Hazards of Headline News & Epidemics (Coronavirus)

Many investors are in a state of euphoria over the S&P 500 index gains followed by most other major asset class positive returns for 2019 in spite of the many geopolitical, political and global epidemic risks hyped by the headline news.

Investing Hazards

Euphoria, or even boredom, can be dangerous to your financial health and be contagious, just like a virus. In the famous book, “Where Are the Customers’ Yachts?”, published in 1940, Fred Schwed wrote: “your average Wall Streeter, faced with nothing profitable to do, does nothing for only a brief time. Then, suddenly he does something which turns out to be extremely unprofitable. He is not a lazy man.”

The top of every year there an uptick of dodgy financial steak dinner workshops based on fear or greed. Fear products may utilize words and phrases like guaranteed, market hedging, limited offer and low risk. Greed products may pitch excitingly dividends to retired investors against their 5 year CD rates which are barely paying 1%.

Just remember the maxim that “there is no such thing as a free lunch,” as with any financial benefit comes unforeseen hazards, costs and risks, including liquidity issues and risk of principal.

If you go to a continuous-process factory, such as a toothpaste manufacturing plant, if you find anything exciting, you’ve found something wrong. Just the same, investing your nest-egg should not be a process that excites your brain activity. If you seek excitement, go to Las Vegas.

Headline Hazards

While access to information 24/7 can make you a better investor, data- overload combined with your own emotions of fear and greed can be catastrophic to your financial health over time if you act on short term news- like over consuming material on dieting (a crash diet), especially if you are not an expert in either field.

When peeling back the onion of all the Wall Street headline news, consider that volume does not equal quality. Do not assume that there is an impartial world of news on investing out there to draw upon from the financial reports on TV to the 24/7 news feeds on social media where everyone looks and sounds like an expert.

Coronavirus and Wall Street

A big question on the minds of our clients this week is if the China corona virus could become contagious enough to both affect people around the globe and infect the markets.

While recent news on the spread of the corona virus in China and abroad has created an environment of uncertainty, it’s more important than ever for investors to maintain a long-term perspective. After all, while this public health issue can be scary, it is but one of the many story lines that matter to investors right now.

For long-term investors, there are two important ways to analyze any worrisome headline. First, it’s necessary to consider the longer-term economic impact of recent events. While the outbreak of the corona virus could reduce economic activity for a short time, especially in China, history suggests that not only is this very difficult to measure, but that the market impact can be limited if the outbreak is ultimately contained.

SARS Crisis

In comparison, The SARS crisis of late 2002 and 2003, during which nearly 800 people in 17 countries died in an outbreak of another previously unknown respiratory illness that originated in southern China, gives investors some precedent, albeit with limits.

As of Friday, the Chinese government had expanded its travel ban, with a total of some 35 million people unable to leave by air or rail. As a result, analysts predicted that sectors such as travel and leisure, as well as energy and retail, could experience greater pain, while healthcare – including medical supplies and vaccine manufacturers could benefit from the crisis.

For instance, the SARS epidemic of the early 2000’s is estimated to have reduced economic activity in range of tens of billions of U.S. dollars, and possibly reduced Chinese GDP by up to 1%. While these are not small numbers, today they are in the context of the U.S. economy generating over $20 trillion per year and the Chinese economy growing by over 6% per year.

From a market perspective, the SARS episode occurred in the wake of the dot-com crash which had a much larger impact on markets. The same is true of more recent Ebola outbreaks which, fortunately, were also contained and thus had minimal effects on investment returns.

A similar argument could be made for geopolitical risks as well. Recent tensions with Iran resulted in only a brief period of market turbulence. Whether headlines involve Iran, North Korean missile tests, Russia’s annexation of Crimea or other geopolitical events, there will always be global events at play.

Consume Less Headline News

Thus, the second, broader way to view these headlines is to realize that there will always be concerns that drive market uncertainty. Whether these are related to public health crises, geopolitical tensions, trade wars, central bank policies or other concerns, investors will always find reasons to view the glass as half empty. Yet, over the long run, continuing economic growth can drive investment returns despite these headlines.

Even though there have been too many negative headlines to count over the past decade, the U.S. stock market has risen almost 400% since 2009.

Thus, what should not affect the decision-making of long-term investors is how the market is currently reacting to a news story. Of course, this is not to say that markets only move up. In fact, after the strong returns of 2019, market valuations are near their highest point this cycle, and volatility at the start of this year was extremely low.

