Fitch Credit Downgrade Warning Shot

Fed Chair Powell recently provided a wee bit of optimism that there may not be an economic meltdown and that the Fed may slow down their historic rate hike program. Despite a banking crisis, war, lingering inflation, high interest rates and negative investor sentiment, many economic forecasts from the “experts” have flipped more to the same rosy outlook as the Fed. Many investors have been since pleasantly surprised with one of the strongest starts to the year for stocks, fueled by the strength of consumers, jobs, and positive economic data for the first two quarters of 2023, despite a slowing economy.

The low market volatility, sleepy VIX index, and tranquility of this year got interrupted again this week from yet another surprise- economic event. Even though congress voted to raise the debt ceiling just a couple months ago, Fitch Ratings swiftly downgraded U.S. bonds one letter from “AAA” to “AA” +, noting “expected fiscal deterioration” in coming years with a focus on the growing debt burden and led by an “erosion of governance.” As Tyson famously said, “everyone has a plan until they are punched in the mouth.” Should you lose sleep over this letter being knocked-out and off – by Fitch? The short answer is not in the short term.

We have not yet had a historic debt ceiling crash, and have not experienced a U.S. credit downgrade since the Obama/Biden White House in 2011 that was mostly caused by debt ceiling posturing between political parties, while this week’s downgrade was caused by the very large budget deficit that has been silently building up over the past two decades through all past Presidential administrations. Simply put, this is not a political party issue or debate, but may end up backfiring on future generations of Americans.

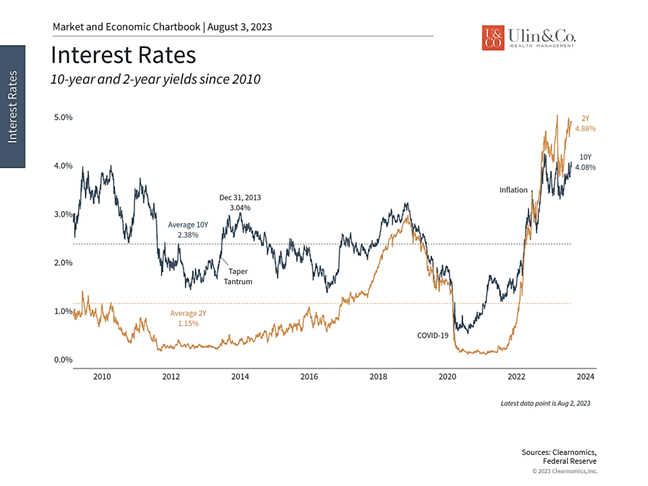

The result of the Fitch credit downgrade highlights the debt pile that the US has built up in recent years, largely due to pandemic stimulus since 2020 ($5+ Trillion) as well as prior tax cuts. More recently, the government has also launched investment programs for infrastructure, technology, and clean energy in the Trillions. Meanwhile the cost of borrowing has soared (for example mortgages, credit cards, small business loans, personal lines of credit) as the Fed pushed interest rates to a 22-year high.

Debt Clock Time Machine

Jon here. We have been telling our clients for years that the US Government spending a trillion or more on average per year over its earnings is like driving across the country with only a quarter tank of gas and may lead to a future black swan event.

It’s not surprising that Fitch downgraded the US debt, as we have not been acting responsibly for the past couple of decades – in the trillions with now rising rates. The downgrade was more like a loud warning shot to bring this issue front and center, than an actual tsunami-event. This is not saying something terminal will or will not eventually happen this year, but with today’s high interest rates, unlimited government spending, rising health care costs and an aging population, a future “black swan” event may be driven by a major US government default and shutdown.

