Recession Headlines vs Reality

With 400 million google search results on “will the stock market crash,” it should come as no surprise that many news and media pundits are capitalizing on doom-and-gloom recession headlines and financial shows that may be helping their ratings, in as much riling up investors of all ages. Maybe its time for a “digital detox” in the midst of a stock and bond market rally despite crash talks, war and a banking crisis.

The AAII Sentiment Survey headline recently noted: “Pessimism Stays Above Average for Eighth Consecutive Week,” while indicating only 26% of votes are bullish. This survey may be the mental litmus test of investors that remain severely pessimistic, with a significant percentage mistakenly assuming we’re in a recession or are convinced one will arrive by year end. When we ask anxious investors where they came up with their viewpoints, their answer most often is “from the headlines.”

Your investor brain can get stuck on crystal-ball predictions, rather than examining actual economic improvements evolving this year. CPI recently clicked down to 5% and may land near 3.5% by year end if the trend continues, a dozen eggs now cost about $4, and a gallon of gas near $3.50, even in the face of OPEC+ recently announcing sharp supply cuts all the while employment remains historically strong.

60/40 is Alive!

We keep reminding long term investors to not fight the fed fighting inflation while maintaining a diversified “all-weather” portfolio as a risk management tool to help whether economic storms and to help minimize volatility over time.

Last year was truly different as every crash is as unique as a snowflake, but eventually business cycles change and evolve. Bear markets don’t last forever. This past Friday a WSJ headline exclaimed that “The 60-40 Investment Strategy Is Back After Tanking Last Year, and that the recovery has emboldened investors who didn’t stray from the approach during 2022’s market tumult.”

A potential bullish market momentum indicator was noted recently on twitter by Ryan Detrick, CMT®, “more than 93% of stocks were recently above their 10-day moving average. This is a strong sign of market breadth, and one that tends to resolve higher eventually as the S&P 500 is up a year later 23 out of 24 times and up 18.4% on average.”

Yet even with a good bit of stock and bond sectors in positive territory year to date, decreasing inflation, and improving economic conditions and indicators, many investors are still panicking due to regency bias of the past years tumultuous events combined with ongoing uncertainty.

Don’t Trip Over Recency Bias

Recency bias describes our tendency to extrapolate our recent experiences into the future in any area of our lives and can cloud our judgement when making decisions.

Jon here. Don’t let headline news or recency bias drive your emotions and portfolio decisions. In behavioral economics, recency bias is the tendency for people to place too much emphasis on experiences, events or information that recently occurred, even if they are not the most reliable indicators of what is to come.

For example, would you want to go for a long ocean swim after watching the movie, Jaws? Probably not, even though the chances of being bitten by a shark are very small (1:3.7 million). Many more people drown in the ocean every year than are bitten by sharks (UF Museum).

Recency bias can cloud your judgement as memories of recent market news or events can lead you to irrationally believe that a similar event is more likely to occur again. As a result, investors following the madness of the crowd may make poor decisions to cash out and sell into bear markets or buy into bubbles (real estate, markets, sectors, or hot stocks) at exactly the wrong time. Fear and greed are not sustainable investment strategies.

Expectations vs Reality

There is an old saying that happiness equals reality minus expectations. This is relevant when it comes to financial wealth management during times of uncertainty. Having unrealistic short-term expectations of investment returns and financial outcomes, as many often do, can lead to discouragement and misteps.

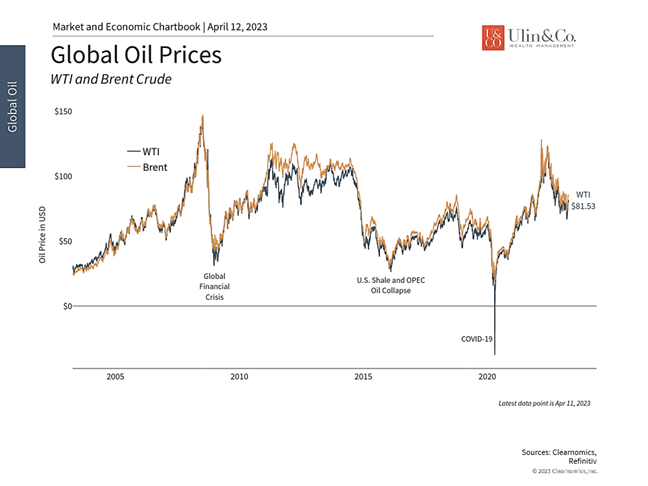

Oil prices are well below recent highs despite surprise OPEC+ cuts

The same is true when it comes to what financial markets expect. By their nature, markets are designed to anticipate future events and assign them a price today. The gap between reality and expectations can drive large market swings, just as they did for inflation and Fed rate hikes over the past year across both stocks and bonds. This divergence has only grown as the Fed nears the end of its rate hike cycle and the economic outlook becomes more uncertain. Consider the following three key areas in which the expectations gap is impacting portfolios.

