Three Fed Landing Scenarios

While market forecasts are in disarray between the possibility of the Fed inducing a soft or hard economic landing or no landing at all, consumers are still dealing with the lingering effects of above average “sticky” inflation, especially on goods and services, all the while headline inflation cooled off slightly, which we’ll chart out and discuss in a bit more detail below.

Still, the aggressive Fed rate hike actions have not greatly buckled the economic data or consumers from slowing down or braking their spending habits. As reflected by a recent Market Watch headline, “What recession? Consumer sentiment hits 13-month high of 67%.” In many ways, the good news of record low unemployment and high consumer spending may send a smoke-signal to the Fed to stay aggressive with their inflation- fighting flight pattern.

Supply vs Demand

While not a hot topic for most news and media stories concentrating mostly on the Fed going after demand-side issues by hiking the Fed Funds rate, what is not covered as much is that almost half of inflation volatility is logically driven by supply and not controlled by the Fed. It’s like trying to land a twin engine plane with one engine. Not impossible but not effortless.

If you think about it in this manner, it may be a wee-bit difficult for the Fed to hit their 2% inflation goal by year end with one engine. Congress and the President though could influence the supply-side issues if they took a bit more measures to increase oil supply and semiconductor chips, by example on two supply side- politically hot topics.

Three Fed Landing Scenarios

We do not anticipate the Fed will steer us into a perfect runway landing with exactly the right amount of rate hike numbers. At the same time, strong economic growth along with solid disinflation sounds like an oxymoron for this narrow runway targeted by the Fed to land by year end.

A soft landing by the Fed is when the central bank tightens monetary policy to fight inflation but does not cause a recession. We believe this may be possible if the Fed can exercise a bit more patience for inflation numbers to roll off the runway and extend the 2% target goal out till the end of 2024. If the Fed gets overzealous and keeps the gas on the pedal for rate hikes, it could cause a recession that will slam the breaks on the overheated economy, causing a hard landing, which may be less probable.

The new headline du jour predicts “No Landing,” with continued high CPI despite Fed intervention due to the positive, heated results of January’s retail sales and low unemployment numbers. No landing may result in a hard landing. We do not think this may be the case either. In our opinion, it may be a challenge to have a major recession with record low unemployment and a solid underlying economy.

Groundhog Day

For investors with the Fed and inflation circling the headline news at the top of every month in a vicious cycle, it may feel like the movie Groundhog Day, where weatherman Bill Murray finds himself in a time loop, and the day keeps repeating until he gets it right.

After all, the numerous market swings last year were driven by ever-changing expectations around the Fed – both when investors believed the Fed was doing too little, and when they thought the Fed was tightening too much. With markets once again concerned about the direction of the Fed, perhaps Jay Powell is the weatherman in this evolving story.

Only three weeks ago at the Fed’s latest press conference, FOMC Chairman Jay Powell stated that “the disinflationary process has begun.” This is undeniably true across many parts of the economy as inflation has eased. However, recent data raise new questions around how quickly inflation is improving and whether the Fed will need to act more forcefully in the coming months. Not surprisingly, this has spooked markets.

Headline vs Core Inflation Debacle

The challenge facing markets and the Fed is simple: textbook economic theory says that inflation is the result of an overheating economy. Thus, in order to beat inflation, the Fed may need to slow the economy to a crawl or even cause a recession as it did in the early 1980s. There are many ways economists slice and dice inflation data to best understand the underlying trends.

