Black Swans, Pandemics & Small Business

The rear view mirror is always clearer than the windshield. -Warren Buffett.

Black Swans

No one can correctly call a market top or predict a “Black Swan” event, like the recent COVID-19 pandemic that instantaneously spread human and financial mayhem over the world from China like some sort of fibonacci algorithm spiraling out of control in a sci-fi movie.

Black swan events are defined as rare, unexpected and catastrophic occurrences that are impossibly difficult to predict. The term was popularized by former Wall Street trader and finance professor Nassim Nicholas Taleb, who wrote about the concept in his 2001 book “Fooled by Randomness.”

The term is based on an ancient saying that presumed black swans did not exist, a saying that became reinterpreted to teach a different lesson after black swans were discovered in the wild. Taleb describes a black swan as an event that 1) is beyond normal expectations that is so rare that even the possibility that it might occur is unknown, 2) has a catastrophic impact and 3) is explained in hindsight as if it were actually predictable.

Black Swan events are becoming more frequent rather than being a rarity, from the dot.com crash (2000), 9/11 Terrorist Attacks (2001), SARS Virus (2002) Global Financial & housing Meltdown (2008), Zimbabwe 79.6% hyperinflation (2010), Fukushima Nuclear Disaster (2011), Crude Oil Crash (2014), Black Monday China (2015) and the Brexit (2016). These events seem to tie financial and non-financial events together with a reach affecting people globally well beyond Wall Street.

While you cannot predict a Black Swan event, you can nonetheless put a contingency plan in place from installing impact-proof windows to your house to initiating a disciplined portfolio diversification process if you are concerned about Cat-5 hurricanes or a bear market inflicting havoc.

Financial vs Economic Distress

Not all bear markets are created equal and this one is no exception. Work stoppages, state lock-downs and limited demand due to the coronavirus have already begun to affect the economy in unprecedented ways. To make matters worse, it’s unclear whether this will last weeks, months or even longer, even with the roll-out of a $2 Trillion dollar bailout.

While controlling the spread of the coronavirus is still the primary focus, markets are already worried about the follow-up effects. With the S&P 500 hovering down near 20% year-to-date (and was down 32% from its peak just a month ago) it’s important for investors to understand these concerns.

One key concept in corporate finance is the difference between financial and economic distress.

These terms separate the underlying business of a company – i.e. its products/services, whether there is demand for them (economic), and whether they can produce them profitably – from how it is financially managed – i.e. how much debt is raised to fuel growth and stay afloat (growth, payroll, etc.) This is an important distinction because financial leverage can sometimes make bad companies look good, and companies with sound business models can fall victim to poor financial management.

As the oft-quoted Warren Buffet saying goes, “only when the tide goes out do you discover who’s been swimming naked.” The tide isn’t just going out – the water is already drained.

The question is whether individuals and companies can stay covered until the tide inevitably comes back.