First, OPEC+, a group of oil producing countries and Russia, recently surprised the market when it announced 1.16 million barrels per day (mmpbd) of cuts to oil production starting in May. This is in addition to previously announced cuts, bringing the total to 3.66 mmbpd. Higher oil prices affect the entire global economy since everything depends on the price of energy. One of the primary drivers of inflation last year was Russia’s invasion of Ukraine which caused oil prices to spike above $120 per barrel, increasing gasoline prices at the pump along with other costs to consumers and businesses.

The goal of these production cuts is to prop up oil prices which have been steadily declining. However, it’s important to maintain perspective around this announcement. The relevance of OPEC as a price-setting cartel has declined over the past decade, partly because cuts by each country are voluntary and difficult to enforce.

Despite the immediate jump in oil prices, both Brent and WTI remain unexpectedly well below their recent peaks. At around $85 and $80 per barrel, respectively, prices are back to where they stood in early March (see chart) and are still within their ranges over the past six months.

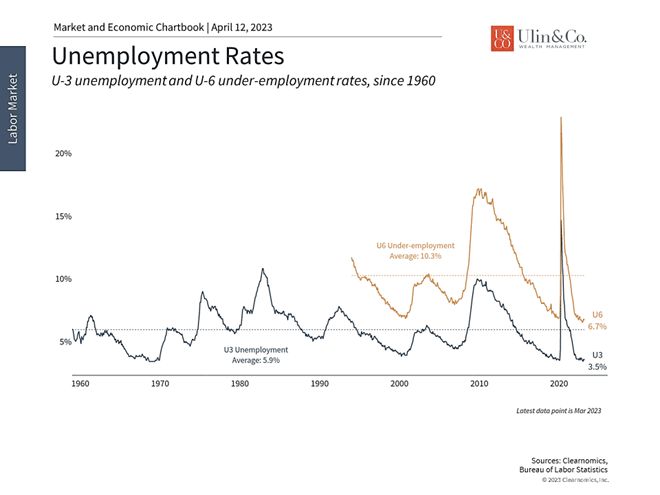

Unemployment remains near historic lows

Second, last week’s healthy jobs report also impacted investor expectations on the economy. The unemployment rate unexpectedly also fell back to 3.5%, once again near its historic low. (see chart) Areas such as construction lost 9,000 jobs while leisure and hospitality continued to recover with 72,000 payrolls added (Bureau of Labor Statistics)

These particular figures were right in line with what economists had expected. However, the overall strength of the job market continues to be at odds with what many investors and economists believed would occur as the Fed raises rates. The job market is slowing, but not at the pace that would be consistent with such a significant tightening of financial conditions or with a possible recession. The only exceptions to this gradual pace are in the tech sector, which lost thousands of jobs this year, which we covered in a few past newsletters.

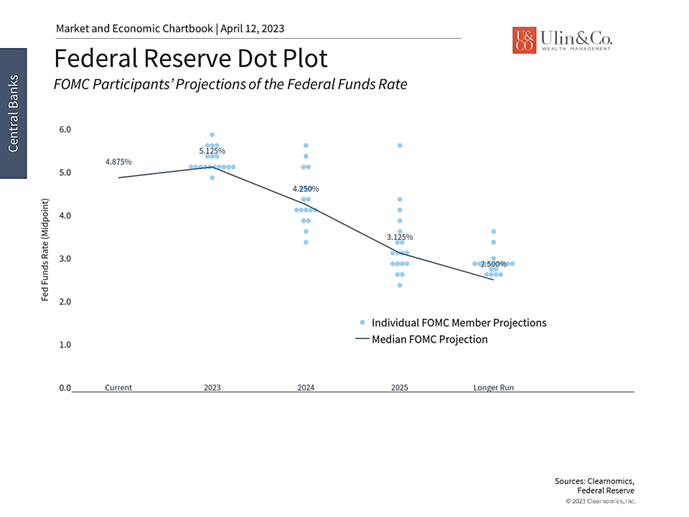

The Fed and markets disagree on the path of policy rates

Finally, at only 3.5%, the unemployment rate remains well below the Fed’s projection of 4.5% at the end of this year. This is one reason that some expect the Fed to continue raising rates, or at the very least to keep them higher for longer. The Fed’s own forecasts imply that it will raise rates by another 25 basis points and keep them steady through year end. After all, the Fed has prioritized fighting inflation which remains much higher than they would like.

This is a significant divergence from what is implied by fed funds futures today. These market-based expectations suggest that the Fed could unexpectedly begin cutting rates by September and continue doing so into 2024. Thus, there is a big expectations gap between what the Fed is saying is appropriate and what the market believes could occur. This could drive market swings in the coming months just as it did throughout 2022.

The bottom line? There are a few key areas where market expectations have diverged from reality with recession headlines and news shows riling up investors. Investors should stay focused on their long-term investment and financial plans with an understanding that missed expectations could drive volatility in the coming months.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us Below.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.