Looking Back: Top Five Investment Lessons Learned this Year

There’s a difference between knowing the path and walking the path. Morpheus, The Matrix”

In many ways, the stock market is like the weather, in that if you do not like the current conditions, all you have to do is wait. Yet patience can be a hard pill to swallow when market volatility appears regardless of your age, IQ, Mensa score, college degree or career.

The past two years for investors may have frustratingly felt like “Waiting for Godot” for the stock and bond markets to turn around. While Godot never actually arrived in the Irish play of the same moniker, investors were greatly rewarded by a record run up of the S&P 500 in November followed by most other asset classes, to even gold and crypto as part of the “everything rally.”

Surprisingly enough, one of the least performing asset classes in 2023 was cold, hard, cash. Perhaps at some point the over $5 trillion dollars parked in cash and money market funds purchased for safety and as a hedge for a recession that never arrived will trickle back into the stock market in 2024.

Data over Headlines

“It’s not what you look at that matters; it’s what you see.” – Henry David Thoreau.

While seasonal tendencies, maxims and forecasts have their merits and make good headlines, history combined with current data and economic indicators offer a more robust approach to investment decision making than just mulling over mortgage rates or oil prices by example. Knowing what may move these rates, how they may affect the overall economy and how to navigate your portfolio is key.

While many investors were over-analyzed ominous financial news reports this year along with every word out of Fed Chair Jay Powell’s mouth, underlying economic factors have been slowly improving over the past year as inflation has fallen from over 9% to nearly 3%. Consider that recession indicators are based on past data – while the stock market is a forward-looking indicator by several months and quarters.

Jon here. As we will discuss below, it’s good to read what the experts are publishing for their 2024 Market Outlooks but take it all in with a grain of salt. As recently noted in a Fortune headline, the majority of economists and financial experts at the top of this year were 100% dead wrong about the U.S. economy crashing into a recession in 2023. That is quite amazing like watching the Weather Channel report feverishly on a potentially catastrophic hurricane that never arrives. The following are five lessons investors learned this year.

1 Challenge the Consensus:

An intelligent investor gets satisfaction from the thought that his operations are exactly opposite to those of the crowd. Benjamin Graham

The majority consensus among financial experts can sometimes be off the mark as we discussed above. This highlights the importance of critically analyzing expert opinions and considering alternative viewpoints.

Successful investing often involves questioning conventional wisdom and doing your own research. Many times, when all experts and the crowd agree taking a contrarian approach can be beneficial as the opposite of what is expected usually happens. We were of the few “no recession” crowd this year and stayed on course with our client portfolio strategies through all the negative sentiment. More than a few influential financial leaders helped fuel the ominous economic headlines beginning at the top of this year. A few of the best headline- hits include:

“The US and global economy is facing a “very, very serious” mix of hurricane like headwinds that is likely to cause a recession by the middle of 2023,” Jamie Dimon.

“There are a lot of current similarities in 2023 to the 1929 stock market crash which lead to the Great Depression,” and there is an “economic hurricane on the horizon.” Elon Musk

Robert Kiyosaki Warns of Giant Market Collapse, War, ‘Really Hard Times Ahead’ for Millions

Michael Burry, the “Big Short” investor who became famous for correctly predicting the epic collapse of the housing market in 2008, bet more than 90% of his portfolio at $1.6 billion on a Wall Street crash.

2 Stocks are Resilient

This year presented a barrage of challenges and economic uncertainties from geopolitical tensions (two major wars) U.S. banking crashes, union worker strikes, debt ceiling problems, elevated interest and mortgage rates, a hawkish Fed, and lingering inflation. Despite the doomsday headlines and a multitude of crises, the stock market not only weathered the storms, but swiftly advance forward.

This underscores the resilience of markets and the importance of staying focused on long-term goals rather than being swayed by short-term volatility and investor angst. Many were surprised by the strength of consumer spending to help push stocks and the economy forward despite elevated prices and inflation. This does make sense as 70% of GDP is powered by the consumer that was powered by wage inflation and an influx of cash from COVID relief funds and other measures.

3 Fed Manipulation Affects Stocks

Don’t fight the Fed fighting inflation. Jon Ulin

While we have mentioned in many newsletters through 2023 to ‘not fight the Fed fighting inflation,” this year punctuated the maxim that “stocks take the escalator up and the elevator down.” This refers to the tendency of stock markets to experience slow and steady growth over time, but sudden and sharp declines happen, as we experienced in October.

