Framing is Bad for your Financial Health – It’s all in your Brain!

In the world of psychology, the “framing effect” refers to a mental bias that leads us to process and react to information based on the way it is presented. Framing can influence subconscious reasoning in almost any area of our life.

Every day we wake up, we make tons of decisions about what to drink, eat, purchase and invest in along with children’s education and parent’s healthcare options, home repairs, voting in the U.S. elections and other causes we champion for. Regrettably, we often make poor selections.

For example, which hamburger meat would you rather purchase: the one labeled 25% fat or 75% lean? Although the actual meat is the same, the framing of it can influence people’s choices to prefer the later package.

Another widely utilized example comes from the analysis of how doctors can alter their patient’s minds about a major surgery. When the doctors said there was a 90% chance of survival vs a 10% chance of mortality, the first option seemed more preferable, though the same set of factors were provided.

In the behavioral book, Nudge, the authors discuss that the “framing effects occur because people tend to be somewhat mindless, passive decision makers with cognitive deficiencies” that could also lead to inertia. Inaction from not electing to have a major operation to not voting in the U.S. elections could perhaps cause a worse dilemma.

Investing

Like watching two politically opposing news networks discuss the same exact story with vastly different opinions, framing occurs frequently for investors. There can be optimism or fear baked into opposing reports of this year’s economic and stock market reports, all utilizing the same data that could sway your decision-making process in either direction.

Simply put, investors seem to have behavior biases that often affect investing decisions more than empirical data. Mulling over charts that illustrate the Dow Jones Index (DJIA) returned near zero through August 31st for the year while tied to doom-and-gloom opinions of an impending crash (negative framing) or a chart noting the DJIA is up more than 50% since the end of March through the end of August along with improving economic conditions (positive framing) could motivate investors to either cash out their investment accounts – or maintain their current strategies.

Crowd Psychology

Disciplined, long-term investors understand that financial markets can behave unpredictably over the course of days, weeks and months, driven in as much sometimes by crowd psychology (the madness of the crowd) in as much the underlying facts and figures.

How an investor reacts to this short-term uncertainty can play a significant role in whether they achieve their financial objectives. This is why it’s important for investors to have both perspective and a trusted advisor in their corner since, in volatile times, the only thing we can control is our own behavior.

Fortunately, experience can play a big role in helping investors to stay disciplined and composed. Living through a turbulent period is worth more than reams of investment data and statistics. The feeling when the stock market appears to be in free fall and the financial media is in a bear market frenzy is a sensation that can only truly be experienced, not taught. The feeling in our gut that this time might be different, despite all of the academic and intellectual knowledge in our heads, is impossible to ignore.

Thus, despite the rapid recovery in the stock market during the “COVID19- summer”, it’s important for investors to focus on the right lessons in order to prepare for the next inevitable market bump. Even if history records the first half of 2020 as a blip for markets, it was a test of investor fortitude, nonetheless.

