Shark Week, Selfies and Stocks- Don’t’ Get Bitten!

July brings the Discovery channel’s Shark Week, an annual reminder of the vicious creatures lurking beneath the surface as people head out to the beach for some summer sun, sand and relaxation.

Just the same, the psychological trauma of the ups and downs of the stock market, further fueled by financial news shows can be mentally overwhelming for investors to jump into the ocean of the stock market and stay afloat.

While our rational mind knows that both market crashes and shark attacks are rare, if there’s information available to us that’s not only more recent, but more traumatic, it’s likely to have a stronger influence on our decisions. This is called “availability bias.”

Availability bias is our tendency to recall events that are recent, relevant and traumatic. Instinctively, if something can be easily recalled, we believe it must be essential. Unfortunately, that can result in biased decisions based on emotions rather than facts and rationale.

Shark Drama vs Data

Steven Spielberg’s 1975 blockbuster, “Jaws,” was a game-changer for sharks. We can all still hear that theme music in our heads as we look out to the sea… “Dunh, dunh, Dunh, dunh.”

If you find yourself scrutinizing the opaque ocean while at the beach on vacation with a little bit of fear in your heart, maybe it’s because sharks find themselves in the news all summer long after a kick start by Shark Week. Shark attacks make international headline news while reinforcing the idea that simply swimming in the ocean can be a risky activity.

Surprisingly, more people meet their demise attempting to take “selfies” than from shark attacks. A recent study found that 259 people worldwide died in selfie-related accidents between 2011 and 2017, compared to just 50 people killed by sharks over the same seven years.

We like to think we invest rationally, but the field of behavioral finance has shown there are social, emotional, and even cognitive factors that can affect our investing decisions just like in any other part of our lives. By becoming aware of these unconscious inclinations, we may have a better chance of meeting our long-term investing goals and perhaps experiencing less anxiety when reading headlines on sharks or on the stock market. The following are three reasons disciplined investors should stay focused.

