Will Afghanistan Turmoil Affect Wall Street?

The short answer is probably not much at all. One of the risks that all investors must keep an eye on and manage is geopolitical uncertainty. Headlines on domestic and global catastrophes are not only alarming but can take investors by surprise since they are often beyond the typical business, economics, and stock market news flow.

To make this even more challenging, managing these risks usually has less to do with adjusting one’s portfolio than about managing expectations and staying level-headed. Don’t let headline news or “recency bias” drive your portfolio decisions. Short term market timing can be the fool’s errand for long term investors.

If the Afghanistan situation and conflict were to re-escalate, consider that a review of 20 major geopolitical events going back to World War II indicate that stocks had fully recovered losses within an average of 47 trading days after an average maximum drawdown of only 5%, according to a CFRA study. In fact, market returns, on average, have been positive 12 months after spikes in economic uncertainty, just as we witnessed with the recent pandemic- led crash and swift rebound.

There have been many geopolitical crises over the past two decades that have been intertwined with business cycles. These include: the attacks on September 11, the war in Iraq, Russia’s annexation of Crimea in 2014, on-going concerns over the nuclear capabilities of North Korea and Iran, the rising global influence of China, its crackdowns in Hong Kong, refugees in the Mediterranean, and many more. While each of these episodes is impactful in its own right – especially when there are humanitarian consequences – this does not mean there are always implications for Wall Street.

This is because while markets may react to a variety of short-term news on a daily and weekly basis, what drives portfolios over years and decades is quite different. Over longer periods of time, slow and steady economic growth, corporate performance, and valuations matter much more. This was true during the conflicts in the decades following World War II and during the Cold War, when there were several long bull market expansions.

Of course, markets depend on global stability, the rule of law across regions, and business/consumer confidence. However, history shows that it’s a mistake to make dramatic shifts in portfolios in response to regional crises.

Jon here. Appropriately globally diversified portfolios, especially those built around long-term financial plans by a trusted advisor, are designed to handle these periods of uncertainty. After all, markets can fluctuate wildly at any moment, whether it’s due to geopolitics, economic shocks, or as we’ve learned the past 18 months, pandemics. Investing is truly an art and science. The science part being portfolio construction and management. The art part being on behavioral finance.

Afghanistan Instability

Recent events in Afghanistan where thousands of Americans were left behind after the military withdrawal are troubling and still evolving under President Biden.

The Afghan government has been losing its tenuous hold on the hundreds of districts across the country over the past three months. U.S. and NATO troops had been scheduled to be withdrawn for some time now after a 20 year occupation. There was even a peace agreement signed between the U.S. and Taliban last year.

Clearly, huge mistakes and miscalculations have been made which are all the more frustrating given the U.S.’s involvement in the conflict for two decades. And while these issues will be debated by pundits for months to come, investors ought to avoid passing judgment with their portfolios.

Ultimately, investors must consider these events in a broader economic and market context. Despite the strong bull market, there are still many investment opportunities across regions as valuations recover and earnings grow. Below are three charts that help provide perspective on how geopolitics affect investors.

