Retail Sales Driving Economy Through AI Revolution

While wall street is cheering Nvidia’s historic surge this past week moving across the stock market like a wave, while raising Ai, tech and semiconductor investments to new highs, significant cash, along with many investors are still sitting on the sidelines with PTSD syndrome from the 2022 market crash where many of the major tech stocks were down 50%- 70% on average.

Jon here. Should you be deploying cash and staying on course with your nest-egg through the “new” AI powered revolution and roller coaster market volatility, or instead be expecting the next post apocalypse Y2K dotcom crash? The short answer is the former. Consider the consumer is the main driving force of GDP and is continuing forward, though at a more normalized, slowing rate. It’s critical to look at the whole economy when investing for the long run, not as much what is driving stocks in the short term.

Investors Behavior to Consumer Spending

Investor behavior can move markets up to new highs even if it seems illogical. History has demonstrated that record highs usually lead to more record highs partially driven by herd behavior and the madness of the crowd. Just the same, the all-time highs of the stock market along with elevated housing prices have helped to boost the “wealth effect” mentality and euphoria among consumers to spend more on goods, services, travel, luxury items and more, while helping to boost the economy.

Headlines to most all financial news shows this month are enthusiastically reporting on Nvidia sales and growth outlook like it’s 1999. This is par for course, not just because it reps the entire AI space, captures 80% of the global market share in GPU’s, and it’s the 3rd largest company in the U.S. but it’s a significant weight on many indices including the S&P 500 and Nasdaq.

While Nvidia designs and sells GPU chips for gaming, cryptocurrency mining, and professional applications, as well as chip systems for use in vehicles, robotics, and other tools across most industries, the focus of today’s newsletter is more on consumer end-sales and retail.

Retail Metrics

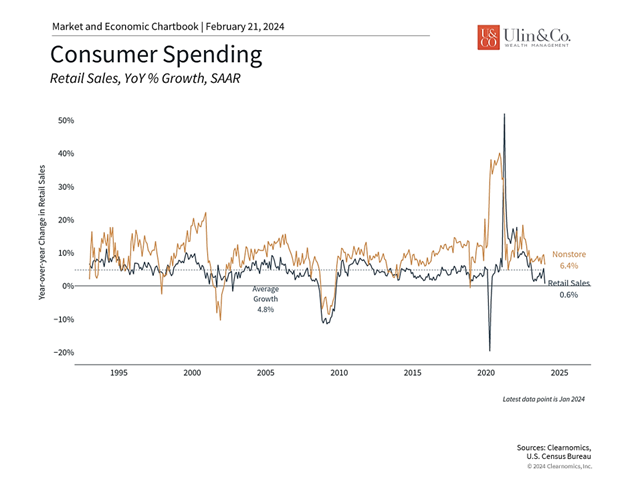

As we keep reporting every month, retail, driven by the engine of the consumer, is the key metric to keep an eye on this year – that has driven the markets through quite inclement weather over the past few years. If it heats up or falters, will have the most direct effect on inflation along with Fed Chair Jay Powells soft- landing goals. Where perhaps bad news is good news, retail sales in the US cooled off a nominal 0.8% month-over-month in January 2024, reversing from a revised 0.4% rise in December. (Trading Economics.)

US Retail Sales YoY is at -0.18%, compared to 4.45% last month and 5.92% last year. (Y Charts) This is lower than the long-term average of 4.69% but nowhere near during the financial crisis of 2009 when sales were 14% off highs.

Coming down from the 20% elevated spending sugar high of 2021 has been more than a speed bump to retailers but not harmful. The Fed eventually cutting rates this year will be a tailwind for retailers and small businesses making cash and loans more achievable for growth investments, inventory and employment.

Consumer Spending Supports the Economy and Markets

US Retail Sales measures the total sales within the US economy excluding food services. Retail sales are a good gauge of how the economy is doing. It can also give an idea of whether or not consumers are using their discretionary income

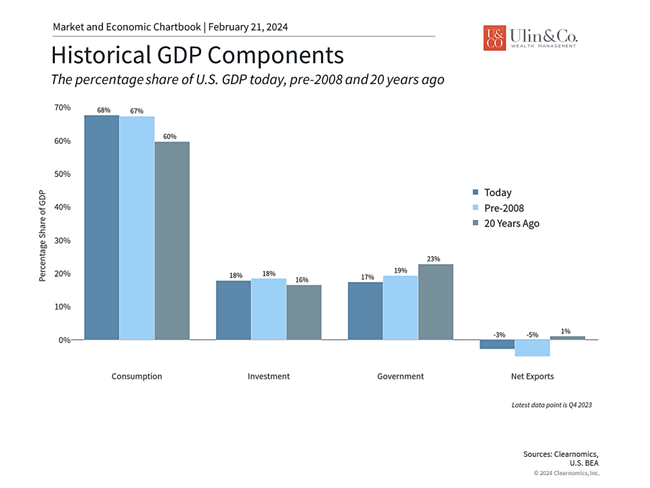

Consumer spending is the backbone of the U.S. economy, constituting over two-thirds of our nearly $28 trillion GDP. When consumers spend money on everyday goods and services, and make large one-time purchases, it not only helps to spur economic growth but is also a reflection of economic trends and GDP outlook.

