Investor Edge: Wall Street vs Casinos

You may not know much about the nuts and bolts of what drives the stock market and individual stocks or even care. Many of the stock markets eye catching headlines today from Bitcoin, GameStop and Robinhood to cannabis stocks, could lead you to believe that many people are “gambling their savings away” in the stock market faster than on a craps table at Vegas.

Casinos and Odds

You may not be completely wrong. Academic research suggests stock-market trading and more traditional casino gambling have quite a bit in common. One study noted there’s 3.5 times more gambling in stock markets than in more traditional venues like casinos, with investors in America and Hong Kong leading the way with about 15% of volume associated with gambling.

Contrarian Mindset

Casinos are highly regulated, though unlike the stock market, there are no long-term positions or “crowd psychology” factors that can be built in, like a game of blackjack with only a few participants per table.

Unlike a casino game where the house typically wins, the worse off the stock market is, the better the opportunities are to profit. That’s seemingly the credo for contrarian investing. Baron Rothschild, an 18th-century British nobleman and member of the Rothschild banking family, is credited with saying that “the time to buy is when there’s blood in the streets.”

The most prominent example today of a contrarian investor is Warren Buffett. “Be fearful when others are greedy, and greedy when others are fearful” is one of his most famous maxims.

Contrarian investing is, as the name implies, a strategy that involves going against the grain of investor sentiment and the crowd at a given time. The principles behind contrarian investing can be applied to individual stocks, an industry, or even entire markets. A contrarian investor enters the market when others are feeling negative about it, fueled by an abundance of pessimism.

Consumer Confidence

Consumer spending is the backbone of the $21 trillion U.S. economy. When times are good and consumers are confident in their jobs and financial situations, they tend to spend more. This boosts sales for small businesses and large corporations alike, which then hire more workers, develop new products, make financial investments, and more. Often this creates new jobs and boosts wages which increase consumer spending further. Conversely, when consumers are nervous, spending slows which has the opposite ripple effects across the economy. Thus, how consumers feel is an important economic indicator for investors to consider as stock markets hover near all-time highs.

