Shark Week, Selfies and Corporate Earnings

July brings the Discovery channel’s Shark Week, an annual reminder of the vicious creatures lurking beneath the surface as people head out to the beach for some summer sun, sand and relaxation.

A recent spate of shark sightings and attacks along the East Coast, from Cape Cod and Long Island all the way to South Florida, have prompted officials to close beaches and warn swimmers to stay in lifeguard-supervised areas. While these reports of shark activity are scary and can seem like they signal a big change in risk for beachgoers, they’re not out of the ordinary.

Just the same, the psychological trauma of the intense swells of the stock market fueled by ominous forecasts on financial news shows can be mentally overwhelming for investors to jump into the ocean of the stock market and not have concerns. Annual pullbacks near 14% and bear markets every 6 years are also not out of the ordinary.

While our rational brain knows that market crashes and shark attacks are rare and not permanent, if there’s information available to us that’s not only more recent, but more traumatic, it’s likely to have a stronger influence on our decisions in the short run. This is called “availability bias.”

Availability bias is our tendency to recall events that are recent, relevant and traumatic. Instinctively, if something can be easily recalled, we believe it must be very important. Unfortunately, our assessments can result in sudden, short term biased decisions based on emotions rather than facts and rationale.

Shark Drama vs Data

Steven Spielberg’s 1975 blockbuster, “Jaws,” was a game-changer for sharks. We can all still hear that theme music in our heads as we look out to the sea… “Dunh, dunh, Dunh, dunh.”

If you find yourself scrutinizing the opaque ocean while at the beach on vacation with a little bit of fear in your heart, maybe it’s because sharks find themselves in the news all summer long after a kick start by Shark Week. Shark attacks make international headline news while reinforcing the idea that simply swimming in the ocean can be a risky activity.

Surprisingly, more people meet their demise attempting to take “selfies” than from shark attacks. A 7 year study found that 259 people worldwide died in selfie-related accidents between 2011 and 2017, compared to just 50 people killed by sharks over the same seven years.

As we discussed previously in Diamond Hands, things That Are More Likely Than Winning the Lottery include; Car accidents: 106 to one, Falling out of bed: 2 million to one, Lightning strike: 1.2 million to one, Dog attack: 118 thousand to one, Shark attack: 3.75 million to one. Turns out swimming with the sharks is safer than petting a dog, driving your car, or sleeping in your bed. Stock market odds look even better- over time.

We like to think we invest rationally, but the field of behavioral finance has shown there are social, emotional, and even cognitive factors that can affect our investing decisions just like in any other part of our lives. By becoming aware of these unconscious inclinations, we may have a better chance of meeting our long-term investing goals and experiencing less stress when reading headlines on sharks or on the stock market. The following are three reasons disciplined long term investors should stay focused and invested based on corporate earnings.

Corporate Earnings Adjust to Inflation

Recent economic reports show that inflation continues to accelerate. Not only does this impact consumers’ wallets but it also has wide-ranging implications for corporations, the broader economy, and investment portfolios. However, it’s important to consider how inflation affects both sides of the income statement when making long-term financial decisions. After all, while expenses are increasing for consumers and businesses, inflation also allows corporations to raise prices. How can investors focus on both sides of this equation?

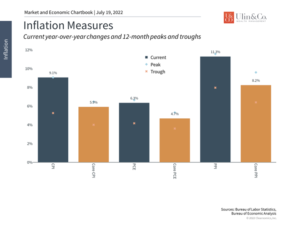

Last week’s Consumer Price Index (CPI) report showed that prices rose by 1.3% over the month of June which amounts to 9.1% compared to the prior year. This is the fastest annual pace since 1981 when inflation was falling and since 1978 when inflation was rising. While nearly all price categories increased, suggesting that inflation is broad-based, by far the largest contributor was energy with gasoline prices rising 60%. Another report on the Producer Price Index showed that the prices charged by suppliers rose 11.3% on a year-over-year basis.

Inflation continues to accelerate both broadly and due to energy prices

No matter how you slice it, inflation is at its hottest level in four decades. These reports all but lock in another 75-basis point rate hike by the Fed later this month and many are wondering if they may raise by a full percentage point. However, there are some positive signs too. To the extent that energy and gasoline are the biggest contributors to inflation, it’s good news that oil prices have been stuck in a range since March, even falling under $100 per barrel briefly. What’s more, the price of wholesale gasoline produced by refiners, known as “Reformulated Blendstock for Oxygenate Blending” (or RBOB for short), has plummeted nearly 25% from its June peak. So, while the nationwide price of gasoline remains high at $4.50 per gallon, it has already fallen 10%.

In the long run, corporate earnings drive the stock market higher

Relief at the pump, if it happens, couldn’t come soon enough since higher prices have weighed on consumer sentiment. Still, there are signs that consumers continue to open their wallets. Last week’s retail sales numbers grew +1% in June after shrinking the prior month, representing an 8.4% jump from last year. This is partly due to inflation itself raising prices, but also because the average consumer is still doing well financially due to high savings rates over the past two years, despite the stock and bond market declines. Regardless of the cause, ongoing consumer spending, coupled with price increases, helps the top-line sales figures of public companies.

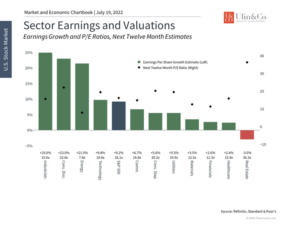

This makes the current earnings season even more important as a gauge of how companies are adapting to this inflationary environment. So far, companies are beating analyst estimates with Wall Street forecasts suggesting that S&P 500 profits may reach $225 per share by year end, an 11% year-on-year growth rate. Even if this decelerates, earnings could still grow faster than the historical average of 8%. Earnings growth helps to improve valuation metrics such as the price-to-earnings ratio which supports long-run returns.

Earnings are expected to grow across nearly all sectors

These patterns hold true across almost all sectors. Ten of the eleven sectors are expected to have positive earnings growth over the next year, with sectors such as industrials, consumer discretionary, energy and technology expected to grow earnings faster than the overall S&P 500. The exception is real estate which is directly hurt by rising mortgage rates.

History shows that as long as revenue and earnings growth remain steady, the stock market and investment portfolios can benefit over time. Thus, while inflation hurts the spending side of the equation for consumers and investors, it can help their investment portfolios. This is because investors don’t invest in the economy directly. Instead, when the economy grows, portfolios benefit as companies earn more which supports stock prices over time. Thus, investing in stocks which benefit from rising prices can be a way for investors to hedge inflation risks in other parts of their everyday lives.

The bottom line? While inflation is challenging for consumers, especially when filling up their cars at the pump, it can also help corporate earnings and stock prices. As always, it’s best to hold a portfolio that is diversified across different parts of the market that can benefit from rising prices.

Diversification strives to smooth out unforeseen unsystematic risk events lurking under the water, so the positive performance of some investments neutralizes the negative performance of others. The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated -that is, they respond differently, often in opposing ways, to market influences.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.