Bank Crisis May Pause Fed Rate Hikes

Can the Fed help put out the fires from the bank crisis while simultaneously working to cool off the heated economy? The short answer is perhaps, but only after a wee bit of a rate-hike pause till the financial sector recalibrates and the dust settles.

There’s a saying on Wall Street that the Fed stops hiking rates when something breaks. While nothing major shattered over the past year from the Fed’s massive rate hikes and its QT (quantitative tightening) path, the historic failures of Silicon Valley Bank (SVB), Signature Bank, First Republic Bank and now the Credit Suisse debacle fueled by accelerated bank runs, caught many by surprise, and are causing widespread uncertainty and panic from the media.

Though no discussion on lack of oversight, Treasury Secretary Janet Yellen recently offered firm, upbeat reassurances to rattled bank depositors and investors telling senators at a Capitol hearing that “the U.S. banking system remains sound and that Americans can feel confident about their banks.” Perhaps the nearly $200 Billion so far in direct central bank support in addition to other mega-banks jumping in with cash bailouts can at the very least lower the significant downside risk of a recession fallout from the bank disasters.

These recent headline-worthy events may not lead to a systemic viral banking system failure and a recession worse than the 2008 credit crisis as we will further attempt to cover both the similarities and differences.

Bank Crisis Runs

Are you having déjà vu from these ominous events? Relax. Don’t expect the failures of two U.S. banks, which rank as the second- and third largest after the collapse of Washington Mutual in 2008 to cause a widespread financial contagion where your megabank or community bank fails, and something goes wrong with the FDIC. While there may be some similarities to 2008 and no one can predict what else may happen, there are major differences. This is not a subprime/ mortgage/credit/banking failure coupled with significant leverage- that led to the Great Recession and housing meltdown.

The collapse of SVB was caused by a “run” on the bank, partly fueled by its unusual concentration of their clients in tech, crypto companies, venture capitalists (VC’s) and startups – of which many were multimillion dollar customers with a good portion of their cash not FDIC insured. Many of these risky companies probably took out loans to reinvest into their own stocks and business operations, while utilizing their pre-IPO shares as collateral. This sounds more like a Vegas casino game- rather than the safety expected from a traditional bank.

This episode reveals that these particular U.S. banks grew too aggressively and with too little risk management as tech valuations rose and crypto prices rallied over the past several years. While this worked exceptionally well in a bull market, the reversal of these trends in 2022 made these banks vulnerable to classic bank runs.

Bank runs happen when many people start making withdrawals from a bank all at once, because they fear the institution will run out of money. It’s a matter of crowd psychology. A bank run is typically the result of panic rather than true insolvency. However, a bank run triggered by fear can push a bank into actual insolvency.

Cash Under Your Mattresses

Earlier this week when the Federal Deposit Insurance Corporation announced they would make all the accounts whole held at Silicon Valley Bank, there was still fear brewing amongst investors seeking to move their cash to a bigger bank or broker-dealer, or out of the system completely.

Jon here. Before you buy a bigger mattress or dig a huge dirt hole in your backyard behind the woodshed to store stacks of Benjamin’s, consider there may not be a widespread banking failure and the FDIC will most likely not go out of business. If you can’t trust the FDIC and U.S. backed T-bills, we may as well be living in a banana republic.

Also consider when holding cash outside of your bank, that home insurance policies may not cover much value of your cash due to theft, plus your cash will lose value over time because of inflation. For example, your insurance policy might have a $200 – $1K claim limit on cash, banknotes, jewelry and watches.

Fed Rate Hike Path

Bad news from the recent historic bank failures may be good news for the stock market and Fed intervention for the next couple of quarters. As noted by a recent WSJ headline, “The Economy Shows Signs of Cooling as Bank Troubles Spread. Retail spending fell, and price pressures eased in February.” This “cooling off” of the economy combined with the recent bank failures and stressors on the financial sector may cause Fed Chair Powell & Co. to reassess their aggressive rate hike path.

In another recent WSJ article, “Bank Failures, Market Turmoil Fuel Bets on a Pause in Fed Interest-Rate Increases.” They further note that a shift in outlook comes ahead of next week’s central bank meeting while market bets on rate cuts as early as this summer. That would come as an incredible reversal just over the past month when Powell was signaling more aggressive hikes were on the way above perhaps 5.5%.

In our opinion, the Fed needs to create a prudent balancing act between the financial sector fallout, while not getting to passive or about face with their inflation reduction goal that is still a long way off from 2%. While more investors anticipate that the Federal Reserve’s rate increase cycle could be over after to broader financial turmoil arrived this month, we think that after a potential quarter point rate increase at their next meeting, the Fed may go on vacation over the summer months and return closer to yearend to resume their inflation slaying program of interest rate hikes after the banking channel cools off a bit more and perhaps CPI continues to decline, albeit very gradually.

