Bear Down Through Midterms and Rate Hikes

Stock market corrections and crashes are social spectacles where technical indicators combine with external economic events, crowd behavior and computer algorithms in a negative loop magnified by the media where humans and quants are motivated to follow the herd off a cliff from an Armageddon headline or tweet.

The Fed is fighting inflation and investors are trying not to fight the Fed. Outside of high inflation, we are not experiencing a dotcom bubble nor a credit crisis. To say this is a mild recession if any, is not an understatement, but not comforting. In a major crash leading to a great recession, cash and credit dry up, creating a domino effect. This is not currently happening as the US banking system is not in distress.

The bear market may continue as long as the Fed is hiking rates attempting to lower “headline inflation” back down near 2% by 2025. As much as the markets may react to a potential 4.5% Fed funds target being reached, consider that Fed Chair Jay Powell could change this path any time. The good news is that the Fed will be very close to their target rate after the next hike and there are CPI indicators slowing down in addition to the obvious like real estate sales.

Lens of Inflation

As noted in MarketWatch, “everybody is looking at the CPI through the wrong lens. The best measure shows inflation fell to the Fed’s target in the past three months.” Consumer prices have risen 8.2% since September 2021. That’s elevated, but lower than the 9% year-on-year increase recorded in June. In other words, it’s decreasing, but not fast enough for Jay.

For those of you that fell off your chair Thursday morning on the inflation headlines – all the while the US markets went up almost 3%, consider that inversely, investors may be betting that the elevated inflation report means price increases are peaking. As noted by Schwab chief strategist, “we get this last gasp higher in inflation, and from here we start to decelerate.”

Vote For Stocks and Midterms

We recommend investors continue voting for recovery with stocks and bonds while staying diversified, while making sure to vote for your political party of choice in this year’s midterms. As best said by economist Ben Graham, “in the short run, the market is a voting machine but in the long run, it is a weighing machine.” Despite ominous headline news on inflation and market prognostications from billionaires and bankers, the 10 Year Treasury rate, S&P 500 and the VIX (fear) indices have all been a bit rangebound after retouching their June lows and highs.

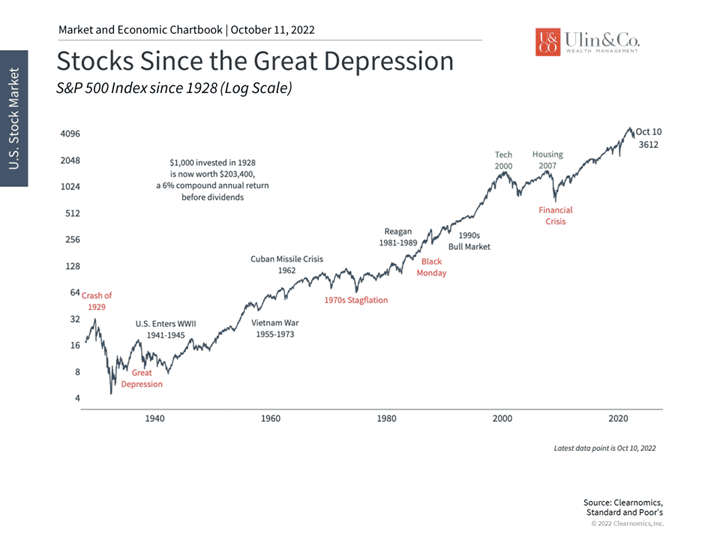

There is a famous quote that “the stock market is the only market where things go on sale and all the customers run out of the store screaming.” In uncertain times where financial oracles are out in full force, staying the course while buying low, dollar cost averaging and rebalancing can be very difficult, but history shows that it is ultimately rewarded.

Economic policies are difficult to evaluate and often work with a lag. There are always pundits – on both sides of the aisle – predicting doom and gloom based on the other party’s proposals. While there are policies that can promote long-run investment spending and labor force growth, the record shows that it’s incredibly difficult to predict the economic impact of any particular proposal.

How To Stay Focused Through Midterms

U.S. midterm elections take place on November 8th amid significant market, economic and geopolitical uncertainty. Inflation continues to be a top issue for voters and while some prices such as those for gasoline have improved, price pressures remain the highest in 40 years. Major stock market indices are also still in bear market territory which hurts consumer and investor sentiment. These factors make this election cycle especially heated across both sides of the aisle. However, history shows that among the many ways that elections are important, informing investment decisions is not one of them.

Current polls suggest that we could end up with a divided government after two years of Democrats controlling the White House and Congress. There are 34 seats in the House that are toss ups, creating a path for Republicans to reach the 218 or more seats needed to form a majority. Democrats are projected to maintain a slim majority in the Senate since the Vice President breaks any ties. A divided Congress could result in more Washington gridlock, reflecting our polarized political landscape.

