Stimulus Package Helps Fuel Bull Market to Its First Birthday

While “bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria,” (Templeton) consider that we are just at the beginning stages of a new bull market, while climbing a new wall of worry. (photo: Lewis BBQ/ Charleston)

Looking back a year ago, the global coronavirus crisis and subsequent national quarantine caused a sudden and swift sell-off on Wall Street last February that sent the Dow index spiraling down into the fastest bear market in history, stronger and faster than the ‘87 and the ’29 crashes, two notorious years in investment history.

Historical Worst Day for Stocks: On March 16th the Dow plummeted nearly 3,000 points to close at 20,188, losing 12.9% in one day. The drop was so enormous that the NYSE suspended trading. In all, the Dow lost 37% of its value putting investors in panic mode from this virus-driven, black swan event that led to the lock down of America (and all of civilization) with over 20 million U.S. jobs lost, the oil index breaching below zero, and most businesses closed.

The broad equity benchmark eventually hit bottom on March 23rd, 2020, touching 19,173. Right after, tech stocks powerfully led the way out of the darkness for a full market recovery incredulously by August, fueled by the “sheltering in place” stocks and behavior that affected almost everything from work, fitness, entertainment and education to shopping.

Impressive rebound from red to green: While it may seem amazing for the Dow to rise over 70% from the bottom to briefly hitting 33K just this week, it should not come as a great surprise, as stocks are “forward looking” six to twelve months into the future, while many times having “priced in” past negative news, and perhaps can be more rational at times than investors themselves.

Perception is Everything

With the current Bull market about to turn one year old, it’s as good a time as ever to reflect on the market’s resilience and our own behavior.

From COVID-19 human losses, protests and destruction across America and the Presidential election fiasco, big events rattled markets but also showed the importance of patient perseverance. Just as having the right perspective on a problem can help to solve it, having perspective in investing is about addressing the right issues while knowing what we can, and cannot control as individuals.

Jon here. One of my favorite “behavioral finance” quotes of all time comes from Jack Bogle, founder of Vanguard (Saint Jack) who said “The stock market is a giant distraction to the business of investing.”

While history doesn’t repeat itself, but It often rhymes, (Mark Twain) we have seen this movie before- where many investors end up panicking during times of volatility and end up ‘cashing out’ at exactly the wrong time. Translation from St. Jack to Mr. Twain- we need to get out of our own way.

Stimulus Package Expectations

With the latest $1.9 trillion stimulus package now signed into law, over $5 trillion has been authorized over the past year to combat the economic impact of the COVID-19 pandemic. Like its predecessors, this bill provides checks to households, supports small businesses, extends unemployment insurance, funds healthcare initiatives and more. Although this spending is not without controversy, that this level of relief has been passed one year after the lockdown began speaks to the long-term impact of the economic shutdown.

The fact that stimulus spending at this moment is controversial is due to the nature of the recovery and the ability to provide targeted relief. While the overall economic recovery has been strong and is expected to accelerate throughout 2021, this is not universally the case. This divergence is often referred to as a “K-shaped recovery” in which some sectors (tech, online retail, etc.) have not only bounced back but grown, compared to sectors at the “epicenter” (brick-and-mortar retail, restaurants, travel, etc.).

Although this disparity has clearly impacted stocks, the rotation from pandemic-resistant sectors to epicenter ones has already taken shape. This is partly due to the strong performance of growth and tech sectors over the past twelve months, high valuations among those sectors, and the re-opening of the economy alongside vaccine distribution. Year-to-date, the energy, financials, industrials and materials sectors have led the market while information technology and healthcare are flat.