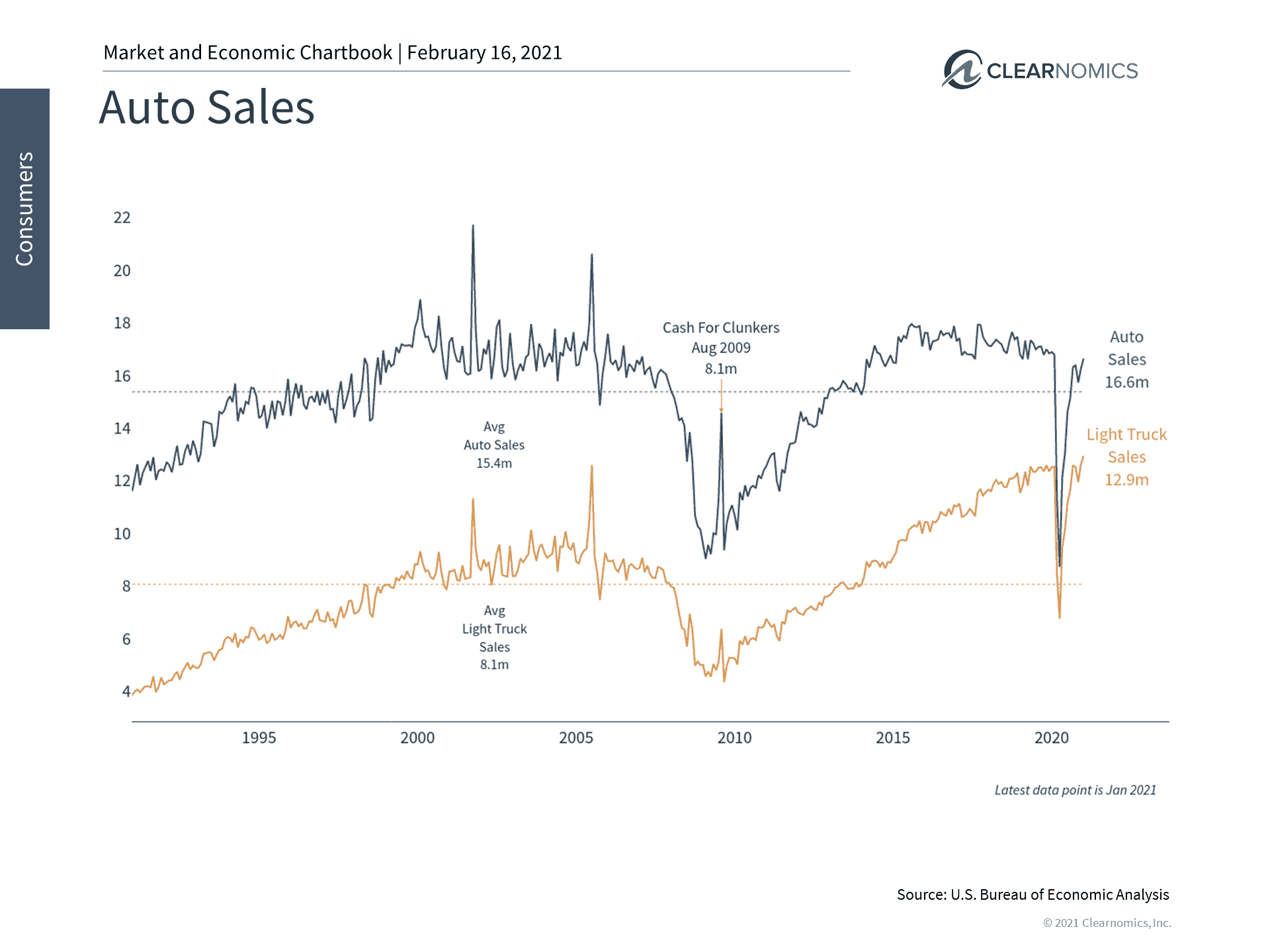

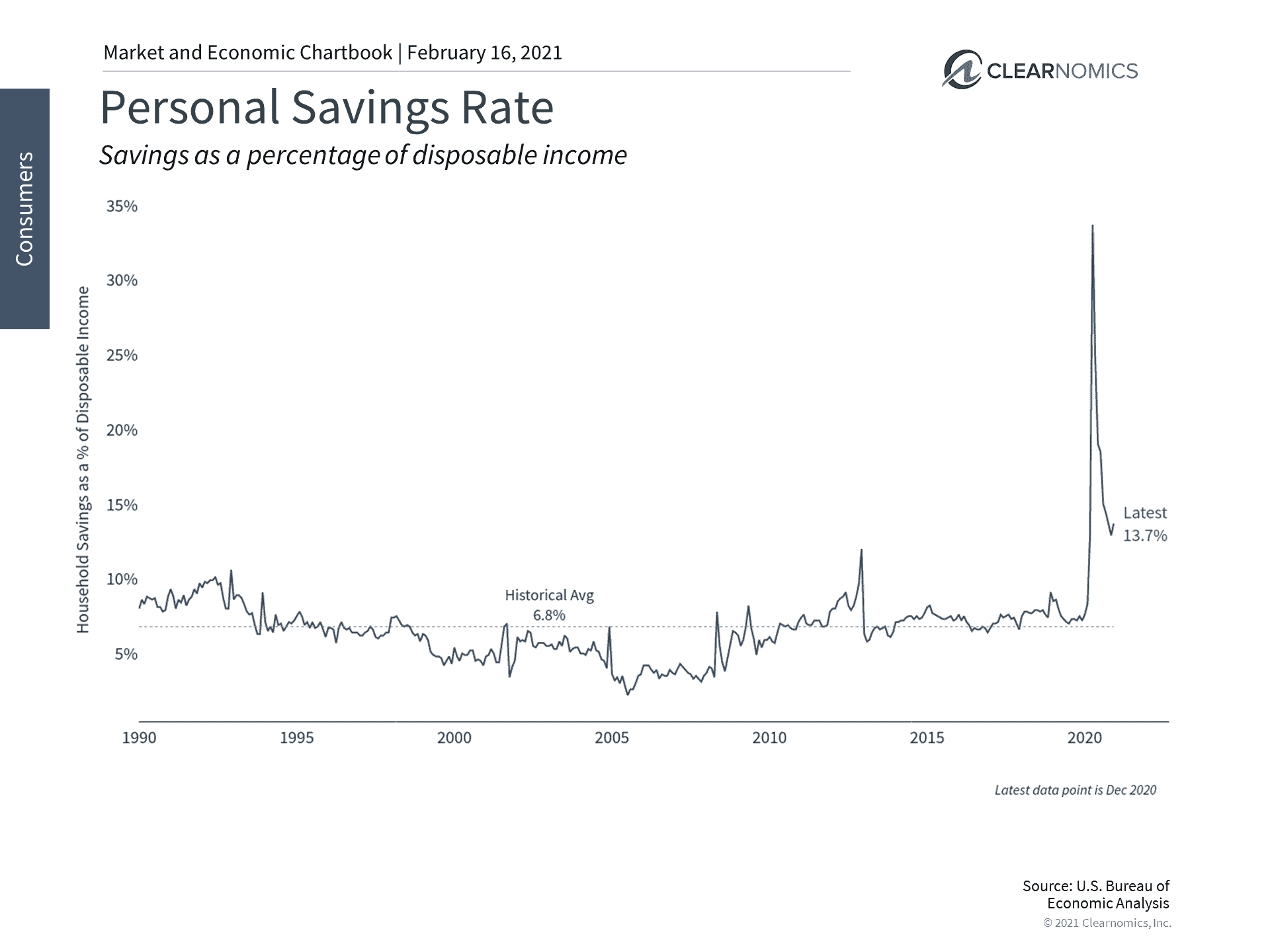

The average consumer has been financially healthy since last summer when the economy began to reopen. Not only did jobs return quickly in many sectors, but retail spending rebounded (see below), the household savings rate remained high (see below), and the cost of borrowing fell. Together, these factors boosted the balance sheets of many households. For instance, housing prices have continued to climb and spending on durable goods such as cars is back to pre-pandemic levels. (see below)

