Inflation is not Returning to the ‘80’s

Is inflation returning with a vengeance? Ominous headlines hyping the biggest inflation scare in 40 years is forming and will wreak havoc on consumer goods, interest rates and the stock market, appears to be the “theme du jur” this week for those who are not getting overly distracted by the recent crypto crash.

Whether the recent surge in demand following the “supply shock” rebound out of the economic shutdown will take us back in time to the aught-eighties with crazy-high double digit interest rates, rising inflation, big hair, spandex, mullets, ripped jeans and unforgettable dance-pop music, is highly unlikely. Still, before you “Bust a Move” in your jean jacket to “Funkytown” on your Sony Walkman, this year may not be a breeze for investors hoping to be “Walking on Sunshine” in the back half of 2021 with minimal volatility or pitfalls.

Prices are rising for some everyday goods and services as well as for important commodities. (see below) The fastest increases in decades could alter growth in certain sectors, impact household spending, and affect the value of savings and investments. While these concerns will only grow as the economy returns to pre-pandemic levels, they may not be enough to lose sleep over for long term investors.

Toilet Paper

Last fall, Barron’s amazingly warned “that the coronavirus pandemic has made the aggregate inflation data mostly useless.” Aggregate indicators are informative only to the extent that the importance of the underlying components are constant over time.

The skyrocketing price of toilet paper and hand sanitizer products during the pandemic wasn’t referred to as inflation, since it was understood to be temporary and was driven by panic buying. Images of empty shelves and shopping carts piled high with supplies inundated news reports and social media feeds. Panic begets panic.

While the fall in certain good and services a year ago was not normal, we are experiencing this effect today in reverse. The current temporary inflation flair-ups driven by the reopening does not affect all goods and services at the same time or in the same way.

Barron’s notes that most of the current increases can be attributed to a few categories that collectively account for just 13% of consumer spending, at least in normal times: used cars and trucks, hotels and motels, airfares, motor vehicle insurance, car rentals, admissions to live events and museums, and food away from home, otherwise the huge boost to housing prices and construction.

Amazon Effect

Jon here. The majority of goods and services (the other 87%) does not appear to have a huge inflation spike. This goes to show you that separating the headlines from the actual details can help you to better understand what is actually going on under the hood of the economy.

A few areas that are continually creating headwinds (deflationary forces) against inflation include demographic trends of the aging boomer population, technology replacing workers, globalization, and the “Amazon effect” that has been found to cause numerous changes in the retail market. Among these impacts is a increase in price flexibility and uniform pricing in traditional brick-and-mortar stores. An externality of the increasing price flexibility and uniform pricing has been a decrease in pass-through inflation.

3 Factors Driving Inflation During Recovery

In everyday language, we often talk about any price increase as inflation which reduces purchasing power. However, it’s important to distinguish between three factors at play during this post-pandemic recovery. Understanding the differences can help investors to stay balanced in their portfolios and be properly diversified for these changes in the years to come.

First, some prices are simply bouncing-back from historically low levels. Oil, for instance, plummeted at the onset of the nationwide lockdown last year, with the front-month contract falling into negative territory for the first time in history. Even with no changes to the oil industry, it would be expected for prices to rebound as the economy reopens. The fact that these price increases are large on a percentage basis is due to the low starting points last year.

Second, there are supply and demand imbalances in certain industries that are causing prices to soar. This is true in semiconductors, housing construction, agriculture, gasoline and many more areas. In most cases, this is what captures the attention of news headlines and the general public. Each industry has its own supply and demand story.

The third factor is a broad rise in prices across the economy due to monetary and fiscal stimulus. This is textbook inflation caused by increases in the money supply and/or the velocity of money – i.e. the pace at which money is spent. Unlike an energy pipeline disruption, the effects of this type of inflation is theoretical and can be harder to see.

Monetary inflation is not a universal concern among economists today. Although loose monetary policy was one reason for the inflation of the 1970s and early 1980s, Fed stimulus after the 2008 financial crisis did not result in the inflationary pressures many expected. Additionally, there have been strong deflationary forces over the past several decades as we discussed above. Our following three charts for the week break this all down.

