Staying Ahead of Robot Investing Disruption

The world has become greatly automated over the past few decades with the Internet of things (IoT) – a system of interrelated computers, objects, animals and people that are provided with unique identifiers and the ability to transfer data over a network without requiring much human or computer interaction while powered by deep learning.

We’ve seen tech replace switchboards, lift and toll booth operators, to robots eliminating manufacturing jobs. With Netflix eerily recommending movies, smart homes listening in to conversations and Face Book masterfully working to modify our behavior with Pavolvian panache, AI is not so quietly integrating into our lives. Simply put, AI works to integrate into machines that imitate human intelligence while gathering and processing massive data and executing tasks around the clock.

John Connor: “You don’t feel any emotion about it one way or another?”

The Terminator: “No. I have to stay functional until my mission is complete. Then it doesn’t matter.”

This script is from the 1991 movie Terminator 2: Judgment Day. Eerily enough, this dialog could now come from more than a few major asset management companies on Wall Street.

While the workforce across many industries is being redefined by the AI revolution, financial advisors should not lose sleep just yet over Wall Street’s industry disruption from robot traders. Yet the transition on Wall Street from humans to machines has been not so silently evolving.

Robo Advisors

Robo-Advisors offer retail investors a low-cost, unemotional and automated approach to investing utilizing ETF model portfolios. While Robo-Advisor companies along with their captivating advertising to investors of all ages can be alluring from the likes of Betterment, Wealthfront, Fidelity, Schwab and SigFig, make sure to consider whether outsourcing some of your money management and planning needs to a machine is the right decision for you.

Robo models, like target date fund models, have set restrictions on sector allocations and could be a challenge when developing tax efficient or income focused portfolios, to providing more globalized or eclectic strategies such as socially responsible investing. Human advisor may have greater leeway to diversify into a larger range of customized tactics while also utilizing individual securities as well as active managers. As important, human advisors may better help investors to mentally “stay the course” while following a financial plan and process.

Consider that most Robo-advisors entered the market just over the past decade and have not yet really been tested over time. While “cost may be king,” other similar “one-stop” package- deals from target-date funds in employer retirement plans to some quant models and hedge funds did not hold up as well as expected during the market crash in 2008.

Imagine being two years away from retirement and seeing your 401(k) — which you may have thought was shielded from massive market corrections — tank by more than 30%. As discussed in 2008 401(K) Beatings, that was the reality in 2008 for workers who had invested their savings in target-date funds.

Even more unsettling, a few major robo-advisor companies had their websites crash during the pithy corrections in 2018 where clients could not even get online. This happened again February 2020 near the beginning of the COVID19-led crash where it was noted in FP Magazine that “more than a handful of wealth management websites went dark after a turbulent two days of trading – a possible early warning sign that even relatively new digital platforms can get overwhelmed dealing with high visitor volumes during selloffs.”

The Quant’s

Quantitative trading incorporates strategies based on quantitative analysis, which rely on mathematical computations and AI number crunching to identify trading opportunities. Price and volume are two of the more common data inputs used in quantitative analysis as the main inputs to mathematical models.

These tech systems can be reading” Trump’s tweets overnight and then selling specific stocks or sectors at the opening bell – before you even get your morning coffee.

Recent studies indicate passive and algorithm-driven “quantitative investing” account today now for more than 50% of stock trades. Trading algorithms respond to the same evidence as humans that they are trained to sniff out, yet quickly sell- out from broad indexes to individual companies if they recognize certain triggers.

The robots unemotional, high frequency trading is another form of disruption to watch out for, that can then cause humans, in mass, to panic and follow the trend thereby causing mass havoc in the global markets

While we cannot control the robots, we can control our behavior in the short term to not panic with our investment strategy based on a belief that geopolitical events such as war, impeachment, tariffs or major epidemics will put the quants into a dizzying selling fervor.

Jon here. Strategically and tactically diversifying your portfolio while maintaining a global approach (as the planet gets more interconnected) can be key to help decrease the caustic effects of the short-term AI trading volatility effect while focusing to minimize correlation to any one index or sector. This concept is simple to understand but a bit complex to execute.

