Buckle Down While Investing Through Rising COVID19 Cases

The whole planet seems a bit surreal like a sci-fi movie with a good portion of the world’s 7.8 Billion population having been quarantined for over almost a year, with businesses and families forced to change and adapt to new ways of work, living, shopping, education, travel and leisure activities.

Many tech companies benefiting from “sheltering in place” mandates have been highly profitable through the man-made Bear market, helping us to more efficiently order groceries, attend fitness classes, check up on friends, market our small business, bill clients and attend virtual work or family meetings almost simultaneously.

Human /tech amalgamation powered by data and deep learning may permanently change our daily routines and behavior even after America “re-opens” post-Covid19, with potentially millions of people continuing to work from home, to “zooming” into college classes, doctor appointments and sales meetings, to attending virtual cocktail parties.

As a positive outcome to this pandemic, we may be gaining “time” (and family time) back into or lives as well as being a bit more environmentally friendly by driving and traveling less. Those returning to the workplace over the next year from Wall Street banks to Michigan automotive plants (both with considerably different constraints), will find that corporations have been working swiftly to implement new flexible work options, office space and safety protocols.

Long Term Trends

Despite the Presidential election and COVID19 headlines, headwinds and headaches, the stock market has done better than expected over the past eight months. This is because there are many factors that drive financial asset prices beyond these headlines. Since then, the economy reopened, many companies were able to find alternative ways to operate, consumers began to spend again, and companies began to rehire workers and expand. While many parts of the economy are still struggling, this foundation has allowed the stock market to notch strong gains for the year.(see below.)

In the end, 2020 and 2021 will likely represent two “lost years” of economic and profits growth, based on consensus economist and analyst estimates. This has not meant that the market would wait until GDP is fully recovered. Rather, the stock market considers new information quickly and is always forward-looking. The fact that there is more clarity today, in all of the factors discussed above, has allowed the stock market to approach new highs just months after the pandemic began.

This doesn’t mean the stock market only goes up or that it is always right. However, it’s a reminder to investors that focusing on long-term trends, rather than short-term events and roller-coaster typed volatility, is still the key to achieving financial goals over years and decades.