Small Business Stress Test

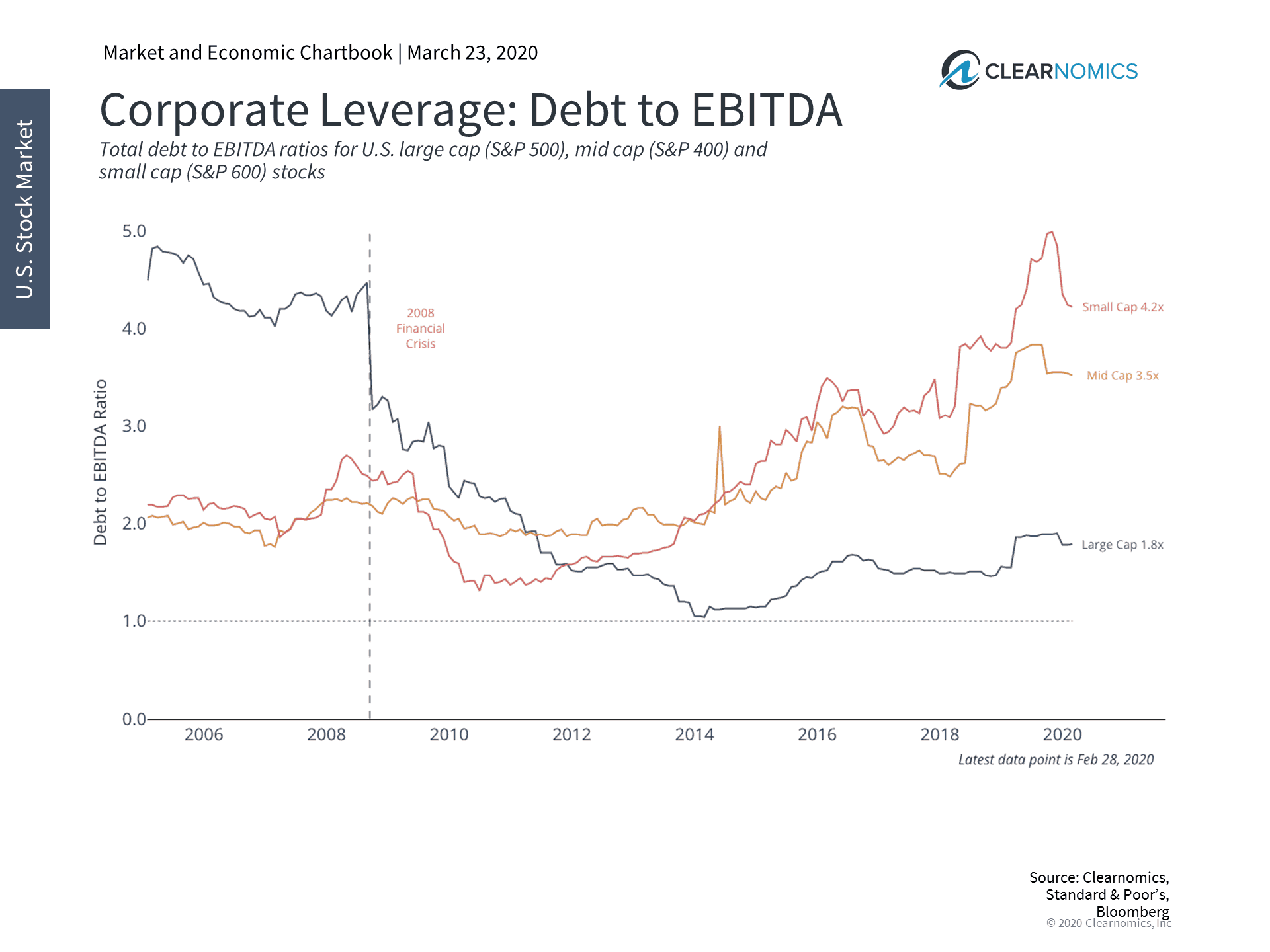

In normal times, this depends entirely on the strength of balance sheets. While the years after 2008 witnessed corporate and personal de-leveraging, this has reversed itself somewhat. The first chart below shows the debt ratios across large, mid and small cap companies. This ratio gives us a sense of how much debt a company has relative to earnings that can be used to pay down that debt.

While large cap companies do not appear to be over-levered compared to the housing bubble years – because earnings and equity values have both risen – small companies have increased leverage over time.

For markets, a legitimate concern is that even if these companies are otherwise economically sound, they may face financial distress as demand dries up. As small business runs almost half of America, keeping an eye on the pulse of this sector and employment numbers is key.

