Generative AI Boosting the Magnificent Seven

Tech and AI are on the cusp of a new era of transformation across sectors and industries led by the Magnificent Seven stocks, while getting investors and companies excited to see future change, growth and profitability fueled by a paradigm shift not seen since the dotcom days.

The term artificial intelligence was initially coined and came into popular use in 1950 when Alan Turing published “Computer Machinery and Intelligence” which proposed a test of machine intelligence called The Imitation Game. Fast forward to 1997 for another memorable tech headline when the IBM computer named “Deep Blue” beat world chess champion Garry Kasparov.

Jon here. Having worked with IBM and other high-tech employees and retirees over the past couple of decades in South Florida, I personally enjoy mulling over tech topics like in this newsletter and seeing how innovation integrates into our lives. This reminds me a bit of Steven Spielberg’s “Minority Report” where Tom Cruise strolls through a mall and gets bombarded with ads that mention him by name, implying they’ve been targeted specifically to him. Except that the world slated for 2054 from the movie is already here now.

The Quants

Bringing tech full circle to Wall Street, the 2010 book The Quants, published just after the Great Recession described the world of quantitative analysis and the various hedge funds that use the technique. The book covers studies indicating ai algorithm-driven “quant investing” systems account for more than 60% of stock trades, especially in more volatile environments. Trading algorithms respond to the same evidence as humans and are trained to sniff out, yet quickly trade on broad indexes to individual companies if they recognize certain triggers. These robots can pick up data from Fed Chair Powell’s comments instantly from a TV interview and take action before you finish your morning coffee.

Generative AI

Generative AI focuses on creating new content and data, while traditional AI solves specific tasks with predefined rules. Generative AI uses unsupervised learning and generative models, while Traditional AI often employs supervised learning and discriminative models.

Generative AI holds enormous potential for enhancing the productivity and profitability of tech stock companies, including the “magnificent Seven.” By leveraging AI for data analysis, personalized customer experiences, content generation, art, design, music creation, drug and disease research, and more, these companies may stay at the forefront of innovation and should gain a competitive advantage in their respective industries.

Not Dotcom Déjà vu

While the spike in tech stocks the first half of the year led by the Magnificent Seven may have been more hype than application, this is not a dotcom déjà vu that led to a historic crash in 2000. The 90’s frenzy of buying internet-based stocks was massive, as many internet-based companies, so-called dotcoms, were starting up. Because they were in a high-growth industry, they needed funding. Funding came primarily from venture capitalist (VC) firms. Lenders and individual investors also followed later.

Instead of focusing on the fundamental company analysis involving the study of company revenue generation potential and business plans, industry analysis, market trend analysis, and P/E ratios, many investors focused on the wrong metrics such as traffic growth to their website propelled by the startup companies leading to the demise of companies like pets.com with their sock-puppet dog mascot.

Magnificent Seven Driving Market Turbulence

We have witnessed this year the financial markets can swoon seemingly without reason and, in the worst case, in a way that appears to contradict underlying improving fundamentals as we have discussed over many newsletters this year. In these situations, investors can either try to justify these market swings or recognize that they are likely to be temporary. Consider the following when mulling over tech and overall stock market performance as part of your diversification strategy.

A small group of stocks has driven market swings this year

The market recently fell into correction territory by Halloween eve, typically defined as a 10% decline from the previous peak, a fact that may seem to be at odds with many measures of strength in the underlying economy. Since the end of July, the S&P 500 has pulled back 10.3% due to concerns around rising interest rates, Fed policy, slow growth in China, political uncertainty in Washington, geopolitical risks, and more. (see chart) Even at its recent peak, the market had not fully recovered from last year’s bear market, coming within 4.3% of its all-time high at the start of 2022. Year to date after a big bounce last week, the S&P 500 has still gained nearly 14% and the Nasdaq 31%.

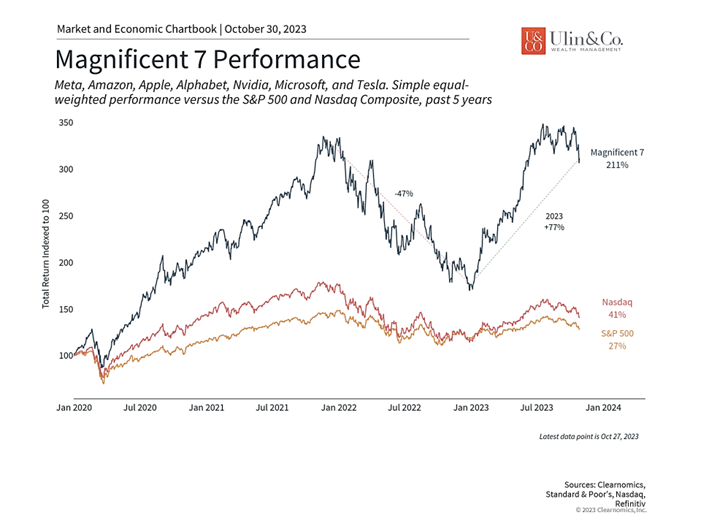

Given these macroeconomic concerns, the biggest contributors to both the up and downs in major indices have been tech stocks. One group of these high-flying stocks is now referred to as the “Magnificent 7” and includes Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla. As the chart above shows, this group has gained 77% on average in 2023, contributing significantly to the returns of both the Nasdaq and S&P 500. Over the past five years, they have risen 211% compared to 41% for the Nasdaq and 27% for the S&P 500.