Below are three charts that put the recent market reaction in perspective:

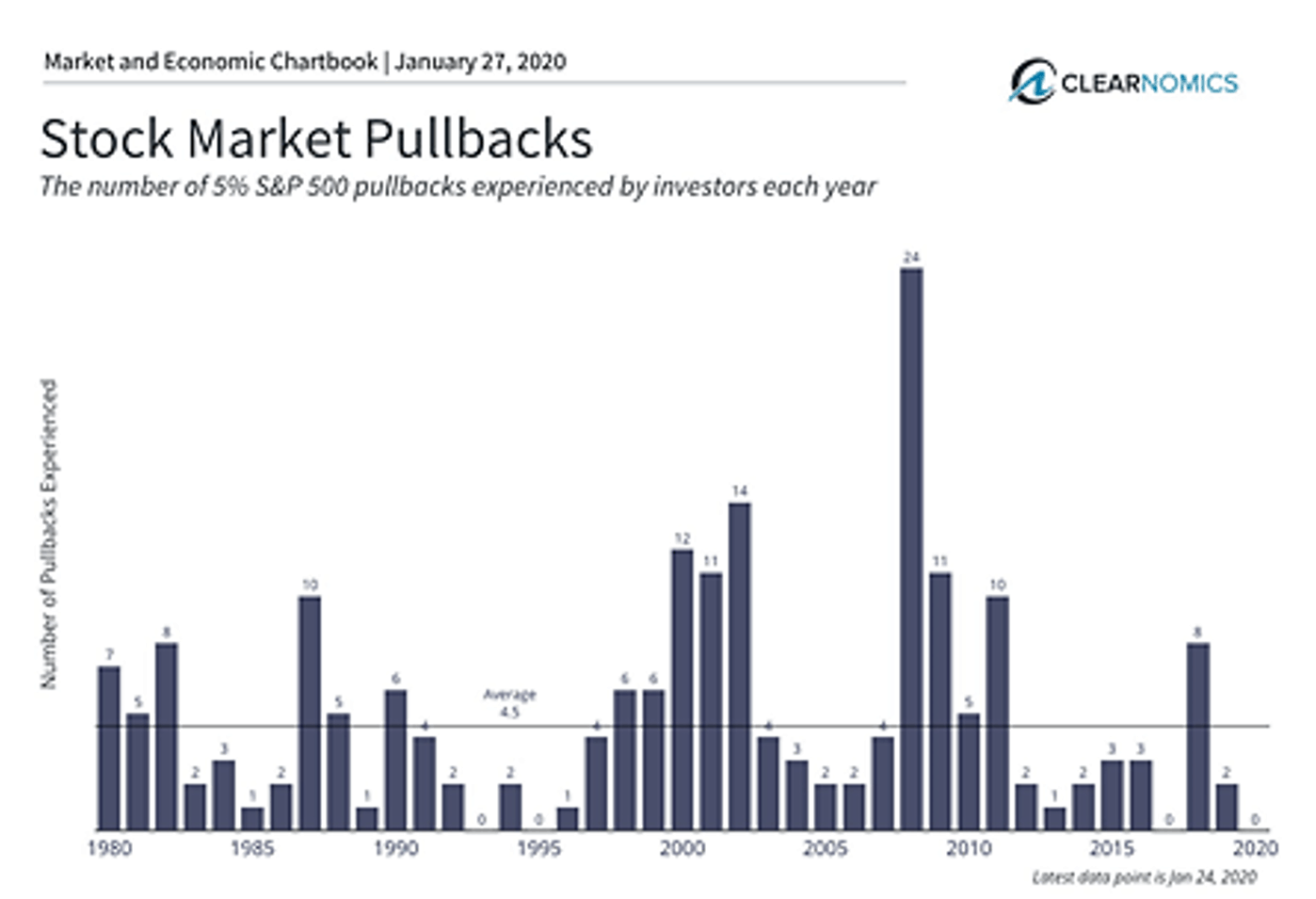

1. It’s normal for markets to experience several market pullbacks each year

Not only is it normal for stock markets to be volatile, but it’s one reason that investors are rewarded for staying patient over the long run. The average year experiences several pullbacks of 5% to 14% per year. Even a terrific market year like 2019 experienced two of these pullbacks. At the moment, recent market volatility is still quite low from a historical standpoint.

