Don’t Push Your Luck: Tech, Gold to Bitcoin

Symbols of St. Patrick’s Day include green attire, Irish food and drinks, parades, music, shamrocks for good luck and leprechauns with pots of gold coins. Just the same, today’s investors are seeking to get lucky with tech stocks, gold, and bitcoin, all recently on a roll like a good day in Vegas.

Jon here. You’ve got to ask yourself one question: Do I feel lucky? Well, do you? These lines were notably spoken back in 1971 by Clint Eastwood in the film Dirty Harry. As we’ll mull over in this week’s newsletter, investing is part skill and part luck, but should not feel like you are playing a Vegas game for the bulk of your nest egg.

The choice to invest in any asset class from crypto to physical fine art, gold, jewelry, wine, or real estate should be done in moderation and viewed in the context of a diversified portfolio, rather than as a standalone investment. When appropriate, doing so can help to balance other asset classes, creating a smoother ride toward long-term financial goals.

Not to say that some of our clients don’t have a bucket or two of investments in concentrated, high-risk bets for 10% or more of their liquid net worth, but we view that more as their “Vegas bucket.”. Our clients that have over a million in crypto, gold, real estate, private equity, or a business venture, are continually mulling over when to cash in their chips, but are in no rush to do so.

Luck vs. Skill:

Investing in the stock market is often viewed as a blend of luck and skill. While luck can play a role in short-term gains or losses like on an individual stock, successful investing over the long term typically requires a combination of skillful decision-making, discipline and executing an investment plan.

While short-term trading and speculation may yield profits for some individuals, the odds are often stacked against those who try to time the market or chase quick gains in concentrated sectors or holdings like certain tech stocks, gold or crypto. Long-term, diversified investing allows investors to benefit from the power of diversification along with compounding returns while providing investments with time to grow and weather market cycles with less volatility and smoother ride.

Whether luck or skill, patience is the most important ingredient for long term investors. Legendary investor Warren Buffett famously advises investors to adopt a long-term mindset: “Never buy something you don’t plan on holding for a long time.” Buffett’s approach emphasizes the importance of focusing on the intrinsic value of investments and holding them through market fluctuations and short-term volatility.

Vegas Vs Wall Street

Investing in the stock market should not look or feel like a casino game where the odds are stacked against you. There are some similarities and differences between casino games and investing in the stock market.

While the saying “the house always wins” holds true in the long run due to the built-in house edge in most casino games, like investing in the stock market, there are opportunities for skilled players to gain an edge in games like blackjack by employing strategies that mitigate the house edge. However, it’s essential to remember that luck ultimately plays a more significant role in casino gambling, especially in games like roulette.

The difference with investing as compared to casino games, is that you can build up higher levels of skills and expertise over time through education, practice, and experience to help better determine and better achieve your long-term goals and outcomes while navigating through different market conditions while deploying methods of asset allocation and diversification.

Gold and Bitcoin Portfolio Impact

The stock market rally has briefly paused as investors weigh the timing of the first Fed rate cut this cycle. So far this year, the S&P 500 has achieved 16 new all-time highs amid steady economic growth, improving inflation, and the ongoing rally in tech stocks. Many other asset classes have also contributed to portfolio gains in this environment. Both gold and Bitcoin, for instance, have also reached new highs in recent weeks, rising above $2,185 and $68,399, respectively.

New Highs for Gold May Be a Warning Sign

“I have no views as to where (gold) will be (in the next five years), but the one thing I can tell you is it won’t do anything between now and then except look at you” — Buffett, CNBC’s Squawk Box, 2009

In times like these, it’s important for long-term investors to stay diversified and not lose sight of the bigger picture. True financial success is not about timing the market perfectly or going “all-in” on a single investment. Instead, it’s about building and maintaining a portfolio tailored to financial objectives that can perform well across all phases of the market cycle.