This year also was a reminder that stocks “climb a wall of worry” greased by Fed manipulation and policy. Every bull and bear market cycle seems to have a Fed Chair in the background like the Wizard of Oz behind a curtain. Jay Powells is the Wizard.

For the most part of this year, the Fed’s aggressive rate hike campaign along with Fed Chair Powells hawkish words created an atmosphere of uncertainty while fighting inflation. However, stocks and bonds advanced after the November reversal suggests the intricate dance between monetary policy and market dynamics. It’s a reminder that markets don’t always move in lockstep with interest rate changes, and timing is crucial.

4 EQ is More Valuable than IQ

The world of Wall Street can be a very overwhelming place like a Matrix movie with conflicting ideas and ideologies, financial jargon that sounds like a foreign language, and numbers flying around like Matrix digital rain. Many smart investors may have made bad decisions this year based on fear vs facts.

Investor behavior plays a significant role in shaping market outcomes no matter how smart you are. In our own experience of running investing and retirement workshops at high tech Fortune 500 companies and working with clients of all ages, there is no direct correlation between your IQ or EQ (emotional intelligence) when investing. The realization that long-term investors should not let current events and sensational headlines derail their returns is a crucial insight. Emotions can lead to impulsive decisions, and understanding this can help empower investors to stay the course and stick to their long-term strategies.

EQ (or EI) provides a more holistic view of an individual’s investing capabilities than IQ. While a high IQ may indicate analytical prowess, it does not necessarily correlate with effective decision-making, especially in emotionally charged situations. In the dynamic and often unpredictable world of finance, where human behavior plays a significant role in market movements, the ability to navigate the emotional landscape is a distinct advantage.

At its core, EQ involves the ability to perceive emotions accurately, both in oneself and in others. In the fast-paced world of finance, where market dynamics are influenced not only by economic factors but also by human behavior, the capacity to recognize and interpret emotions is invaluable. Investors with high EQ can adeptly read market sentiment, anticipate shifts, and make informed decisions based on a nuanced understanding of the emotional landscape.

5 Cash Has Risks

The belief in cash as a safe-haven was challenged, especially with the anticipation of decelerating rates into 2024. When rates eventually get back closer to where they were in 2021, consider that your cash, CD, and money market investments may hinder more than help to meet your financial goals over time. While we do stress the importance of holding one to two years in cash reserves before and through retirement, overconcentration in cash over your rainy-day fund can be a detriment.

We have been declaring all year that cash may not benefit long-term investors in the face of taxes, inflation, and retirement goals emphasizes the importance of a diversified portfolio. It’s a reminder that staying invested in a mix of assets tailored to your financial objectives is crucial for long-term success.

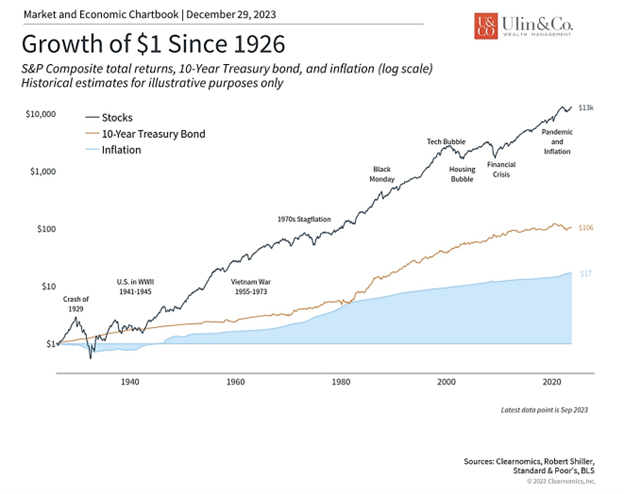

For our one chart of the week and last chart of the year, we provide our crowd favorite- Growth of $1 Since 1926 (going back 98 years.) It’s a good reminder that (1) the stock market has prevailed though all kinds of mayhem overtime for long term investors and (2) stomaching risk year to year resulted in a $13K return by 2023 (of one dollar since 1926) and kept well far ahead of bonds and inflation over time.

Most important the chart shows that as painful as some market crashes may have been, when you zoom out, they are just a blip on the screen. We do advocate deploying a balanced portfolio mix of cash, bonds, stocks and alternatives to help play offense and defense at the same time.

The bottom line? The top five investment lessons we’ve learned this year underscore the dynamic and unpredictable nature of financial markets. They highlight the importance of adaptability, a long-term perspective, and the ability to navigate through the noise of short-term fluctuations and ominous headlines. As an investor, embracing these lessons can contribute to a more informed and resilient approach to managing your portfolio before and through your retirement years.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.