What we have Learned

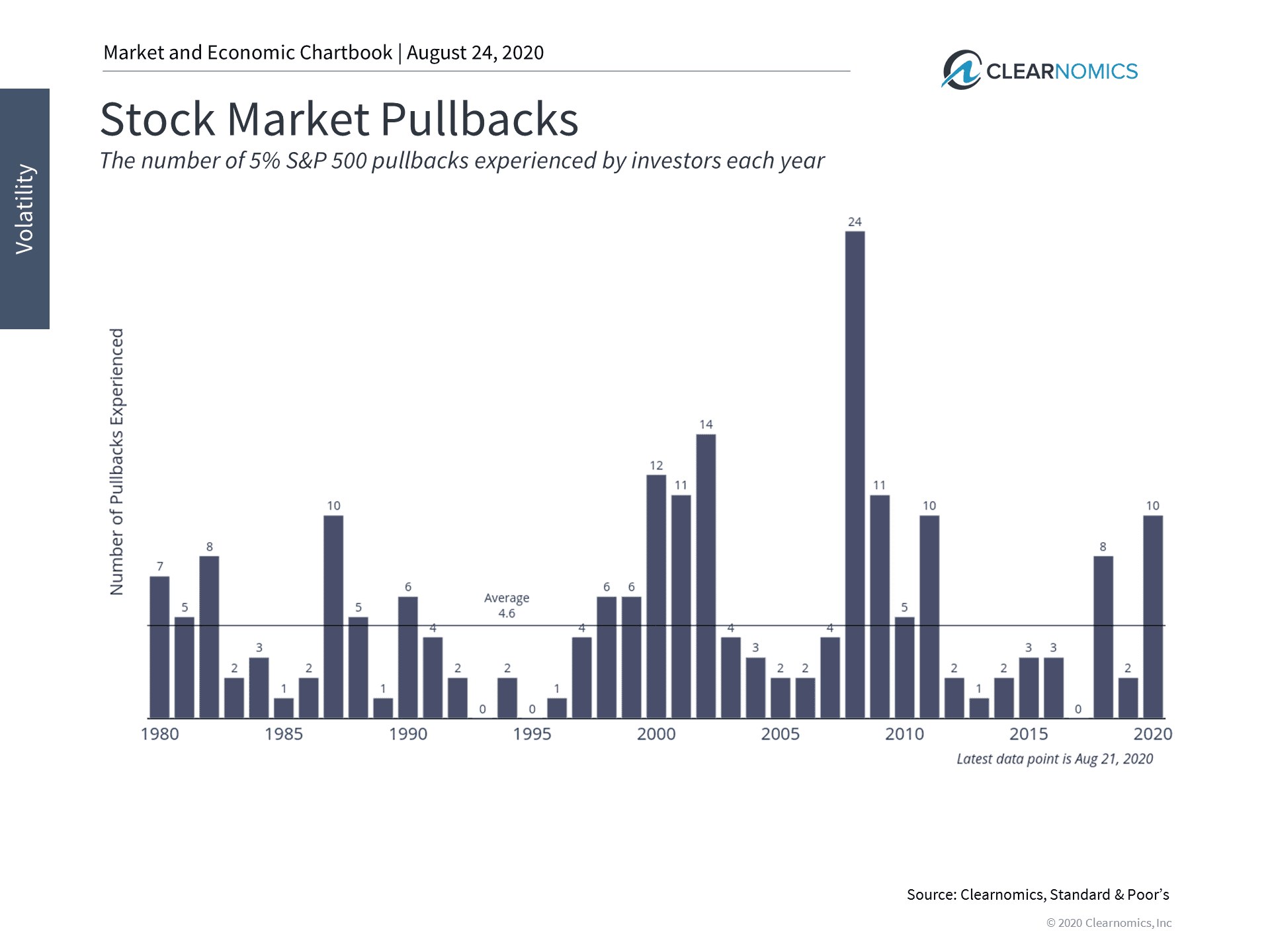

First, it’s not unusual for the stock market to fall several percent points, even in a single day. Over the course of 2020, a theoretical investor that checked their statement regularly would have experienced ten distinct 5% pullbacks in the stock market as it fell into bear market territory. (see below.)