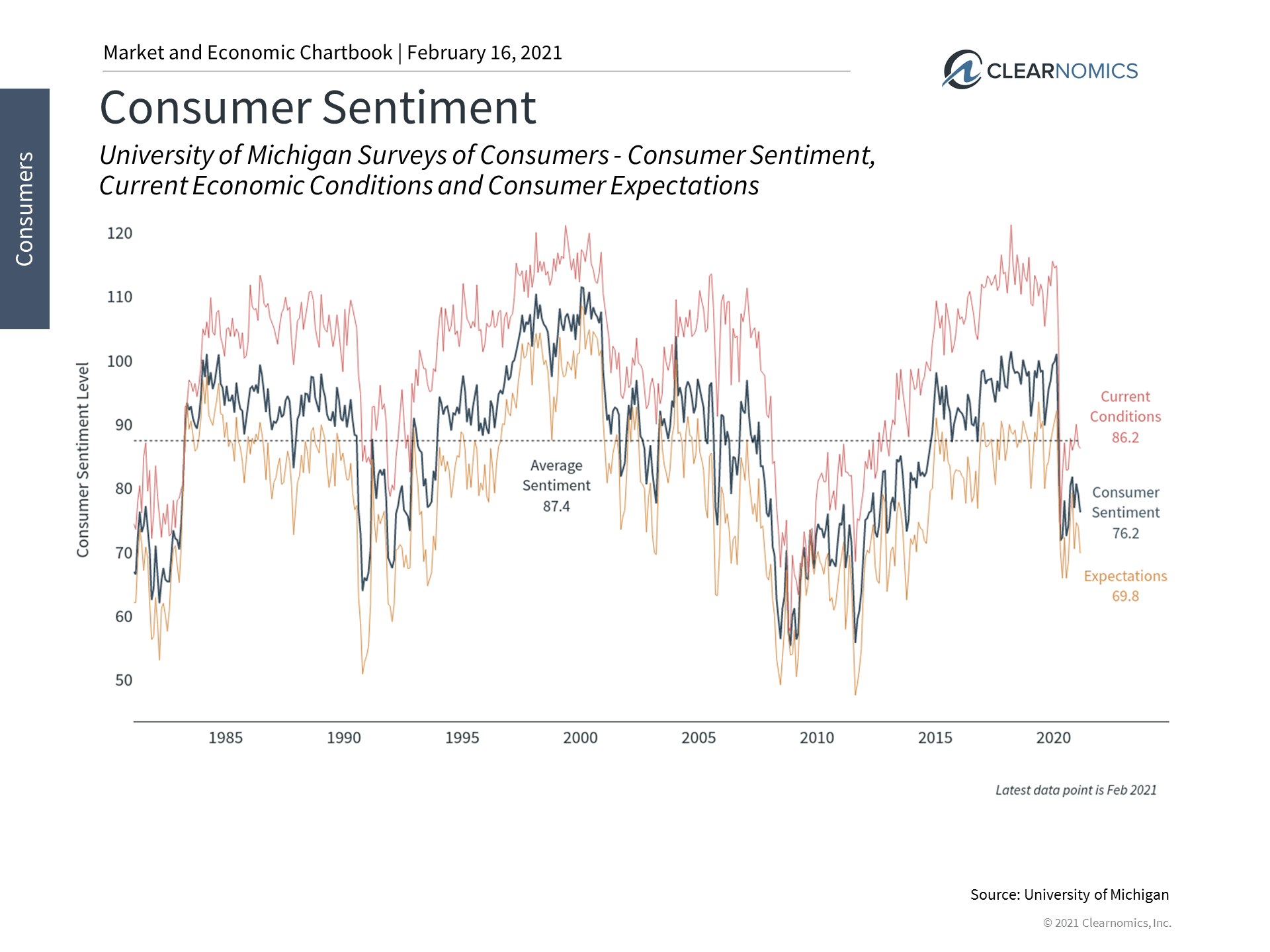

Despite this rosy picture, the University of Michigan Consumer Sentiment Index shows that overall sentiment is stuck at 2013 levels. (see below) This is partly because, until enough of the population has been vaccinated, everyday life will continue to be disrupted by the pandemic. Even then, it’s unclear whether life will truly ever return to “normal.” This is also partly because not all households have recovered from the shutdown. Millions of Americans are still without work and many are relying on unemployment benefits and government stimulus.

What does this mixed environment mean for investors? The history of consumer behavior, the economy and the stock market suggest that consumer sentiment tends to track the business cycle. Sentiment – both in terms of current conditions and expectations – is extremely depressed after a crisis. It then slowly recovers over the course of years as memories of economic and financial shocks fade. Finally, late in the cycle, consumers are extremely confident just as stocks are near their final peaks.

For this reason, consumer sentiment is often a contrarian indicator for investors – i.e. it is often better to invest when consumers are nervous than when they are confident. At the moment, consumers still have a long way to go before they are able to put the experience of the past twelve months behind them. This is also reflected by a savings rate which is still elevated, suggesting that households continue to be cautious with their spending. (see below)

Of course, consumer spending alone isn’t enough to explain or produce true economic growth. This is because national income accounting only tells us where and by whom the dollars were spent – not what allowed them to spend more. For this spending to be sustainable, it has to be put to good use. In the long run, economies grow due to increased workers, equipment and more importantly, greater productivity through technology and better know-how. Thus, while government stimulus measures may help to keep the economy on life support, investments in people and technology are needed to keep the economy growing once the crisis is in the rearview mirror.

Thus, consumer sentiment is only a single indicator but it’s an important one. At the moment, the data suggest that everyday individuals and households still have a long way to go before they feel better about the world. This is another reason for long run investors to focus on the future by staying diversified and invested. Below are some charts that provide perspective.

1 Consumers are still nervous about the pandemic

Consumer sentiment is still near 2013 levels – well below pre-pandemic peaks and the long run average. This is true for both measures of current conditions and future expectations. Clearly, everyday Americans are still nervous about the pandemic and its economic impact.

2 However, sales of durable goods like automobiles have recovered

Despite this nervousness, many measures of consumer spending have rebounded. Retail sales jumped immediately after lockdowns were lifted last summer, and even large purchases like cars have returned.

3 Consumers are saving much more than average which improves their financial security

Although the savings rate has fallen over the past year, it is still well above historical averages. This is further evidence that households are cautious with their spending.

The bottom line? Consumer sentiment, a key contrarian indicator to the markets, currently suggests that many individuals are still nervous about the pandemic. Historically, this attitude has been a sign that it is still quite early in the business cycle and there may be more economic growth and stock market gains ahead. Investors ought to stay invested and focus on the long run as the economy recovers.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.