This is because many factors affect consumer purchases as we noted above including consumer sentiment, the job market, household net worth, inflation, housing prices, the stock market and more. Consider the following points on the consumer and how it may affect the stock market and economy this year.

Largest component of U.S. GDP

Of the various components of GDP, consumer spending has been the most stable over the past decade at a time when government spending has fluctuated, business investment has been low, and the country has been a net importer of goods. In the fourth quarter of 2023, the economy grew 3.3% with consumer spending contributing 1.9% to that total. The strength of the consumer has helped the economy stay out of recession despite high inflation rates, layoffs in the tech sector, and ongoing uncertainty. In turn, this has helped to propel the stock market to new all-time highs.

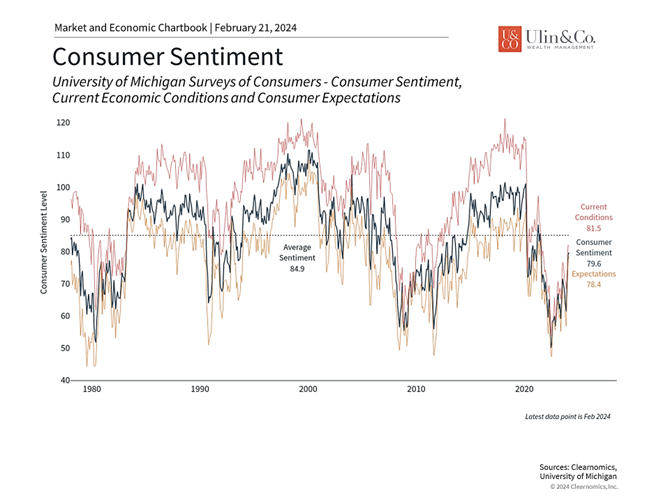

While consumer spending has a direct impact on economic growth, how everyday consumers feel about the economy can vary dramatically over time. Perhaps the best example is the decade following the 2008 global financial crisis. Consumer sentiment was poor for many years due to a weak job market. The housing bust and a sharp decline in manufacturing activity led many to give up on finding work, resulting in a falling labor force participation rate. Even when the overall economy was recovering, consumers were pessimistic. The fact that housing prices collapsed and it took the S&P 500 five years to recover (after a near 58% downfall) also led to lower consumer net worth.

In many ways, the situation today is the opposite of the post-2008 period. Despite fears of economic weakness, the unemployment rate is still at a historically low 3.7%, 353,000 jobs were added in January, wages have risen over 4% during the past year, and there are still nine million job openings across the country. The fact that the stock market is near all-time highs has also helped to boost the “wealth effect” among consumers as previously mentioned. While the housing market still faces many challenges with 30-year mortgage rates around 7%, transactions that do occur are closing at relatively high prices.

Consumers are feeling more optimistic about the economy

The accompanying chart shows that while consumer sentiment has not yet returned to historical averages after plummeting two years ago, they have improved dramatically. The rise and fall of inflation has been a major contributor to this effect since rising prices directly hit consumer pocketbooks. Inflation rates based on measures such as the Consumer Price Index have improved and the same University of Michigan survey shows that consumers expect inflation over the next year of only 3%. Gasoline prices, for instance, are hovering around $3.20 on average after reaching $5 less than two years ago.

While the consumer story is mostly positive, there are reasons to believe that spending could slow. Households have drawn down their extra cash and savings rates have fallen to only 3.7%, well below the historical average of 6.3%. Recent consumer spending data have also been mixed. On a year-over-year basis, retail sales have decelerated to 0.6%, or -0.8% month-over-month. As the accompanying chart shows, even online retailers have experienced a slowdown in growth after a decade of robust sales growth.

Retail sales have decelerated

Another important piece of the consumer puzzle is the level of household debt. Higher interest rates are a drag on household income statements and balance sheets, especially with the 10-year Treasury yield back around 4.3%. The latest Federal Reserve Bank of New York data show that total credit card debt is just under $1.13 trillion and 9.7% of balances are 90 days delinquent or more. Student loans are also back in the news with the White House seeking to forgive certain eligible borrowers. While there are no easy solutions to these underlying challenges, the financial stress on consumers could improve somewhat as the Fed begins to cut rates later this year.

The bottom line? While wall street is cheering Nvidia’s historic surge and sales this past week, we remind investors to keep an eye on retail and the consumer as the driving force of the economy and GDP. Consumers are increasingly optimistic as inflation improves and the job market remains strong. While there are still challenges ahead, consumer spending could continue to support the economy and stock market.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.