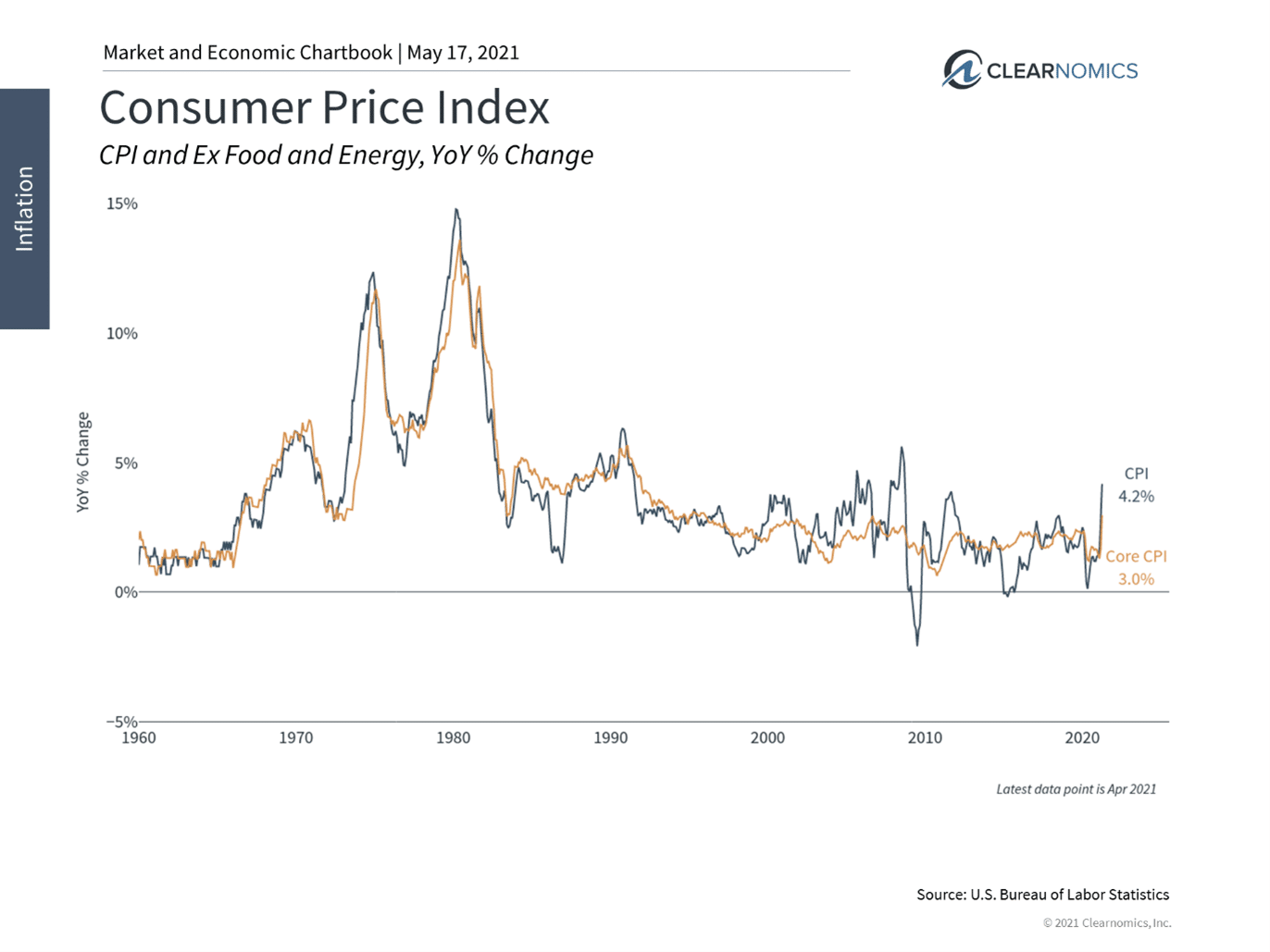

1 Many measures of inflation are accelerating

Many measures of inflation including CPI and PPI have increased in recent months. In some cases, prices are simply jumping off last year’s pandemic lows. These base effects should be expected to fade over time.

2 Many commodity prices are rising too

In certain industries, significant demand coupled with constrained supply have resulted in price spikes. Lumber, for instance, is at record levels due to strong demand for new homes and limited capacity at sawmills.