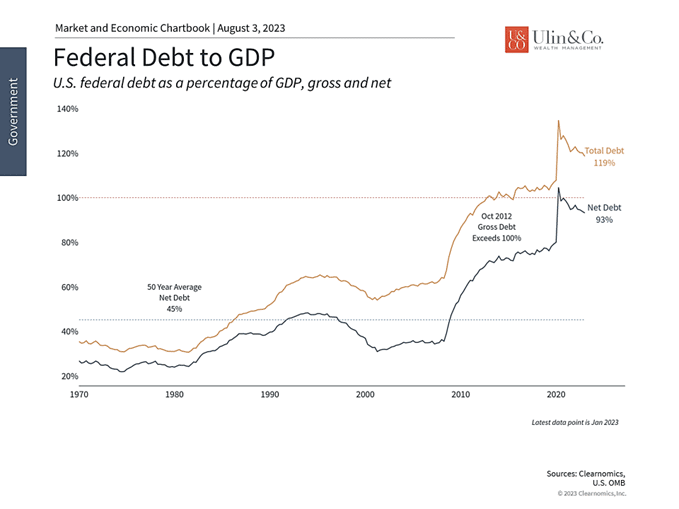

The more encompassing issue than the annual debt ceiling political theater, is that the federal debt has doubled over the past decade and, with very few exceptions, has grown nearly every year, adding fears to a future potential debacle. If you are seeking an ominous forecast, look no further than the US Debt Clock “time machine” website data that has a chart predicting the now $32.6 Trillion dollar U.S. debt to be near $44 Trillion by 2026. On top of this ominous news, Fitch forecasted US debt to reach 118% of gross domestic product by 2025, about three times higher than the median of 39% among countries awarded the top-of-the-class AAA rating.

After Effects of the Fitch credit downgrade

More important than the annual game of chicken played out by both political parties around annual debt ceiling remedies, both political parties have equally added to the snowballing debt that will but stress on all future administrations and generations of Americans. This will need to be addressed. Simply put, the U.S. cannot afford to have its reputation tarnished. Our credit rating and the value of the U.S. dollar is viewed as a barometer of America’s importance on the global stage.

While it seems that few investors, economists, and business leaders view the downgrade itself as meaningful, especially because AA+ still represents an extremely low default risk, that does not mean it has not impacted financial markets. After all, the (short term) after-effects of the recent downgrade will be felt by consumers. Lower quality debt results in a demand for higher payments by the USA/ Fed- that will start with government paper and bleed into consumer loans, auto loans, business loans, mortgages, credit cards, etc. Consider that over time, if the deficit isn’t suppressed, Social benefits may be cut and taxes will be raised to the point that the engine of the US economy (the consumer) will have substantially less discretionary income.

In Retrospect

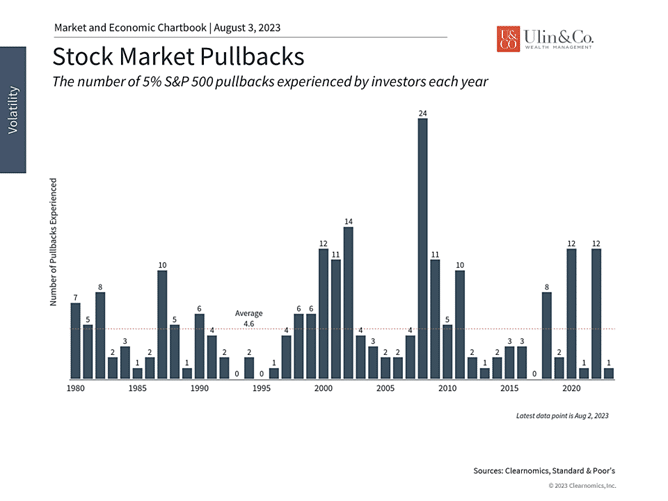

Investors have benefited from markets mostly moving upward this year, leaving some investors unprepared for even small stock market swings. Understanding how these issues impact a properly constructed portfolio that meets the needs of a long-term financial plan is what’s most important. Next up, we’ll review what drove the downgrade of the U.S. debt and how long-term investors can maintain a balanced perspective.

20 Years of Snowballing Debt

It’s no secret that the level of the national debt has grown considerably in recent years, from $9 trillion in 2008 to over $32 trillion today. As a percentage of GDP, debt levels have risen to nearly 120% in total and 93% if inter-governmental debt holdings are excluded (i.e., debt one part of the government owes to another). (chart) Regardless of how you slice it, debt levels have risen dramatically with little end in sight. This is largely due to periods of economic turmoil, especially the 2008 financial crisis and the 2020 pandemic, that required government stimulus.

