Cycling Through a Bear Market- Insights & Economics

In the world of competitive cycling and bike racing, it’s often said that there are only two types of cyclists: those that have crashed and those that will.

The same is not only true of market cycles but of investors. If history has taught us anything, it’s that bear markets are an unavoidable part of the stock market’s behavior. Given this fact, the best thing that investors can do is to have an appropriate financial plan and balanced portfolio in place, while seeking professional guidance. Eventually, even the worst market downturns break-away to bull market recoveries.

How you manage the cadence of your plan, portfolio, personal finances and emotional mindset in the short term through a bear market “down-cycle” can greatly affect your financial health and well-being for the long run before and through your golden years.

While investors should trust in their hard work and preparation, this doesn’t make market downturns any less palatable, emotional or challenging as they are occurring. To better understand what is happening in the markets, it’s helpful to disseminate the coronavirus effects from how it affects the economy, the ripple effect across industries and what investors can do to help manage risk and returns across all parts of the market cycle.

1 Downhill Cycling

“Crashing is part of cycling as crying is part of love.” -Johan Museeuw, Belgian cyclist

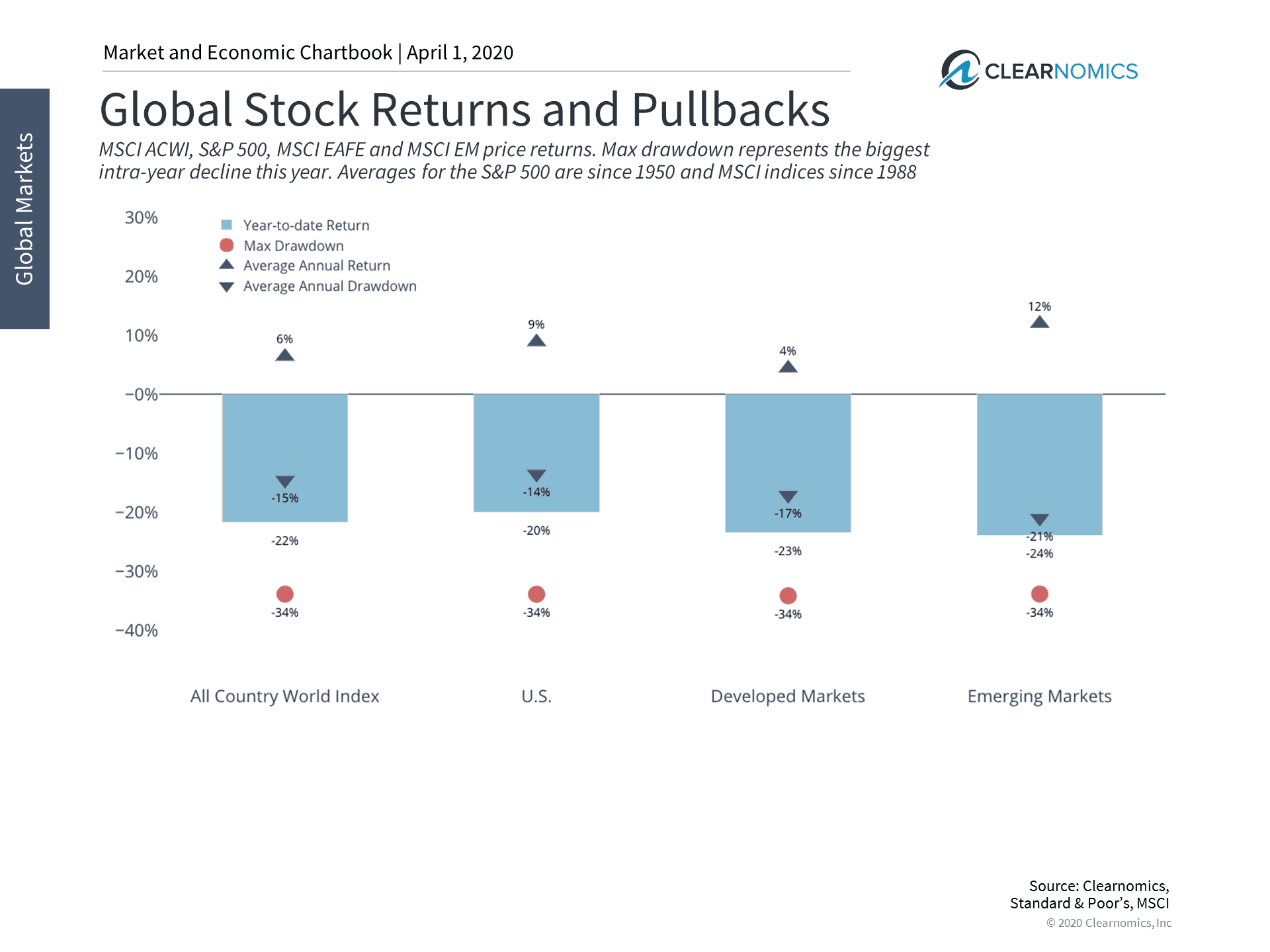

For the first time in over a decade, the U.S. stock market officially entered a bear market in March with the S&P 500 finishing the first quarter down 20%, falling as much as 34% at its lowest point (see below). With the index at all-time highs as recently as mid-February, this was a swift decline. However, market swings have been large in both directions, with several large positive moves as well.

Of course, some perspective is needed here. The S&P 500 is still up 15% over the past three years and 280% since the market bottom in 2009 – numbers which don’t even include dividends.

Returns and Pullbacks

Interest rates also decelerated in Q1 as investors switched down into lower gears and sought the safety of U.S. Treasuries. The 10-year Treasury yield fell to its lowest level in history, ending the quarter below 0.7%. Due to emergency Fed rate cuts, the yield curve has actually steepened in recent weeks with short-term rates declining even more. Oil prices also fell significantly with WTI priced at around $20 per barrel due to limited demand and excess supply.

In the middle of a bear market, these are the types of numbers one would expect. Unlike other factors that have resulted in market volatility over the past few decades, nothing has turned everyday life upside down like the coronavirus. The fact that its spread is exponential, depicted in the chart below across states, means that the public health and economic picture has changed rapidly.

2 Uphill Economic Impact

“The bicycle is a curious vehicle. Its passenger is its engine.” — John Howard, US cyclist

