Midterms and Bear Market Killers

September 28th, Cat-4 hurricane Ian tied for the fifth-strongest storm to ever strike the United States with maximum sustained winds of 150 mph as it hit near Fort Myers, Florida.

The Saturday before hurricane Ian landed, only one of many global computer models predicted an Ian landfall vaguely close to what transpired, with our colleagues at IFP Securities battering down the hatches and evacuating from the Tampa Bay area along with most other people expecting the worst in that region.

Weather channel meteorologists ruminating over the strength and direction of a major hurricane with forecasting tools may help to raise the awareness and blood pressure of viewers along with providing an entertainment factor, similar to predictions on the strength and direction of a market crash and potential recession by the financial news shows.

Headline Risk

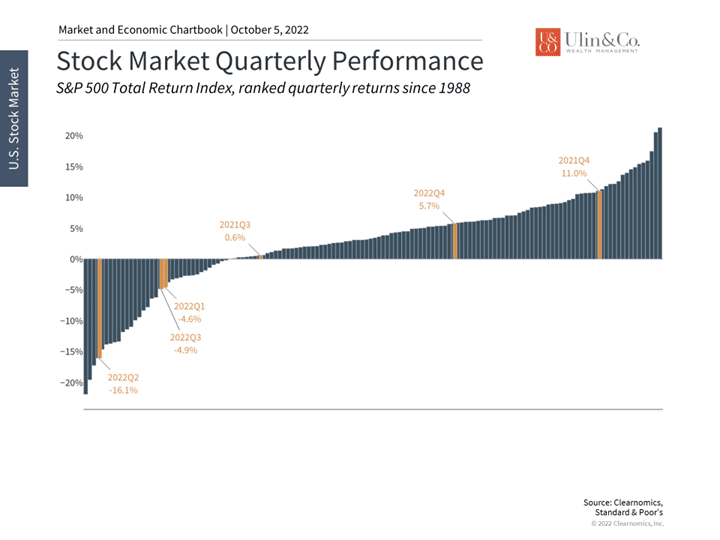

With the U.S. stock market recently retracing the June low a bit below 20%, some investors are getting a queasy feeling that worse days may be ahead. Some people are telling us that the headlines are making this year more painful than what is actually transpiring.

A key principle of investing even for disciplined, diversified investors is that achieving long-term returns doesn’t just involve risk – it requires it. This is true whether markets are down due to the economy, geopolitics, a pandemic, or any of the hundreds of investor concerns over the past few decades.

After all, if staying invested were easy, everyone would do it and there would be no opportunities at all. History shows that those investors who have the discipline and fortitude to handle market pullbacks are more often than not rewarded. So, for those focused on the rear-view mirror, the glass may seem half empty. For those focused on future recovery and growth, the glass is overflowing. Having the right mindset to overcome our own psychology has never mattered more.

As I recently discussed on CNBC, “If you wake up in the morning and decide to cash out and capture losses, it’s either too late or a bad decision. Cash does not provide much in the way of a dividend to pay your bills and will not help to make up for 8% losses to inflation over time in as much as a diversified portfolio.”

Market Cycles and Midterms

History rhymes and at times repeats. More so than providing an opinion or prediction, analyzing current market and economic indicators, fundamentals and trends while looking back at past market cycles can provide some good insight.

Considering the VIX (fear index) and S&P 500 have been a bit rangebound and we are not experiencing a great recession, most average bear markets last 388 days — or just over one year with a downside low near 34%. This may indicate we may be near 70% through the current bear market. As inflation eventually ticks down, we may see stocks move forward while supported by a bit more slower-growth economy.

To add in a bit more optimism, October tends to be a “bear-market killer,” associated with historically strong returns, especially in midterm election years in the midst of 15%+ gains regardless of the cause of the crash. October’s track record may offer some comfort as it has been a turnaround month, or a “bear killer,” according to the data from Stock Trader’s Almanac. Twelve post-WWII bear markets ended in October: 1946, 1957, 1960, 1962, 1966, 1974, 1987, 1990, 1998, 2001, 2002 and 2011 (S&P 500 declined 19.4%) Seven of these years were midterm bottoms.

