Volatility Tax – Navigating Market Turbulence

There is an old saying that happiness equals reality minus expectations. In other words, unreasonably high expectations is often a recipe for dissatisfaction and leads to making bad decisions in the short run.

This same formula can be loosely applied in the evaluation of investment outcomes with your portfolio and related actions. Should you bail out of the stock market when turbulence hits, or instead utilize pullbacks and corrections as a buying opportunity? The short answer is the latter.

Many investors got spooked from the near 2%, 825-point DJIA index selloff on Monday in as much from the sudden turbulence – like an airplane quickly losing altitude from a downdraft – to disturbing headlines that a hard landing may be approaching if the Fed stays “higher for longer.” Consider the following 5 valid points to help keep your money and brain in the game.

First, consume less financial news posts and shows discussing market and economic forecasts like predicting the outcome of the next Presidential election. Instead focus more on actual market data, trends, and your long-term financial plan. We meet with clients quarterly to review their portfolio performance as well as to help keep their brain in the game according to their risk tolerance and goals.

Second, consider that over the past couple decades, 14% pullbacks and corrections every year are normal. While a one day, thousand point drop of the DJIA index in January of 1985 would equate to an outrageous 26% loss from the high of 3,761, a thousand point drop today is only equivalent to only a 2.6% loss from the 38,900 recent high. It’s all relative. As the index continues growing near 10% per year on average, the volatility measured in points will continue to exponentially increase over years and decades.

Third, in times of extreme market volatility with 2%-5% swings in one day, more than half of those trades moving markets are more quant, ai, and algorithm- driven, than investors calling up their broker on the phone and telling them to “sell everything.” We also remind clients that their strategic balanced, diversified portfolio of cash, bonds, stocks, liquid alternatives, and international investment themes is not marching in lockstep with the S&P 500 nor the NASDAQ indices and are capturing less overall risk. The best offense to volatility is a strong defense led by diversification and sticking to your plan according to your risk appetite. Diversification is in essence an insurance policy for investing.

Fourth, the stock market continually making new highs should not alter investors’ behavior or investment strategy in the short run. Staying invested in a diversified strategy through all-time highs is not counterintuitive or crazy. Cashing out your portfolio at an all-time high because of fear – or pouring all your cash back into the stock market because of FOMO (fear of missing out) is not a disciplined strategy for long-term investors. Market timing is truly a fool’s game.

As we discussed last week, don’t sweat the market ringing the bell on new highs. While the market is finnicky and cyclical, it goes up most of the time over years and decades. History has shown us that record highs usually lead to more record highs – though there is a pullback or crash every five or six years. About 80% of the S&P’s records since 1950 led to at least one more all-time high the following week. Over 82% of the time the S&P is up. (etoro 2024

Fifth, focus more on data and market fundamentals than predictions and forecasts. We are in the second year of a bull market cycle with positive GDP and a nominal chance of a recession in sight. What matters is not the level of the market, but the business cycle and underlying trends. While there is still much uncertainty today due to inflation and the timing and size of Fed rate cuts, market sentiment has improved due to steady economic growth driven by a strong consumer, cooling inflation, low unemployment, and still a potential Fed Soft landing in sight. Don’t fight the Fed fighting inflation.

How Sequence of Returns Impacts Investors

While some investors are understandably nervous any time the market is near record levels, investors also tend to grow more bullish as the momentum continues. Across market cycles, fear often turns to caution, giving way to optimism and eventually irrational exuberance. With the market’s rapid climb over the past year, keep in mind the following points to stay on course.

Know Breakeven Points (Volatility Tax)

For some investors, it may increasingly feel as if the market can only go up despite ongoing financial and economic uncertainty. The bear market of 2022 may even seem like a distant memory now that the Fed is expected to cut rates and inflation has fallen to more manageable levels. While structuring portfolios to benefit from market gains is important, it’s also critical to manage risk. How investors behave when markets are down – even if only for a few days, weeks or months – can be as important as how they position over years and decades. In this context, there are a few key principles to keep in mind.

