Flying Through Economic Recovery

Wealth management should encompass a “team approach” with advisors and clients working together for a common goal of financial security and independence. It should not be a separate experience like taking a flight on a commercial plane where you are enjoying your tasty beverage in the cabin while vaguely hearing your pilots voice over the intercom providing safety and flight updates from the cockpit.

Statements from most broker-dealers only illustrate how you have performed over the past month and are not a good indicator of portfolio performance, costs or strategy over any point in time. Working with a great financial advisor can help you to test and benchmark your portfolio results while while making any needed adjustments to your plan. Not knowing what you are invested in or where you are traveling can lead you down a path of uncertainty.

Whether from a life event, market correction or jet turbulence, we don’t want our clients panicking and parachuting out of a moving proverbial airplane into the Rocky Mountains. This is exactly why we are in phone and video conference meetings with all our clients quarterly throughout the year to help keep their financial vitals and behavior on track

3 Investor Checklist Items

In aviation, a “preflight checklist” is a list of tasks that should be performed by pilots and aircrew prior to takeoff. Its purpose is to improve flight safety by ensuring that no important tasks are forgotten. Just the same, consider implementing the following three investor checklist safety items before turbulence hits.

1 Stay Calm: Whether piloting a commercial jet airplane or your portfolio, calmness makes sense, panic does not. Panic buying tons of toilet paper at Costco, or panic selling out of your 401K and investments like many people did March of 2020 as states were issuing “shelter in place” orders may end up putting you in a worse psychological and financial situation than the actual event itself. In particular stressful life situations, the ability to pilot your emotions and remain calm under pressure can provide a direct link to your investment performance and health outcomes.

Being rational, calm and unemotional can be difficult when it comes to managing money. In a perfect world, every investor could “buy low and sell high”- however, the realities of markets often prove more complex, and require a more measured approach and process.

2 Stay Liquid: Maintain at least 6-12 months in your “cash reserves emergency – bucket” of essential expenses for when inclement weather hits before and through your retirement. This can help to avoid selling securities low during a market correction or crash at exactly the wrong time you may need cash.

Also avoid “retail therapy” as an emotional outlet. While you may have extra time on your hands at home through the pandemic and are getting “cabin fever,” now is not the time to go on a major spending spree online to help reduce stress while increasing your debts and obligations.

3 Stay Balanced: If you are appropriately diversified and know your portfolio “risk budget” matches your financial goals, “doing nothing” may provide a better outcome overtime for your nest-egg and retirement goals than getting emotionally wound up and making a lot of unnecessary changes or executing a “fire sale” during times of turbulence.

Market timing is a fool’s game. Investor studies indicate that the human brain is not a rational economic actor. When faced with uncertainty, even the best investing minds may throw good money after bad, sell at the first sign of trouble or make all manner of jumbled financial decisions when stress and turbulence hits.

How the Next Phase of the Business Cycle Affects Investors

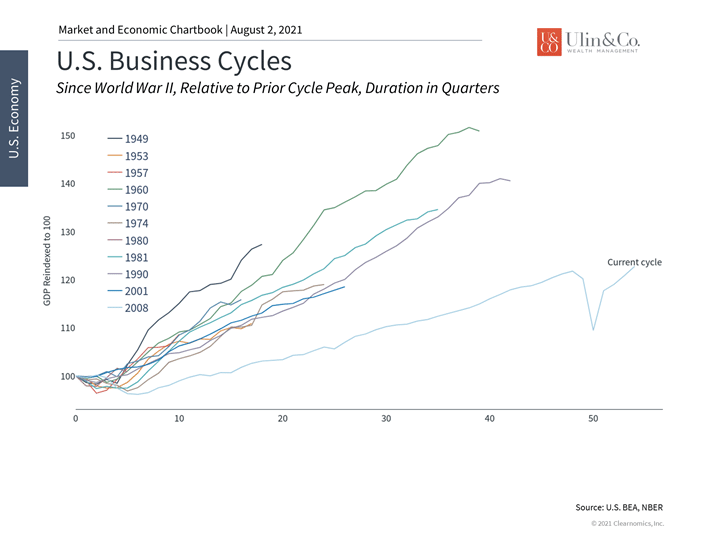

The economic recovery has officially surpassed pre-pandemic levels after the sharpest recession and recovery in history. (see below) That this took place in less than a year and a half is not only remarkable but has also created opportunities for investors. More than ever, it’s important that long-term investors focus on the entire business cycle as they manage their portfolios.