Q4 Inflationary Market Insights

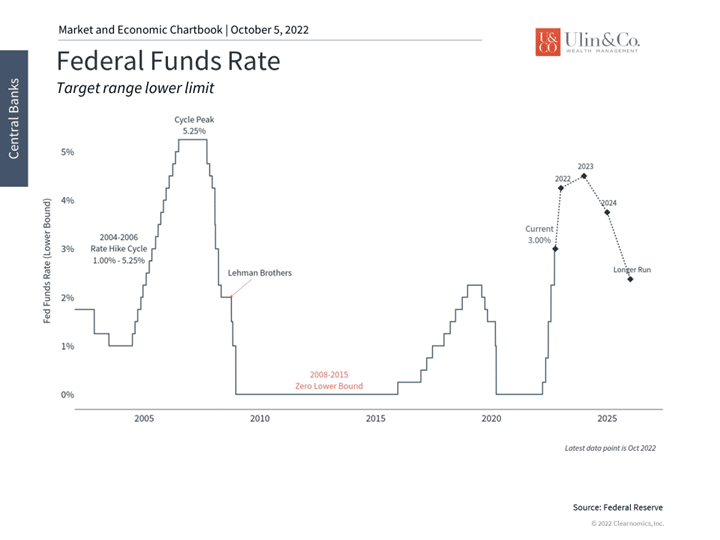

Investors have navigated a difficult market all year and the third quarter was no exception. All major indices ended the quarter in bear market territory. Interest rates jumped with the 10-year Treasury yield climbing above 4% on an intra-day basis, the highest level since 2008. The challenges of persistently high inflation and slowing growth have continued to impact the expectations of both investors and policymakers.

In times like these, investors would naturally prefer to wait until it feels comfortable to invest, and even experienced investors may wonder if markets will ever turn around. This is why it’s important to remind ourselves that while bear markets are unpleasant, they also create opportunities for long-term investors. The valuations of major indices, sectors and styles are at their most attractive levels in years, and bond yields are finally at levels that can support portfolio income.

Below, we highlight seven important insights based on history and current trends that will continue to affect markets and the economy through the remainder of 2022 and beyond.

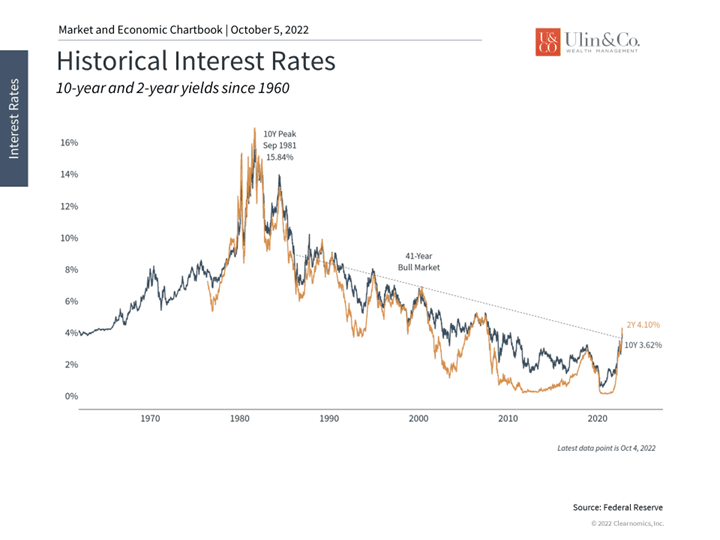

- Interest rates are rising after declining for 40 years

Markets rallied beginning in June but abruptly reversed course in late August. The turn in the market coincided with Fed Chair Powell’s speech at Jackson Hole during which he emphasized that the Fed would continue to fight inflation by keeping interest rates higher for longer. This message was then reiterated at the Fed’s September meeting with the third 75 basis point hike in a row and higher projections through 2023.

This jump in both policy and market rates is breaking a 40-year pattern of declining interest rates. It’s no wonder that financial markets have been volatile as they adjust to a higher cost of capital and slower economic growth. Regardless, both history and the summer period show that markets can move forward once they digest these new expectations.

- The stock market is adjusting to higher inflation and rising rates

While the first three quarters of this year have experienced poor returns, it’s important to maintain perspective on the past few years. Last year experienced some of the best returns as the world emerged from the pandemic. In all, markets are still quite positive since 2020 and the S&P 500 has gained over 40% since the beginning of 2019. Since markets never move in a straight line, it’s important for investors to take the good with the bad in order to not overreact to short-term events.