As citizens and taxpayers, there is no civic duty more important than participating in elections. This is because elections determine the principles we want to uphold and type of country we want. Regardless of which side of the aisle we’re on, it’s critical as citizens to make our voices heard.

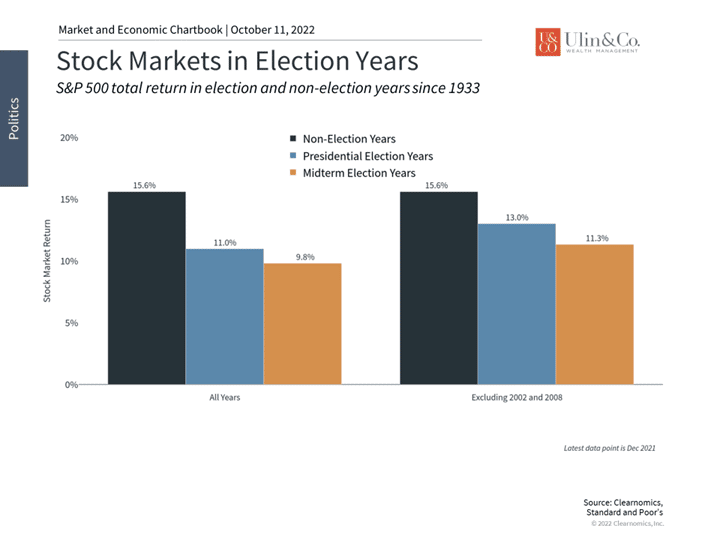

Historically, midterm election years experience positive returns

It seems natural to assume that politics should impact stock market returns. After all, elections do affect economic policies which directly impact specific industries and companies. However, how this impacts broader financial markets is often not as straightforward.

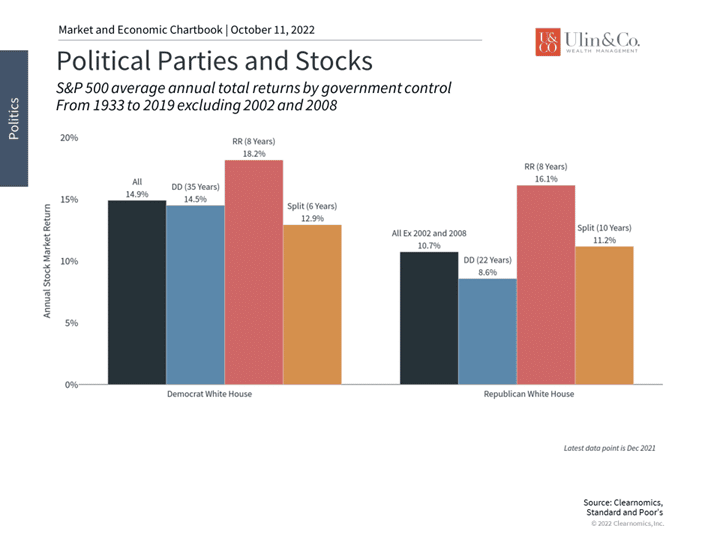

History shows that markets have done well in a variety of political configurations under both Democrats and Republicans and, conversely, that poor market conditions often have little to do with politics. The chart below shows that although there are variations between party configurations, they are all quite positive. It is not the case that one type of party leadership always results in poor economic growth or market returns, and vice versa.

Markets have done well across political parties

Political views can be strongly held by investors, distracting us from achieving financial goals. Avoiding the urge to allocate portfolios based solely on these views can be a challenge. Consider the following factors to stay disciplined during election seasons.

First, history does not support avoiding election years or a particular political party. The first chart above shows that while midterm elections do have somewhat lower returns on average, they are still strongly positive going back to the Great Depression. Of course, this is a moot point at the moment given the bear market environment. Additionally, the basic statistics that are often cited suggesting one party performs better than another are often skewed by small sample sizes (there have been only 15 presidents since 1933), significant outlier events (by chance, much of the dotcom, housing and pandemic market crashes took place under Republican presidencies), and many confounding variables such as what else is happening in the world and economy.

Second, it’s the full economic cycle that matters for investment returns and this often has less to do with who’s in office than other factors that drive growth. For instance, in the 1990s, it’s unlikely that the Clinton administration and the Republican controlled Congress at the time were the main drivers of the tech boom of that era. Similarly, it’s hard to argue that the George W. Bush White House or the split Congress at that time were the reasons for the subsequent bear market of the early 2000’s or the later housing crisis. These were driven by technological and economic trends that were larger than politics.

Investors should focus on the long run despite heated election rhetoric

The bottom line? The economy and market are in precarious positions due to inflation, geopolitics, and many other issues. This may lead many investors to focus too much on the upcoming midterms and adjust their portfolios inappropriately. The chart above shows that markets have done well over long periods across different types of political leadership. It’s important for investors to maintain balance in this environment, regardless of political views.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetically used for illustrative purposes only and do not represent any actual investment.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.