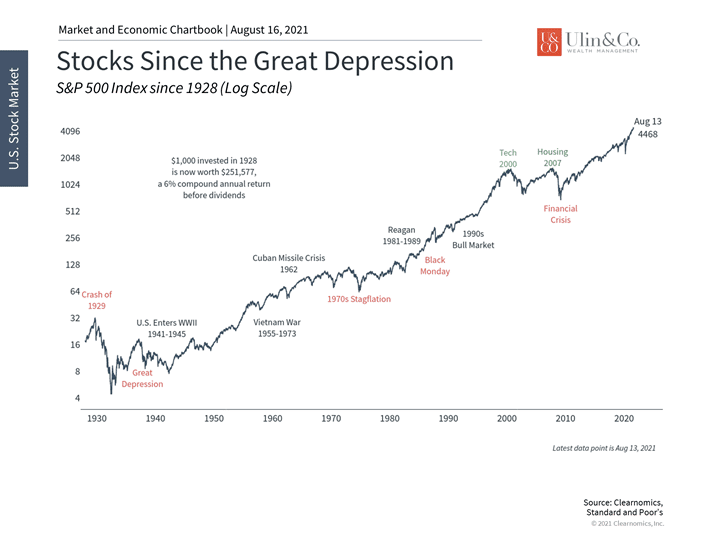

1 In the long run, markets have risen through periods of uncertainty

Despite recessions, political uncertainty and global wars, the stock market has generated strong returns over the past century. Investors with long time horizons can benefit from a growing economy despite short-term crises.

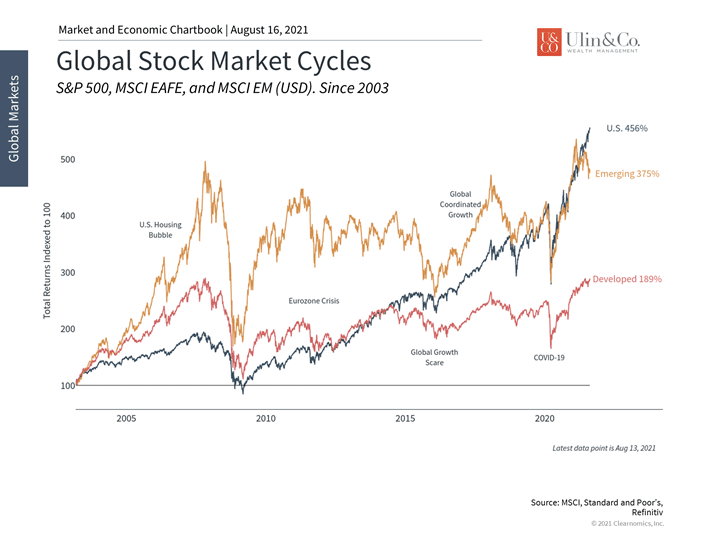

2 Global markets also perform well over time, despite ups and downs

Although each region behaves differently, investors have done well across global stock markets over the past two decades. Emerging markets in particular are especially volatile. Still, they have been an important component of diversified portfolios for years.

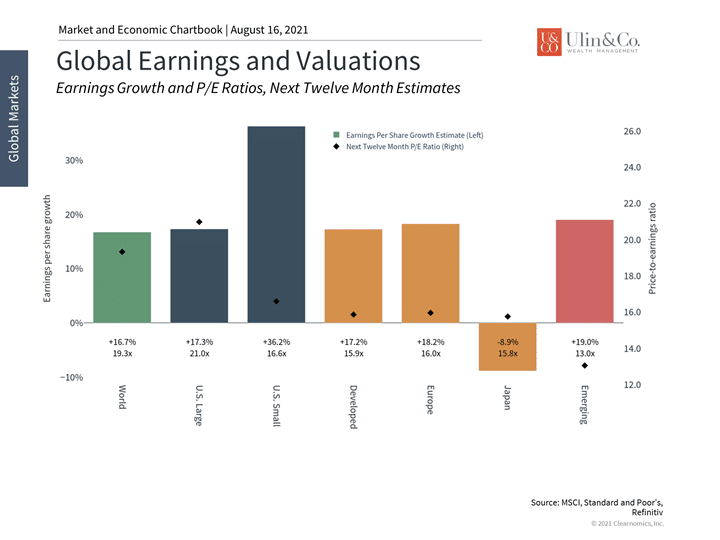

3 There are many global opportunities today

Many regions are still catching up to the strong U.S. recovery of the past year and a half. Valuations are still attractive in emerging and developed markets, and uncertainty from geopolitical conflicts may create opportunities for long-term investors.

The bottom line? The stock market has driven through many geopolitical crises over the past two decades even with some short term setbacks. A major challenge for long-term investors is to always keep a level head. History shows that doing so is often rewarded and improves the odds of achieving financial goals for the long run.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.