “ultimate meditation”. There are many other positive “10’s” to consider. There are the Ten Commandments, ten vowels in the Korean alphabet and “ten yards” in football to get the first down. Still, you may not want to be in front of a Mike Tyson, as a “ten second count” leads to a knockout decision in boxing.

Reality (Fundamentals)

This week there were over 300 million google search results for “when will the market crash next.” This is of no surprise as many of the so-called financial experts on the news shows are throwing around terms like bubbles, mean reversion, death-crosses and recessions in as much to get airtime, as market share for their companies.

Economist Edgar Fiedler eloquently stated, “he who lives by the crystal ball soon learns to eat ground glass.” While the laws of gravity and business cycles continually go up and down, what we have learned over time is to remember the past but take the financial news shows with a grain of salt.

While we may be in the “back nine” of the current economic cycle, does the bull market’s age really matter? While some worry that bull markets die of old age, we remind investors that market cycles typically come to a bitter end due to increases in overspending, over-borrowing and or overconfidence.

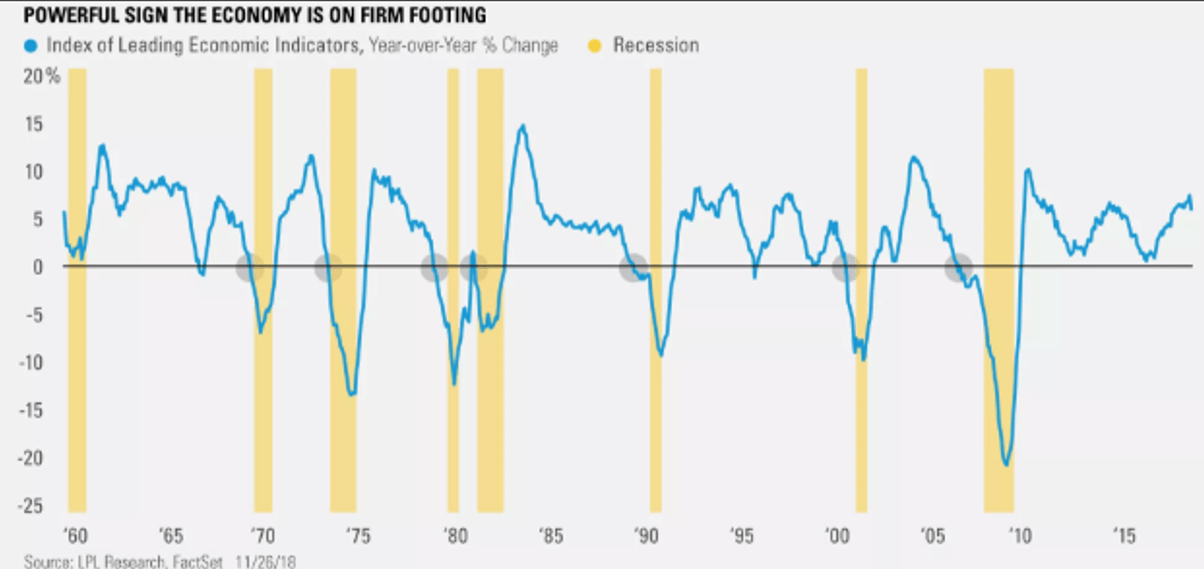

One technical bellwether to consider in forecasting recessions is the leading economic indicators index (LEI), which supports the likelihood of growth in the economy in coming year. The Conference Board’s LEI measures 10 key data points including economic elements such as unemployment, building permits and stock prices.

Historically, when the LEI posts a negative year, a recession may be soon approaching, which is not currently the case. This goes par-for-course on our past quotes, noting that real GDP numbers last quarter where phenomenal, which were further stabilized by historically low inflation, interest rates and unemployment numbers, with no apparent ‘bubble’ in sight.

Simply put, this bull may be long-in-the-tooth, but it has been a slow progression and not ‘overheated’ like the 80’s and 90’s expansions.

Just remember, no matter how much real news, fake news, Trump “tweets” or commentary may rattle the street or investor sentiment in 2019, we advise investors of all ages to “follow the fundamentals” which are very much intact. Whether you are retired or aspiring to retire, your time frame may be well out in the future.

If you are a disciplined long term investor with a comprehensive wealth plan in place, you are not one to take short term action with your money based on market forecasts, hot-stock tips, seasonal patterns or the calendar turning, but on your actual investment process and financial goals for the long run.

By design we keep our blogs apolitical and non-predictive, but strive to provide insightful feedback and well thought out strategies to help navigate forward. Now is a good time to open up your statements and check that your strategy is in alignment with your goals and expectations while adjusting accordingly.

The goal isn’t to swerve around every pothole. Not only is this dangerous, but some bumps are entirely unforeseen or unavoidable. The goal is to set yourself up for a balanced ride, regardless of the terrain as the bull treks forward.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.