Acrophobia and Stock Market Bubbles

The stock market has performed better than expected over the past year through the COVID19 pandemic. This is because there are many factors that drive financial asset prices beyond headlines.

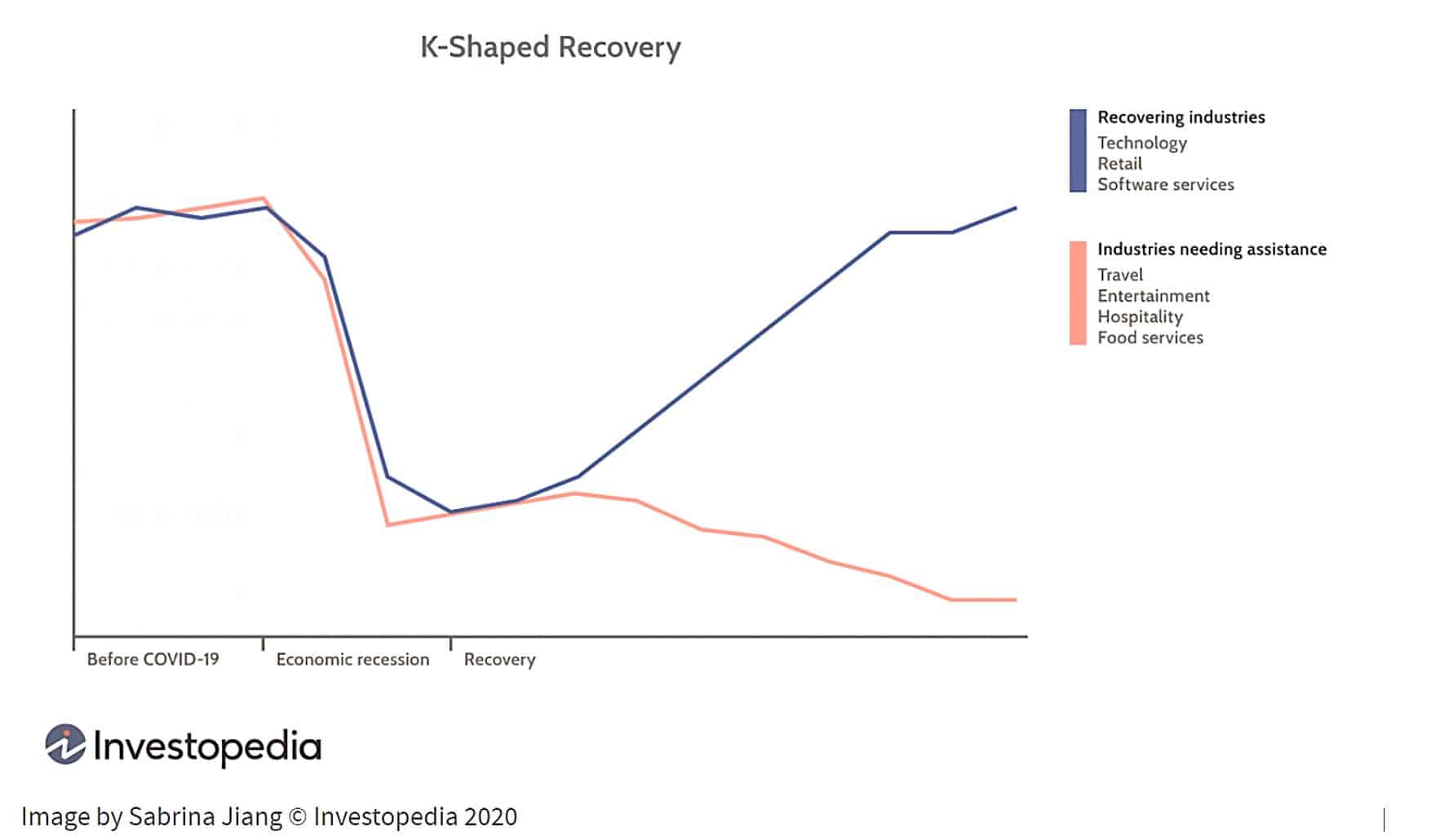

The economy reopened, many companies were able to find alternative ways to operate, consumers began to spend again, and companies began to rehire workers and expand. While many parts of the economy are still struggling, giving way to a “K- shaped” recovery, this foundation has allowed the stock market to notch strong gains. (see below.)

This doesn’t mean the stock market only goes up or that it is always right. However, it’s a reminder to investors that focusing on long-term trends, rather than short-term events, is still the key to achieving financial goals over years and decades. Whether or not stock market values are overheated, we are due for a tech-stock crash or if the Fed’s future tax policies will throw the bull off course, are all on the top of investors’ minds this year.