1 Strong Economic Recovery

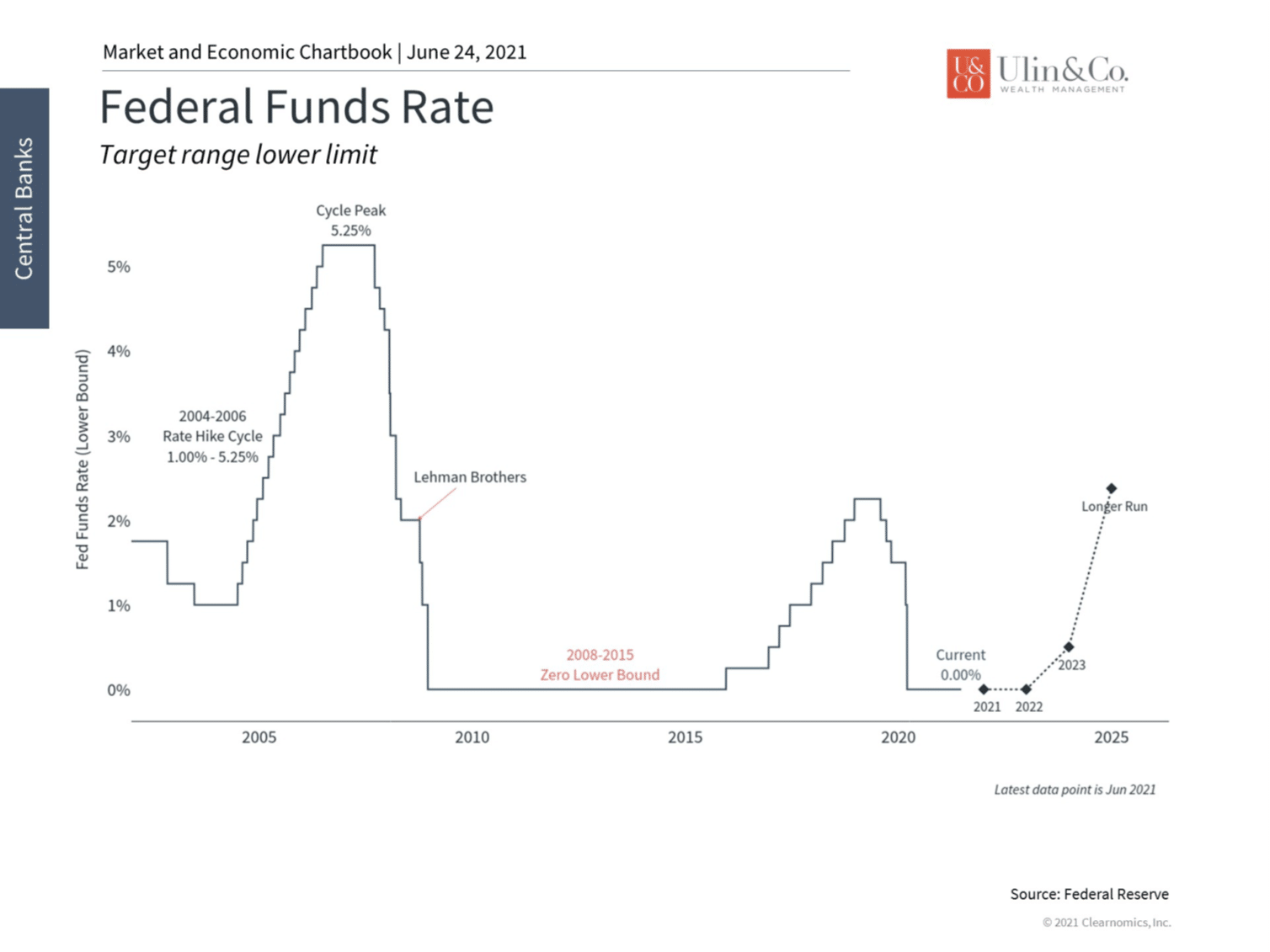

Last week’s update to the Fed’s summary of economic projections set the first expected rate hike to early 2023, still at least a year and a half away. Before then, the Fed is likely to first begin “tapering” its bond purchases as a first step. As we discussed last week, tapering is simply the process of the Fed slowing the pace of its $120 billion per month bond purchases and cash-infusion into the banking system. Just the “mention” of this process in 2013 caused trauma to investors to start selling bonds and stocks in a shark like frenzy.

The potential “liftoff” date suggests that the Fed believes the economy is healthy. When it comes down to it, the Fed raising rates is a positive sign, not a bad one, since it means the economy is growing, even if there are short-term concerns. Despite this, the path of rate hikes is still extremely gradual by historical standards. This is because the Fed expects to keep rates low not until inflation is above its 2% target, but until the average rate of inflation (over an unspecified period) is above 2%. In short, the Fed will be more tolerant of an overheating economy.