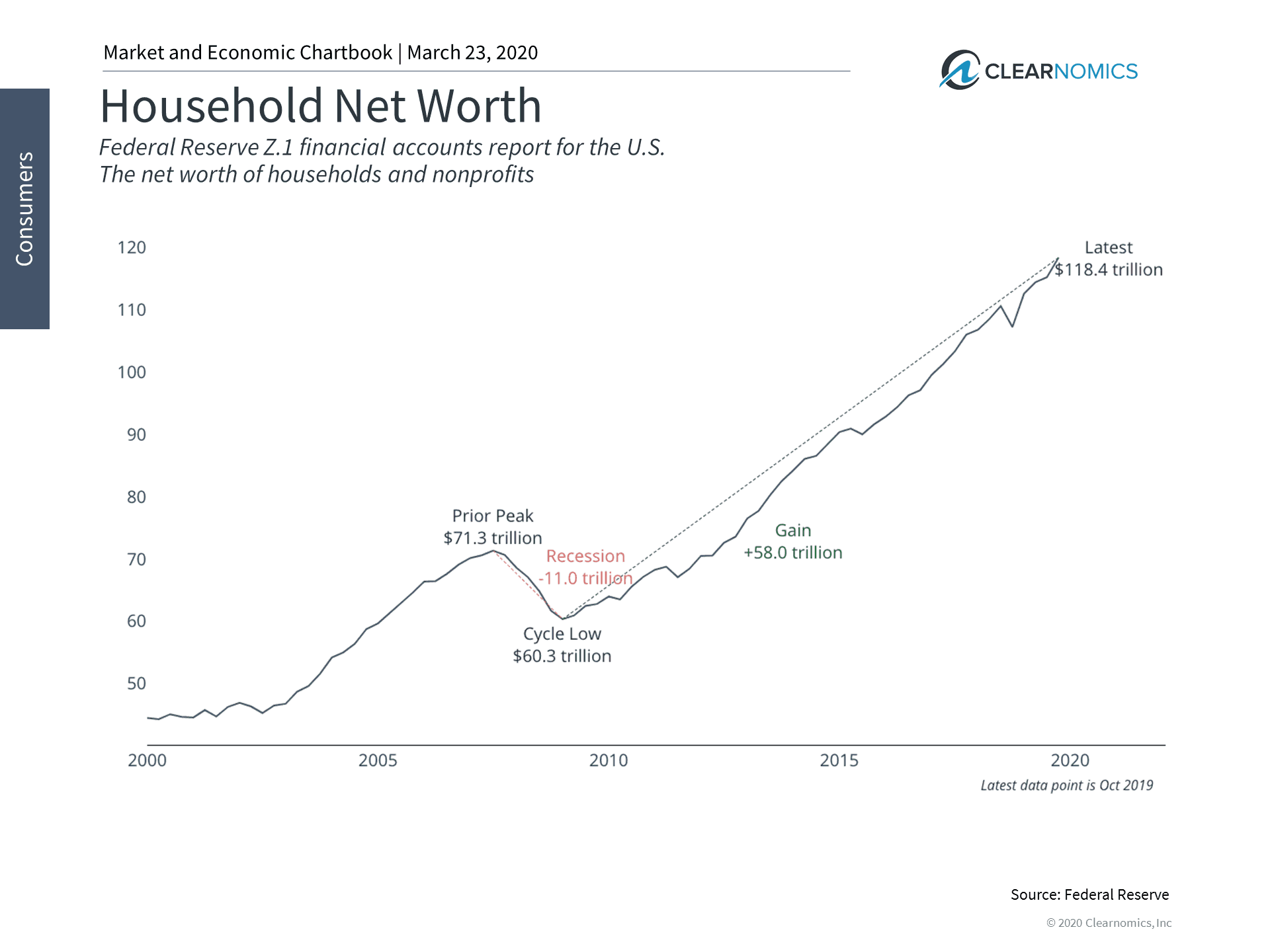

All of these concepts apply to personal finance as well. The strength of an individual’s balance sheet can be the difference between high-profile athletes that go bankrupt and middle-class workers that successfully save for retirement. Fortunately, while certain areas of debt, such as student loans, have increased for Americans, the average household balance sheet is still strong. Household net worth has doubled since the last economic expansion began in 2009.

This is not to say that many Americans will not face difficulty, nor does it imply that all households are created equal. Jobs data, including the recent jump in initial jobless claims (over 3 million), already indicate that many will need assistance. While we may not reach the 14.5 million unemployment number of 2009 after the last crash, the wave is just beginning.

Virus Rescue Package

It’s amazing how fast Washington is taking action this time around. The Fed has now pledged open-ended asset purchases, often dubbed “QE infinity,” after pushing rates to zero. The Senate is seeking to pass the “Virus Rescue Package.” Tax deadlines have already been pushed back. Many industries, especially in travel and hospitality, will likely receive government bailouts. Whether one agrees with this philosophically or not, and whether or not it creates bad incentives, it’s hard to argue that it’s not needed to stave off financial distress – as long as these individuals and businesses would otherwise be economically sound.