Risks to the Financial System- What Unraveled

The recent U.S. bank failures have raised concerns over the financial system. This crisis has already created hardship for many businesses and individuals as payrolls are disrupted and access to cash is halted. However, when it comes to investing, it’s more important than ever to stay levelheaded and focus on the big picture. Consider the following:

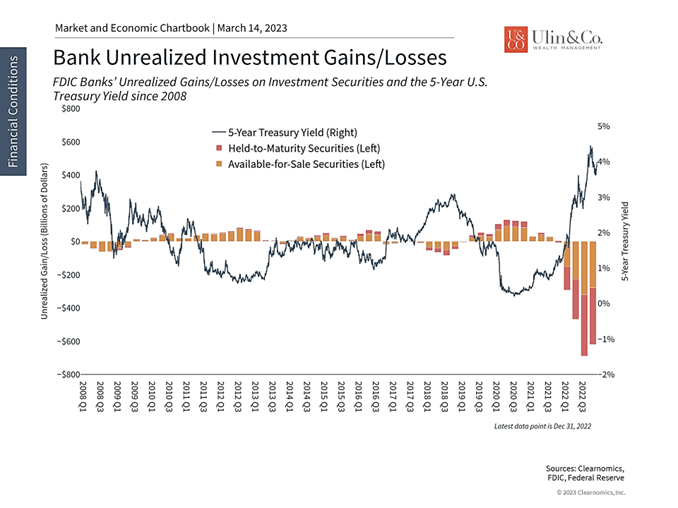

1 Banks accumulated unrealized losses on investment securities as rates spiked

First, rapidly rising interest rates and Fed rate hikes over the past year created financial stresses on bank balance sheets. Bonds had their worst performance in history in 2022, driving unrealized losses on investment assets including U.S. Treasuries (see chart.) Whether banks need to book these losses depends on how these securities are accounted for, but this worsens as banks face pressure on deposits. Thus, SVB and others found themselves with assets that were worth far less as rates rose and were fairly concentrated in longer duration bonds that got walloped through the 2022 hikes.

Second, as we noted above, SVB’s concentration of tech and startup customers made it vulnerable as conditions deteriorated for that sector, just as Silvergate and Signature Bank were exposed to the slowdown in the crypto industry. SVB tried to plug this gap by raising fresh capital, but this backfired since it highlighted the liquidity and solvency issues it faced. Like shouting “fire” in a crowded theater, once there is the perception of solvency problems, a classic bank run can occur swiftly, which can then become a self-fulfilling prophecy. To a large extent, this played out publicly as many in the startup and VC communities urged companies to move their funds.

While government actions are always controversial and subject to political debate with a bank crisis, moves by Treasury, the Fed, and the FDIC to backstop customer deposits across these banks will likely help to prevent contagion effects across the system. We get that.

At the same time, it does not directly address the underlying issue of impaired assets which depends on the quality of risk and asset/liability management at each bank. However, the risk that unrealized losses become a solvency issue is mitigated for larger, more diversified banks who are less reliant on deposits, have a stronger deposit base, and maintain higher amounts of capital.

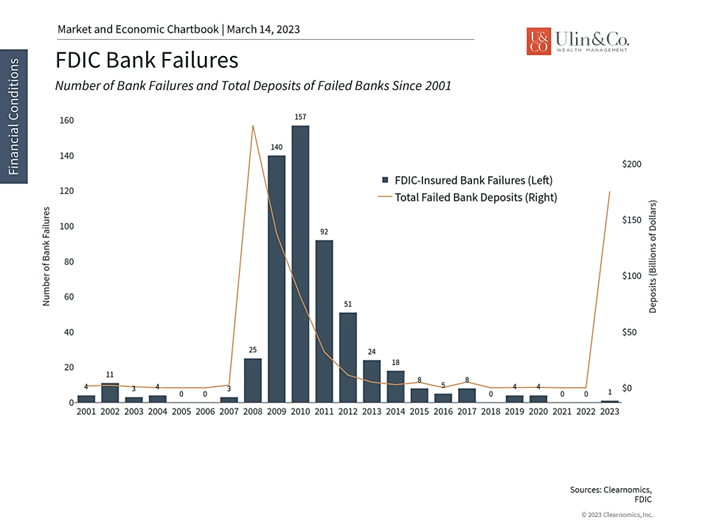

2 These bank failures are the largest since 2008

*Note that this FDIC data does not yet include Signature Bank

One reason that investors may be concerned is that there have been few bank failures in recent history, especially since banking legislation such as the Dodd-Frank Act was put into place after the 2008 financial crisis. According to the FDIC, there were only 8 bank failures from 2019 to 2022, far below the 322 experienced around the global financial crisis or the hundreds that regularly occurred in the 80s and 90s. That said, SVB is an outlier in that it had total deposits of $175 billion while the 8 from 2019 to 2022 had a combined $628 million.

Naturally, there are also parallels being drawn to 2008 when the last wave of bank failures threatened the global financial system as we mulled over above. It’s important to keep in mind that, back then, the problem was not just that all banks held significant amounts of mortgage-backed securities and other housing-sensitive assets that ended up being worth only pennies on the dollar. Rather, significant amounts of leverage coupled with new financial instruments such as collateralized debt obligations allowed a housing crisis to turn into a financial meltdown. While it’s unclear exactly how this episode will play out, many banks today are much better capitalized and do not primarily rely on tech or crypto deposits. Additionally, any economic spillover has so far been concentrated in the technology and venture capital industries which were already struggling with layoffs and a slowdown in demand.

These developments impact the Fed’s upcoming rate decisions since they underscore an unintended consequence of rapid rate hikes. It’s likely that this creates a new sense of caution for the Fed as they continue to battle inflation. According to market-based measures as we also chewed over above, investors no longer expect the Fed to raise rates again this year (if any after the next meeting) but believe that there may be a rate cut by September. Interest rates have also fallen with the 2-year Treasury yield declining over one percentage point to around 4.1% helping to support bond valuations. While these expectations can change rapidly, they show how much sentiment has shifted in the past week.

The bottom line? While the recent Bank Crisis is problematic, parallels to 2008 are premature. Investors ought to stay diversified as the situation stabilizes, while focusing on the big picture rather than minute-by-minute speculation.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us Below:

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

bank crisis blog

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.