Rising COVID19 Cases

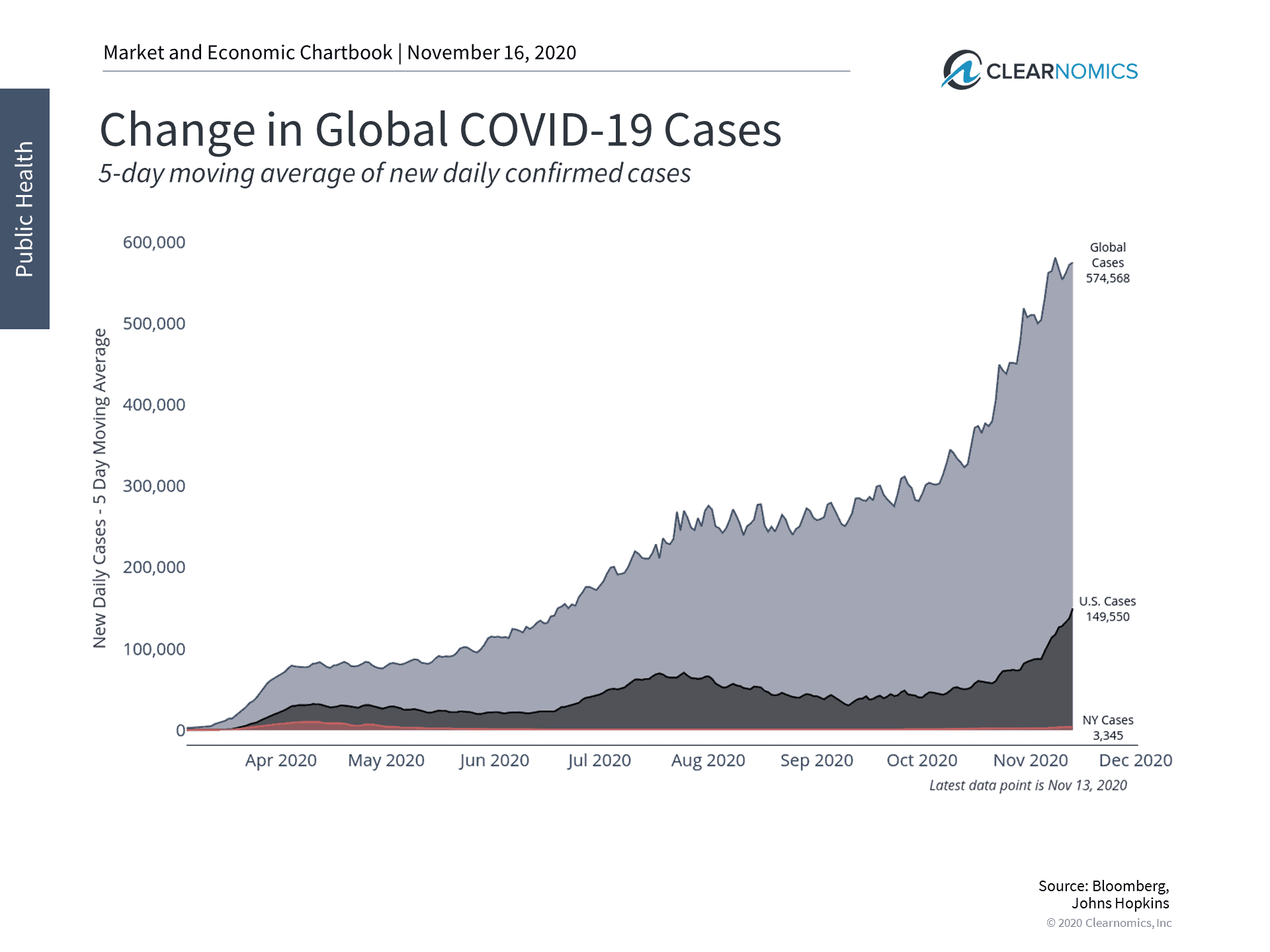

As COVID-19 cases continue to rise (see below), new restrictions and lockdown measures are being considered. Some states have implemented curfews, dining restrictions, mask rules and more in an attempt to curb the exponential spread of the disease. In many places, this has been a heated political issue as the balance between economic activity, personal liberties and control of the coronavirus is debated. At the same time, death rates have remained steady and progress is being made on possible vaccines. How should investors react to the ongoing pandemic almost a year after it began?

Unlike the beginning of this year when policymakers and investors were flying blind, much more is known about the disease and its impact on the economy today. There is clearly a trade-off between economic activity and control of the virus due to how easily it spreads. The first nationwide shutdown was a blunt tool but likely helped to slow the spread significantly, especially at a time when the healthcare system was under stress. Fortunately, the economy was resilient and has recovered quickly since shutdown measures were lifted.

Jon here. Although COVID-19 and its economic impact have affected all aspects of life, it’s important to separate personal views from investment strategy. Whether or not one agrees with the severity of the disease and the appropriateness of public health measures, it’s clear that staying invested, diversified and disciplined with one’s portfolio has been the right approach through the current and many past years unexpected “black swan” events.

Three key takeaways

First, the economy came roaring back by 33.1% in the third quarter even as some parts of the country still faced restrictions. While many businesses and workers in impacted industries such as retail, dining and hospitality are still struggling, this is evidence that a better balance can be struck. Current estimates are for GDP growth to moderate in the coming quarters, but the economy can still fully recover within the next year at this pace.

Second, many businesses and individuals have had time to adapt to working remotely, social distancing, wearing masks, and more. Office workers are now accustomed to online video calls, many factories are set up with health safety measures in place and retail stores have reduced capacity. Many companies who were able to switch to remote work seamlessly have not only survived but have thrived in this environment. While no one would argue that this is ideal for productivity or collaboration, the ingenuity and adaptability of businesses and individuals when facing a crisis are reasons that growth can continue.