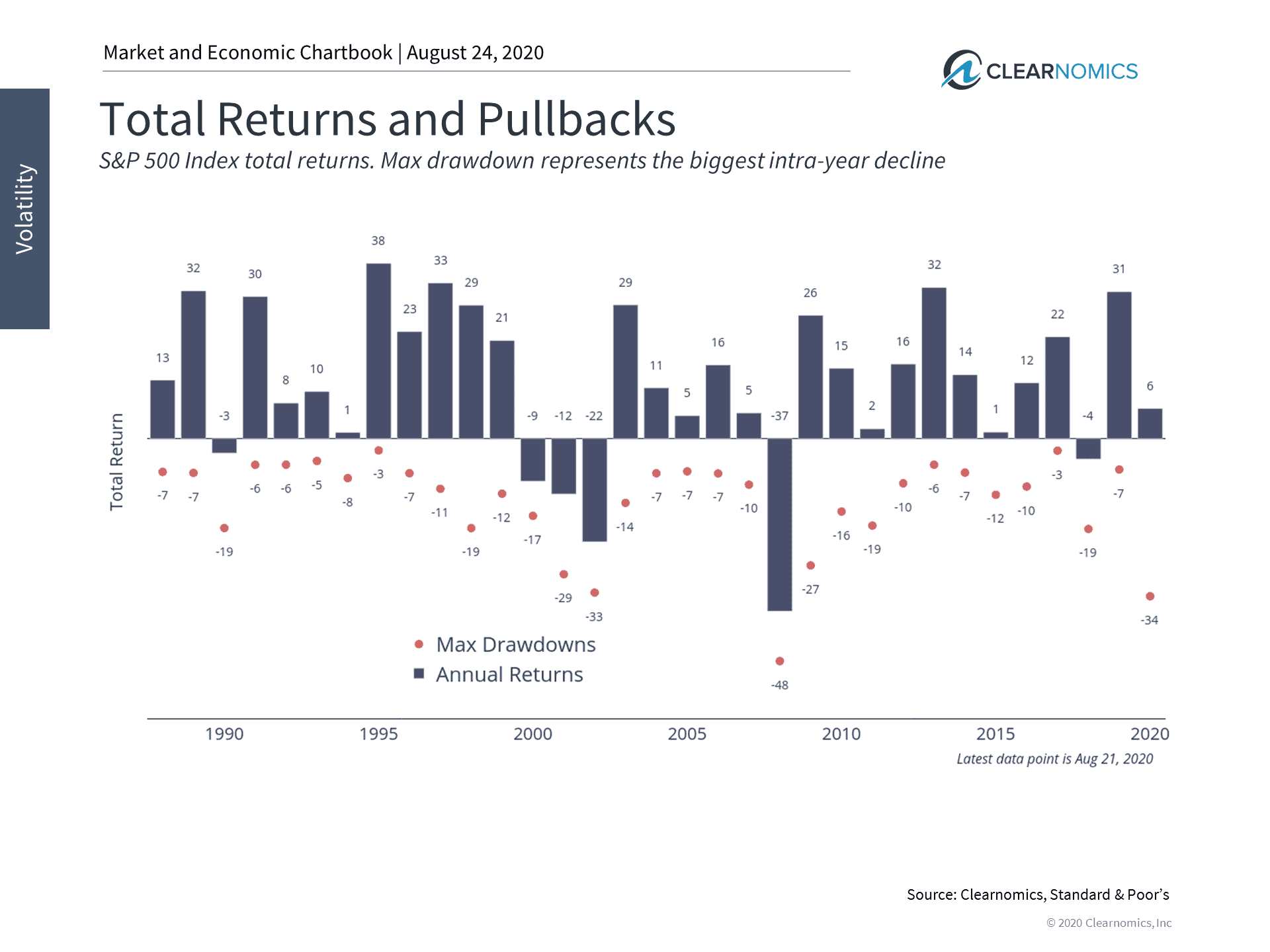

Second, despite large pullbacks in the market every single year, the U.S. stock market more often ends on a positive note than a negative one. Specifically, the last decade has seen intra-year stock market declines ranging from -3% to -34% (with dividends) due to a range of issues including the federal budget, Eurozone crisis, trade wars, geopolitical risk, a pandemic, and more. (see below.)

Still, the stock market finished in negative territory only one of those years. While this provides no guarantees for the future, market recoveries tend to occur if underlying fundamentals are still intact or can recover quickly. Today, the fact that many parts of the economy can rebound quickly after the initial COVID-19 crisis and economic shutdown has spurred a stock market recovery.

