Will Biden’s Tax Hike Proposals Derail Stocks?

The short answer is most likely not. While Benjamin Franklin wrote in 1789 that “nothing is certain except death and taxes,” there are perhaps no two topics as controversial today as deficits and taxes. Differences in political and social opinions on these issues are almost guaranteed to lead to heated discussions, even among otherwise calm individuals.

This has certainly been the case in Washington over the past two administrations. With the pandemic still affecting individuals and businesses, and with new spending and tax proposals being released, it’s important for investors to distinguish their left or right personal views from how taxes affect markets as they manage their portfolios.

The latest Democratic tax hike proposals are being pitched primarily to pay for a spending agenda of up to $3.5 trillion over the next decade and partly, it’s argued, to shift the tax burden within society.

Tax Hike Proposals

Summoning the song title from Cher, President Biden is trying to “turn back time” to the 70’s by proposing several personal, investment, corporate and estate tax hikes to help pay for his intended social-welfare programs, green-energy subsidies, infrastructure development and other parts of his domestic agenda. While the odds may currently be in the Democrats favor to pass some of the proposed tax hikes in bills that become law, albeit at more subdued levels, many of the proposals may not see the light of day.

The house Democrats sweeping tax proposals presented this week appear to be (1) not bumping the 21% corporate tax rate to 28% or higher (may end up at 26.5%) (2) not creating a 15% minimum flat income tax on corporations with more than $2 billion in income (3) not implementing capital gains tax on estate assets (not end what is known as the “step-up” basis for beneficiaries) (4) not increasing revenue for Social Security by raising payroll taxes (5) not doubling the top capital gains tax rate of 20% to near 40% ordinary income tax (could end up at 25%) (6) not lowering lifetime gift and estate tax exemption amounts (currently at $11.5M) and (7) not instituting a wealth tax, though the highest Federal income tax rate may bump up from 37% to 39.6%.

Tax Planning

While history indicates the stock market typically continues to march forward through periods of higher taxes, you should not sit by leisurely on the sidelines. It could be beneficial to continually review your personal financial plan to help minimize your own tax exposure while working to build your wealth, retirement savings and estate. It’s for this reason that investors should consult a trusted advisor and tax professional when policies do change

Some tax minimization or deferral techniques to review with your financial team may include:

- Utilizing municipal bonds in non-qualified accounts to help increase tax free income.

- Employing tax deferred accounts including qualified employer or individual retirement accounts, health savings accounts (HSA’s), 529 education accounts, cash value life insurance and non-qualified fee-based annuities.

- Utilizing ETF’s in taxable portfolios. ETF’s distribute fewer capital gains than mutual funds.

- Roth Conversion strategies. This strategy may expire in 2031 for high earners.

- Accelerating lifetime gifts and other advanced trust and estate planning strategies.

