Don’t Count on a Santa Claus Rally

With the Fed gregariously hiking interest rates attempting to cool off elevated inflation while investor sentiment is at a record low, Santa may not be making his annual appearance on Wall Street next week to deliver the gift of a year-end seasonal stock market Santa Claus rally. Would that provide an ominous outlook for 2023? The short answer is no.

A year-end rally has materialized about 79% of the time since 1950 suggesting the “Santa Clause Rally” is more than a myth. The S&P 500 returns during the last five trading days of December and first two of the subsequent new year were positive for 55 of the 70 years between 1950 and 2020.[1]

While we do not adhere to investing based on seasonal patterns, myths, market maxims or a crystal ball, the typical market tailwinds end of year including increased retail holiday shopping, optimism fueled by the holiday spirit to many short sellers being on vacation may not be enough to provide a visit by St. Nick.

When Good News is Bad News

US stocks plummeted this past week on investors’ fears that the stronger-than-expected GDP numbers that came in at 3.2% for last quarter could prompt the Fed to continue to raise rates more than expected next year and potentially cause a major recession that did not quite happen this year. [2]

While the Fed has been laser focused to cool demand for goods and services and reduce inflation, businesses to consumers have been “on a tear” continuing to spend money regardless of higher rates and prices. In addition, employers have continued to hire at a historically strong pace, although layoffs have increased in some industries, particularly technology.

Fed Chair Jay Powell is not on purpose trying to deliver coal into our stockings while canceling the Christmas rally like a Grinch. The Fed’s swift actions through this year combined with Powell’s hawkish demeanor may be essential for the Fed to not have a repeat of past eras of ongoing inflation like we experienced in the 70’s.

Overall, the macroeconomic event referred to as the “Great Inflation” lasted from 1965 to 1982. This is the story of the painful stagflation period in the 1970s, which began in late 1972 and continued until the early 1980 when “the Gipper” entered the White House and introduced Reganomics. Ronald Reagan’s tenure as the 40th president of the United States began on January 20th, 1981, along with then Fed Chair Volker.

When Bad News is Good News

As mulled over recently in Market Watch, the absence of a Santa Claus Rally does not provide any major signals to stock performance the following year. The U.S. stock market has done just as well following holiday seasons when there is no Santa Claus Rally as when there is.[3]

Hulbert further notes “there is no statistically significant correlation between the stock market’s performance in the Santa Claus Rally period and its return during the subsequent year. In fact, there is modest evidence that the stock market actually performs slightly better following market declines during the Santa Claus Rally period.”

Why Stocks Advance Through Recessions

When volatility arises in the stock market as we have experienced over the past week, one way to help reduce your anxiety would be to “stress-test” your portfolio against an appropriate blended benchmark to view how your strategy is holding up while adjusting accordingly. We highly advocate not to cash out or make any unnecessary short-term moves.

As bad as things may feel or actually transpire Q1 2023, please- keep your bathing suit on (per Uncle Buffett) and remember that the stock market is more forward-looking than the economy. Buffett often remarked “Only when the tide goes out do you see who’s been swimming naked.”

People may ask how the stock market can go up during a recession, and the answer lies within the differences in how economic and financial data are reported. Always remember that the stock market is looking forward by at least six months while the data confirming a recession faces backward (in hindsight.)

In the stock market, valuations are reflective of expected future earnings. They’re a leading indicator for the economy in general. Markets are continually pricing in new information and expectations about the future, which can be difficult to conceptualize for investors. [4]

Focusing Beyond a Fed-Driven Year

Inflation, interest rates and the Fed have been the driving forces behind the market in 2022. These factors broke a number of trends that have influenced portfolio decisions over the past several decades, creating an uncomfortable investment environment. This has kept many investors guessing at what might come next, leading markets to swing back and forth for weeks at a time.

For investors who can ignore the short-term ups-and-downs of the market, this year is a reminder that staying invested is one of the most important principles for achieving long-term financial goals.

[1] Smart Asset, 12.10.20 Is the Santa Claus Rally Real? – 2020 Study

[2] CNN, 12.22.22, Dow sinks after the US economy grew much faster than previously thought in the third quarter

[3] Market Watch, 12.17.22 Why the stock market’s painful December decline might actually be bullish for investors in 2023

[4] Forbes 7.21.22 One important reminder about the stock market and your retirement