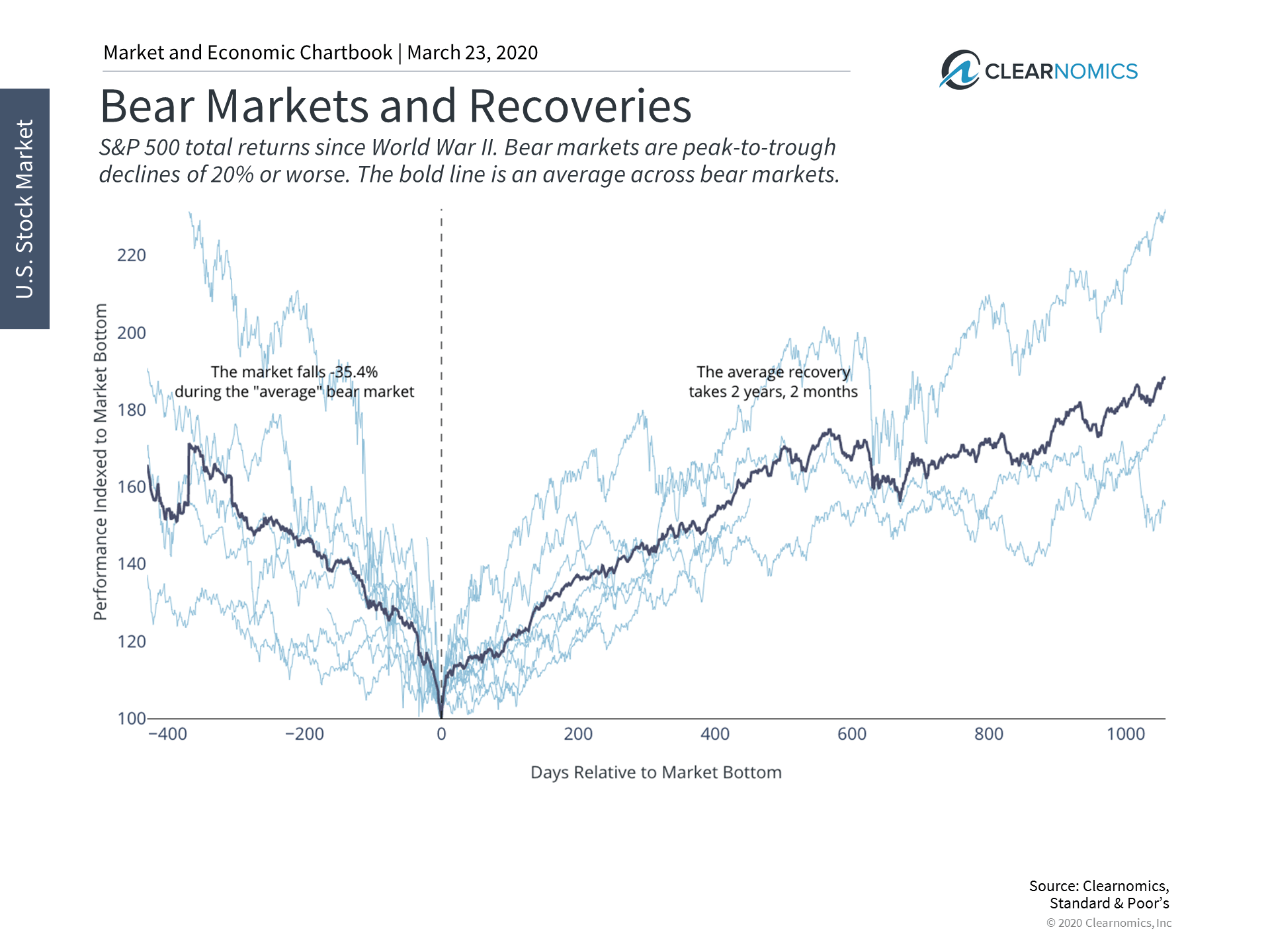

Thus, while the underlying causes of bear markets may all be different, they have two similarities. First, they are generally caused by recessions which can be exacerbated by financial distress. Recessions are topically defined as two successive quarters of negative GDP. De-leveraging and re-leveraging cycles take time, making these recoveries slower but no less robust than recoveries from shallower market corrections.

Second, markets often begin to recover when investors least expect it. The government’s trillion dollar bailout of Wall Street in 2008 did not gain traction with the economy till the market bottom of March 2009 when we finally began to see an economic recovery. And while recoveries may take a few quarters or a couple of years, missing out on these rebounds can have a significant effect on long-run portfolio gains.

The question will be which companies are positioned to avoid financial distress during this period, and whether government stimulus will help them bridge that gap. As individuals, avoiding financial distress depends on having a sound financial plan and possibly the guidance of a trusted advisor.

In the meantime, it’s important for everyone to stay safe and to tackle the public health crisis together.

Below are three charts that help to put the market’s underlying concerns in perspective.

1. Corporate debt levels differ based on company size

While corporate debt levels have remained stable and manageable for large cap companies – since both earnings have equity values have grown significantly over the past ten years – they have risen for mid and small cap ones. This is one reason the government is implementing measures to support individuals and businesses during this time of financial stress.

2. Household balance sheets are strong

Household net worth has doubled since the bottom of the 2008 financial crisis. At nearly $120 trillion, the growth in assets over liabilities has kept personal debt at reasonable levels on average. Of course, many Americans have already begun facing difficulties in this uncertain time and will need the assistance of both public and private programs during the crisis and once it subsides.

3. Despite different causes, bear markets are similar in two ways

Bear markets are often the result of recessions. These can be prolonged if those recessions are the result of over-leveraged business and individuals. Still, recoveries often occur swiftly and without warning. Even the worst recessions can recover within a couple of years amid on-going economic uncertainty.

The bottom line? It’s important for investors to understand the difference between financial and economic distress. Staying focused on diversified portfolios while knowing that businesses and individuals will eventually get back to work is the best course of action for long-term investors.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.