Keep the Pedal to the Metal Through Market Heights

Bubble, bubble, toil and trouble. This notorious line pops up in the Scottish play Macbeth by William Shakespeare. The three witches that predict Macbeth’s future are standing around their cauldron throwing creepy items into the pot to make their spooky brew.

Just the same, there are many ominous headlines this month about stock market heights, valuations and bubbles after the brisk pandemic rebound and recent crypto crash, with financial prognosticators brewing over when the next bear market will come out of hibernation. In fact, there are 86 million google search results today for “when will the market crash” providing plenty of food for thought and discussion.

As I discussed this week with Investment News in response to these elevated uncertainties, “Our contrarian mindset helped our clients to stay on course with our strategic model-based approach through the Covid-19 crash and not panic sell, yet we are not swayed to take the foot off the gas anytime soon in 2021 despite elevated investor sentiment, high market valuations and soaring inflation numbers as the U.S. markets grind higher.”

Jon here. This is precisely the reason why a good portion of our weekly blogs chew over behavioral finance and different types of common human “cognitive biases” that often lead to bad investment decisions often motivated by fear and greed. Cognitive biases are ‘hard wired’ into our brains. We are all prone to take shortcuts, oversimplify complex decisions and can be considerably overconfident in our decision-making ability. Understanding how our brains work can help lead to better decision making, improved risk management, and more consistent returns over time.

Seasonality

That’s not to say we may not experience some major turbulence over the summer months and should pay attention a bit to historical market seasonality. In alignment with the “Sell in May and go away” market maxim, a similar pattern is seen from Memorial Day to Labor Day. Traders are spending more time with kids and family, on the golf course, at the beach and on vacation in the Hamptons instead of doing business deals.

“Yer bum’s oot the windae!” Scottish translation: You’re talking nonsense! If you listen to all the caustic headline noise and market -timing maxims and think you are “smarter than the average bear” to time the market, or pivot mostly to defensive sectors, gold, crypto and cash this summer as a “hedge” to the unknown, you may end up in worse shape to begin with.

Market Bubble Basics

The stock market does not appear to be in a bubble or anywhere around the corner from the next crash. Major crashes have most recently occurred every eight to ten years as we have experienced in 2000, 2008 and 2020. As we are only in the baby-bull infant stages of the new economic cycle, staying optimistic and managing portfolios for downside risk can better help investors’ brains and portfolios stay on track.”

Bubbles are psychological by nature. Pay attention to three “over” metrics when getting close to the top of a market cycle which would include overconfidence (bullish sentiment), over consumption (greed) and overvaluations (price disparity). As bubbles are a reflection of greed, speculation, and emotional biases; valuations are a reflection of those emotions.

Just the fact that the stock market has rebounded dramatically over the past year does not guarantee it will crash in the near future. This is because, almost by definition, the stock market often spends most of its time at or near all-time highs as it rises during bull markets.

The question of whether there is a “bubble,” at least the way most investors understand the term, should be distinguished from “will stocks fall?” This is because short-term stock market pullbacks are normal and can occur without notice. The stock market experiences a few large pullbacks almost every year including declines of about 14%/ year on average which we have not yet experienced in 2021.

Earnings Season Marks a Recovery Milestone for Investors

As the earnings season for the second quarter begins, investors will be looking for new signs of growth in corporate revenues and profits. In countries like the U.S., the conversation continues to shift from recovery to expansion as the economic impact of the pandemic fades and inflation heats up. Whether the bull market can continue and lofty valuations can be justified will depend largely on whether the economy can find a new gear to sustainably grow. What can investors expect from company profits in the quarters ahead?