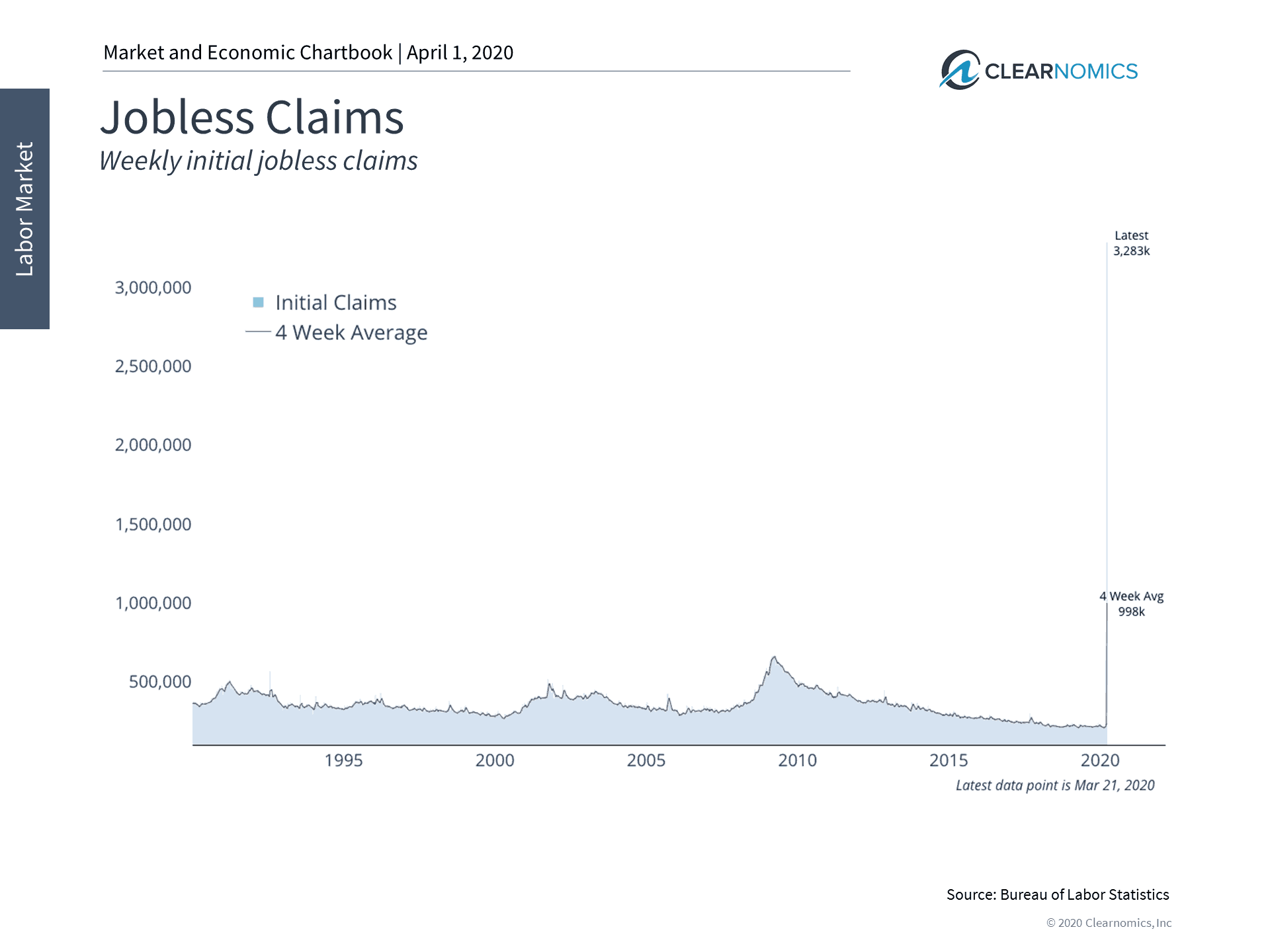

Likewise, consumers are the passenger and engine of the economy . Consumer spending is the single most important driving force of GDP and the economy. While it’s unclear how long these lock downs will last, their effects are now being seen in the economic data. For instance, initial jobless claims spiked from about 200,000 per week to 3.3 million recently (see below).

However, economic data on their own can only tell us about what has already taken pace. In normal times, we rely on this data to help us paint a picture of what is happening beneath the surface. In this case, we not only know the underlying cause, but we also know that the numbers will get worse. Many economists are expecting unemployment to rise well above 10% (34 Million) and GDP growth to slow to recession levels for at least a quarter or two.

Jobless Claims

The fact that the economy was fundamentally healthy going into this crisis increases the likelihood of a full recovery. Whether businesses and individuals can reach the other side will depend on the strength of their balance sheets, access to capital, and the government’s response. This is because the problems being faced are not ones inherent to the economy itself – this is not 2008 when many individuals and financial institutions were significantly over-leveraged.

However, without assistance, it’s possible that short-term financial distress could result in long-term solvency problems, especially for small business owners.

For instance, a shop owner might be able to survive for a few weeks or months even as bills pile up. In the worst-case scenario, the shop owner would have to lay off workers, furlough staff or shut down the business, even if they would be economically sound otherwise. If this scenario is multiplied across the whole economy, cracks could begin to form. One indicator of this is in the credit market where bond yields spiked as concerns of company financial situations increased. They have settled down slightly along with overall market volatility, but many investors are still concerned.