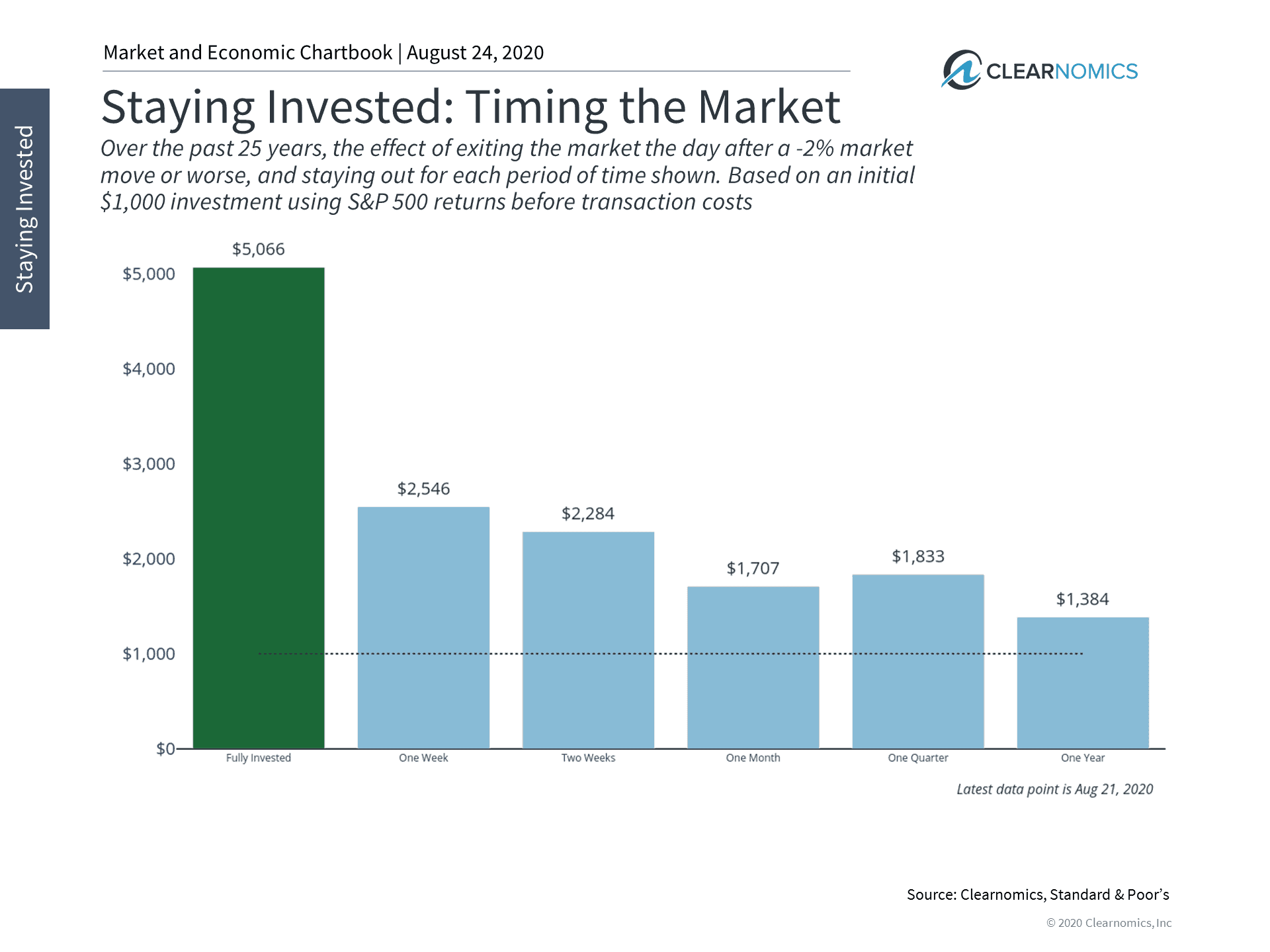

Third, over-reacting to negative headlines or recent market performance often backfires as market sentiment shifts. These swings can happen quickly and unexpectedly, as was the case earlier this year. Attempting to time the market is not only difficult but might be impossible to do consistently. Over the past 25 years, exiting the market after every large daily pullback has resulted in significantly poorer performance whether one stays in cash for one week or one year. Thus, it’s often better to simply hold onto a properly positioned portfolio. (see below.)

As the saying goes, never let a crisis go to waste. Now that the dust has settled for a bit, it’s important for investors to reflect on the experience of the last several months and consider how they might react the next time volatility strikes. The circumstances will undoubtedly be different but having the right perspective and discipline will stay the same. Below are three charts that highlight important lessons for long-term investors.

1 The number of short-term pullbacks in 2020 is the highest in almost a decade

This chart shows the number of distinct 5% market pullbacks a theoretical investor would experience in any given year. Through the first 8 months of 2020, investors have experienced 10 of these declines. While this is the highest level since 2011, it is not unusual for many of these to occur in any given year.

2 The stock market has recovered despite falling into bear market territory

Although the stock market fell into bear market territory this year, it has since rebounded and is now near record highs. This is a common pattern across history – the stock market may pull back in any given year, but often ends on a positive note. While there are no guarantees, those investors who can focus on years instead of weeks are more likely to benefit from these long-run gains.

3 History teaches us to not over-react to short-term volatility

Over-reacting to short-term market performance can often lead investors astray. Over the past 25 years, running to the exits after a large daily decline has been detrimental to portfolios. This is true even if investors only flee to cash or other safer assets for a short period of time. This is because the stock market can often recover unexpectedly and has tended to rise over the course of years and decades. Missing out on these long-term gains is often more detrimental than the initial stock market pullback.

The bottom line? Framing bias is particularly important to consider (along with learning from market history) because it can influence how we perceive investment and market performance, which can then directly affect our brain and investment decisions. Our elixir to Framing: The next time you are consuming information on any subject matter, work to see and challenge the evidence in a more logical, unemotional manner. Rephrase the information and see the impact, if any, that it has on your decisions.

Jon here. The most important lesson from the data presented in this blog is to stay the course. Every year there are new obstacles and headlines that work to throw investors and the markets off course, though overtime, the law of averages shows otherwise for the later. Through such an unpredictable, amazing year, now more than ever it’s important remember that investing is truly about your “time in the market” and not trying to time the market because of overwhelming short-term uncertainty.

For more information on our firm or to request portfolio and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.