Tech Stock Evolution

There appear to be two issues that worry investors about tech stocks today. Some investors may be having “Total Recall” PTSD symptoms, like we’re back in1999 before the “dot-com” terminated the market.

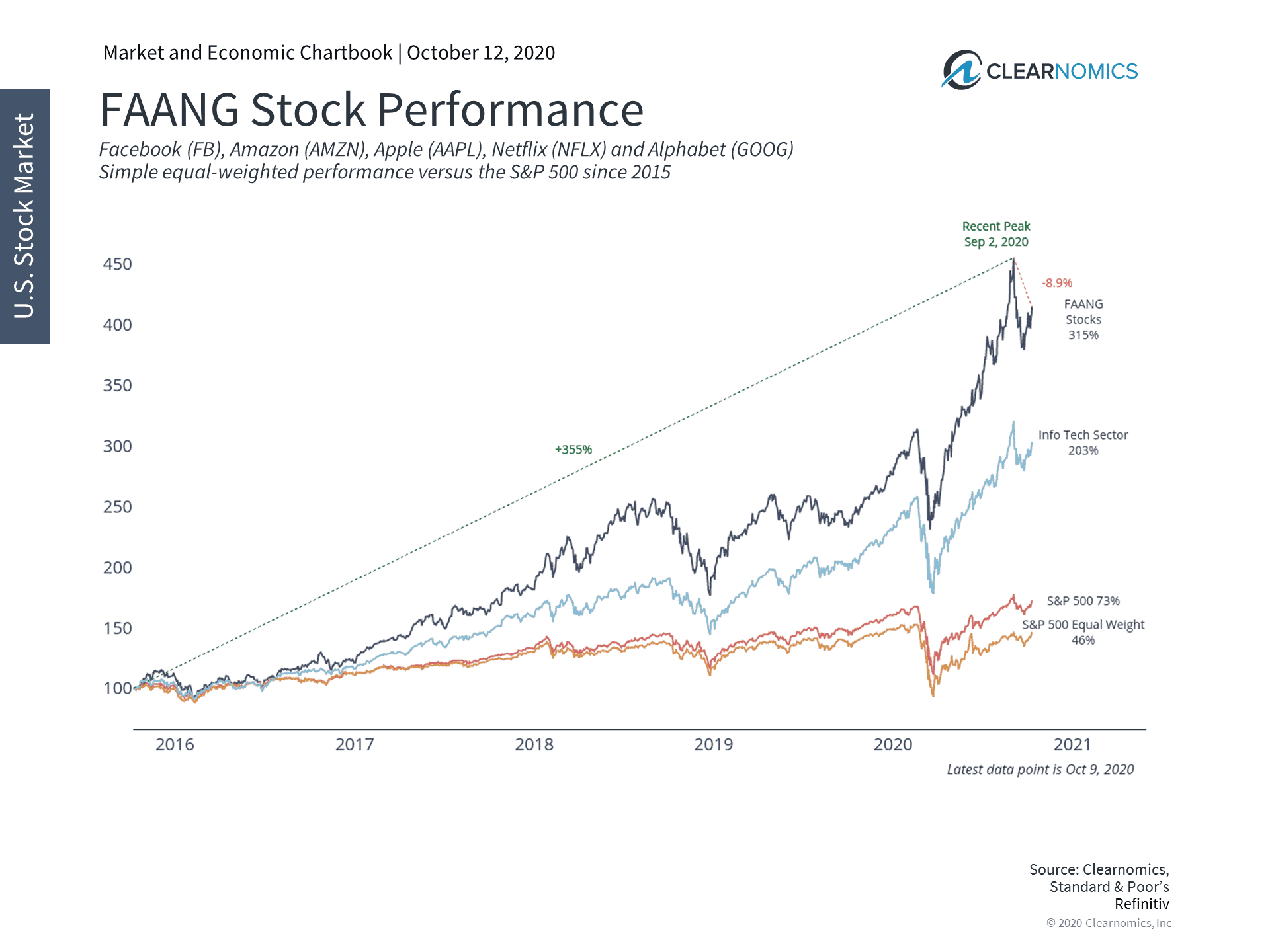

Outperformance: First, many are concerned by the recent outperformance of technology-driven stocks. The so-called FAANG stocks, along with other large tech companies and more recent IPOs, have significantly outperformed the rest of the stock market both this year and over the past decade. (see below).