However, despite periods of investor enthusiasm, these stocks are far from a sure thing. Not only have they led declines in the recent market pullback, but they lost nearly 50% of their value during last year’s bear market pullback. Thus, any strong positive gain for this group comes with heightened risk. As is always the case, what matters for long-term investors is how these stocks can contribute to a diversified portfolio, and a broader financial plan, rather than as standalone investments.

One set of opposing forces driving the ups and downs in tech are enthusiasm for new technologies such as artificial intelligence (Ai) on the one hand and higher interest rates on the other. When interest rates rise, the value of money promised to you far into the future is suddenly worth less. Another way to understand this is that, when rates rise, you have more attractive ways to invest your money. This can impact technology stocks more than other sectors since they depend on the promise of cutting-edge innovation and commercialization that may be years or even decades away. Not only have interest rates risen, but with the 10-year Treasury yield briefly exceeding 5%, they are at levels not seen since 2007. Unfortunately, this has dragged the overall market lower.

The economy is far stronger than anticipated

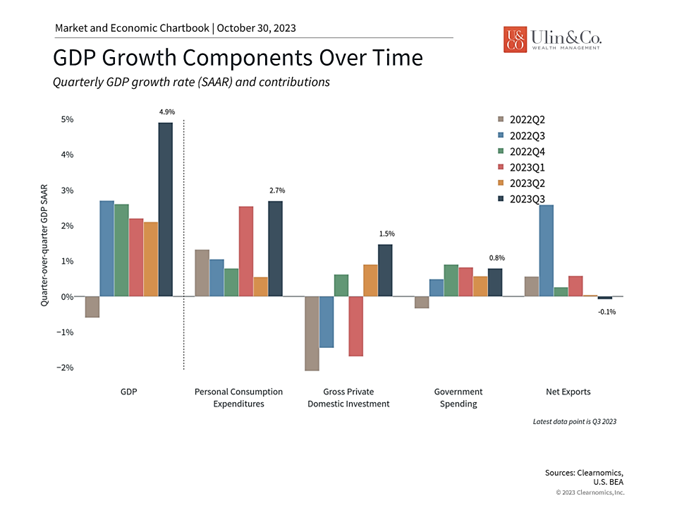

What may drive cognitive dissonance for some investors is that these market moves are happening at a time when the economy is far stronger than previously believed. The latest GDP report for the third quarter was significantly better than economists had expected just a few months earlier. Not only did the economy grow 4.9% at a quarter-over-quarter annualized rate, after accounting for inflation, but growth was also broad across consumer purchases of goods and services, business investment, and government spending. (see chart)

In fact, this was the best quarterly GDP number since 2021 when the economy surged after the pandemic. Growth rates this strong have only occurred a few times over the past two decades – prior to 2021, it last occurred in 2014, and before that in 2006. That said, some investors are naturally concerned that this may not continue and that a recession is still possible if rates remain elevated and if the Fed does tighten further. There are also worries that consumer spending may decelerate as households draw down their excess savings and private investment could slow as a buildup of business inventory reverses.

Still, it’s undeniable that the economy has been far stronger than economists expected. While it is still early, consensus expectations are for the economy to grow 0.8% in the fourth quarter while the Atlanta Fed’s GDPNow model is forecasting 2.3%. Either way, this year has shaped up far better than many had feared, especially because inflation continues to improve toward the Fed’s long-run target and the labor market remains strong. If you had told an investor a year ago that conditions would be this positive, they most likely would have guessed that we would be in the midst of a new bull market.

Market corrections occur regularly

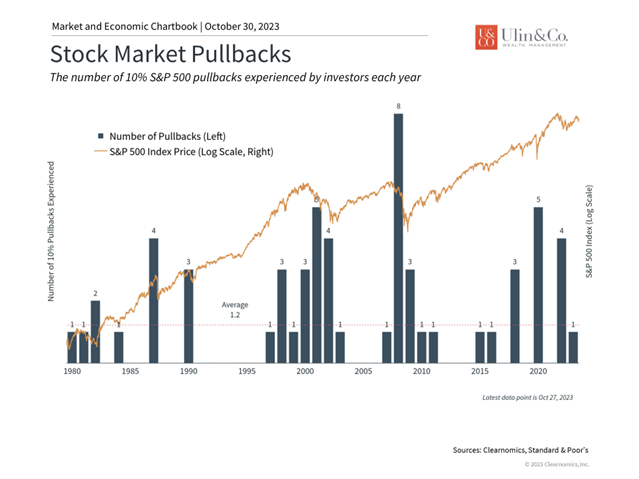

So, what are investors to do when markets swoon despite strong fundamentals? The chart above is a reminder that market corrections occur on a regular basis, in both good and bad years, and even during strong bull markets. When corrections do occur, markets often fall as much as 14% or more. Despite this, major indices have historically recovered in a few months.

What’s more important is that rebounds often occur suddenly and unexpectedly, just as they did in mid-2020, earlier this year after the banking crisis, and throughout countless other examples. Trying to time this reversal perfectly often backfires since it means missing out on the earliest part of a recovery. Of course, the past is no guarantee of the future, but this a reminder for investors to stay focused on the long run and not get caught up in short-term market movements.

The bottom line? The market recently fell into correction territory led down by the magnificent Seven tech stocks despite many signs of economic strength. Investors should continue to focus on the big picture trends rather than react to daily market moves.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.