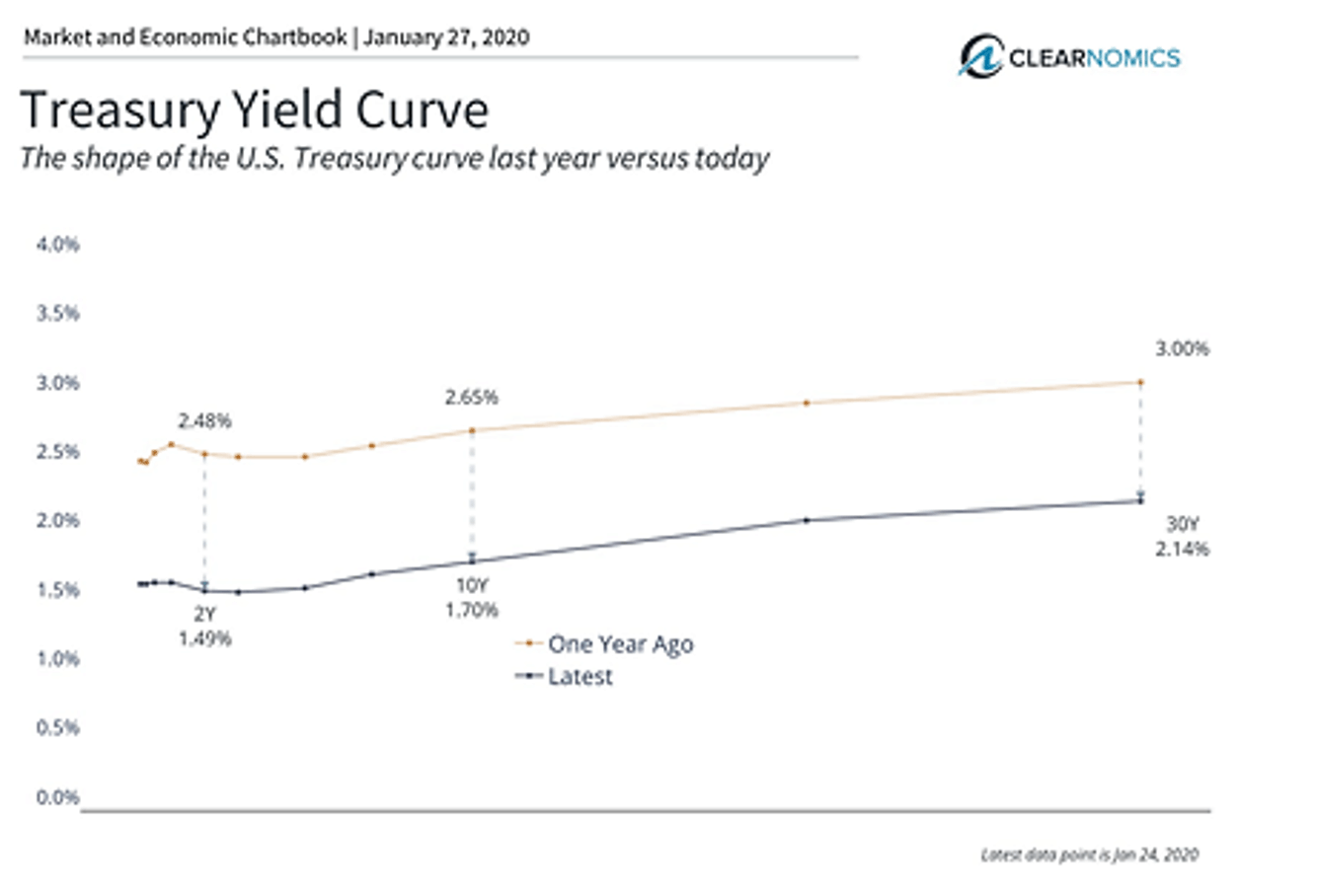

2. Interest rates have fallen further this year

Interest rates have fallen this year. In fact, the 10-year Treasury yield is now below its levels prior to the 2016 presidential election. While this is a negative economic signal, it also means that rising fixed income prices have helped to stabilize investor portfolios.

The fact that yields have been low for over a decade has made it difficult for investors to generate portfolio income. However, the bright side is that lower interest rates are generally positive for consumers and borrowers. For instance, the 30-year mortgage rate is averaging about 3.6% nationwide. This has helped to support the housing market and has made it worthwhile for many homeowners to refinance.