3 Government Basics

Riding a bicycle is about getting back to basics. -Philip John Keoghan

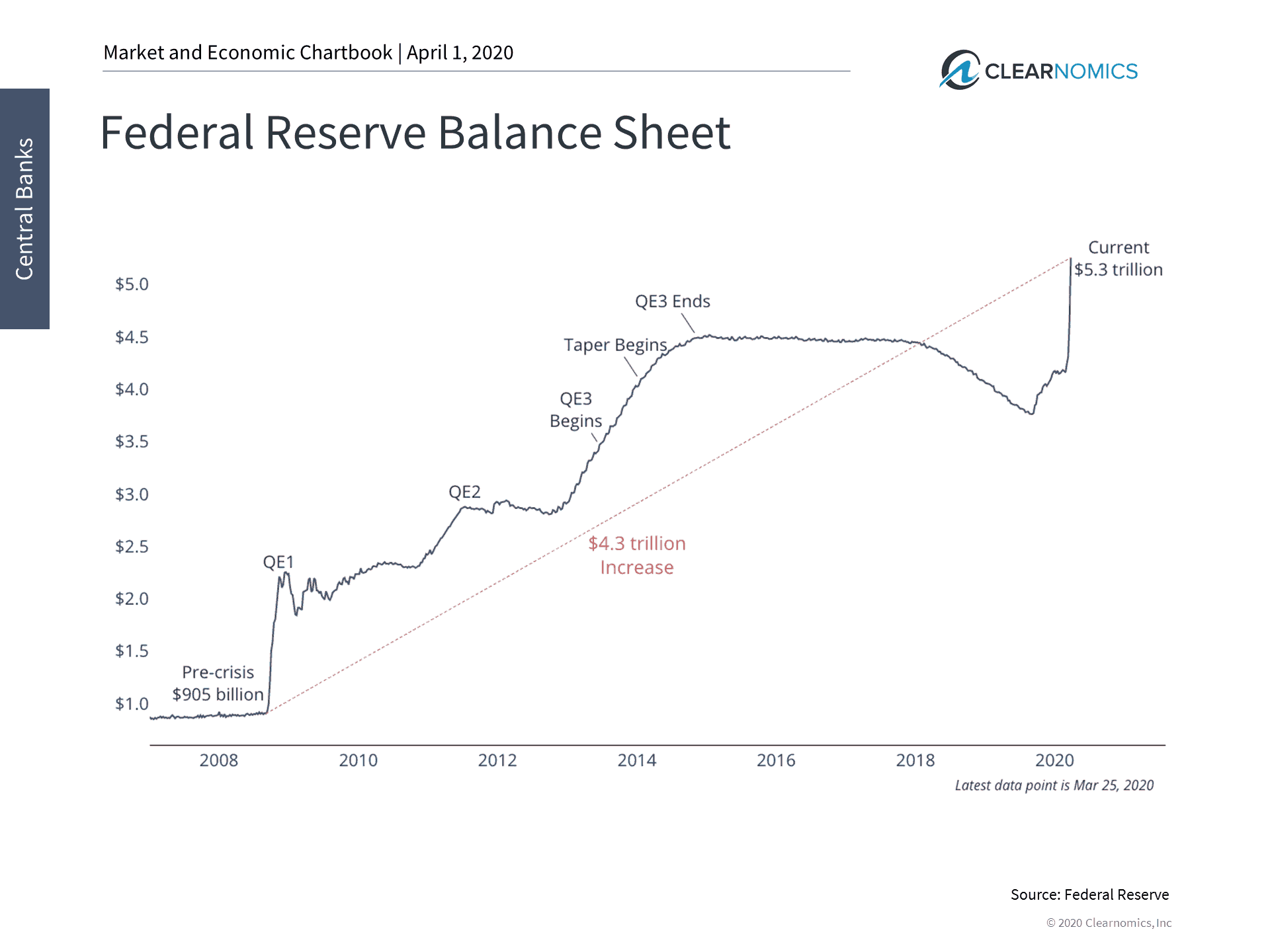

It’s for these reasons that the government has pulled out all the stops. In times of economic crisis and downturns, the government is in a position to spend when others aren’t in order to keep the economy on life support until it has recovered. The Federal Reserve has cut interest rates to zero and has activated a number of programs from the 2008 financial crisis (see below), including open-ended asset purchases (i.e. quantitative easing). Congress passed a $2 trillion bill, the largest in history, to provide stimulus checks to households, forgivable loans to small businesses, bailouts to some critical industries, and more.

Federal Reserve Balance Sheet

How soon Americans can return to work and shops can reopen depends on the spread of the coronavirus. The experience in China and elsewhere suggest that this could happen within the next couple of months if the virus is contained. If individuals and businesses can make it to the other side while staying safe and healthy, then work can resume and the economy can get back on track.

4 Balancing Investor Behavior

Investing and life are like riding a bicycle. To keep your balance, you must keep moving forward. -Albert Einstein

