Disciplined Investors “Mind the Gap” Through COVID19

Investor euphoria is not greatly prevalent today as one would expect after the swift 40%+ rebound of the Dow Jones Index (DJIA) just obliterated most of the bear market losses endured from the COVID19 led crash.

Recent AAII Investor Sentiment Survey data on “what direction” members feel the stock market will be in next 6 months has been trending lately near 42%- 48% Bearish, quite well above the 30.5% average. This is encouraging to us from a contrarian point of view, suggesting the rally has a bit more leg room to advance.

Many of the news prognosticators are at it again, forecasting another wave of stock market turmoil due to the uncertainty of the upcoming Presidential elections while suggesting that the market is overvalued and must come down. This brings us to mind Bob Farrell’s “9th Rule of Investing” maxim: “When all the experts and forecasts agree -something else is going to happen.”

Mind the Gap

“Mind the gap” is a worldwide audible warning phrase issued to rail passengers to take caution while crossing the horizontal gap between the train door and the station platform ultimately to avoid a potential disaster.

It can be acutely more challenging to avoid falling into typical investing pitfalls than boarding a train as there are no guardrails or warning signals to help investors minimize making significant financial mistakes.

Each year, Dalbar publishes its Quantitative Analysis of Investor Behavior study. The study indicates how the stock market performed over 20-year periods of time, compared to how investors performed. Most studies have shown us how investors end up greatly underperforming the markets by about 60%. Picture this by example: investors’ portfolios would be returning closer to 3.6% vs 9% for the markets over time. Imaging a NFL quarterback missing 60% of their receivers!

An unmistakable pattern emerges from the data from this “behavior gap.” A class of investors is always buying high, selling low, repeating endlessly and wondering why they have such poor results. This recalls the witticism of Einstein: “Insanity is doing the same thing over and over and expecting different results.”

Patterns

Jon here. After almost two decades of investing for client’s portfolios, the most important thing I’ve learned is that nobody can predict the future. Unfortunately, every year there are no scarcity of opinions, indicators, charts and fortune tellers that work to motivate investors to take action with their money at exactly the wrong time.

It’s human nature to look for patterns. When people figured out that tigers could eat us for lunch, we avoided tigers. We sought patterns for survival. But when it comes to investing, the same instincts don’t always help. The markets are driven in as much by human behavior (investor sentiment) and numbers, none of which can be predicted.

Comparing fuzzy numbers and indicators from past economic events, such as the dot-com “tech” crash, to today’s “new world” where tech is helping lead the way out of the current COVID19 recession, while Fed policy is helping to prop up stock valuations with low rates and significant quantitative easing measures, could be a big misstep. As Warren Buffet is often quoted, “The rearview mirror is always clearer than the windshield.”

Maintain Discipline

The recent steep climb of the U.S. markets has occurred despite on-going economic, market and policy uncertainty and is further evidence that investors who are able to stay disciplined while invested in an appropriate “all weather” diversified strategy, rather than over-reacting to short-term news and charts or try to time the market, are more likely to achieve their financial goals..

Perhaps the most important principle for disciplined investing is to focus on economic and market fundamentals rather than day-to-day price changes. This has been difficult to do given all of the unknowns surrounding the COVID-19 crisis and the government response. At the moment for instance, it’s still unclear when another round of economic stimulus will be passed by Congress, whether those cities and states facing an uptick in coronavirus cases will re-open soon, and how new trends in retail investing will affect individual stocks and the market as a whole.