- 6.Tax loss harvesting

How Investors Should React to Government Spending and Taxes

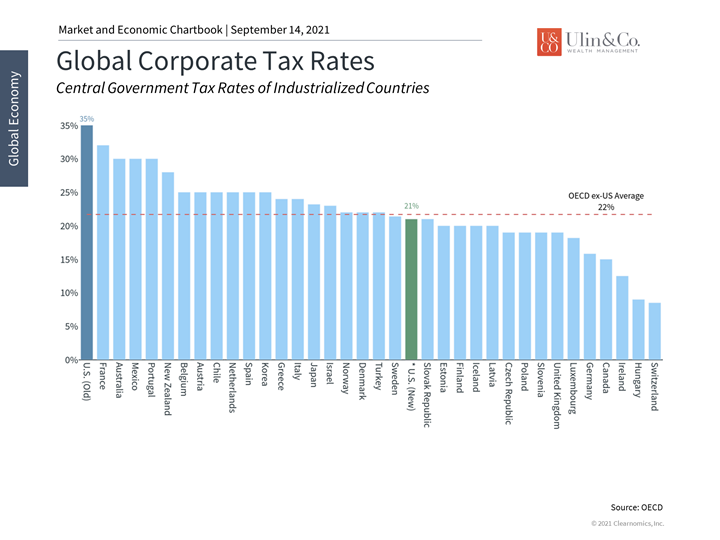

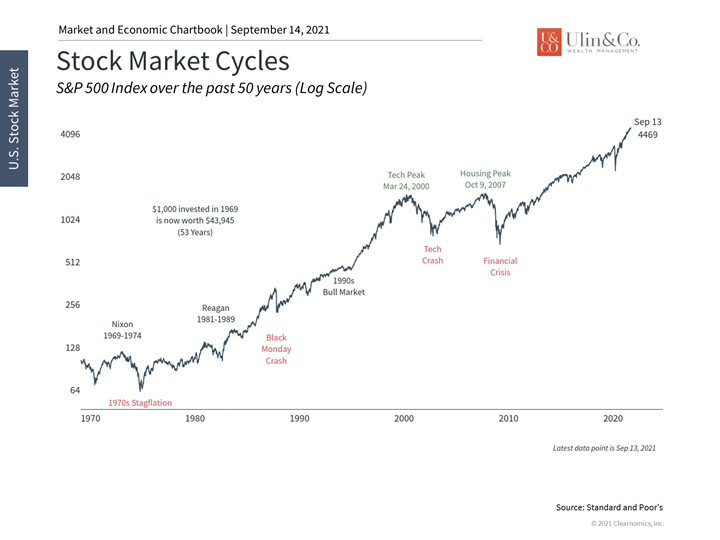

Investors often worry too much about the effects of deficits and taxes on financial markets. The reality is that the stock market and economy have both done extraordinarily well under a variety of tax regimes. (See below) This was true even when the highest marginal income tax rate was above 90% through the mid-1960’s and when the corporate tax rate was the highest in the world, at 35%, prior to the 2017 tax reform. What matters more than specific tax rates is that the economy continues to grow in a way that benefits individuals and businesses. Fiscal policy, alongside monetary policy, can certainly be a tool to spur growth if done appropriately.

This is not to say that taxes can’t distort economic incentives or affect profitability. At a company or industry level, specific tax laws can make a big difference, especially when they are driven by broad objectives such as combating climate change. At an individual level, fiscal policy can change incentives to work and invest, at least in theory. There is evidence that stimulus and unemployment checks created disincentives to work over the past 18 months.

The point is that for everyday investors who are planning for retirement and life goals, basing asset allocation decisions on changes to tax rates, or trying to time the market based on tax policy changes, would have backfired over the long history of financial markets. This is because both individuals and corporations find a way to maximize their incomes and profits over time by adjusting to new economic incentives and rules.

For those investors who have long time horizons and hold broadly diversified portfolios, it’s been better to simply stay invested in a well-designed balanced portfolio. Investors should view these new tax proposals with a level head. Below are three charts that help provide perspective on spending, taxes and markets.

1 Corporate tax rates are expected to rise

U.S. corporate tax rates were the highest in the world prior to the 2017 tax reform. Today, at 21%, they are in the middle of the pack. The current proposal to increase this rate to 26.5% would almost split the difference between the old and new rates.

2 The deficit and debt have ballooned

The federal deficit and debt have both ballooned due to COVID-19 stimulus measures. However, these were one-time spending measures designed to prevent even worse outcomes for the economy. Current spending proposals of up to $3.5 trillion would need sources of funding via higher tax rates or a different tax structure.

3 Stock markets have done very well across tax regimes

Despite concerns over taxes, history shows that financial markets can perform well under a variety of tax regimes. This was true both before and after the Reagan tax reforms. What matters is that the economy continues to grow in a way that benefits individuals and businesses.

The bottom line? Spending and taxes will always be a focus for investors. It’s important to maintain perspective on this topic and not overreact when managing portfolios. Make sure to continually review your own financial plan while implementing techniques to help minimize taxes while working to maximize your wealth, retirement savings and estate.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.