At the moment, the market believes it’s a matter of when, not if, the Fed will begin its first rate cut cycle since 2019. The underlying economic trends are in favor of lower rates, but recent economic data have sent mixed signals as to the exact timing.

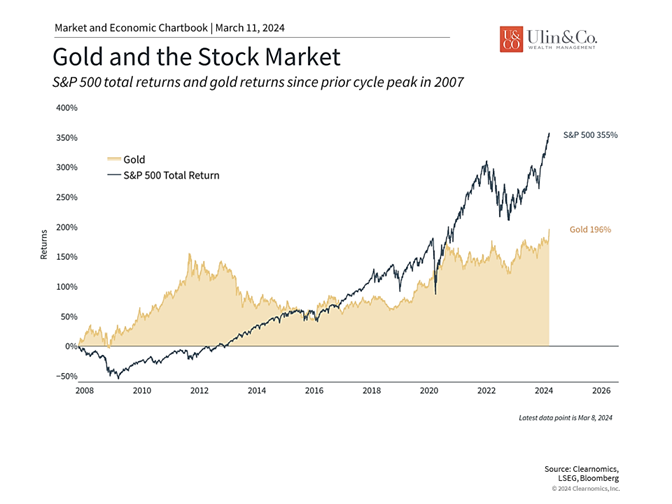

In theory, gold can benefit from rate cuts just as the stock market does. Lower interest rates make bonds and cash relatively less attractive, leading investors to seek alternative ways to preserve wealth. This is especially true when investors are worried about the country’s fiscal discipline and geopolitical risks in the Middle East and Ukraine. The accompanying chart shows that gold has gained about 35% since its lowest point in 2022 when the Fed was hiking rates rapidly.

Interestingly, the S&P 500 has outperformed gold over this period with a gain of 44% with reinvested dividends. This is partly because gold does not always behave as one might expect or hope. In times of high inflation and economic distress, hard assets such as gold and other commodities are expected to outperform. While gold did rally in early 2022 when inflation was accelerating, gold prices then pulled back and did not recover until the middle of 2023. Gold also provides no income benefits which makes it less attractive if interest rates remain higher for longer.

Thus, while gold has experienced a strong rally and is hovering near all-time highs, it’s important to keep its relative performance in perspective. The choppiness of gold prices over the past few years shows that while it can act as both a hedge during inflationary periods and serve as a store of value, this can reverse quickly as conditions change.

History rhymes and sometimes repeats. I met an investor in 2010 who’s CPA had previously recommended to put one of their $1M dollar IRA portfolios in gold mutual funds that eventually got sliced almost in half a year later during the post- great recession bull market cycle.

Bitcoin has jumped sharply

“While a little bitcoin can go a long way, it is at greater exposures where investors will see the largest shifts in the total risk toward bitcoin. At 5%, the bitcoin allocation contributes over 20% of the portfolio’s total risk and produces a volatility that’s roughly 16% over the 60/40 portfolio. A 10% allocation increases volatility by 41%.” -Morningstar on Bitcoin risk 1.18.24

