Staying Balanced Through Historic Economic Decline

Ominous financial headlines remarking on the historic economic decline due to the COVID-19 quarantine and resulting recession can cause investors of any age to get anxious and wonder how this news may affect the markets and their savings.

Headline Hazards

While access to information 24/7 can make you a better investor, data- overload combined with your own emotions of fear and greed can be catastrophic to your financial health over time if you act on short term news- like over consuming material on dieting (a crash diet), especially if you are not an expert in either field.

When peeling back the onion of all the Wall Street headline news, consider that volume does not equal quality. Do not assume that there is an impartial world of news on the economy and investing to draw upon from the financial “experts” on TV.

The broader way to view financial headlines is to realize that there will always be concerns that drive market uncertainty. Whether these are related to the public health crises, geopolitical tensions, Presidential elections, trade wars or other future concerns, investors will always find reasons to view the glass as half empty. Yet, over the long run, continuing economic growth can drive investment returns through inclement conditions despite these headlines.

Handling Risk

As we discuss with our clients in every meeting, “focus less on the headlines and uncertainty,” and to “focus more on what you can control,” while developing and implementing a long-term retirement plan and mindset.

How we handle risk and daily decisions from the amount of speed we choose to drive our car down the highway to selecting health insurance coverage and deductibles, or even just getting on an airplane for the next family vacation are all examples of risk baked into our daily lives.

Investing your retirement savings should also entail a well thought out process with guidelines in place, and not just be “winging it” with picking individual stocks and sectors, like playing a game of roulette in Vegas while betting on black or red. In our opinion, investing your savings without a disciplined risk management process in place (or guardrails) is as reckless as driving a car without auto insurance or faulty brakes.

Diversification

Diversifying your retirement savings is the closest thing to help insuring your financial future, in our opinion. Diversification is the process of allocating capital in a way that helps reduce the exposure to any one particular asset class or risk, otherwise known as “not putting all your eggs in one basket.” A common path towards diversification is to help decrease risk or volatility by investing in a variety of sectors and asset classes.

By example, you may be of “moderate” risk profile while utilizing a 60/40 portfolio. The 60/40 rule dictates 60% of the portfolio is invested in stocks and 40% in bonds or other “safe” classes. Utilizing the “60/40 rule” to diversify between stocks and bonds has helped many investors over time to minimize volatility and losses while helping them to mentally stay on track.

In our opinion, the 60/40 portfolio is not “dead” and has done its job accordingly in 2020. Year to date, a 60/40 portfolio mix based on Vanguard returned 3.19% year to date as compared to the Dow Jones (DJIA) Index down -2% for same time period. Many other major asset classes are down significantly in 2020 including oil, energy, banks and small cap sectors, no less the headwinds that may be felt for years in the travel, food and hospitality industries.

Dog Days of Summer

As we stride through August and the “dog days” of summer, the economic recovery is still sending mixed signals. This is primarily due to the accelerating number of COVID-19 cases in many parts of the country which has sparked increased restrictions by governments and businesses. This means that many of the economic numbers will vary from region to region, following the overall trends of the disease. Despite this, there are still signs that the economy is getting back on track. At the very least, the data suggest that the worst is almost behind us and jobs may slowly return.