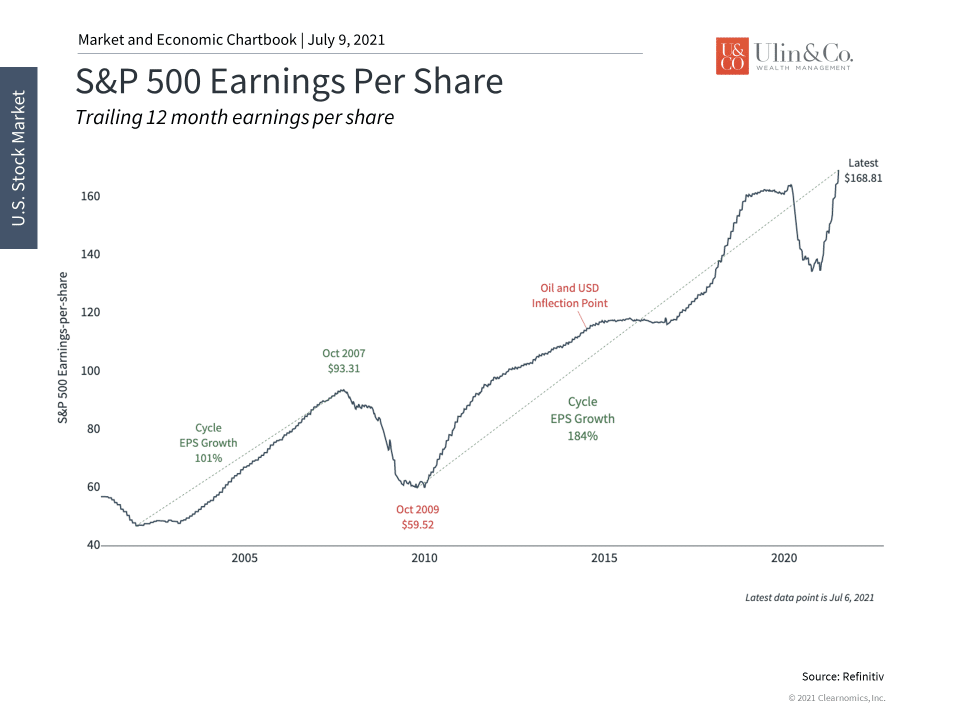

Current Wall Street estimates suggest that S&P 500 profits returned to pre-pandemic levels of $164 per share during the second quarter, mirroring the expected recovery in GDP across the broader economy. (see below) This is faster than expected and would represent a 38% growth rate in 2021 and 21% over the next twelve months. As recently as the beginning of the year, the market didn’t expect a full recovery until the fourth quarter. A full recovery during the second quarter means that the recession in earnings only lasted four full quarters, rather than nearly two years.

This is especially important since the recovery, driven in no small part by pent-up demand, is most likely already incorporated into stock prices. The ongoing bull rally, which has generated double-digit percentage gains across major indices this year, has kept valuations such as the price-to-earnings ratio high even as earnings growth has accelerated.

The economy may need to reach a new gear of organic growth in order to propel markets further. Growth expectations can become self-fulfilling prophecies if businesses invest to meet new demand and consumers spend because they feel more financially confident.

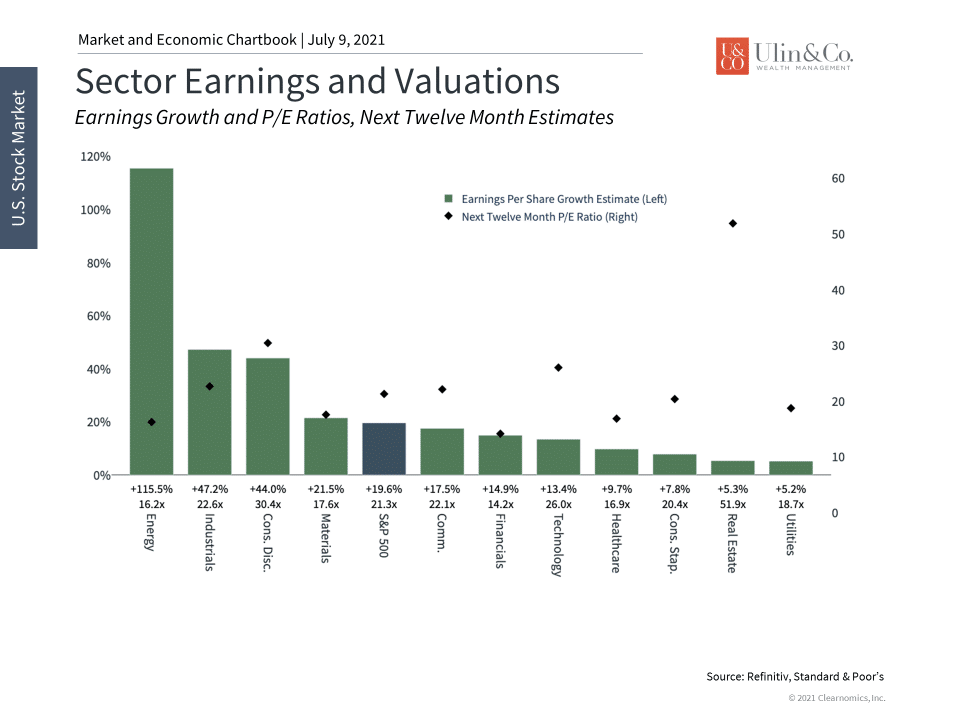

Of course, investors don’t invest in the economy directly. Instead, when the economy grows, investors benefit as companies earn more which supports stock prices over time. Some sectors saw immediate earnings boosts one year ago due to the acceleration of digital transformation, the spending of stimulus checks, buying goods online, and more. This growth has broadened as commodity prices and interest rates have risen, benefiting sectors such as energy, materials, financials and more. (see below) The following are two charts that help to keep the earnings season in perspective.

1 Corporate earnings have likely staged a full recovery

U.S. large cap earnings are believed to have regained pre-pandemic levels during the second quarter. This is a significant milestone and, if true, means that the recovery took place two quarters faster than expected. Earnings are expected to grow at a rapid pace as the economy continues to expand.

2 Many sectors are benefiting from economic growth

While sector leadership was narrow at the start of the recovery, many parts of the market are now benefiting. This is especially true among sectors such as energy and financials which have outperformed this year.

The bottom line? Upcoming earnings reports will be followed closely for signs of continued growth. Long-term investors ought to stay diversified across sectors and regions as the market shifts from recovery to expansion. Although there are always uncertainties, history shows that those who are able to stay invested throughout the business cycle can improve their odds of financial success.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.