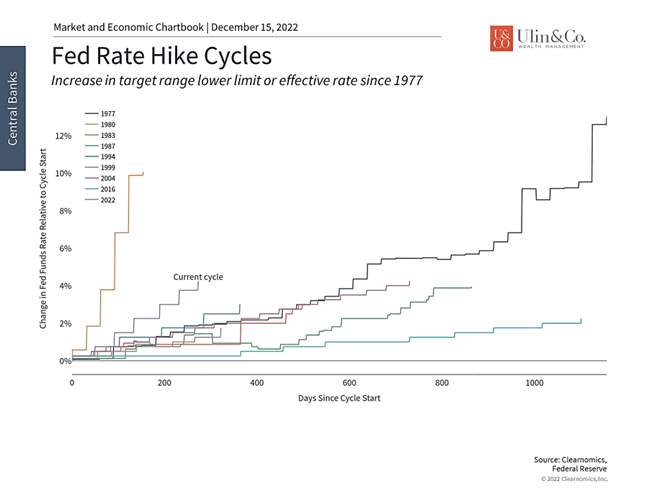

The Fed is raising rates at one of the fastest paces in history

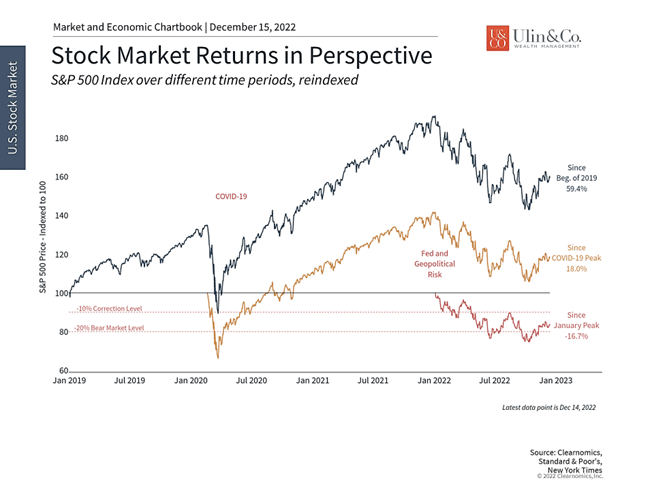

To highlight how manic markets have been, we have only to look at the many swings in sentiment this year. Markets fell from their all-time highs at the beginning of the year due to concerns that the Fed wasn’t reacting quickly enough to inflation. Markets then rallied in March when the Fed began to raise rates, only to then plummet into bear market territory as the inflation data worsened. Markets then rallied 17% from June to August in hopes that the Fed would slow its rate hikes, for fear of a recession. These hopes were dashed when Fed Chair Powell doubled down on the inflation battle by maintaining 75 basis point hikes, causing markets to give up their gains. Markets then jumped 8% in October and 5% in November, some of the best monthly gains in history, before once again stalling out.

For many, this turbulent ride may feel like a reason to avoid the stock market. After all, didn’t markets rise steadily from 2009 to 2020, and then again during the pandemic recovery? The reality is that markets were turbulent even during those periods and investors were constantly worried about a whole host of issues. It’s only with the benefit of hindsight, and possibly rose-colored glasses, that it feels as if those were calmer periods. So, while markets will very likely end the year negative, the final numbers won’t be nearly as bad as some of the low points of the year might have suggested. At the same time, there have been periods of optimism that have highlighted how quickly markets can rebound once the underlying fundamentals turn around.

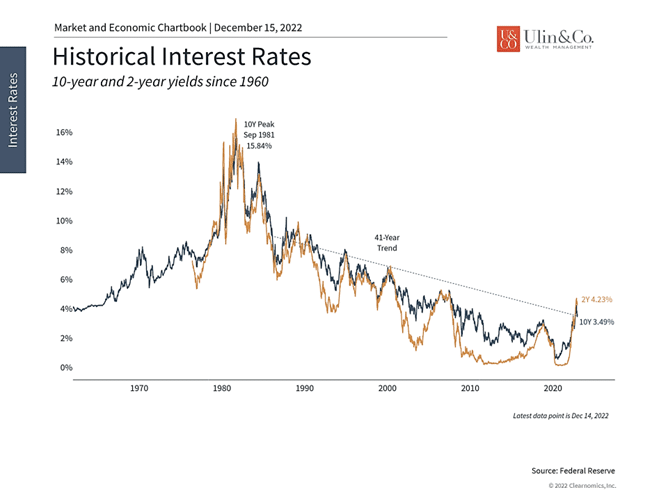

Markets have responded to rising inflation all year

It’s not unjustified for investors to focus so much on the Fed since this past year experienced shifts in the four-decade pattern of falling inflation and interest rates. Since the stagflation of the 1970s and 1980s was reversed through a series of rapid rate hikes under Fed Chair Paul Volcker until the pandemic, inflation had been steadily declining. This culminated in interest rates reaching the zero lower bound in the U.S. and entering negative territory in places like Europe. In general, this led to an era of relative price stability, the ability to borrow cheaply, and supportive monetary and fiscal policies.

It’s for this reason that the sudden jump in inflation, rates and Fed hikes have been jarring. The first chart above shows that the current rate hike cycle is one of the fastest in history, second only to the rate hikes that began in 1980 when the Fed was also battling inflation. The 1977 cycle is also prominent on the chart as the longest period of sustained hikes, also due to price pressures across the economy.

Interest rates broke a four-decade pattern

Unlike that era, however, the economy today is still fundamentally stable and the job market is still strong, despite a number of investor concerns. Unemployment is still near historic lows, new jobs are still being added each month at a strong clip, and there are still millions more job openings than unemployed individuals. Some inflation components such as energy prices have improved significantly in the past several months.[5]

Perhaps the biggest concern among economists and the Fed is rising “core” inflation for important expenses such as housing. The Consumer Price Index has experienced an acceleration in “shelter” costs, rising from a low of 0.6 percentage points of total inflation to 2.2 percentage points in October. The fact that most rental lease terms are only renewed once a year means that this data may take time to reflect what households are already experiencing. Still, most data series have shown that house prices and rental prices have declined from their recent peaks. While this may take time to stabilize, the Fed will likely remain committed to keeping interest rates at a restrictive level through most of 2023.

Rather than try to guess exactly how these numbers play out, investors ought to stay focused on the bigger picture. There are early signs that inflation is easing, the economy is still stable, and market valuations have improved significantly. Whether the terminal fed funds rate next year is slightly higher or lower than 5% should not significantly change the asset allocations or financial plans of patient, diversified investors, even if it does cause the market to swing in the meantime.

The bottom line? Investors should stay disciplined and not focus too much on seasonal market maxims such as a Santa Claus Rally nor each individual Fed move in order to be positioned for opportunities and an eventual economic and stock market rebound.

[5] FRED Economic Data, 11.1.22 unemployment data chart

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetically used for illustrative purposes only and do not represent any actual investment.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment

objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.