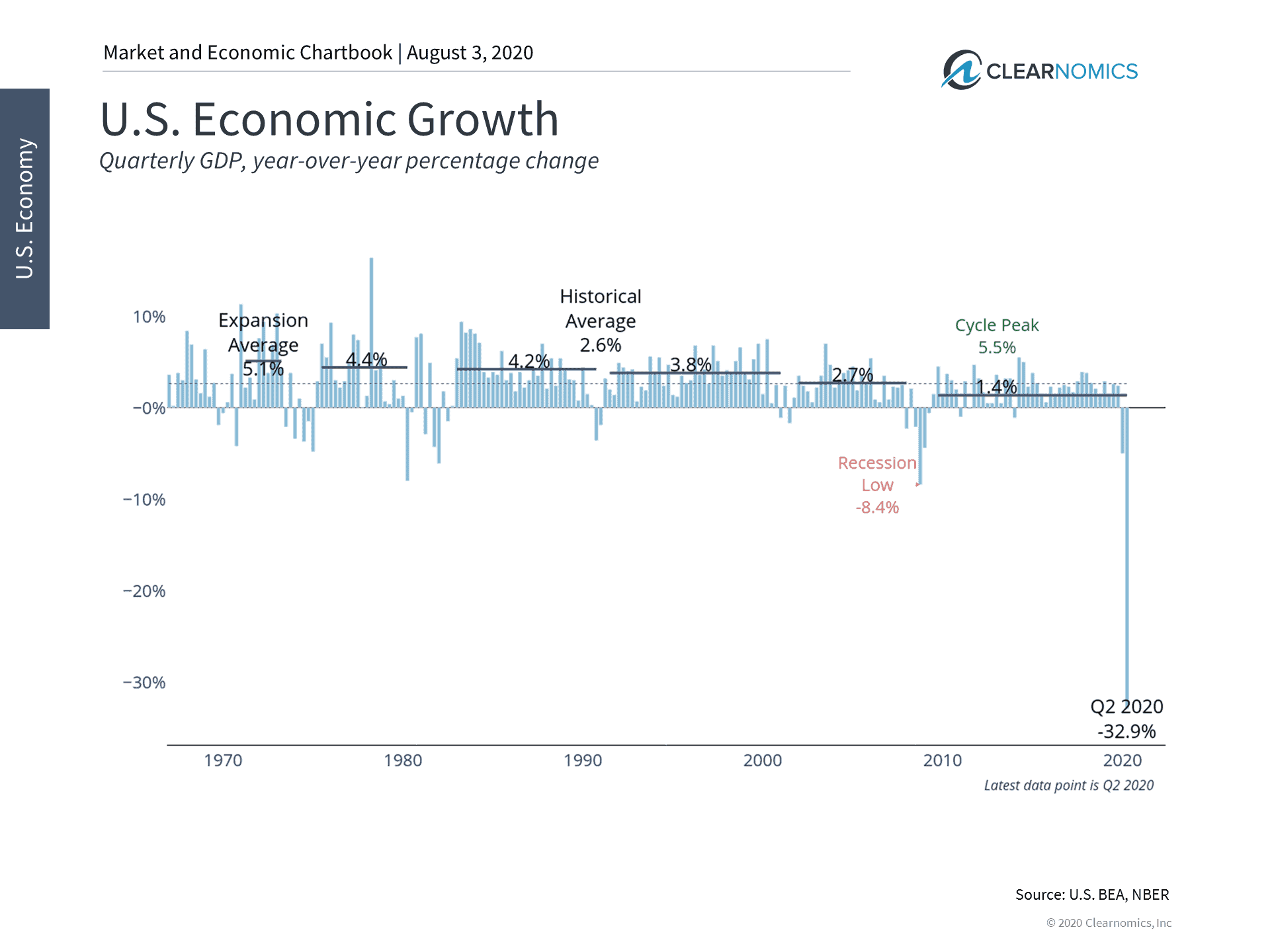

In particular, recent GDP data for the second quarter showed that the economy suffered its worst decline in history over those three months. On an annualized basis, the economy shrank by -32.9% (see below) worse than any quarter during the Great Depression nearly a century ago. However, it’s important to keep a few facts in mind when interpreting these statistics.

First, we often annualize economic numbers in order to understand trends. Normalizing the data helps us to better compare measurements by imagining what would have happened had these events been stretched out to a whole year.

In this case, the magnitude of this GDP decline is not expected to last a full year since the worst likely occurred during April and May. The actual quarterly decline was 9.5% – both compared to the first quarter and compared to the same quarter a year ago. While this is still terrible, it can’t truly be compared to the Great Depression which lasted a decade and technically consisted of two economic cycles.

Second, the GDP numbers are naturally “backward-looking” since they are only released quarterly with a lag. The reason that many stocks continue to reach all-time highs is because these numbers were widely anticipated.

Finally, the GDP numbers don’t take into account what we’ve learned since the economy was in free-fall: that businesses can successfully reopen, and the economic numbers can improve. Of course, this is highly dependent on the public health trends.

Looking Forward

If businesses can continue to run and expand their operations – even at partial capacity – jobs can return and corporate profits can recover. There were clear signs of this in the jobs data during May and June when even weekly jobless claims were improving.