Unfortunately, there are few examples of the federal government not just running a balanced budget but operating at a surplus. This last occurred during the dot-com boom under the Clinton administration and, before that, in the early 1970s under President Nixon.

Fitch’s downgrade reflects the fiscal and political climate with which investors are already familiar. While their decision was based on the familiar factors of worsening government revenues, Fed tightening, and the possibility of a recession, it was largely driven by the “repeated debt-limit political standoffs and last-minute resolutions” in Washington. This is important because it draws a distinction between the ability to pay the country’s debts versus the willingness to do so. Most investors would likely agree that national politics has only grown more divisive over the past two decades. It has only been two months since the last debt ceiling standoff was resolved and the agreement only kicked the can down the road to January 2025.

The U.S. now has ratings of AAA from Moody’s, AA+ from Standard & Poor’s, and AA+ from Fitch. Only nine countries, plus the European Union, maintain the top ratings across the three major credit ratings agencies, including Germany, Switzerland, Australia, and Singapore.

Interest rates have jumped following the downgrade

Why does this matter? Despite periods of brinkmanship, the U.S. has never defaulted on its debt. The creditworthiness of U.S. Treasuries is critically important not only to everyone that holds these securities – from the largest pension funds to everyday households – but the global financial system is built on the premise that Treasuries are unquestionably risk-free. While the situation is still evolving, the immediate impact of the downgrade has been higher interest rates.

There are some parallels to the summer of 2011, almost exactly 12 years ago to the day, when Standard & Poor’s was the first credit ratings agency to downgrade the U.S. debt. At that time, only a couple of years after the 2008 financial crisis, the global economy was facing many challenges including the debt crisis in Europe that led to the Grexit situation. This was a drag on markets even before the U.S. debt downgrade.

During that period, the stock market fell into correction territory with the S&P 500 declining nearly 19%. Ironically, the prices on Treasury securities increased during the 2011 debt ceiling crisis because, even though these were the exact securities being downgraded, investors still believed they were the safest in the world at a time of heightened uncertainty. The debt ceiling was eventually raised and a new budget was approved, allowing markets to bounce back and reach new all-time highs only six months later. At the time, the market reaction was not only difficult to predict, but was unintuitive to many. For most investors, focusing on the long run while holding an appropriate portfolio, ideally with the guidance of a trusted advisor, was the best way to navigate that year.

Markets have been calm this year amid the strong rally

So, what does the latest U.S. debt downgrade mean for investors? In truth, nothing has changed in recent weeks regarding the health of the economy or the long-term fiscal situation for the country. Given how heated the topic of federal spending can be, it’s important for investors to distinguish between their political feelings and how they manage their portfolios. Investors should always be prepared for periods of market uncertainty, especially given the low level of volatility this year. The accompanying chart shows that there has only been one pullback of 5% or worse this year which occurred in March during the banking crisis, compared to the average year which experiences several.

Two long-term debt concerns that some investors often have are (1) the growing interest payments on the national debt and (2) the reliance on foreign borrowing. Neither has a simple solution. The fact that interest rates have been and remain relatively low compared to history has helped to keep these payments manageable. Deficit levels, and the growth of the national debt, will also naturally improve as the economy recovers. When it comes to our foreign dependency, over 75% of the U.S. debt is still held by American households and institutions, compared to foreign holdings of 3.5% by Japan, 2.7% by China, 2.1% by the U.K., and so on. While this is an issue that matters from the perspective of fiscal responsibility, it is unlikely to be something that should drive portfolio decisions.

The national debt and the fiscal standing of the U.S. matter for many reasons. But from an investment perspective, the irony is that the best times to invest have been when the deficit has been the worst. This is because government spending increases – both in absolute terms and relative to GDP – during recessions and crises. In hindsight, these periods coincide with the most attractive prices and valuations. Ultimately, history shows that investors are rewarded for investing when others are fearful.

The bottom line? Although the Fitch credit downgrade is impacting markets, it is based on factors with which investors are already familiar. As with many political issues, it’s important for investors to separate their concerns and not react with their hard-earned savings and investments.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index. Info on Fitch credit downgrade.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.