Acrophobia

Acrophobia is an extreme or irrational fear or phobia of heights. It belongs to a category of specific phobias, called space and motion discomfort. Acrophobia sometimes develops in response to a traumatic experience involving heights, such as: falling from a high place or watching someone else fall from a high place. For investors this may bring back PTSD memories of the dotcom and housing market heights and subsequent stomach- wrenching plunges.

As the stock market continues its steep climb up a new proverbial “wall of worry” after last year’s bear market crash, some investors worry about the possibility of a bubble. Over this period, the S&P 500 lost 35% and has risen 70% with dividends reinvested even as the pandemic rages on, many businesses continue to feel the pinch, and there are concerns over inflation. While this increase may seem incredible, it goes along with the rule that if you lose half your money you need to double it back to break even.

Thus, it’s natural that the stock market will fall at some point. But whatever the reason for investors to lose their nerves – global headlines, economic concerns, political uncertainty, etc. – the market also eventually recovers. Trying to predict the exact timing and nature of these declines often backfires, doing more harm than good. Staying invested and diversified through these events, no matter how uncertain they may feel, has more often been rewarded.

Stock Market Bubbles

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices high up above their value in relation to some system of stock valuation. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. From Tulips, tech and real estate to Bitcoin, we’ve learned that markets and humans aren’t always efficient.

Mark Twain is often associated with the quote, “History doesn’t repeat itself, but it often rhymes.” Jon here. I think the same could be said for the stock market. The stock market is known for bull- bear cycles. Their repetition makes one believe that history repeats itself. However, in each black swan episode, the underlying theme, participants and events are vastly different.

The question of whether there is a “bubble,” at least the way most investors understand the term, should be distinguished from “will stocks fall?” This is because short-term stock market pullbacks are normal and can occur without notice. The stock market experiences a few large pullbacks almost every year including declines of over 10%.

Last year, there were twelve declines of 5% or worse, with the largest being 34%, the deepest since the global financial crisis. In 2018, there were eight such pullbacks and the largest decline was almost 20%. And yet, the stock market made significant gains over this period despite these setbacks.

The New Normal

To distinguish between these short-term pullbacks and bubbles, it’s important to consider value. As with everything in life, what matters in investing isn’t just what price you pay but what you get for your money. After all, the reason investors buy stocks is to own a part of a business and its cash flows. Thus, valuation metrics such as price-to-sales, price-to-earnings and more tell us not just the price of a share – but what we’re getting for that price.

