Santa Clause Rally Driven by COVID Vaccine Rollouts

Santa Claus visits the stock market about four out of every five years, suggesting the rally is more than a myth. A rally by Saint Nick has materialized about 79% of the time since 1950. S&P 500 returns during the last five trading days of December and first two of the subsequent new year were positive for 55 of the 70 years between 1950 and 2020 – and negative for only 15.

Several notions exist for the Santa Clause rally, including increased holiday shopping, optimism fueled by the holiday spirit to many short sellers being on vacation.

As many individuals, small businesses and corporations have learned to adapt, if not thrive through COVID, a substantial sliver of America has been doing better than ever, or at least just fine despite the pandemic: enjoying the freedoms that remote work paired with disposable income can bring.

Retail Spending

Retail spending may be looking up to bring Christmas cheer to the street and investors by year end, with much of the heavy lifting due to optimism of vaccines rolling out beginning this week. More than 70% of people in developed markets will be vaccinated against the coronavirus by fall 2021, according to an estimate by Goldman Sachs.

If expectations are correct, it means we as a nation can get back to some sort of routine – going out to eat, spending time at the mall, traveling and booking vacations, which will help contribute to GDP growth. Consumer-driven activity is responsible for almost 70% of U.S. GDP and is the backbone of our economy.

Jon here. While we do not adhere to investing based on seasonal patterns, market maxims or crystal balls; market fundamentals do seem intact to deliver the goods going into 2021 after a huge 2020 V shaped market recovery despite growing volatility and continued pessimism in the headline news due to increasing COVID19 infection and mortality numbers heading into the winter months.

What Effective Vaccines Mean for Investors

The U.S. is beginning to roll out the first doses of the COVID-19 vaccine this week just days after it was approved by the FDA. This vaccine, produced by Pfizer, could soon be joined by ones developed by Moderna and others. Government officials estimate that 100 million Americans could be vaccinated by the early months of 2021, or about one-third of the country. Other countries have already begun to distribute vaccines as well. This is very positive news just one year after the new coronavirus was identified. Still, investors should continue to maintain realistic expectations and stay disciplined in the coming months for a few reasons.

First, while the efficacy of these vaccines appears to be high, there are logistical challenges with their production and distribution. Hundreds of millions of doses – and eventually billions – will need to be produced quickly and safely. These vaccines must be kept at extremely low temperatures and thus require special equipment. Patients must receive two doses a few weeks apart thus requiring scheduling and coordination. These challenges will no doubt be worked out as distribution increases, but it may take time.

It’s also unclear how long these vaccines confer immunity or what their full range of side effects may be. For some, there is also a sense of mistrust of these vaccines and other strong personal beliefs. From the perspective of the economy and markets, however, continued growth only requires that enough Americans are vaccinated for herd immunity – and also those that are most at risk, on the front lines, etc. After all, it was only a few months ago that it was uncertain whether a vaccine was theoretically possible.