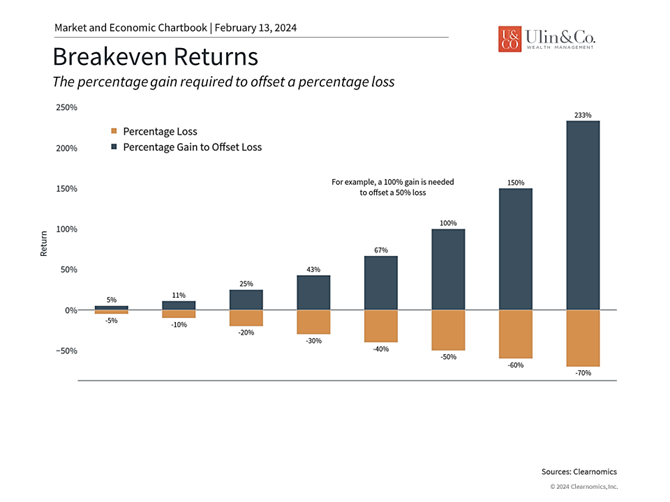

Consider the way investment returns are calculated can create a daunting situation for investors. This is because positive and negative compound returns are not symmetric – in general, a larger gain is needed to offset a loss. For instance, a 10% decline requires a nominal 11% gain to recoup those losses. These differences grow with larger percentages, as shown in the accompanying chart. It’s easy to see that a 50% decline, which cuts the value of a portfolio in half, would require a 100% increase to return to the original value. A 70% loss would need a 233% gain to break even. The effect of losses on compounded returns is sometimes referred to as a “volatility tax” or “volatility drag.” (see chart)

Thus, in the midst of an inevitable market pullback, it can be easy for investors to become discouraged by the magnitude of the gain needed to return to par. However, history shows that markets do rebound over time, even when the S&P 500 declines nearly 50% as it did in 2008 or 34% as it did in 2020, making up for these losses on their way to new all-time highs. Of course, the timing of these rebounds is difficult if not impossible to predict. Thus, it’s important to stay invested and not focus on the magnitude of gains and losses. Too boot, your diversification strategy can help to minimize your downside capture as compared to major market indices.

Having a smoother ride can help investors to say on course

One of the most important ideas in behavioral finance is known as “loss aversion,” the idea that losses tend to feel worse to investors than similar gains. A simple example is that finding twenty dollars on the ground will certainly make you happy but accidentally losing a twenty-dollar bill – or having it stolen from you – will likely make you more upset. This asymmetry in how we experience gains and losses grows as the amount increases. In the extreme, large portfolio gains may make investors quite happy for a short time but large losses may lead investors to give up on their financial plans altogether.

While most investors would like to generate significant portfolio gains year in and year out, the reality is that markets are inherently volatile. This is why, from a long-term perspective, it is far more important for investors to build a portfolio and financial plan that they can stick with through good and bad times, rather than a portfolio with the best theoretical returns.

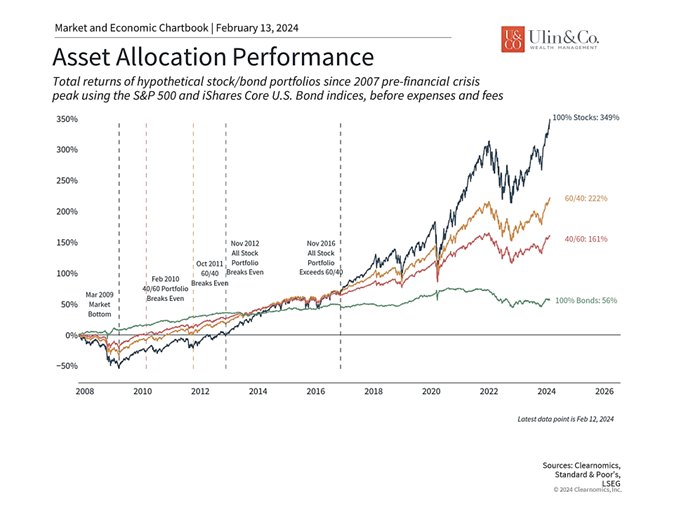

The accompanying chart (above) shows four different asset allocation portfolios and highlights how different their paths have been since the 2008 financial crisis. Clearly, an all-stock portfolio would have performed best over the past 15 years. However, there are few investors who can stomach losses on the order of 50% over the course of years. Thus, most investors would have been better served holding a diversified portfolio instead. Not only would their returns have been quite strong over this period, but they would have been more likely to stick to their financial goals despite the many challenges along the way.

