Valuation Signals

Considering our economy is bigger now than it was before the start of the pandemic is an attestation to human adaptation and perseverance through adversity. Despite ongoing COVID headwinds, consumer spending soared up 11.8% in the spring, helping the U.S. economy surpass “pre-Covid” levels with GDP increasing at a 6.5% annual pace in Q2.

At the same time, many investors contrarian antennas are up as GDP is mostly a look in the rearview mirror. It tells us where the economy has been, but not where it’s going. Whether you are an optimist or pessimist, we have discussed many times before our belief that staying on course with an investment process can help to whether future storms or black swan events.

Valuation Signals

As the economy shifts from recovery to expansion, one challenge for investors continues to be the high level of valuations. In the long run, valuations are investors’ best North Star since they don’t just tell us how much something costs, but also what we get for our money. They are correlated with portfolio returns for this reason – i.e., buying when the market is cheap improves the odds of success, and vice versa. After a spectacular recovery, what can investors expect in the years to come?

The most important thing for investors to remember is that valuations are a much better indicator of whether investments are attractive than prices alone. Prices can rise over long periods of time, just as they have for the U.S. stock market over the past century, despite bear markets and short-term corrections. Comparing prices today to previous peaks and troughs doesn’t consider differences between these time periods. Valuations, on the other hand, “normalize” prices by some important measure such as sales, earnings or cash flow. This adjustment makes prices more comparable over time to determine whether an asset class, sector or individual investment is attractive.

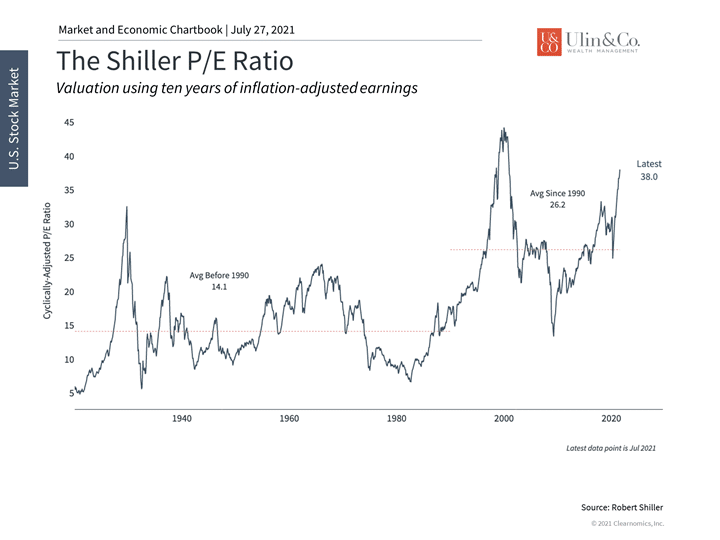

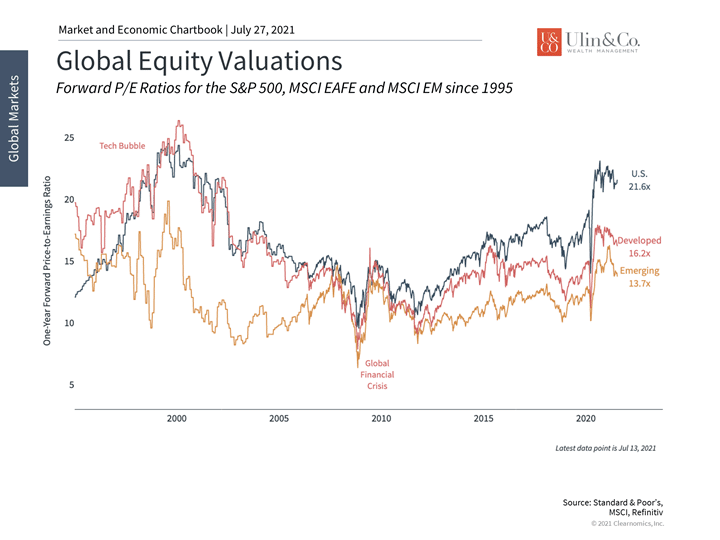

Today, various measures of value are at or near all-time highs not just for publicly traded stocks, but across a variety of asset classes. This is because the bull market has boosted prices faster than fundamentals over the past year. The closely-watched price-to-earnings ratio using next-twelve-month earnings estimates is hovering around 21.6x, not far from the tech bubble peak of 24.5x. The Shiller P/E ratio, also known as the cyclically-adjusted P/E since it uses ten years of inflation-adjusted earnings, is also elevated at 38x. (see below)

Across asset classes, especially public equities, there are very few areas that are “cheap” in absolute terms today.

While investors should be aware of these facts and may find it prudent to make some portfolio adjustments, the following are three reasons investors shouldn’t completely overhaul their plans and stay on course.

First, while valuations are helpful tools for evaluating the attractiveness of investments, they do not predict market behavior in the short run. Markets can continue to rise or fall regardless of valuations for long periods of time, especially during the earlier stages of a bull market when the underlying trends are positive.

Second, why valuations are high matters. While prices have certainly risen, valuations such as P/E’s are elevated because fundamentals are still catching up. As earnings accelerate, P/E’s can moderate to more reasonable levels. On their own, P/E ratios don’t tell us whether it’s prices that will fall or earnings that will rise. In reality, the latter is already occurring as companies and consumers spend more.

Third, in an environment in which all asset classes are increasingly expensive and the value of cash is eroding due to inflation, staying diversified is still the best approach for long-term investors. Other asset classes including fixed income and international stocks can still help improve returns and lower portfolio volatility even if their valuations are also above average.

Where valuations go from here will be important for the direction of long run returns. However, investors should continue to stay invested and diversified as the cycle shifts from a recovery phase to an expansionary one. Below are two charts that help provide perspective around valuations today.

1 Long-run valuations are near historic peaks

Measures such as the Shiller P/E ratio, which uses ten years of inflation-adjusted earnings in the denominator, are near historic levels. This and similar valuation measures are correlated with long-run portfolio returns. However, it’s possible for these measures to improve (i.e. decline) as earnings and other fundamentals catch up to prices.

2 Diversified portfolios can benefit from more attractive regions and asset classes

It’s important for investors to stay diversified in this environment since other regions and asset classes may provide more value than U.S. stocks alone.

The bottom line? As portfolios benefit from the ongoing bull market, it’s also important for investors to stay invested and diversified to manage elevated valuations.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.