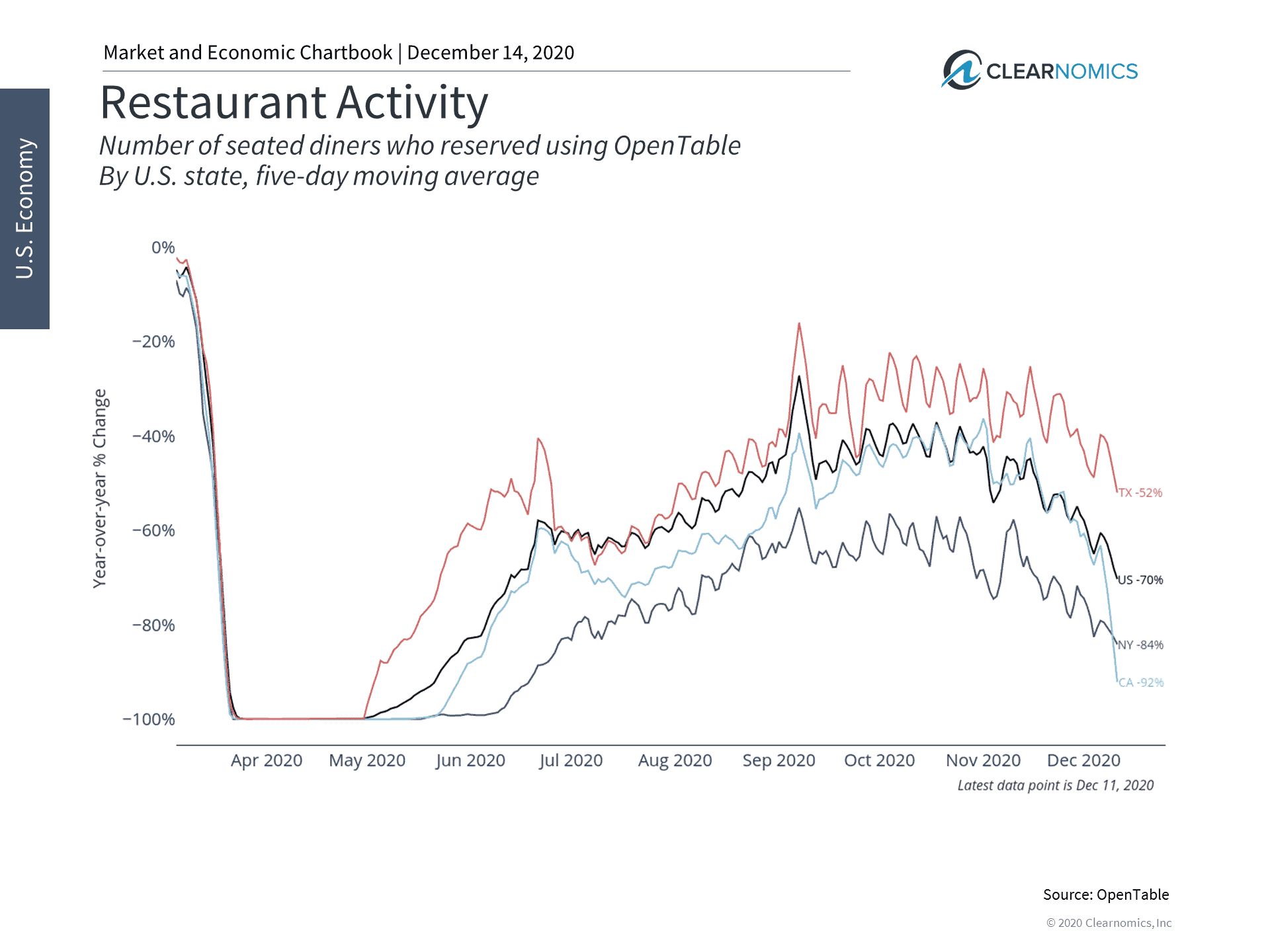

Second, while there is now some hope that life could slowly return to “normal” later in 2021, this hope comes amid a surge in cases in many parts of the country and world (see below.) And while the death rate has not risen significantly alongside new cases, many national and local governments have been forced to enact restrictions just as they did at the start of the pandemic as NY Gov. Cuomo just announced shutting down again of indoor restaurant dinning.

For instance, high-frequency economic data such as dining activity (see below) show a steep decline in all parts of the country as lockdowns are enforced and the weather grows colder. This only adds to the financial stress that many industries have been facing. This is perhaps the area where vaccines and immunity will have the greatest effect as consumers begin to feel safe once again, whether or not another stimulus bill is passed by Congress.