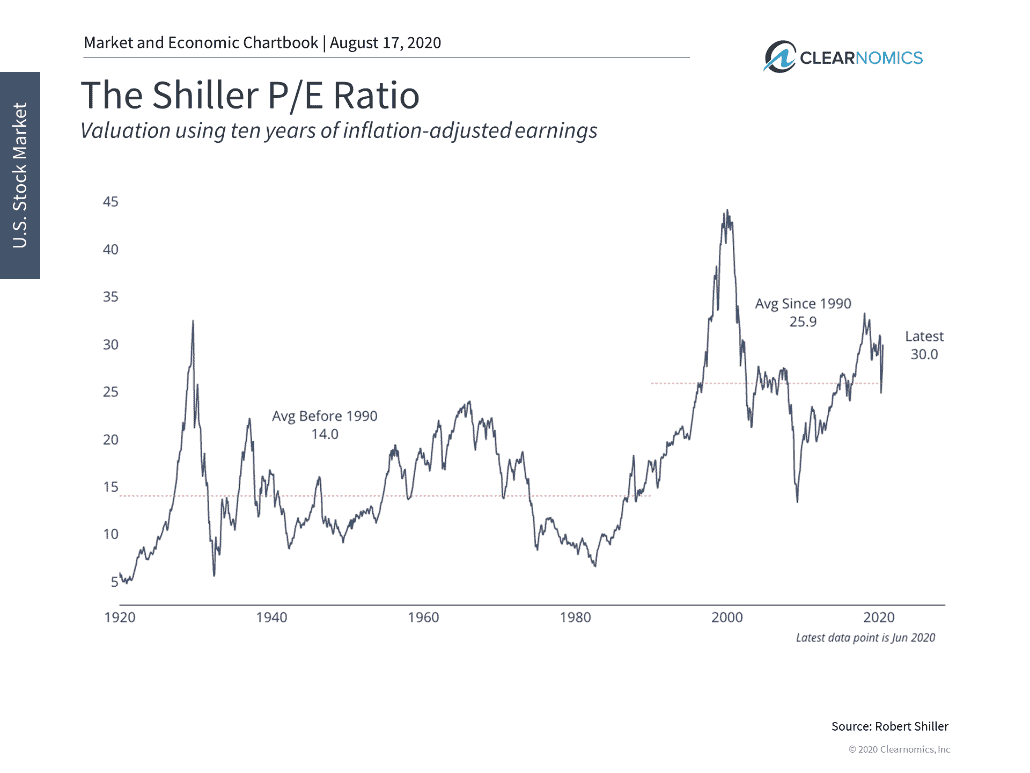

At the moment, not only has the market rebounded significantly, but the lack of clarity around corporate earnings has meant that valuations for the overall stock market are elevated. The Shiller P/E ratio for instance, which measure the stock market’s price to earnings while also adjusting for inflation, is still close to cycle highs. (see below) While this can change very quickly if there is either another episode of market volatility or if the economy recovers even faster than expected, this suggests that the stock market is not cheap at the moment, per se.

However, the traditional Shiller P/E only applies to the overall market. (see below) There are at least two other important ways for long-term investors to maintain balanced portfolios while focusing on valuation measures.

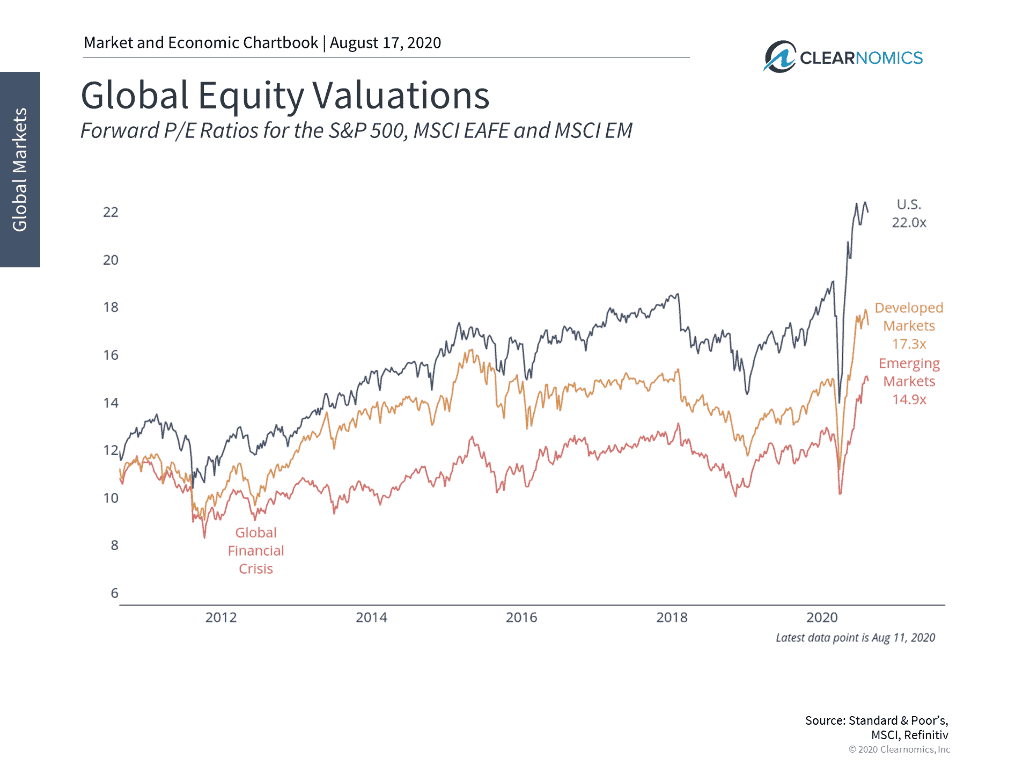

First, international stocks are still much cheaper than those in the U.S. Even though the S&P 500 is trading at a 22x multiple (today’s price compared to expected earnings over the next twelve months), developed market stocks and emerging markets have multiples of 17.3x and 14.9x respectively. (see below) These are also higher than they were before the crisis due to the same factors, but they are clearly cheaper than the U.S. which has already seen a rapid bounce-back.