Many of these companies have benefited from trends in digital transformation which have only accelerated during the COVID-19 pandemic. In many ways, the performance of these stocks reflects the economic success of the underlying companies. Unlike the dot com bubble of the late 1990s and early 2000s, many of these companies have profitable and proven business models. Although their valuation levels can certainly be debated, the performance of these stocks reflects the fast-changing nature of businesses and the economy.

As a result, it’s also undeniable that the composition of major market indices has shifted over the past decade. The five largest stocks in the S&P 500 are Apple, Amazon, Microsoft, Alphabet (Google) and Facebook. Many sectors today are driven by technology stocks including Information Technology, Communication Services and Consumer Discretionary.

The stock market is reflecting the importance of technology companies and the evolution of what is considered a tech stock. For instance, the pandemic and shifting consumer habits have blurred the line between technology and retail. This is not to say that these stocks will outperform forever, and it’s always the case that past performance is no guarantee of the future. However, the rise in these stocks is a reflection of how the economy looks today – a fact that benefits diversified investors. Investors ought to remain balanced across a variety of sectors and styles that are tied to trends in the underlying economy.

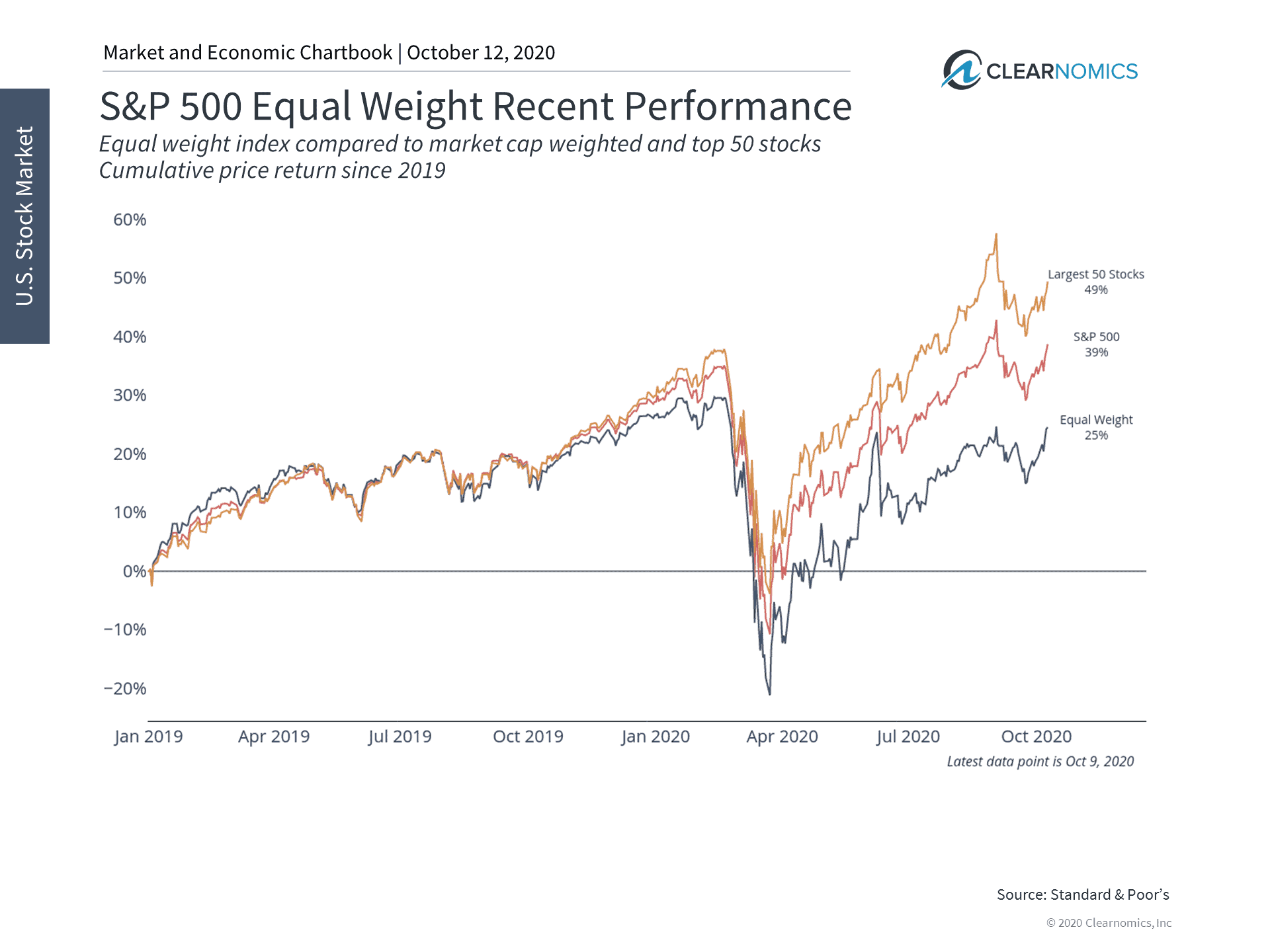

Crowded Play: The second issue is that a small group of companies has had an outsized impact on the overall stock market. It’s understandable that this feels untenable for some investors. (see below)

Perhaps the simplest way to see this is to compare the standard S&P 500 index, which places a weight on each stock based on its size or market capitalization, to one which gives an equal weight to each stock. The theoretical reasons to use one over the other is beyond the scope of this discussion but suffice it to say there are good reasons for both. Using market cap weights provides a more accurate sense of the composition of the stock market – i.e. where the dollars are. Using equal weights helps investors to benefit from a broader base of companies.

Due to the outperformance of large tech stocks, the market cap-weighted S&P 500 has significantly outperformed its equal weight counterpart. (see below) This is even more pronounced when looking at only the largest 50 companies in the S&P 500. Over the past two years, the biggest companies have outperformed the overall index by a cumulative 10%. (see below).