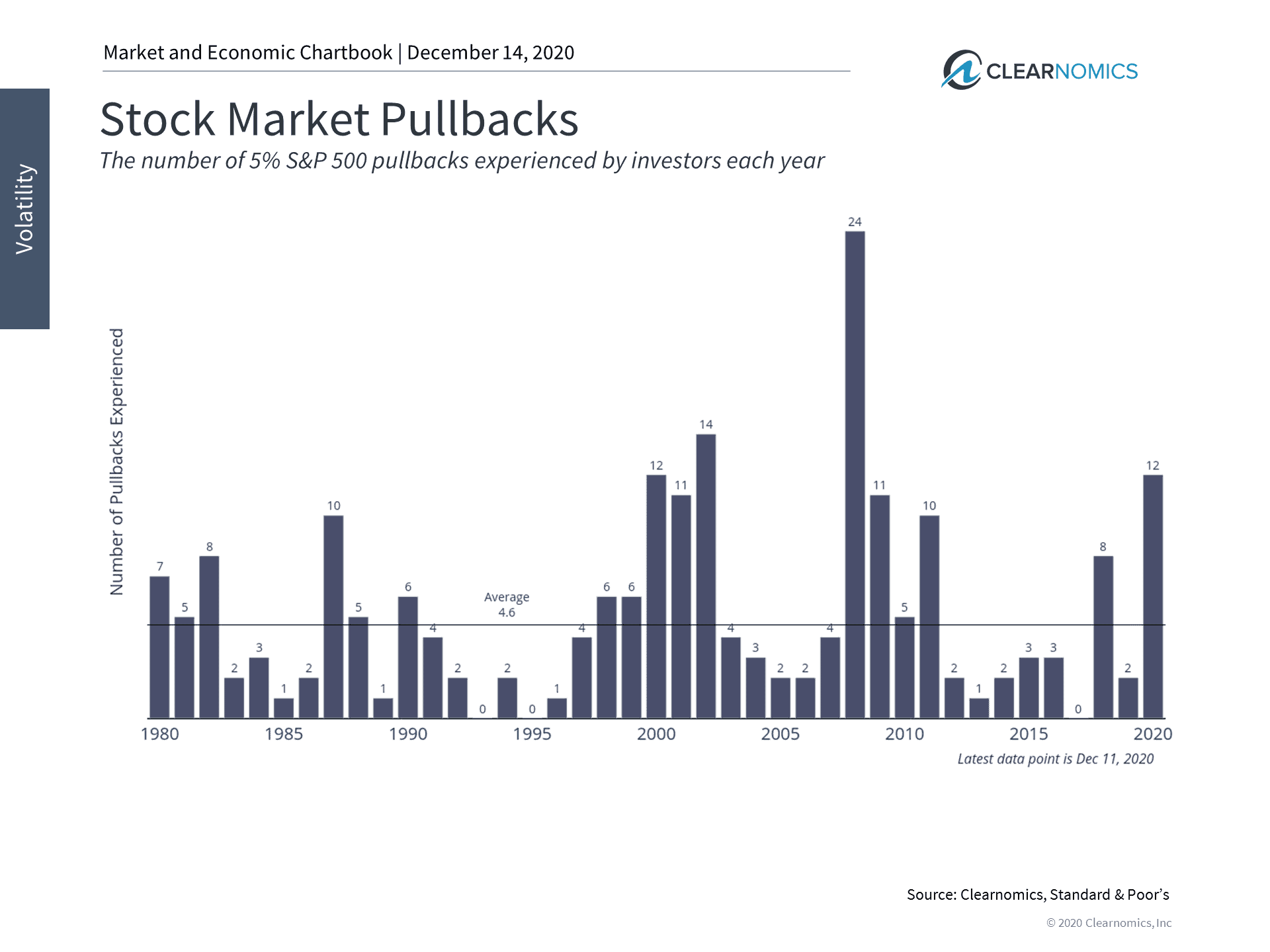

Finally, investors should remember that not even a vaccine can prevent the stock market from behaving in a volatile manner from time to time. Those who stayed invested and diversified this year were rewarded as the economy recovered and the financial system stabilized. Although there is now a clear light at the end of the tunnel after the most uncertain stock market period since 2008, there are still many unknowns related to the coronavirus and other economic, financial and political factors. Investors have withstood a dozen large market swings this year and should remain disciplined in the coming years.

Thus, the deployment of COVID-19 vaccines is no doubt positive. However, if 2020 leaves investors with a single lesson, it is that staying invested is the best course of action, even in the face of a (hopefully!) once-in-a-century pandemic. Below are three charts that highlight this fact.