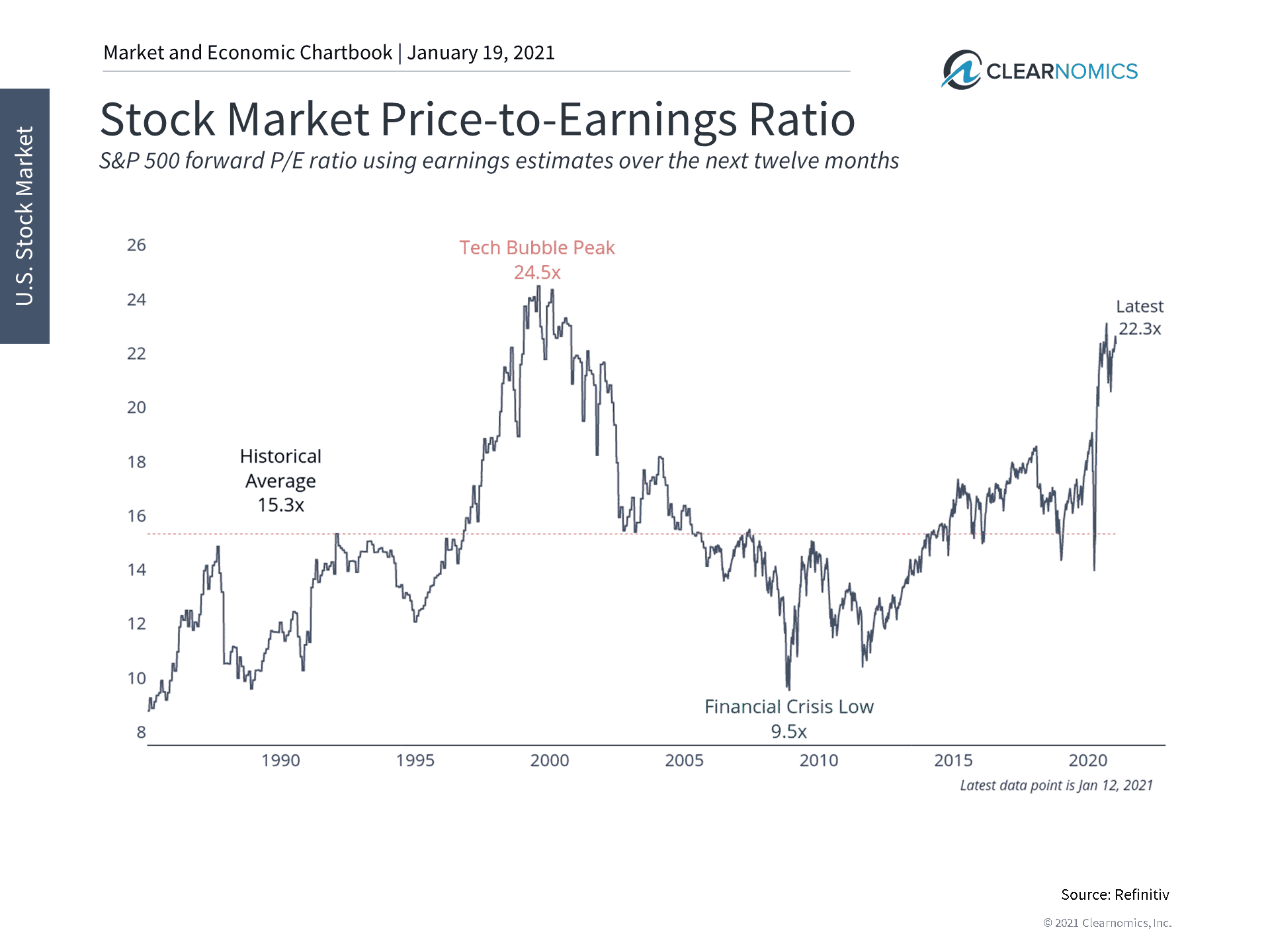

On this basis, major stock markets are certainly expensive by historical standards. The S&P 500’s price-to-earnings ratio, at above 22 times next-twelve-month earnings, is approaching its dot-com era peak. Most other measures are also at their highest levels in the last 15 years.

However, there are three important points to consider. First, it’s well understood why valuations are elevated. The on-going pandemic and economic restrictions have hurt earnings and other fundamental measures. Thus, they have pushed up valuations over the past year. The fact that investors continue to buy and stay invested at these levels suggest they believe sales and earnings can recover, thus bringing valuations back down to earth. While there is still great uncertainty, this optimism has been rewarded since last March.

Second, even with higher valuation levels, the term “bubble” often implies a significant imbalance in the economy that will eventually “pop.” More importantly, this bursting must then spread across the economy and result in a broader crisis. With the benefit of hindsight, this was true of the dot-com and housing bubbles to different extents.

However, not only is it difficult to identify bubbles ahead of time, but not all highly-valued assets become bubbles – especially if they ultimately live up to expectations. The fact that tech stocks and other pandemic-resistant sectors have risen does not necessarily mean they are in a bubble either. Instead, many companies have become more valuable over the past year, both in terms of their services and in their contributions to portfolios. How we have adapted to COVID from home, work, education and shopping may be the new normal for years to come.

Third, interest rates are still extremely low. In general, this can boost stock market valuation levels since there are fewer attractive asset classes that can generate sufficient income and also reduces the cost of capital for companies, among other effects. While this does not guarantee that stock market valuations or prices can stay high indefinitely, it is a factor that has been at play since this low-rate environment began over a decade ago.

What does this mean for everyday investors? Overall stock market valuations are certainly above average. However, rather than constantly fear bubbles, investors are better off staying diversified across sectors, styles and geographies in order to benefit from upside while protecting from possible downside risks.

1 The stock market is not cheap compared to history

The S&P 500 forward P/E ratio is elevated compared to its historical level. At the moment, this and other valuations are approaching dot-com bubble peaks. However, unlike during that era, today’s high valuations are due to economic stress from the ongoing pandemic. Current investor and analyst expectations are for earnings and other fundamental measures to recover over the next year or two. If this happens, many of these valuation measures could come back down to earth.

2 K- Shaped Recovery

The term “K-shaped” recovery rose to prominence in 2020 in the wake of the sharp recession in the U.S. that accompanied the COVID-19 pandemic and was used to describe the uneven economic recovery across different sectors, industries, and groups of people in the economy. (Investopedia)

The bottom line? While valuation levels are high, this does not necessarily imply that there is a stock market bubble. At the same time, short-term pullbacks are always possible. Investors should remain disciplined and stick to their long-term investment plans.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.