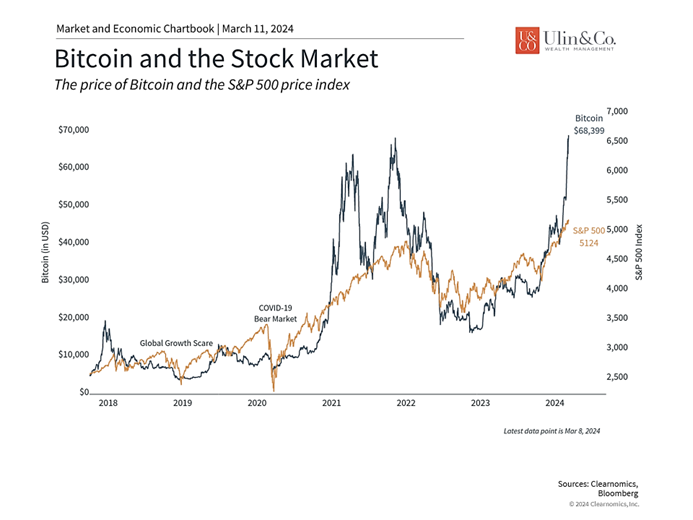

Like gold, Bitcoin has also rallied sharply in recent weeks. This is not just due to the possibility of Fed rate cuts, which should theoretically benefit cryptocurrencies and other stores of value, but is also related to the approval of spot Bitcoin ETFs in January. According to news reports, tens of billions in new funds have flowed into these ETFs which provide a simpler and more attractive way to invest in digital assets compared to Bitcoin futures or holding a digital wallet. On a technical basis, Bitcoin will also experience a “halving” around April during which the reward for mining will be cut in half while lowering supply. Some investors believe this might help to boost the price of Bitcoin as new supply becomes increasingly scarce.

Whether the rallies in Bitcoin and other cryptocurrencies continue is unclear given the uncertain nature of the asset class, especially after the various corporate collapses, scams, and criminal convictions in the ecosystem over the past few years. Still, the rapid recovery from the 2022 crash has no doubt attracted much investor attention.

Similar to gold, long-term investors should view digital assets from the perspective of properly diversified portfolios. Unfortunately, cryptocurrencies have not yet proven to be reliable portfolio diversifiers since they are strongly correlated with the stock market and other risk assets, serving to amplify risk. It’s no secret that Bitcoin is extremely volatile and price swings have been 5 to 10 times larger than the overall stock market.

So, Bitcoin can be thought of as another asset with specific characteristics. The question of whether and how much to invest in this asset should be no different than deciding on any stock, bond, currency, commodity, real estate property, etc. Careful analysis and risk management are needed to understand the potential risks and expected returns relative to other investments.

Many sectors have contributed to S&P 500 returns in 2024

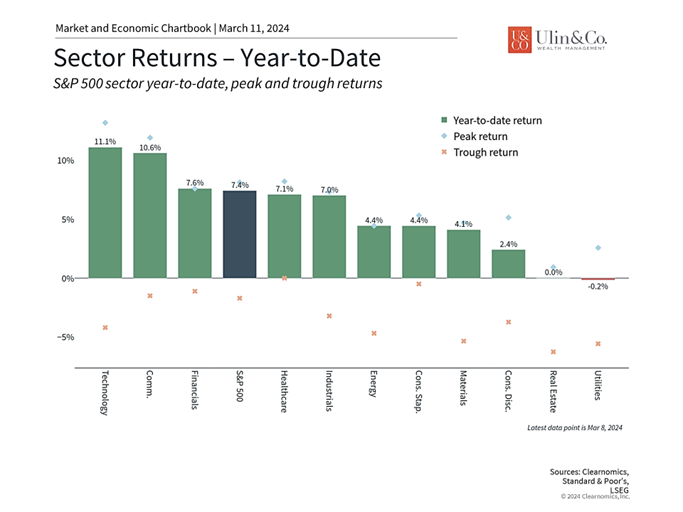

When it comes to the stock market itself, large cap tech stocks, including the so-called Magnificent 7, are still the main focus for many investors. However, many other sectors have contributed to broad market returns this year too. The accompanying chart shows that while the Information Technology and Communication Services sectors continue to lead the market, others such as Financials, Health Care, and Industrials have increasingly performed well.

News headlines tend to focus on the absolute best and worst performers in the market. For investors, how an overall portfolio performs is far more important – not just in terms of returns but its risk profile too. So, while large cap tech stocks have done well for good reasons, investors should not lose sight of the many other parts of the market that could also benefit from rate cuts, ongoing economic growth, easing inflation, a strong labor market, and more.

The bottom line? The choice to invest in gold, bitcoin, tech stocks, or any other asset should be viewed in the context of a diversified portfolio rather than as a standalone investment. When appropriate, doing so can help to balance other asset classes, creating a smoother ride toward long-term financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.