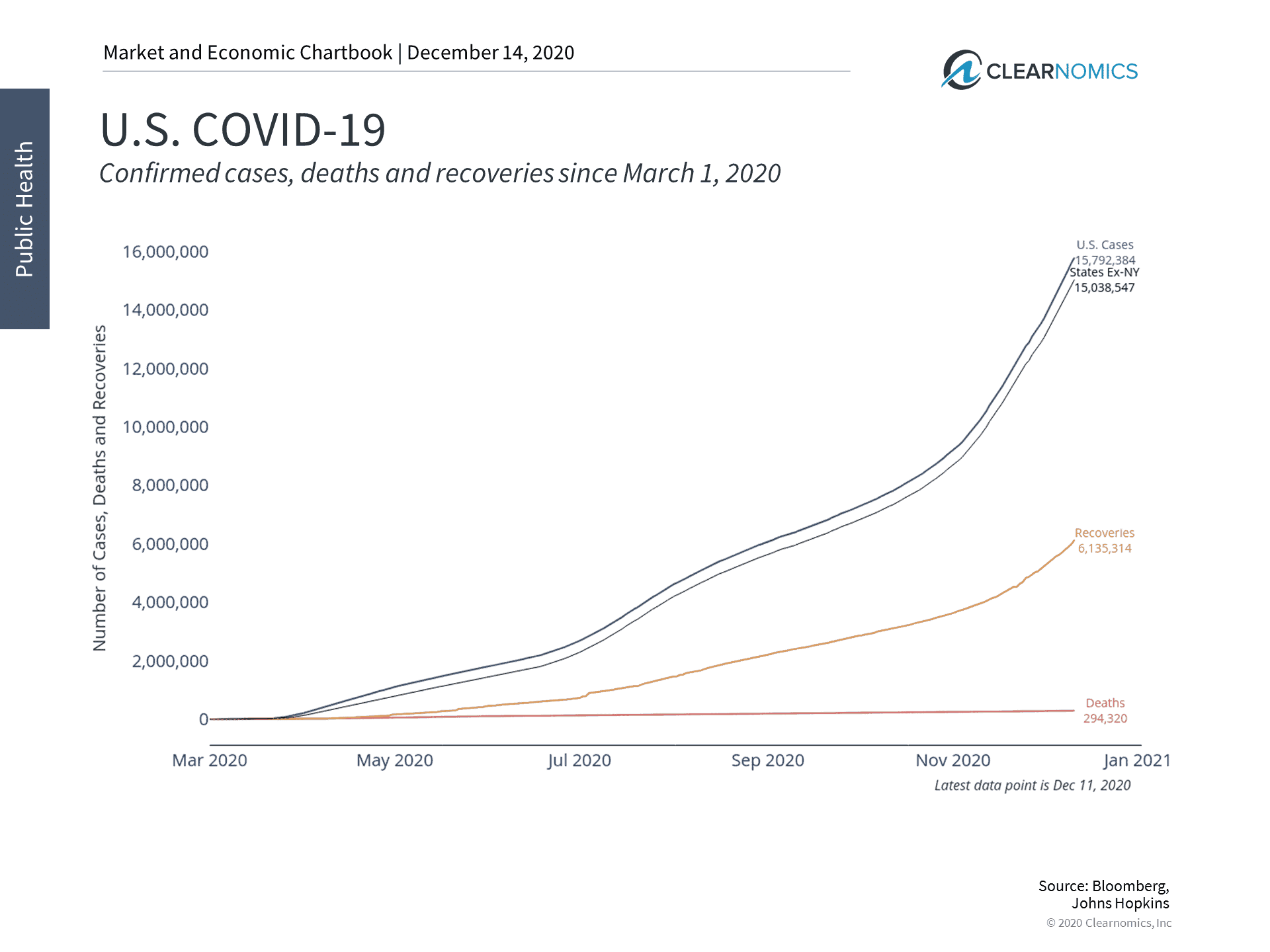

1 COVID-19 cases continue to rise

New COVID-19 cases continue to rise in many parts of the country and around the world. Globally, there have been over 70 million cases. Over 15 million of those cases have been in the U.S. since at least March. It’s possible that the true number is much higher due to undetected cases earlier in the crisis. Fortunately, deaths have not risen alongside cases since the first wave.

2 Dining activity has fallen

While the overall economy has been resilient, many industries continue to struggle. New restrictions have hit the dining, retail and hospitality industries yet again. Only widespread distribution of a vaccine and eventual immunity can help to restore business activity in these sectors.

3 Investors should continue to expect short-term market volatility

2020 experienced the most market pullbacks since 2008. Although there is a light at the end of the tunnel, investors should continue to expect significant market uncertainty in the years to come.

The bottom line? The distribution of vaccines is extremely positive over the coming year. However, investors should continue to stay disciplined in the coming months whether Santa brings us a stocking of coal or a robust Christmas rally heading into 2021.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us .

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index. Past performance is no guarantee of future returns

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.