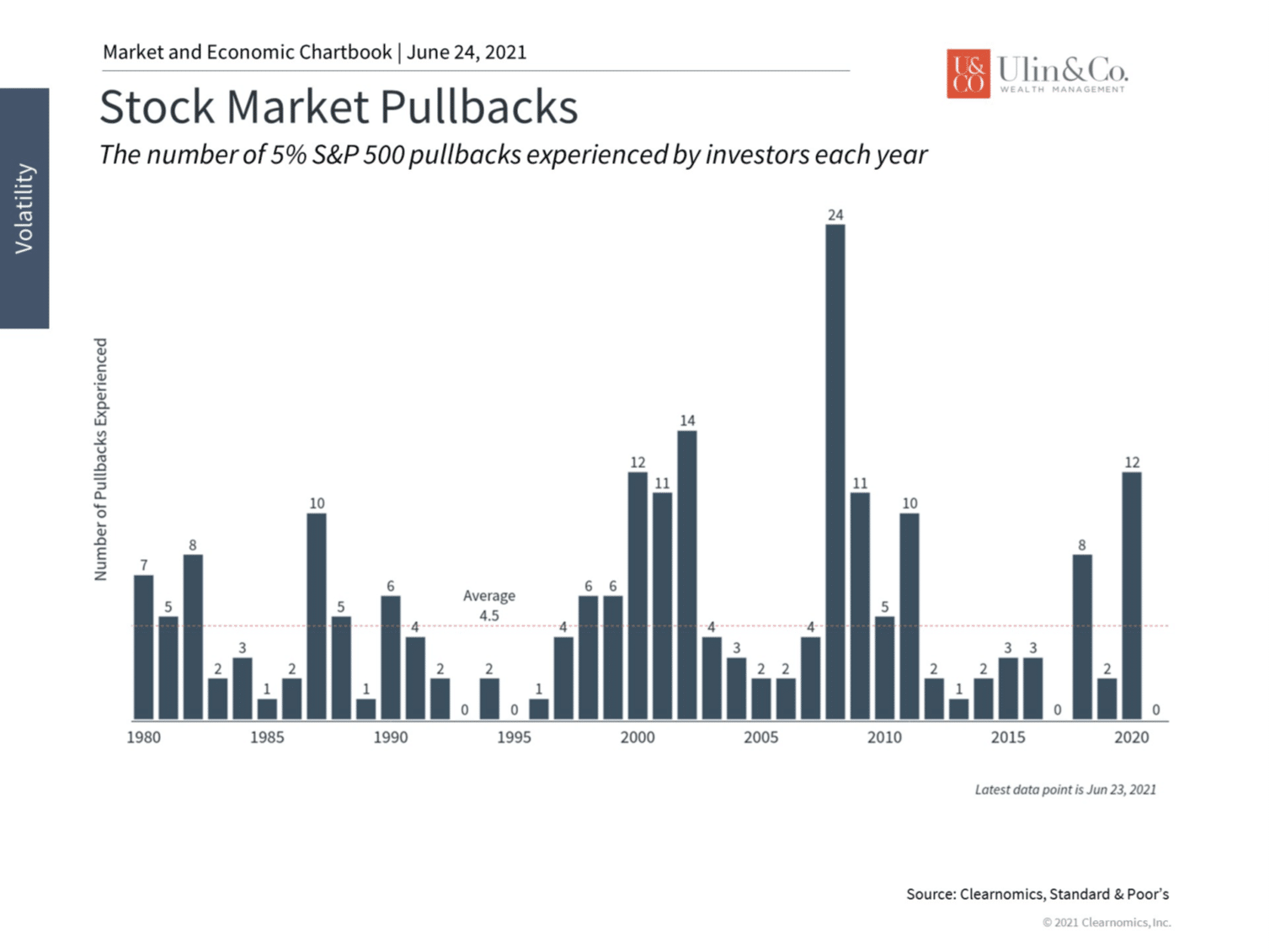

What matters for investors and markets is having time to adjust. Although markets were volatile in the days immediately after the Fed’s recent announcement, the S&P 500 only declined by 2.1% from its recent highs before stabilizing. The largest intra-year decline in 2021 has still only been 4% – far below the 15% average annual pullback.

2 Low MOVE Index

Perhaps what’s more important for everyday investors is the impact on the bond market. Interest rates have felt volatile this year as the recovery has accelerated and inflation concerns have risen. Still, measures of bond volatility such as the MOVE index are nowhere near flashing red to get out of the water.

Similar to the VIX Index, commonly utilized as a measure of “fear” lurking in the equity markets, the Move index measures interest rate volatility concerns. The index will rise more sharply when there are fears in the market that rates may be headed significantly higher as was the case during the 2013 Taper Tantrum.