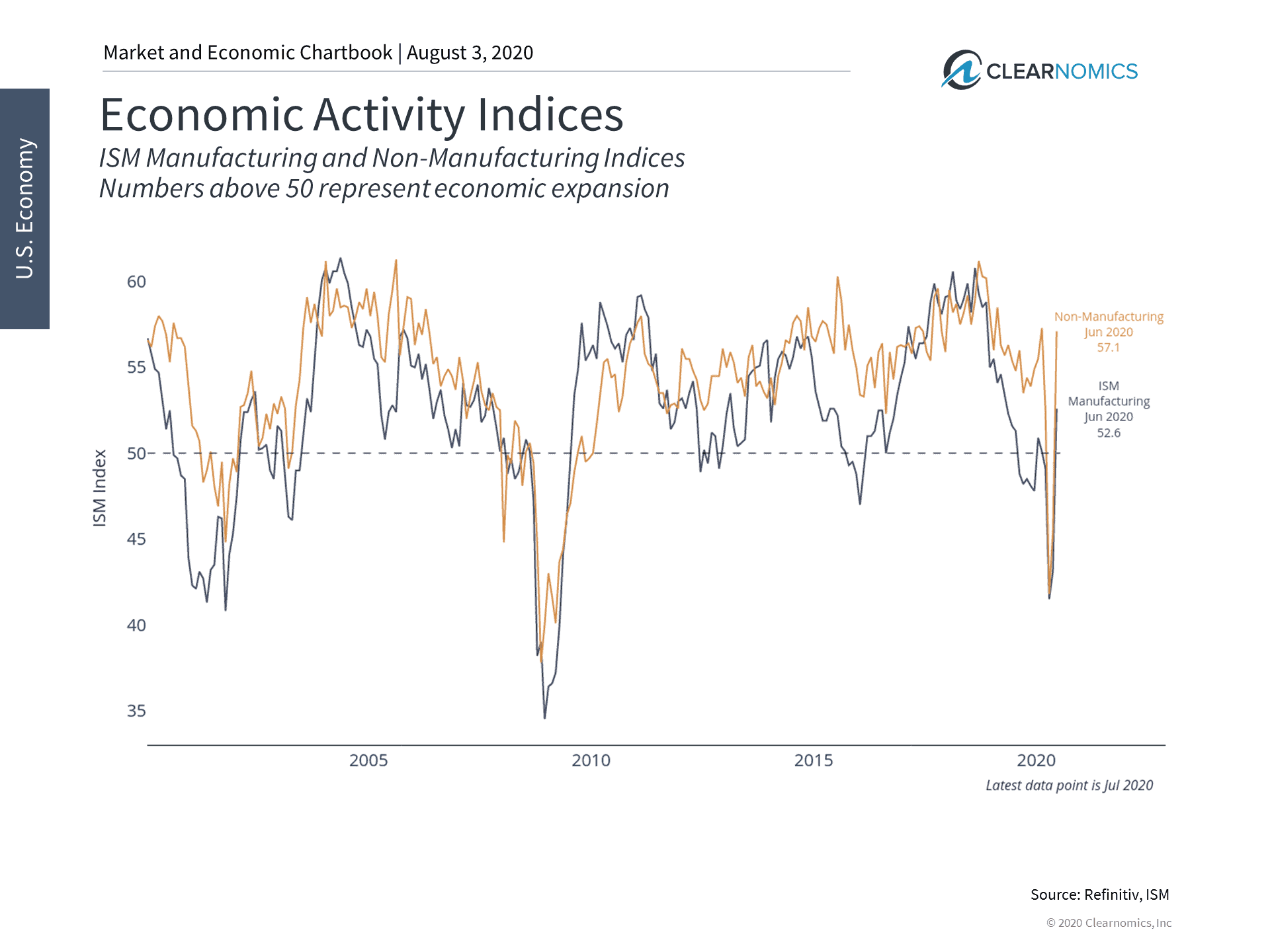

Even if it takes time for retail sector jobs to return, there are signs that business and industrial activity has picked up. Various manufacturing and non-manufacturing levels are now rising at pre-crisis rates – a positive sign for the rest of this year and into 2021. (see below.)