How investors react to bull and bear markets can have long-term consequences

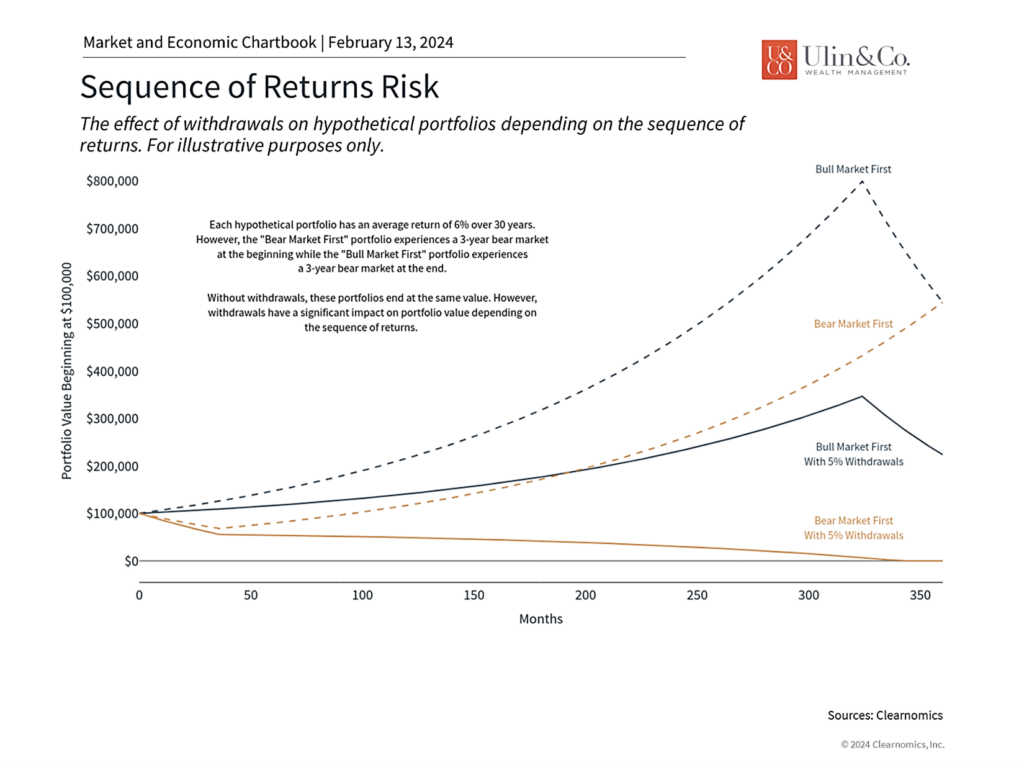

Finally the idea that the timing of positive and negative returns matters is known as “sequence of returns risk.” In a perfect world, whether an investor experiences a bear market or bull market first would not affect the final outcome, as shown in the dotted lines in the accompanying chart. In reality, however, investors will likely behave differently in bull and bear markets, and they may be withdrawing from their portfolios along the way, creating a drag that is compounded over time. This is yet another reason investors should be careful of making sharp portfolio adjustments or cashing out during periods of market volatility, and should consult with a trusted advisor on portfolio positioning and withdrawals.

The bottom line? While markets have reached new all-time highs, investors should not lose sight of risk management when navigating market turbulence. Properly diversifying allows investors to manage through good times and bad, increasing the odds that they will achieve their long-term financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.