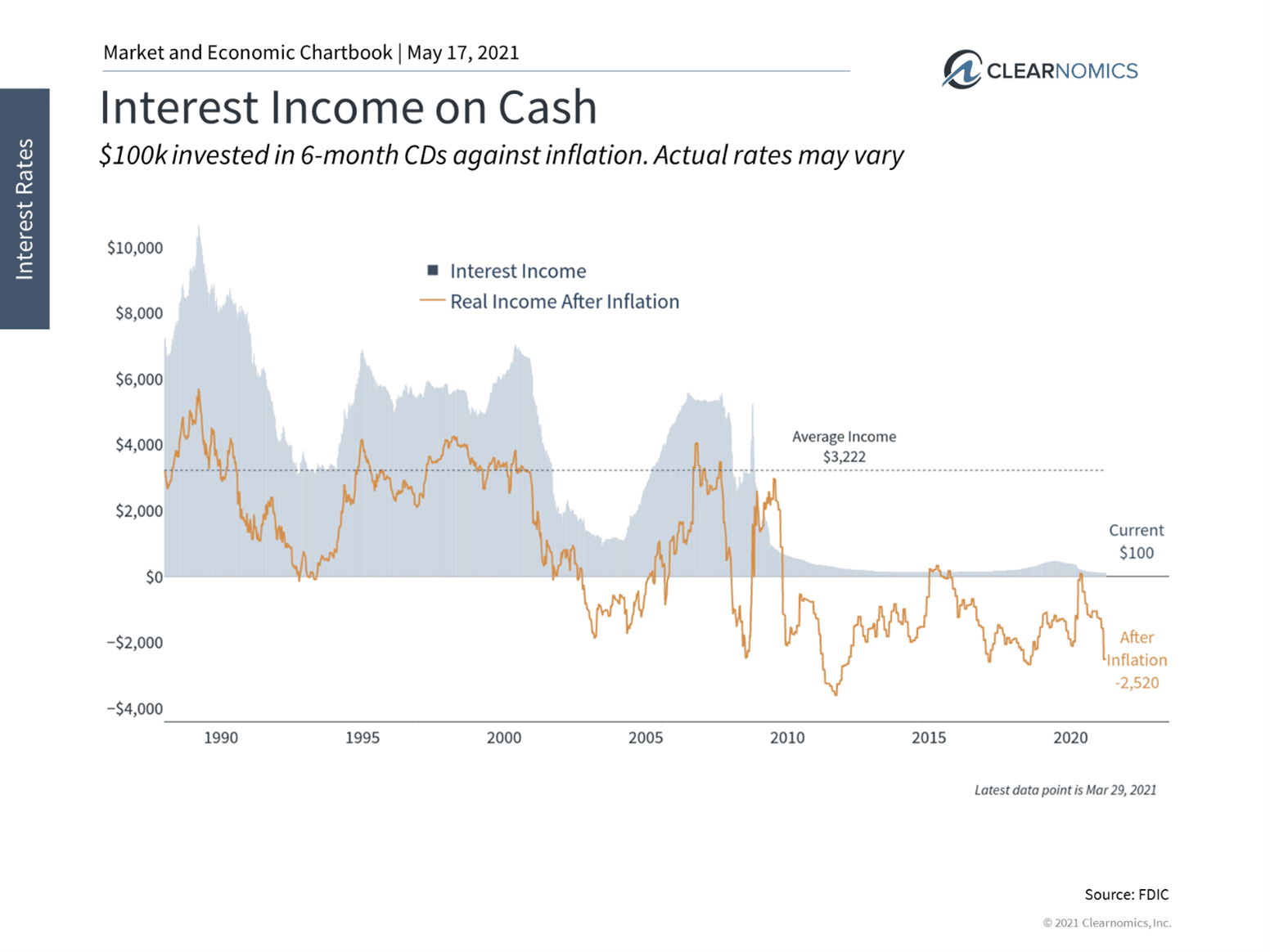

3 Asset classes that protect purchasing power are increasingly important

Rising inflation has already eaten into the purchasing-power of investor cash savings. This is one reason that investments such as stocks, which can benefit from higher prices, are preferred in rising-inflation environments. Being too cash heavy for many years through your retirement can put a direct strain on your financial independence for the long run due to the deteriorating effects of inflation.

The bottom line? Robust supply side inflation driven by the economy “reopening” a year out from the quarantine should not be a significant cause for concern that the high consumer prices and interest rates of the 70’s and 80’s are coming.

How investors deal with “inflation” depends on what is truly driving prices higher. Effects that are more temporary as we boomerang back to a new normal should not cause investors to lose sight of their financial plans. Even in cases where there may be persistent inflation, portfolio adjustments may be enough to maintain purchasing power while working to conserve and advance one’s savings over time and not to overreact.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.