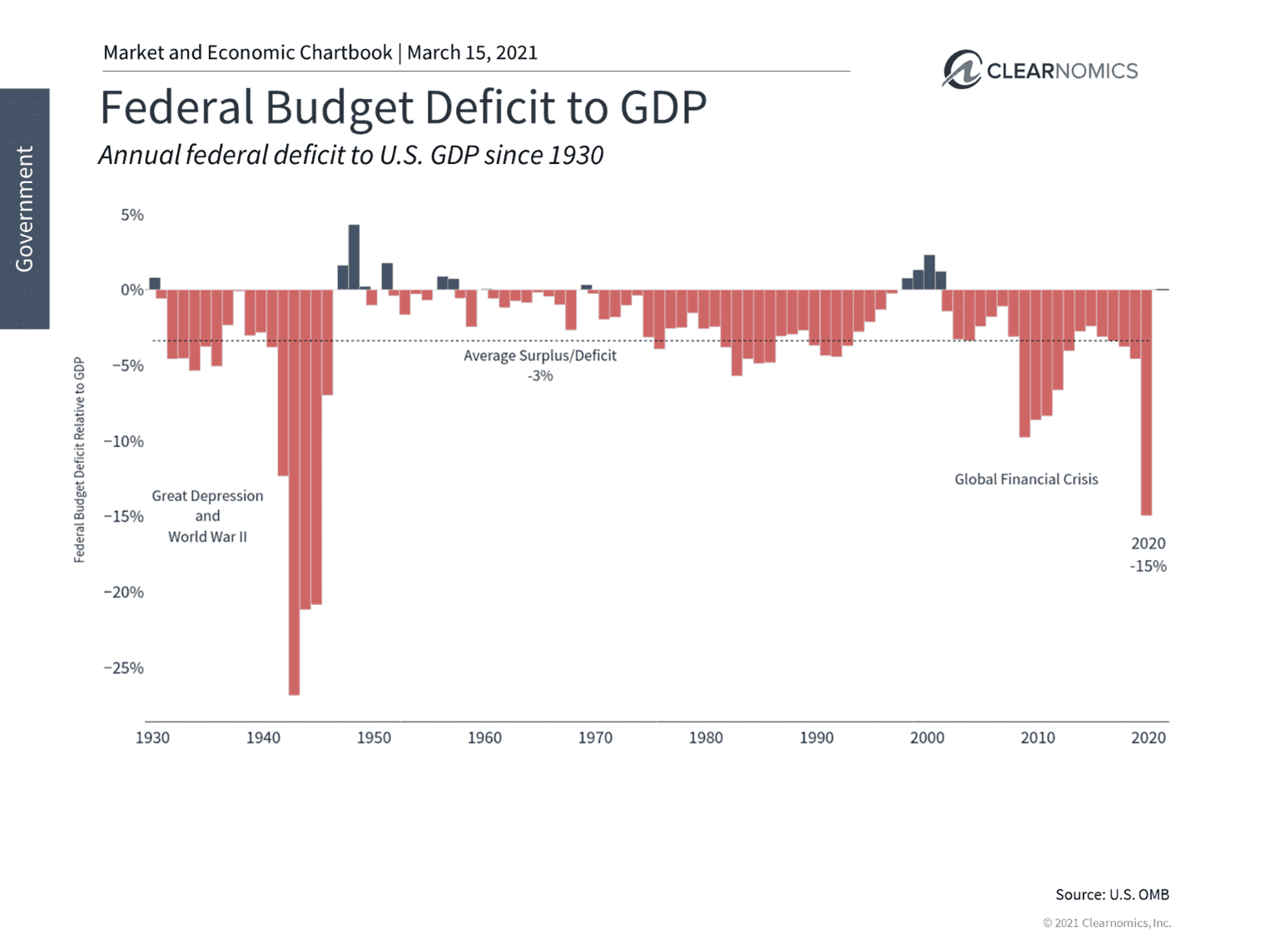

In the context of this economic and market turnaround, the latest stimulus package raises three important considerations for investors. First, many investors are concerned about federal spending over the past year. During the government’s 2020 fiscal year (which ends in September), the CARES Act pushed the federal deficit to 15% of GDP – even worse than during the 2008 financial crisis when it reached 10%. (see below)

In 2021, federal spending will continue to increase but GDP will also improve, helping to keep this ratio in check. Historically, the deficit jumps in times of crisis but then moderates as spending returns to normal and the economy grows. Of course, “normal” over the past 70 years has involved persistent deficits.

While it’s unclear what the limits of the federal debt will be, it’s well understood why the government was forced to spend to keep the economy on life support over the past year. The question is whether there will be political pressure to improve budgetary discipline as the recovery continues.