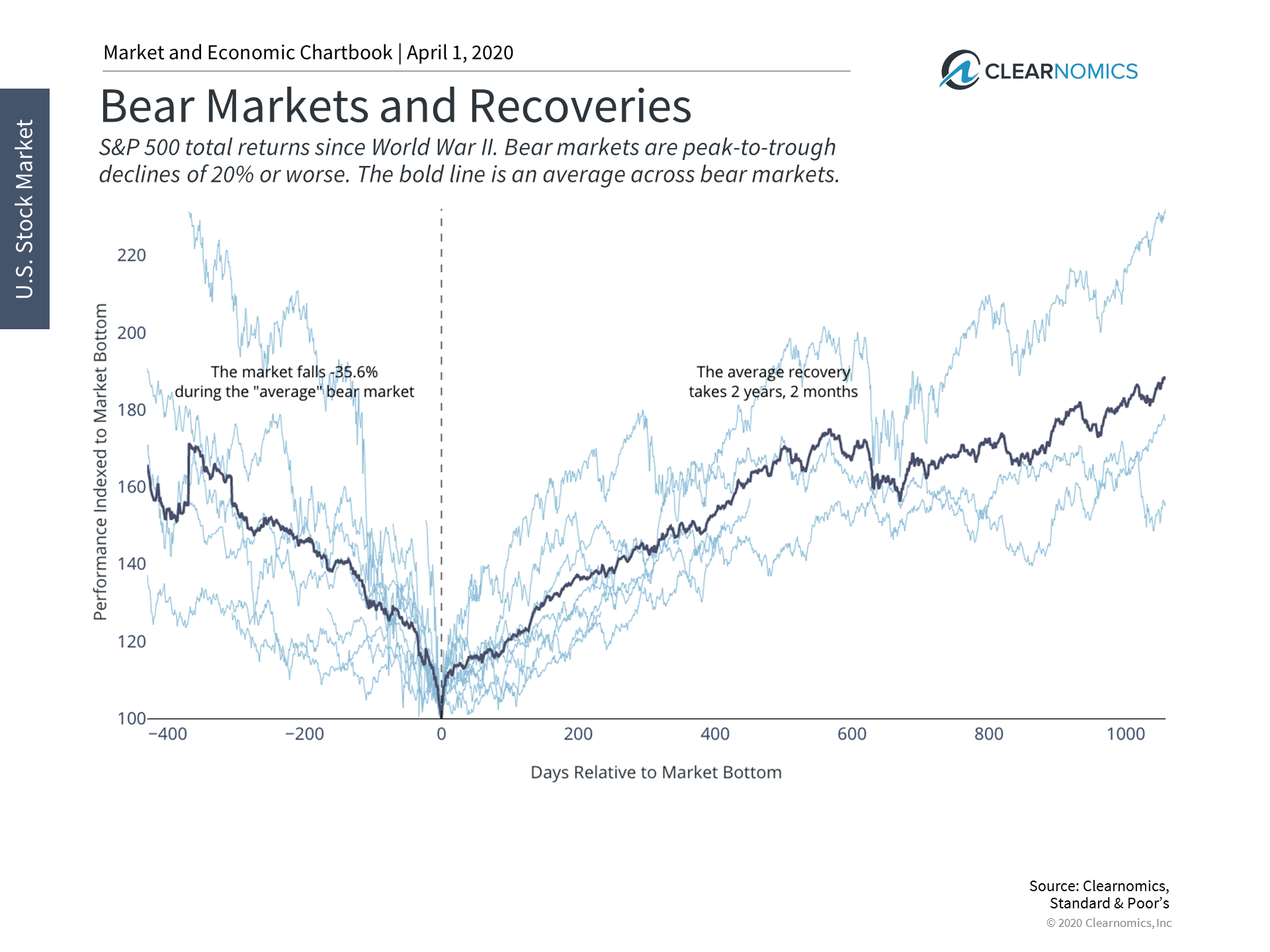

In times of uncertainty, the only thing we can directly control is our own behavior. While the cause of this bear market is unique, the fact that the market has declined is not. Market corrections and bear markets are natural parts of the stock market and of the investor experience.

Bear Markets and Recoveries

While bear markets are typically defined as declines of 20% or more from recent peaks, they are usually much worse. True bear markets almost always occur alongside economic recessions, and this one is no exception. On average, these economic crises result in market declines of about 35%. Coincidentally, the worst decline for global markets this year has been nearly that amount.

So, what can investors do? It’s important to view bear markets with the proper perspective. Not only are bear markets a normal part of the cycle, they often turn around when it’s least expected. For instance, the stock market began to recover from the 2008 financial crisis in March of the following year when there was still significant uncertainty in the world. The average bear market then fully recovers over the next couple of years. Missing out on the subsequent gains makes the bear market experience that much worse.