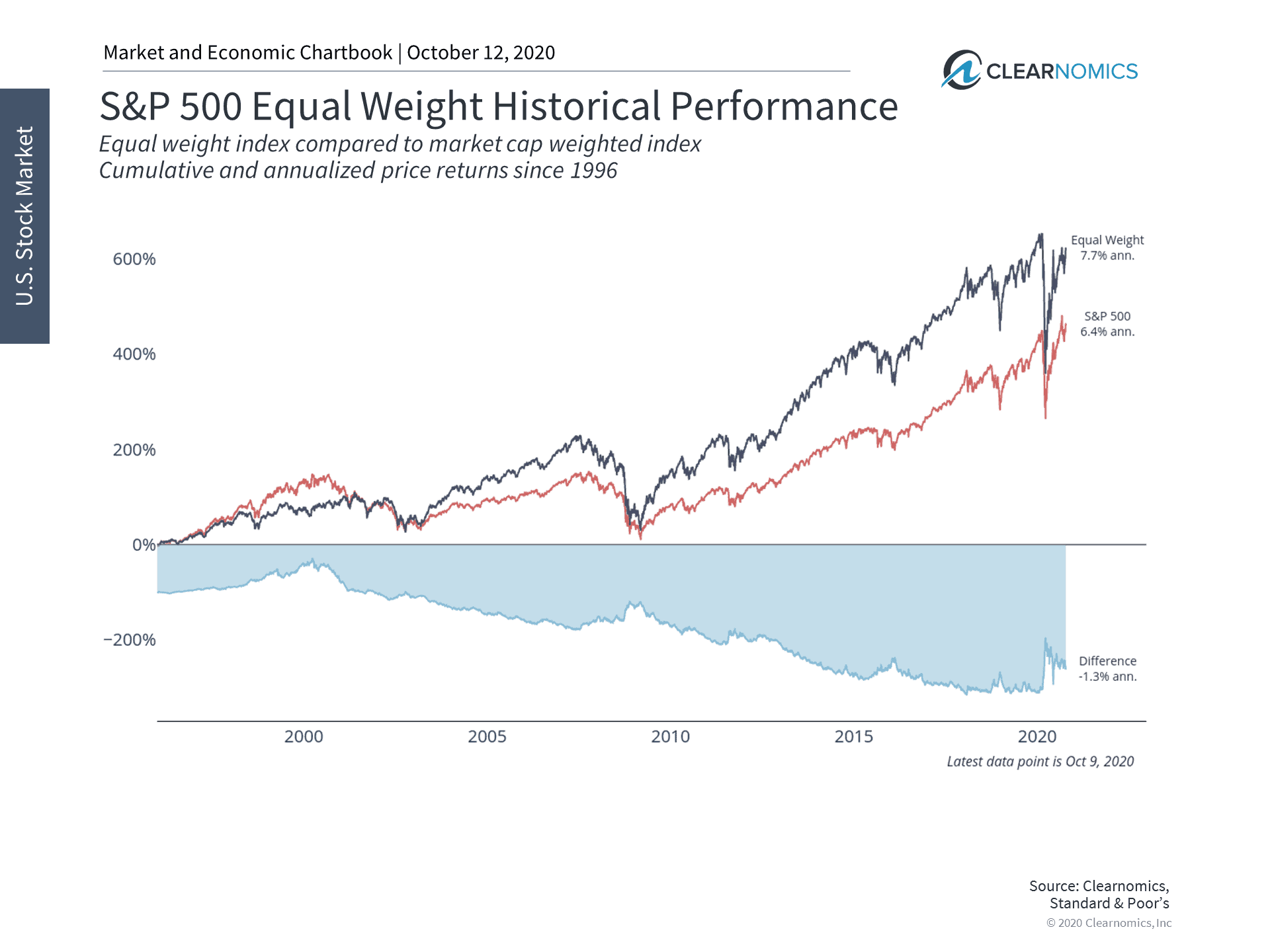

But once again, this reflects the growing importance of these large companies to the economy and the world over the past decade. In fact, it’s not the case that large companies necessarily dominate stock market returns. For much of the history of the stock market, the largest companies were often seen as the most boring (e.g. “blue chips”) – perhaps serving as a source of stable dividends, but little more. Over the past 15 years, an equal weight index has actually outperformed the market cap-weighted one since it benefits from returns across a wider array of stocks. (see below).

Thus, although mega cap companies have driven overall stock market returns recently, whether this will continue depends on the balance between tech trends and the importance of size/scale to companies. It’s important for long-term investors to remain diversified across many parts of the market to benefit from these economic trends. Below are three charts that highlight the impact of tech stocks and market concentration.

1 Technology stocks have driven index returns recently

Technology stocks – both mega cap ones and recent IPOs – have helped to propel overall stock market returns this year and over the past decade. The so-called FAANG stocks have outperformed traditional tech-led sectors, which have in turn outperformed the overall stock market. These stocks reflect the fact that their companies have benefited from trends in digital transformation.

2 Overall market returns have been supported by the largest stocks

As a result, the stock market has been influenced by large technology stocks. An equal weight index of S&P 500 stocks has significantly underperformed the market cap-weighted and the top 50 stocks. This trend accelerated in 2020 due to the COVID-19 pandemic.

3 This is not always the case but reflects an evolving market and economy

However, many of these trends are the result of changes to businesses and the economy. It is not the case that large companies always have an out-sized impact on the overall stock market. Historically, an equal weight index has done well too. Thus, investors should continue to stay diversified among all parts of the market to benefit from on-going economic trends.

While some may be concerned by the impact of large tech stocks and the influence of the largest companies overall, long-term investors should remain disciplined and diversified to take advantage of all parts of the market.

The bottom line? Diversification helps provide investors “insurance” against inclement weather while working to better control portfolio volatility in the short run, even if extreme market swings are fueled 50% by Robo Advisors, AI and quant-trading programs.

Even with the recent addition of human advisors to the robo-call centers, meeting “eye ball to eye ball” with an accredited financial advisor (such as a CFP® pro) to holistically coordinate your planning, tax, retirement and investor mindset concerns – may be of more value than just a low cost robo-investment program.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.