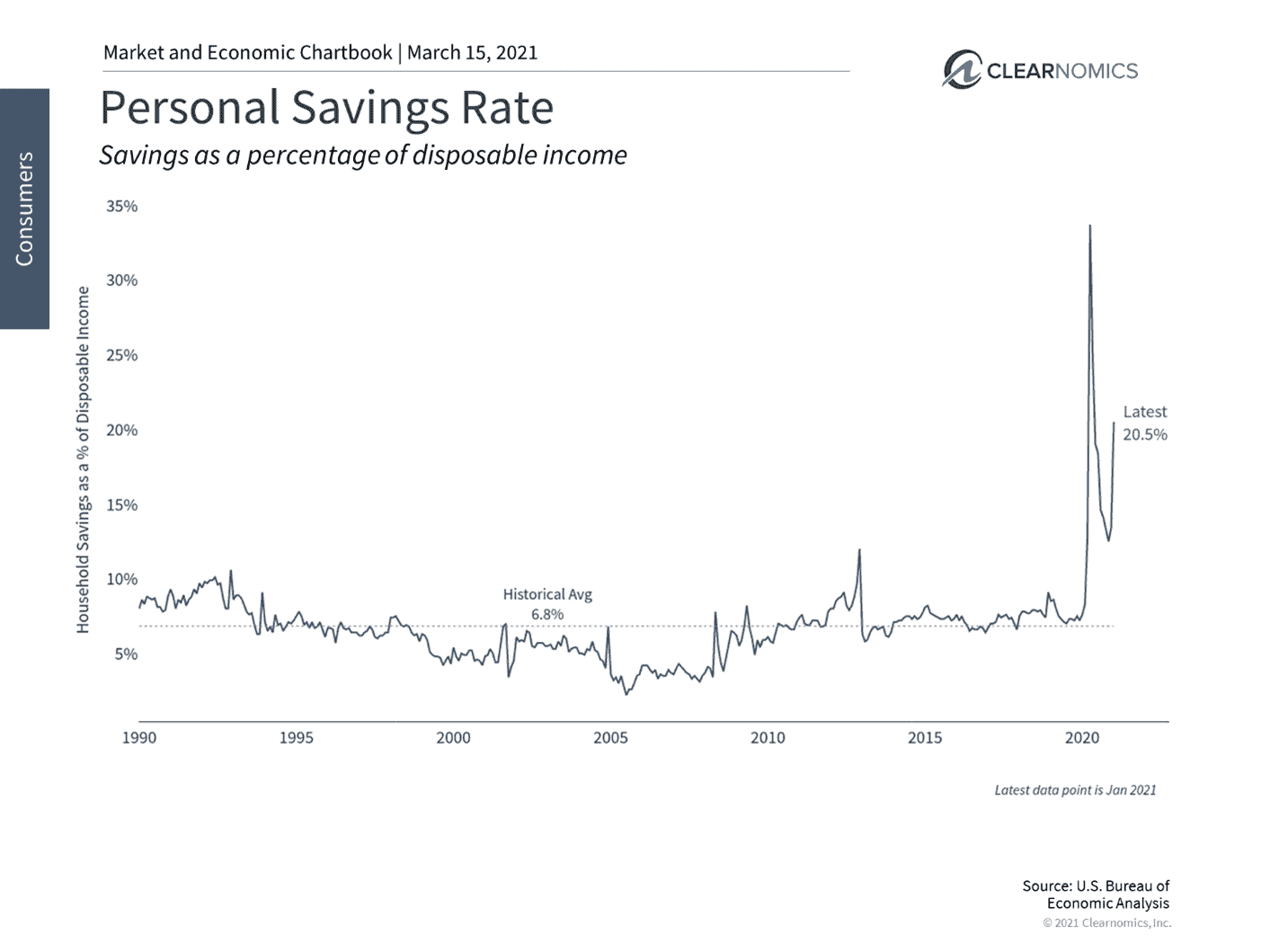

Second, the stimulus bill will help to support those individuals and households who have been directly hit by the pandemic. However, the average household has been financially strong over this period. Not only did many jobs return quickly, but the stock market increased in value, home prices jumped and savings rates improved. This suggests that many households have a greater cash cushion today than in the past. (see below)