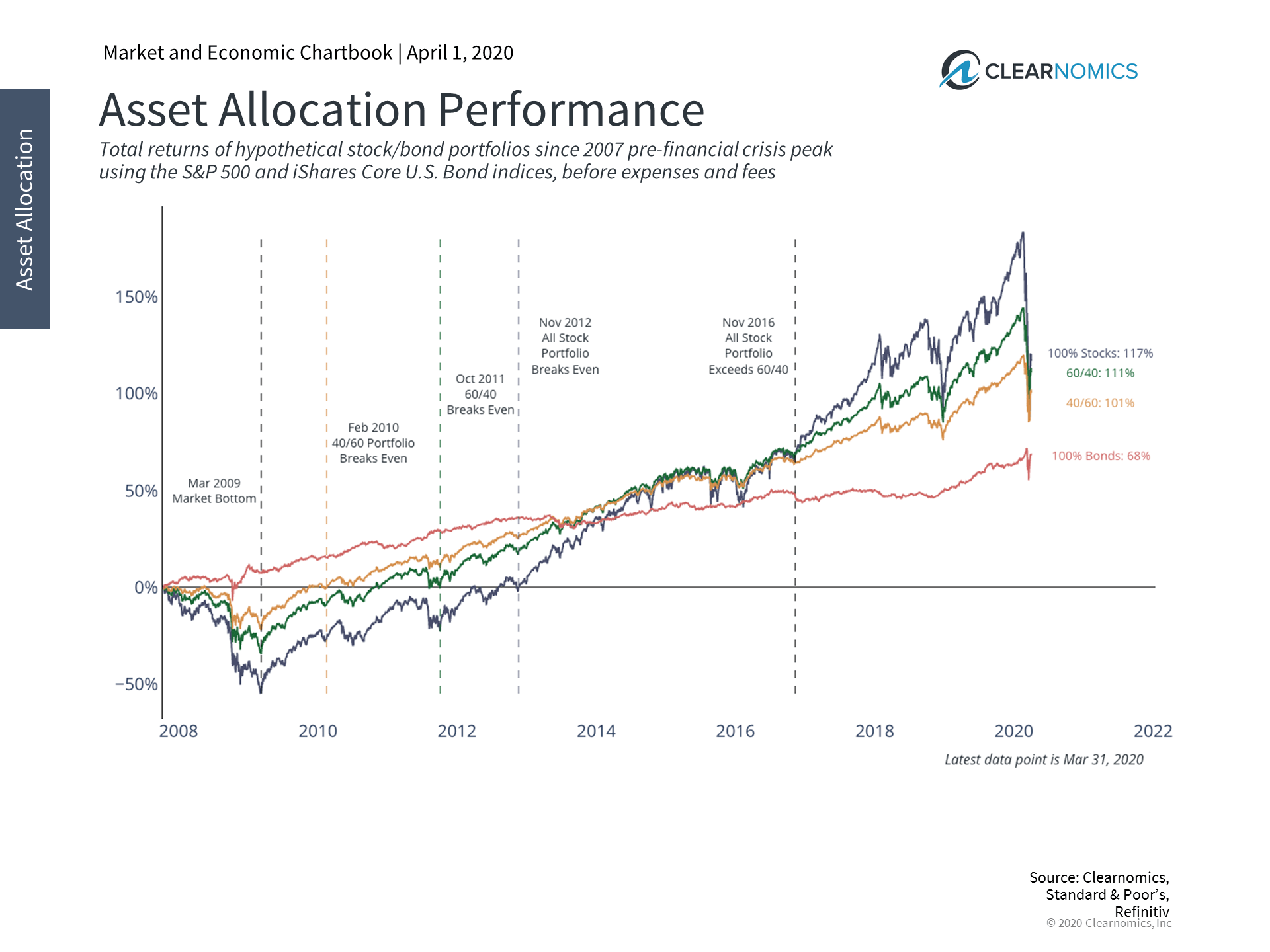

Asset Allocation Performance

It’s important to consider that balanced portfolios often perform far better than stocks alone across the full market cycle. The chart above shows this dynamic since 2008. This is because high quality bonds often outperform as interest rates fall and investors seek safety. During the 2008 financial crisis, these balanced portfolios fell far less than all-stock portfolios and then recovered far more quickly. A hypothetical portfolio consisting of 40% bonds and 60% stocks would have recovered in only 11 months from the market bottom. Even today, diversified portfolios are still neck-and-neck with aggressive all-stock portfolios.

This is exactly what balanced portfolios are designed to do across all phases of the market cycle. Thus, in times of economic crises and market uncertainty, it’s important for investors to remain disciplined and consider their financial plans and portfolios. These are all factors that investors can control in the months ahead, regardless of how the fight against the coronavirus plays out.

The bottom line? Investors should continue to set expectations around poor economic data and market uncertainty. They should focus on remaining disciplined and ensuring their balanced portfolios match their long-term financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.

MSCI ACWI is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. The MSCI ACWI is maintained by Morgan Stanley Capital International (MSCI), and is comprised of stocks from both developed and emerging markets. e MSCI EAFE Index (Europe, Australasia, Far East) is a free float‐adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. MSCI Emerging Markets Index is a free float‐adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 23 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey* and United Arab Emirates.