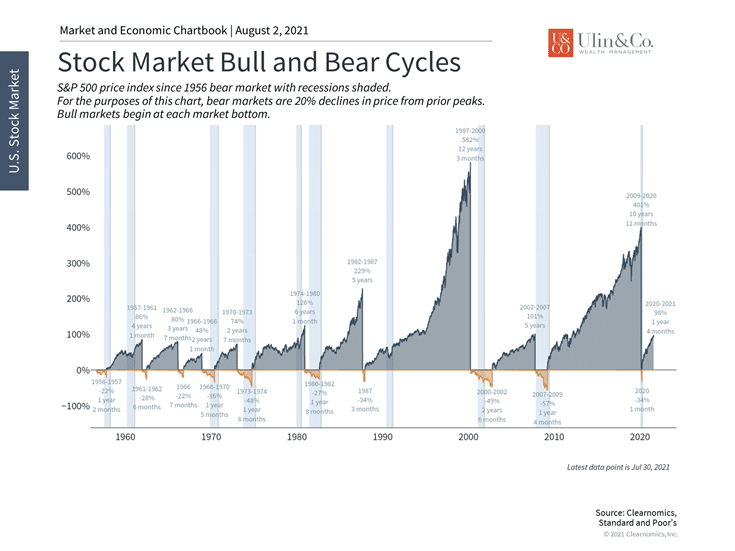

It is natural that, in normal times, investors tend to base their expectations on smooth patterns. This is especially important because forecasts often are projected from what has recently occurred or are based on historical examples. It’s in this way that the unprecedented nature of the pandemic and recovery have been challenging, such as when anticipating the direction of interest rates and inflation. This is especially true for those who based their expectations on the 2008 financial crisis which involved a long decline followed by a slow multi-year recovery.

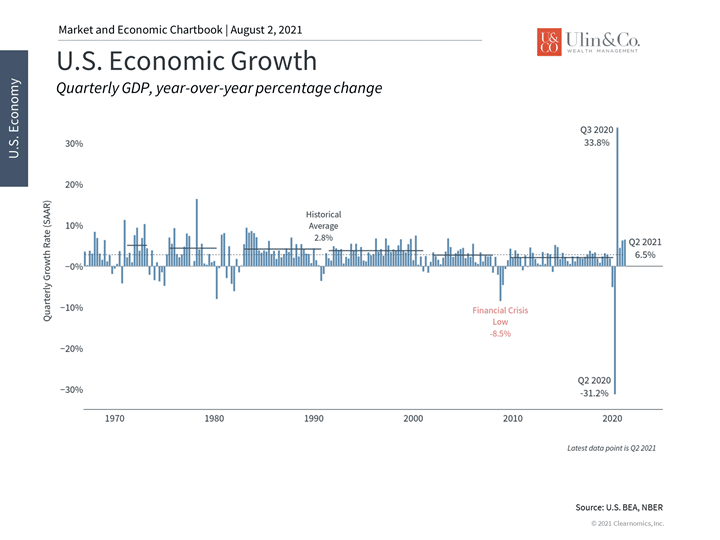

Instead, last week’s GDP report showed that the economy grew at an annualized pace of 6.5% in the second quarter, pushing the economy above its pre-2020 level. (see below) This is the fourth fastest quarterly growth rate since 2000 and is more than three times faster than the 2.1% average over the past two decades.

This surge in growth should not be surprising as the economy reopens from the economic lockdown. This is because the recession was caused by a pause in economic output – not the destruction of productivity that would be expected during a financial crisis, an asset bubble, misallocation of resources, or even a geopolitical crisis. Factories and equipment were still in working order, employees maintained their training and skills, and those businesses with strong balance sheets were able to reopen quickly. Businesses in some industries even thrived during the pandemic.

Because of this, the National Bureau of Economic Research – the official arbiter of business cycle dates – has determined that the COVID-19 recession lasted only two months between February and April 2020, the shortest on record. This means that the current expansion is now nearly a year and a half old which, in hindsight, validates the market’s immediate recovery. (see below)

The question facing investors today is what to expect as the economy transitions from initial economic recovery to sustained expansion.

As this shift occurs and the cycle resembles a more traditional one, it’s possible that historical patterns may become more relevant. This would suggest that, while the business cycle is still young, the pace should decelerate. After all, the economic reopening and COVID-19 stimulus are one-time events which should fade over the coming quarters and in 2022.

Of course, the economy and markets are not the same thing. Instead, they are related since robust economic growth, even if not at the pace of 6.5%, can drive corporate sales and profitability. Over longer timeframes, this can support market returns and bring valuations down to more reasonable levels. This can happen across sectors and asset classes which benefits diversified portfolios.

Thus, investors ought to stay balanced as the economy enters a new phase and hold portfolios built around all phases of the business cycle. While the rapid pace of the past 18 months may decelerate, even slow and steady growth can be enough to support long-term financial goals. Below are three charts that help provide perspective on the recession and recovery.

1 The economy has exceeded pre-pandemic levels

The economy surpassed its early-2020 level after growing 6.5% in the second quarter. It’s expected that growth rates will decelerate over the next several quarters and the initial economic reopening and government stimulus fade.

2 Growth has been robust since the recession

The second quarter’s performance follows growth rates of 33.8%, 4.5% and 6.3% – all spectacular numbers as the economy has reopened. The NBER has determined that the recession only lasted two months which is officially the shortest on record.

3 Slow and steady growth can support markets

History shows that recessions and market crashes are short while economic and bull market expansions are long. While bear markets can be scary, focusing on the right timeframe is vital.

The bottom line? Investors ought to stay diversified and invested across the full business cycle despite slower growth over time after an amazingly powerful economic rebound over the past year from the pandemic driven recession.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent. al Partners (IFP), member FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.