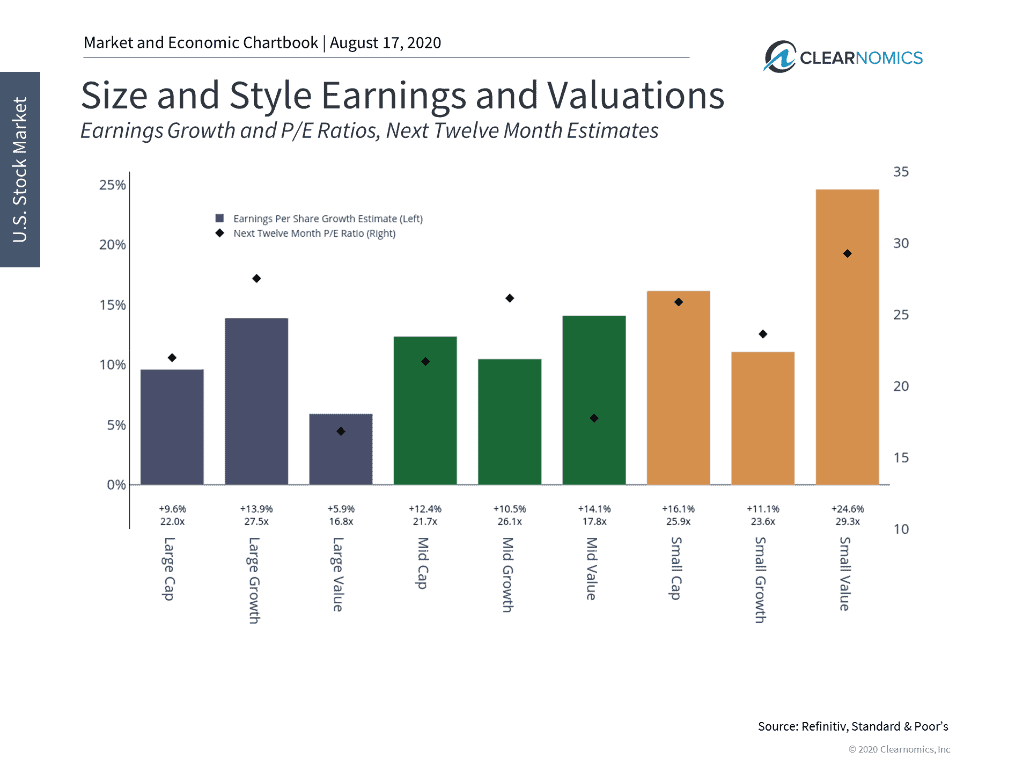

Second, different parts of the U.S. stock market are being valued differently. For instance, large-cap growth stocks have outpaced other parts of the market resulting in significantly higher valuations than both their peers and compared to their historical averages. This is partly because many tech stocks that have fared well during the recent crisis belong to this group.

This means that value stocks are in many cases significantly cheaper. There are also interesting dynamics among other size and style categories. For instance, mid-cap growth stocks are expected to see lower earnings growth than mid-cap value ones, despite significantly higher valuation levels. Small-cap value stocks are expected to experience the highest levels of earnings growth over the next twelve months across the board. (see below)

As is always the case, there are no guarantees that earnings projections or valuation levels will predict returns over the next few months or even years. From tactical and secular perspectives, there may be reasons to invest in higher-valued areas. Adjusting portfolios in a disciplined way toward attractive areas that are under-valued by the market, and away from ones that are over-valued, has been one of the key principles to help achieve long-term investment success.

With the overall stock market near record highs and with valuations at elevated levels, it’s more important than ever for investors to avoid complacency. Below are three charts that put these fundamentals in perspective.

- The stock market recovery and economic uncertainty have pushed valuations higher

The Shiller P/E ratio, which measure the price-to-earnings for the S&P 500 adjusted for ten years of inflation, is still elevated. Although it is not as high as it was during the dot-com bubble, it is still near a cycle peak. This is because the stock market has recovered swiftly over the past six months, boosting the numerator in the ratio. The denominator has also fallen due to economic uncertainty from on-going economic shutdowns, which also increases the Shiller P/E.

- International markets are still much cheaper than the U.S.

Although all regions around the world are experiencing higher P/E ratios, developed and emerging markets are still cheaper than the U.S. Although these regions may continue to face problems around COVID-19, they may still be attractive for long-term investors over the course of years and decades.

- Not all parts of the stock market are equally value

Various parts of the U.S. stock market are valued quite differently at the moment, in no small part because earnings expectations differ dramatically. Although large-cap growth stocks have dominated headlines and recent performance statistics, other parts of the market are either much more cheaply valued or are expected to see much higher earnings growth.

The bottom line? With the stock market reaching new record highs, it’s important for long-term investors to stay disciplined, no take unnecessary short term action with their portfolio based on headlines and work to re-focus on fundamentals.

For more information on our firm or to request portfolio and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not guarantee a profit or protect against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent