Brace Your Brain and Portfolio for Market Volatility

Stock market volatility, corrections and crashes are social spectacles where actual indicators combine with external economic events, crowd behavior and computer algorithms in a negative loop where humans are motivated to follow the herd off a cliff.

After a huge run-up over the past year since the COVID19 crash and subsequent man-made global shutdown, market psychics are out in force on the financial shows mulling over what may set off the next selloff.

The Dow Jones Industrial Average (DJIA) lost 2.1% on Monday, due to fears about the surging delta variant of Covid19. Stocks swiftly rebounded Tuesday. While the headlines made this out to be more horrible than what occurred, consider the DJIA index hasn’t had a clean 10% correction since March 2020, and it has averaged one 10-14% correction per year since 1950.

You need to ask yourself, if the market took a swift 25% nosedive by over 8,700 points (think Black Monday 1987) would you have the stomach to stay the course and buy more securities, or would you be panic-selling and going to cash and capturing losses? Market volatility is a good time to check your mental mindset and portfolio results in extreme conditions to see how your strategy held up, and if you are positioned suitably to what you “signed up” for your risk tolerance.

Think Like a Contrarian

Baron Rothschild, an 18th century British nobleman is credited with saying that: “The time to buy is when there’s blood in the streets.” This is an extreme example of contrarian investing and a bit more graphic than the saying to just “buy the dip.” This powerful maxim implies that the worse things appear, the better the opportunities are for profit. This is another way to think “buy low and sell high.”

Warren Buffett once warned, “you pay a very high price in the stock market for a cheery consensus.” In other words, if everyone agrees with an investment decision, it’s probably not a good one. While the crowd can be right at times during trends, no one has a working crystal ball nor can correctly call a stock, sector or market top or bottom.

Brace your portfolio and brain by seeking buying opportunities during a future market correction or crash and not bailing out due to panic and fear. Simple habits like periodic rebalancing and dollar-cost-averaging are forms of buying low. Disciplined investors look forward to a healthy pullback as a buying opportunity, like shopping for winter clothes in the summer.

Timing is Terrible

Unfortunately, logic does not always prevail with investors as many studies indicate they have the urge to sell during market dips, pullbacks, and crashes. Unfortunately, that impulse will likely cost them and their retirement savings.

An investor who put $10,000 in the S&P 500 at the beginning of 2001 and stayed invested would have turned it into $42,231 two decades later, for only a +7.47% annual return. However, an investor who pulled out and missed the 10 best market days over that period would have just $19,347, only a +3.35% annual return.

Most interesting, seven of the market’s best days happened within just two weeks of the 10 worst, meaning even a short-lived exit may have proven costly.

With the U.S. markets (DJIA) up more than 90% from the March 23, 2020 lows, it would not be surprising if history repeated and major turbulence appears. Considering stock market seasonality, the summer months through Q3 have historically shown to be a bit more volatile than the rest of the year. This goes along with our past discussions on market maxims such as Sell in May and go away.”

Perspective on Pullbacks and Today’s Headlines

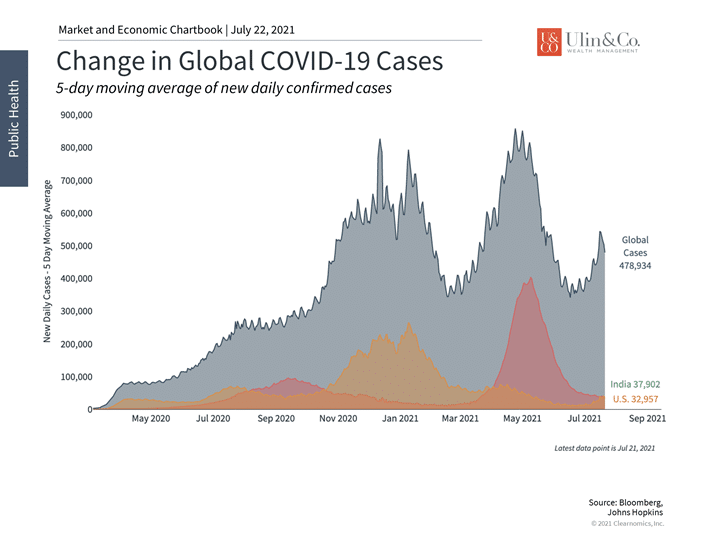

Many daily headlines are focused on the fact that COVID-19 cases have begun to rise again in the U.S. and globally, driven by the delta variant. (see below) While the public health crisis continues to be severe outside the U.S., the market impact today should be quite different from other spikes in cases over the past 18 months. Not only are existing vaccines reported to be effective against the variant, but markets already know what to expect in terms of the range of economic effects. In any situation, it is less likely today that cities will be placed on lockdown, much less the entire country.

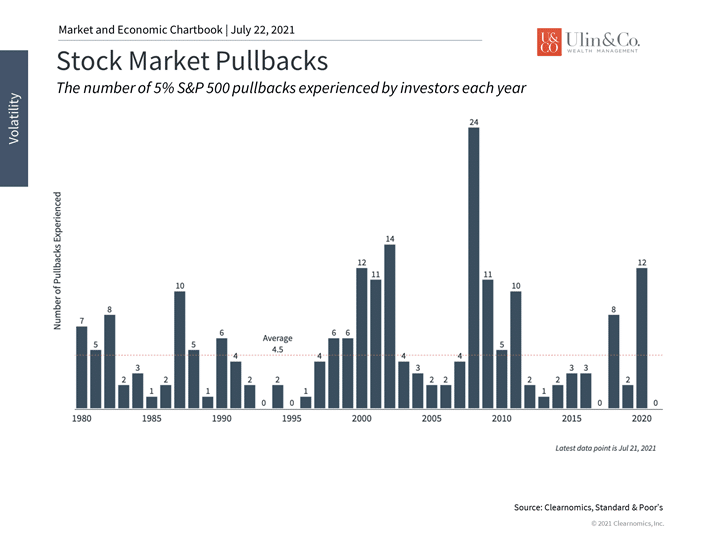

Despite this, it is natural for some investors to be concerned. Stock market pullbacks are never pleasant, especially when they occur unexpectedly, even if they are a completely normal part of investing. One source of this dissonance is the uncertainty that investors perceive compared to actual market performance. So far this year, the largest peak-to-trough pullback has not even been as bad as 5% – despite what one might think from the constant flurry of headlines and concerns.

In contrast, the average calendar year experiences four to five distinct 5% market pullbacks. (see below) Whether or not there is a prolonged market correction or economic recession, each pullback feels as if it will last indefinitely. More often than not, however, they turn around quickly and markets resume what they do best: reacting to corporate and economic data. In the current environment, with strong underlying growth trends for both companies and the broader economy, there are reasons to be positive despite worrisome headlines.

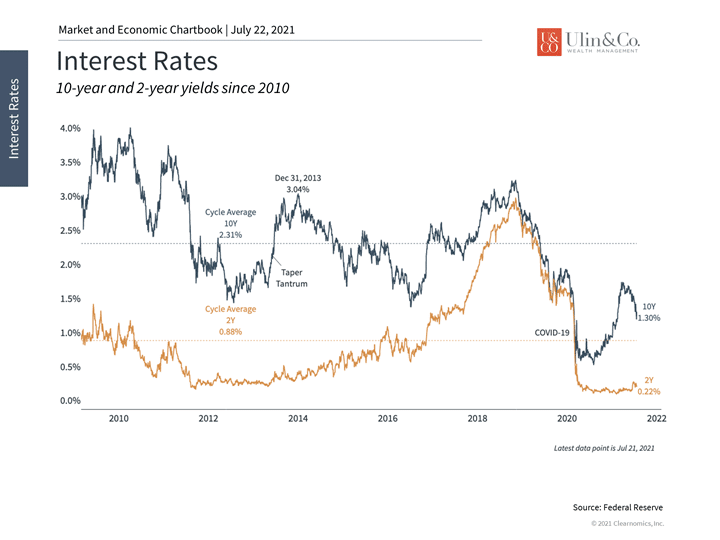

Of course, this does not mean that there won’t be more volatility ahead or differing impacts across markets. At the moment, interest rates appear to have taken the brunt of the macroeconomic impact. The 10-year U.S. Treasury yield, which has been declining since the first quarter, is now back to February levels. (see below) This reflects both a flight-to-safety as investors buy Treasuries as well as uncertainty over the level of inflation. Ultimately, the supply and demand disruptions that pushed inflation higher this year and the consequences of loose monetary policy will be the deciding factors.

Investors should continue to expect periods of stock market volatility. There will always be causes for concern especially as the business cycle enters a new phase of growth, following the initial recovery. Although the delta variant may be worrisome from a public health perspective, the lesson for investors since last April is that markets can and do look through negative events if there are positive trends. Below are three charts that help provide perspective on this important topic.

1 COVID delta variant cases are on the rise

COVID-19 cases have begun to rise again due to the delta variant. However, not only do existing vaccines appear to be effective at minimizing severe cases and hospitalizations, but markets are also better equipped to understand and react to the on-going pandemic.

2 Despite investor concerns, pullbacks have been small

Despite the perception that the economic landscape is increasingly uncertain, the largest stock market pullback has been smaller than average this year. So far, there has not been a single pullback as large as 5%.

3 Interest rates have also fallen in recent weeks

Interest rates have moved in unexpected ways over the past year. Although many expected the 10-year yield to reach 2%, it has reversed over the past 3 months and is now back to February levels. Where rates go from here will depend on growth and inflation trends.

The bottom line? After a huge run-up over the past year since the COVID19 crash, market psychics are out in force predicting doom and gloom. Investors ought to stay focused as volatility picks up. Not only is this a natural part of investing, but it is one reason long-term investors are rewarded in the long run.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.