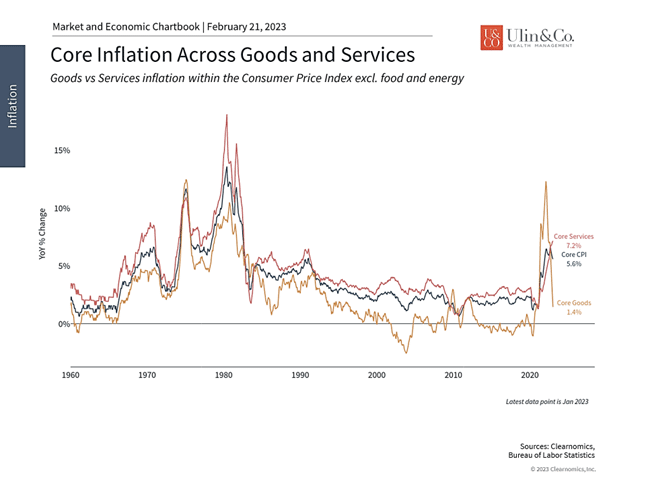

One common way is to compare overall inflation, also known as “headline” inflation, to inflation without food and energy prices, also known as “core” inflation. This is not because food and energy are unimportant to consumers but because these prices tend to bounce around as commodity prices fluctuate, making it difficult to understand the trajectory of inflation. Recent data show that headline inflation has been decelerating – hence, Powell’s disinflationary comment – but core inflation remains stubbornly high. (see above)

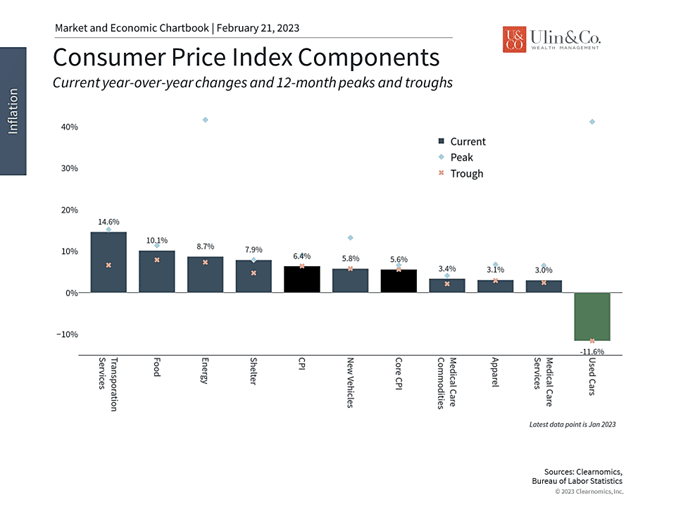

However, another useful way to break down prices is to consider goods vs services within core inflation. Goods are physical, tangible items that consumers buy including new and used vehicles, apparel, home appliances, and more. Services are everything else – rent, transportation services, medical care, etc. Goods and services are both important to consumers but can be driven by different factors.

Improvements for Many categories of consumer goods and services

In many ways, this breakdown more closely aligns with what consumers have experienced over the past few years. Early in the pandemic, goods prices skyrocketed due to shortages of everything from toilet paper to computer chips. Today, these prices have improved with core goods inflation running at only 1.4% year-over-year. (see above) Used vehicles, for instance, have experienced a price decline of 11.6% over the past year, as shown in the accompanying chart.

The prices of core services, on the other hand, climbed 7.2% in January compared to the prior year. It’s for this reason that economists worry about the red hot labor market, including wages that are increasing 4.3% year-over-year for all workers and 5.1% for hourly workers. Higher wages that translate into more spending on services could create inflationary pressures. Retail sales, for instance, surged in January after slowing late last year.

The Fed is now expected to raise rates higher this year

This takes us back to the conundrum mentioned above. While headline inflation is easing, core inflation is still far beyond the Fed’s target due to the prices of services. Standard economic theory suggests that this is driven largely by a strong labor market. Thus, markets are concerned that the Fed may have to do more to break employment numbers down. At the moment, market-based expectations are for the fed funds rate to rise to 5.25% or higher by mid-year.

For long-term investors, it’s important to maintain perspective in this market environment. After all, the stock market has fluctuated wildly over the past year based on Fed expectations, with swings in both directions as investors and economists evaluate the constant flow of data. Inflation has been difficult to predict accurately and both sides of the argument have been wrong at one time or another. Throughout all this, the S&P 500 has risen 14% since last October and the bond market has done better this year as interest rates have been somewhat more stable.

The bottom line? Three Fed Landing Scenarios are all in play, but may not easily come to fruition. Headline inflation has improved since it peaked last June but core inflation, and services in particular, remain a challenge. The Fed will need to walk the line between fighting inflation and maintaining economic growth to avoid a hard- or no landing debacle. Long-term investors should stay the course and not react to the inevitable market swings or headlines.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact us below.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Fed Landing Scenarios

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.