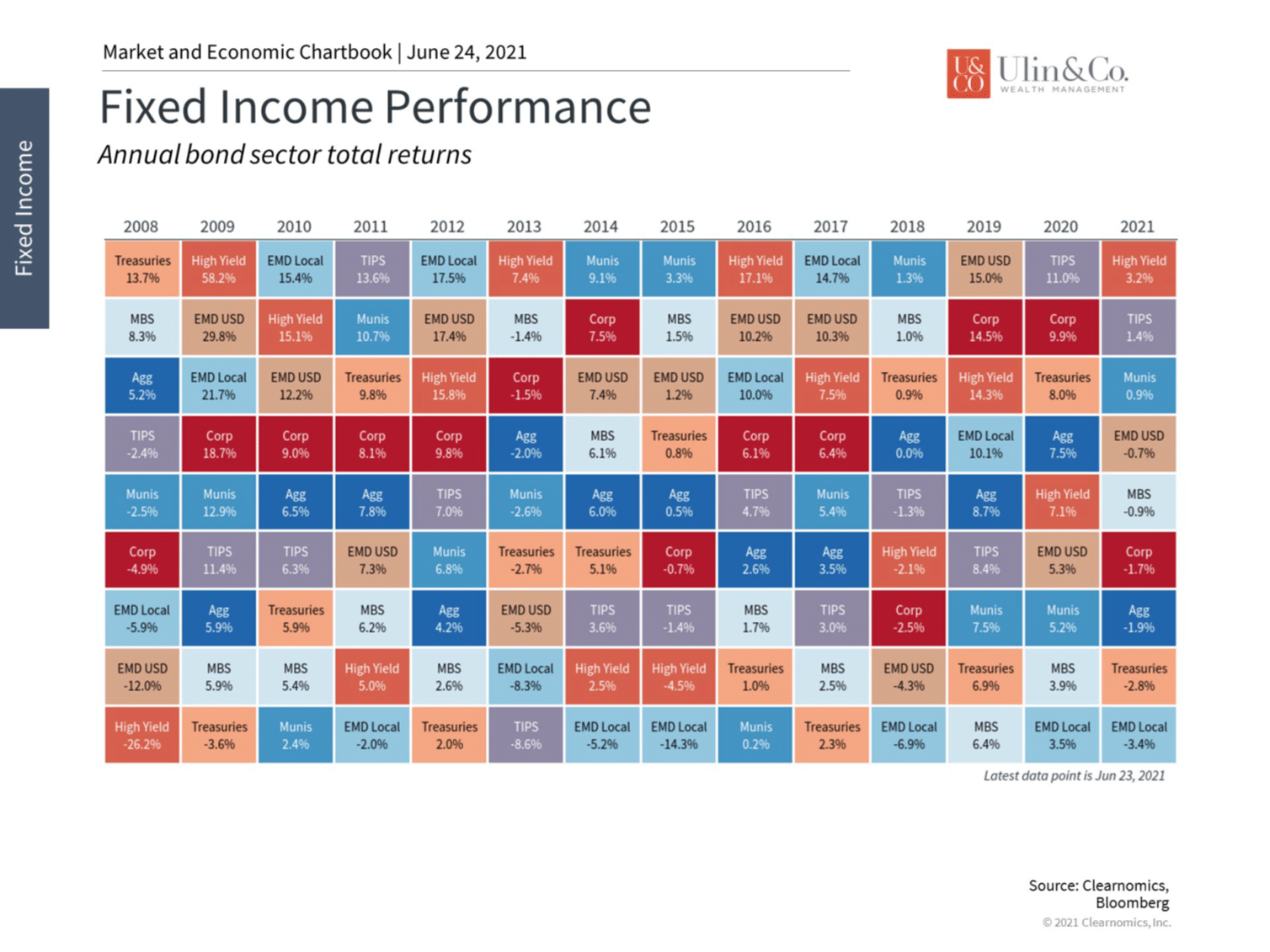

Broad fixed income indices such as the Bloomberg Barclays Agg are in the red year to date, but this is to be expected when the 10-year Treasury yield has risen from 1% to just under 1.5%, and is expected by some to reach 2% or greater in the near future. (see below)

While losses are never pleasant, especially for those in or near retirement that depend heavily on fixed income instruments, it’s also important to not overreact. During the 2013 taper tantrum, the bond market was much more volatile and finished the year in negative territory. However, it recovered the following year as markets adjusted to new expectations.

3 Diversification

Outside of these episodes, fixed income continues to provide portfolio stability and overall diversification even with rates at historically low levels. Utilizing different fixed income holdings and techniques (varying duration, credit quality, sectors) in a portfolio that lines up with one’s financial goals is still the key challenge today – and the reason every investor can benefit from financial guidance.

Diversification strives to smooth out unforeseen unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others. The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated -that is, they respond differently, often in opposing ways, to market influences.

Investors ought to maintain a long-term outlook as the market continues to adjust to this expansionary phase of the business cycle. Below are three charts that can help to put new Fed expectations and the immediate market reaction in perspective.

The Fed now expects to raise rates in 2023

The FOMC’s latest summary of economic projections (SEP) suggests that rates could begin to rise in 2023. This is in response to an accelerating economy with signs of inflationary forces. These forecasts by Fed officials could change as the economic data change.

Markets are adjusting to these expectations

The S&P 500 fell 2.1% from its peak the days following the Fed announcement. This is low by historical standards and the largest intra-year decline in 2021 has only been 4%. Investors should always be prepared for higher levels of stock market volatility.

Many bond sectors are nominally negative as rate expectations rise

Broad bond market indices are negative this year as they were in 2013 as markets adjust. However, fixed income still plays a very important role in all portfolios.

The bottom line? Availability bias can throw you off track when making decisions based on emotions rather than facts and rationale – whether jumping into the stock market or the ocean during shark week.

Investors should maintain a long-term perspective as Fed expectations change and eventually begin bond tapering before raising short term interest rates. So far, the tantrum “damage” has been minimal to both stocks and bonds as markets adjust through rising inflation and rates.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.