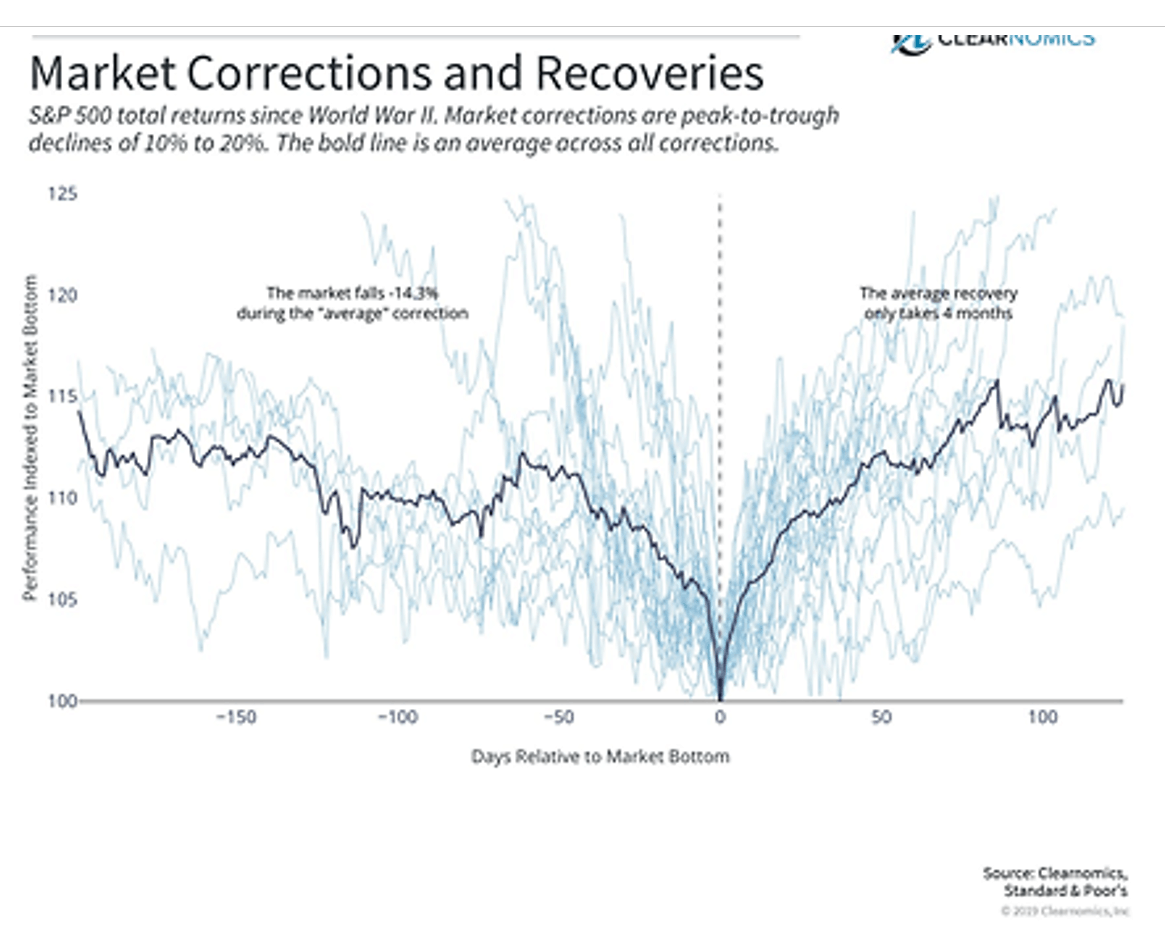

3. The typical market correction recovers within months

Stock market pullbacks can feel scary for many investors. Market corrections – i.e. pullbacks greater than 10% – can occur quite often. Yet, markets also tend to rebound quickly if the economy is still healthy. On average, markets are able to recover from these corrections within 4 months. Coincidentally, this is exactly what happened after the market correction of late-2018.

The bottom line? It’s more important than ever for investors to stay disciplined and not over-react to recent headlines.

History tells us that those investors who can be disciplined and see past short-term volatility are often rewarded. Attempting to jump in and out of markets often does more harm than good. Instead, staying invested, especially in diversified portfolios, can help investors navigate any bumps along the way.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.