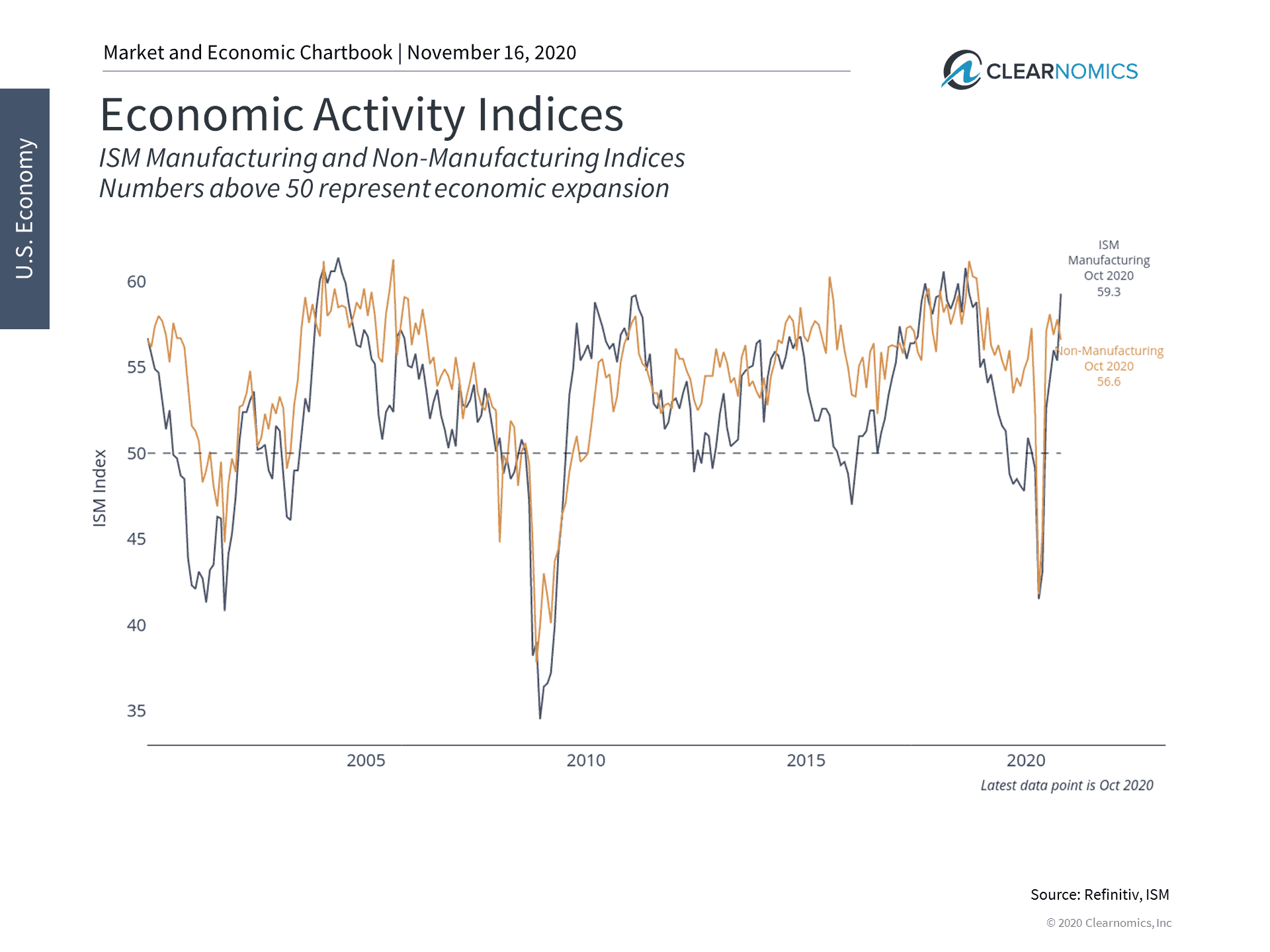

The result of businesses adapting can be seen in various metrics such as the ISM indices (see below) which measure manufacturing and non-manufacturing activity. These have been above 50 since June, a sign that activity has been rising. Hiring activity also recovered quickly as stores reopened and furloughed employees were allowed to return. More than half of the jobs lost during the shutdowns have been recovered.

Third, the stock market continues to look forward and is even approaching new highs in spite of rising COVID-19 cases. This is due largely to the factors above which have allowed businesses to operate and grow. Current earnings estimates mirror forecasts for the economy and suggest that profits can return to pre-pandemic levels by the end of 2021.

The stock market has also cheered positive news of the multiple vaccines under development. While these are welcome signs, much is still uncertain about the efficacy and approval of these vaccines, let alone how they will be rolled out to 330 million Americans, otherwise the world population. Ultimately, it’s clear that the economy can continue to grow without a vaccine in the medium-term, even if one is needed for a return to some sense of normalcy in the long run.

While the ongoing pandemic is affecting all aspects of everyday life, and there are still many uncertainties ahead, it’s important for investors to remain focused on the economic trends and the experience of the past several months. Below are three charts that can help put this in perspective.

1 Global COVID-19 cases continue to accelerate

COVID-19 cases are accelerating around the world, especially in Europe and certain parts of the U.S. This comes after several months of stable case rates.