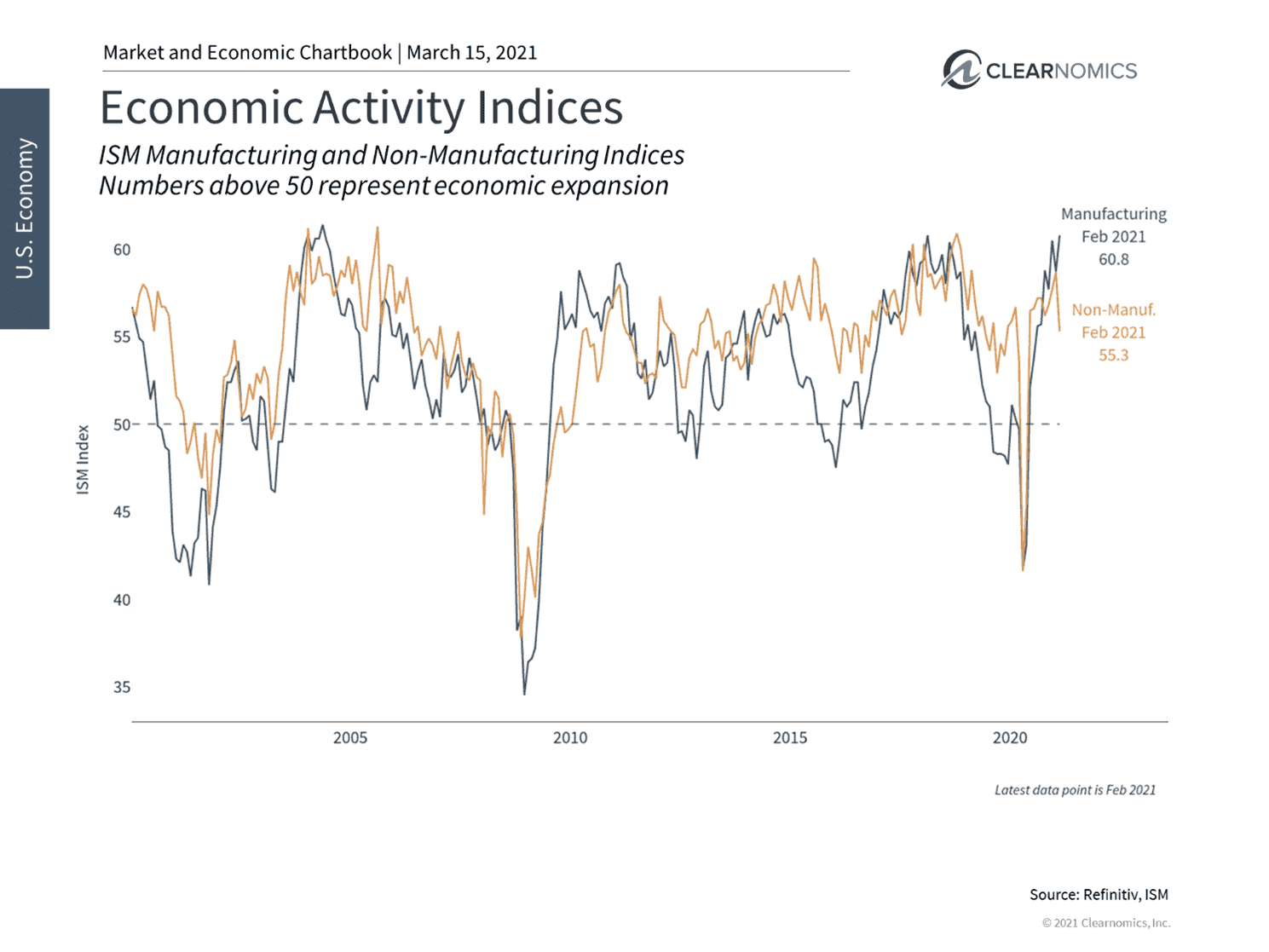

Finally, business activity has recovered remarkably well. By many measures, industrial and manufacturing activity in the U.S. is growing at the fastest pace in 3 years. (see below) Job gains have accelerated in recent months and there are now nearly 7 million open positions across the country – not too far from the historic pre-COVID peak. The market has begun to reflect this reversal as manufacturing-related sectors, including ones tied to commodity prices, have surged.

Thus, while there are still many uncertainties surrounding the recovery, the situation has improved dramatically from just a year ago. Although the stimulus package is not without controversy due to its size and timing, it appears that many individuals and businesses still need support. Below are three charts that put this economic picture in context.

1 The federal deficit grew to 15% of GDP in 2020

History shows that the federal budget deficit tends to expand during times of crisis. This was true during the Great Depression, World War II and the global financial crisis. The question is whether spending will moderate once the crisis subsides. While stimulus spending continues, a growing economy will also improve this outlook over time.

2 Households are saving more

Household savings have remained high even as the economy has improved and consumer spending has returned. In the short run, this is a sign that consumers are cautious. However, it is also a positive sign for the health of consumer finances and for a possible future increase in consumer spending.

3 Economic activity continues to accelerate

Industrial activity continues to accelerate, a good sign for overall economic growth across the country.

The bottom line? The main lesson we learned (yet again) is that “this time is always different” when it comes to catastrophic events, market crashes and rebounds, but “this time is never different” when it comes to our own behavior. It’s important for investors to hold onto these lessons by focusing on key trends and habits, rather than daily market swings and headline news.

Looking ahead, the latest stimulus package could help to cushion many parts of the economy as the recovery continues. Investors should continue to focus on the light at the end of the tunnel as markets adjust to this better outlook.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.