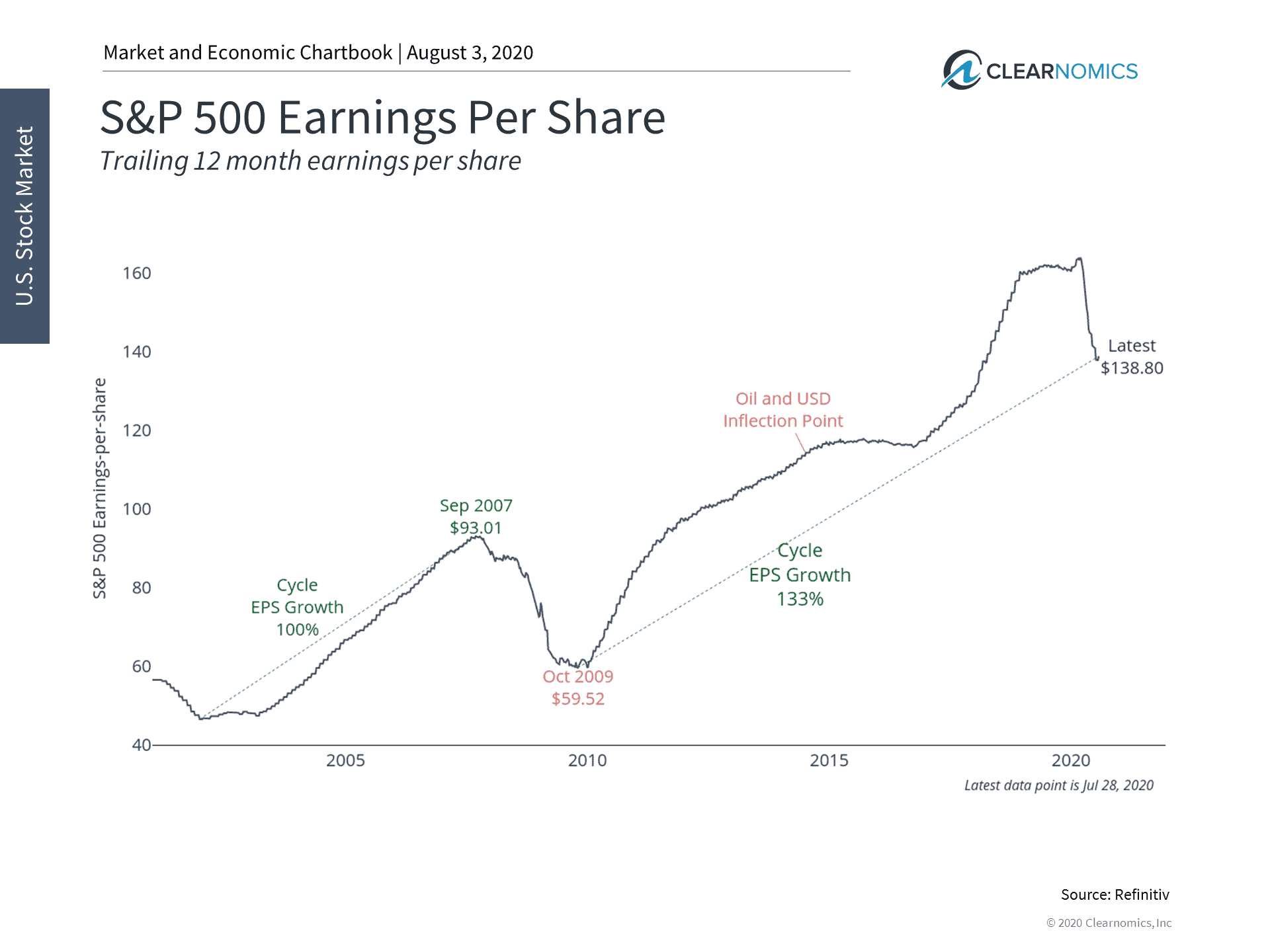

As expected, corporate profits are trending with the economy. It’s estimated that earnings fell between 35% to 40% during the second quarter and will likely decline in 2020 by about 22%. However, estimates also suggest that corporate profits will return to pre-crisis levels by the end of 2021.

While a lost two-year period of profits growth is not what anyone would want, some perspective is needed. This is occurring after the worst quarterly economic decline in history and may be less than the four-year period of flat profits after the 2008 financial crisis.

Ultimately, it’s important for investors to see through this interim period in order to benefit from the economic recovery. After all, financial markets are forward-looking and react to these trends even as they are happening. This is one reason that stocks have performed well over the past few months despite the on-going crisis. Thus, it’s important for investors to maintain discipline and not over-react to backward-looking data in the coming months.

Below are three charts that put recent economic trends in perspective.

1. The economy has experienced its worst decline in history

The Q2 GDP decline was the worst in history. The economy fell -32.9% at an annualized rate or 9.5% on a quarterly basis. Still, unlike in prior recessions and depressions, this is not expected to continue at this pace. There are already many signs that the economy is rebounding, even if the pace is uncertain due to the on-going COVID-19 crisis.

2. However, the recovery is still continuing

Other data show that activity has been returning since the economic bottom. The ISM manufacturing and non-manufacturing indices both show that business activity has returned to a healthier pace. While these numbers will depend on how local governments and businesses deal with COVID-19 outbreaks, the overall trends are positive.

3. Profits are expected to take two years to recover

In the end, what matters to investors is how the economic data affect corporate earnings. So far, earnings have trended with the economy. Profits are expected to recover in the second half of the year and into 2021. This trend is one reason that stocks have recovered in recent months.

The bottom line? While the Q2 GDP report was the worst in history, this was widely expected. There are many signs that the economy has been recovering since then and will continue to do so through 2021.

We have also learned (and seen again in 2020) that it’s more important than ever for investors to stay disciplined and not over-react to recent headlines. History tells us that those investors who can be disciplined and see past short-term volatility are often rewarded. Attempting to jump in and out of markets often does more harm than good. Instead, staying invested, especially in diversified portfolios, can help investors navigate volatility along the way.

For more information on our firm or to request an investment and retirement check-up, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not guarantee a profit or protect against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.