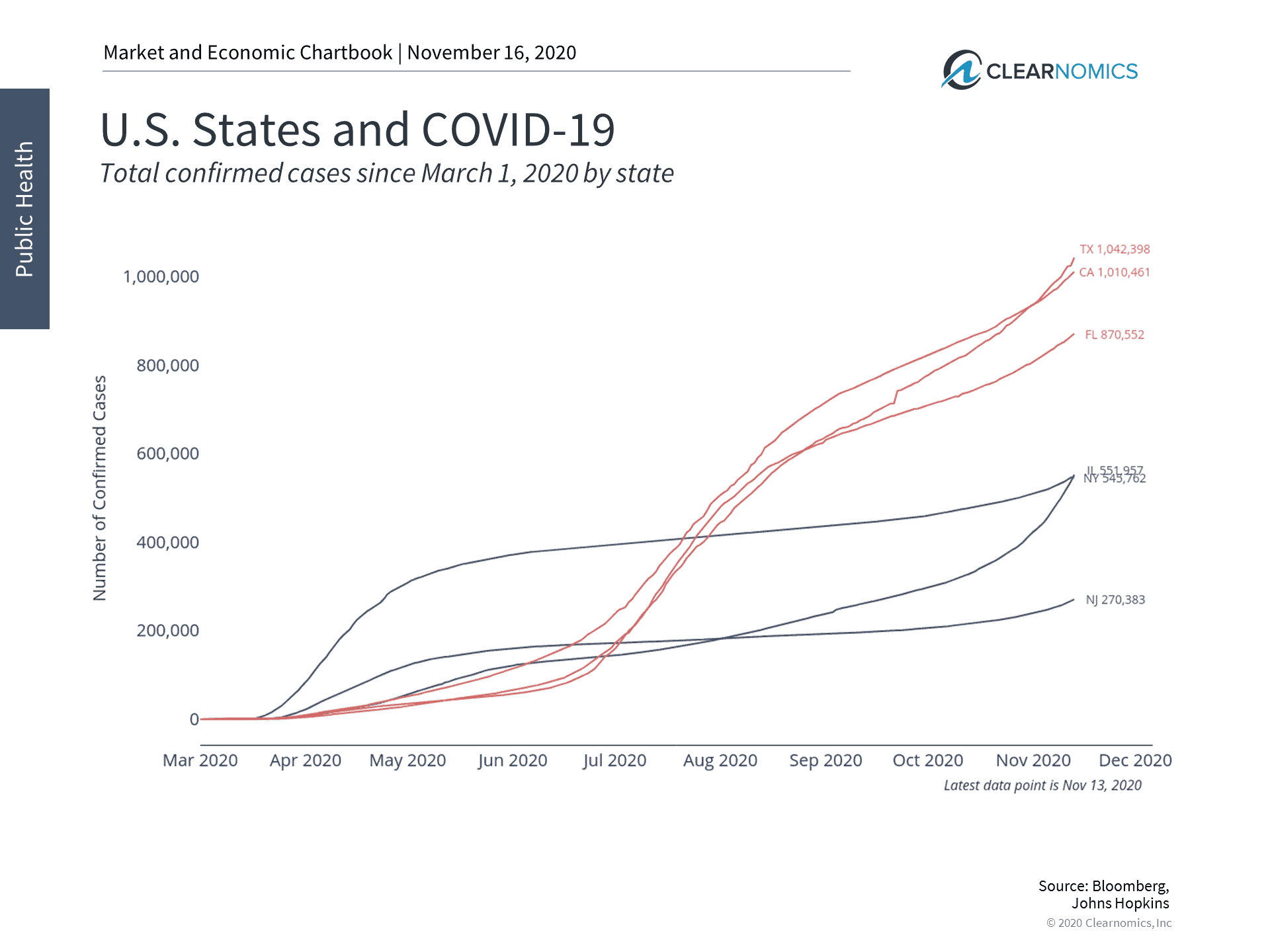

2 Cases are rising in many parts of the U.S.

Many states are seeing an acceleration in new COVID-19 cases. These include those that were affected later, such as Texas and Florida, as well as states that were hit hard at the outset such as Illinois. Each state is taking different measures which include curfews, mask rules, and more.

3 The economy continues to grow despite the pandemic

Economic activity began to surge once restrictions were lifted in the summer. Today, many businesses and individuals have adapted to social distancing and remote work measures. For investors, there is evidence that the economy can continue to operate even with targeted shutdowns and other restrictions to control the spread of COVID-19.

In the wake of the election, despite continued uncertainties, the stock market has been able to approach new highs. While this will depend on continued economic growth and public health developments, this is another reason investors should stay disciplined.

The bottom line? Those investors who stayed disciplined and persevered earlier this year were rewarded. As we near the end of 2020, staying focused on the long run is still the best way to achieve financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.