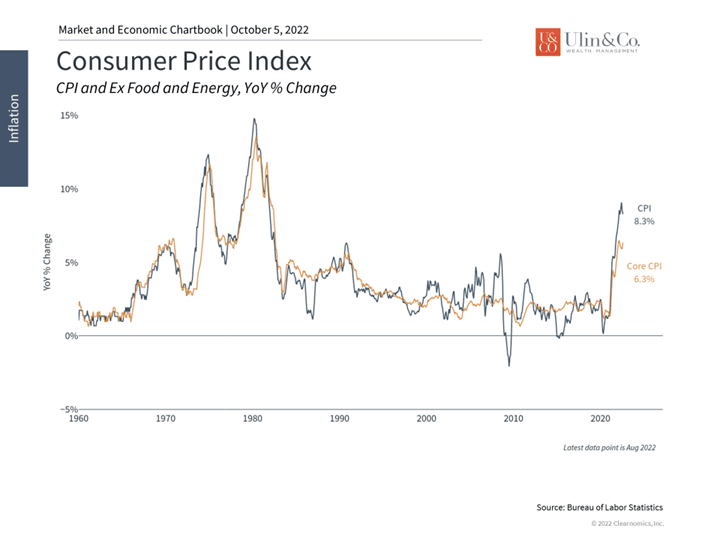

- Inflation is still elevated despite falling energy prices

–

Energy prices plummeted throughout the third quarter, reversing much of the effect of Russia’s invasion of Ukraine on oil and gas markets. This helped to bring gasoline prices down, although they are still higher than during any other period over the past decade. Headline inflation – which includes food and energy – has eased as a result.

Economists and policymakers continue to focus on “core” inflation which re-accelerated in August, a sign that price pressures have broadened and continue to hurt consumer pocketbooks. This is a key reason the Fed has doubled down on its inflation fight.

- The Fed is expecting to keep rates higher for longer

The Fed has communicated that it will keep interest rates higher for longer. This has raised investor concerns over whether the Fed can bring down inflation without creating a deep recession – a so-called “soft landing” versus a “hard landing.” This is a difficult balancing act for the Fed as they try to achieve their dual mandate of both price stability and maximum employment. The markets will continue to adjust to these new expectations in the coming months.

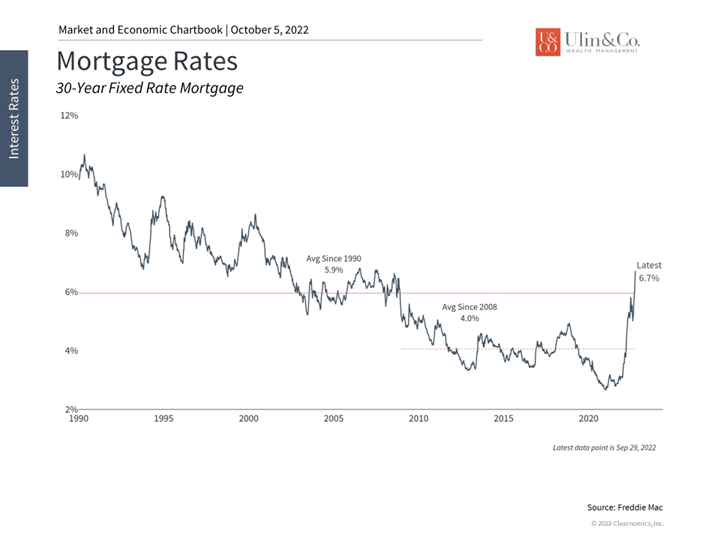

- Higher mortgage rates have slowed the housing market

One of the main effects of higher interest rates is rising mortgage costs. The average rate on a 30-year fixed rate mortgage is now 6.7% – the highest since the mid-2000s and far above the average of 4% since the last housing bubble. Housing activity is slowing across the board from building permits to housing starts, and from refinancing activity to existing home sales.

While there may be some similarities, this underlying situation is quite unlike the housing bubble of the late 2000s. The key difference is financial leverage across individuals, banks, and throughout the financial system. The underlying fundamentals are much better today than those leading up to 2008. Still, a struggling housing market may impact consumer spending and retail sales as household net worth comes down, at least on paper.

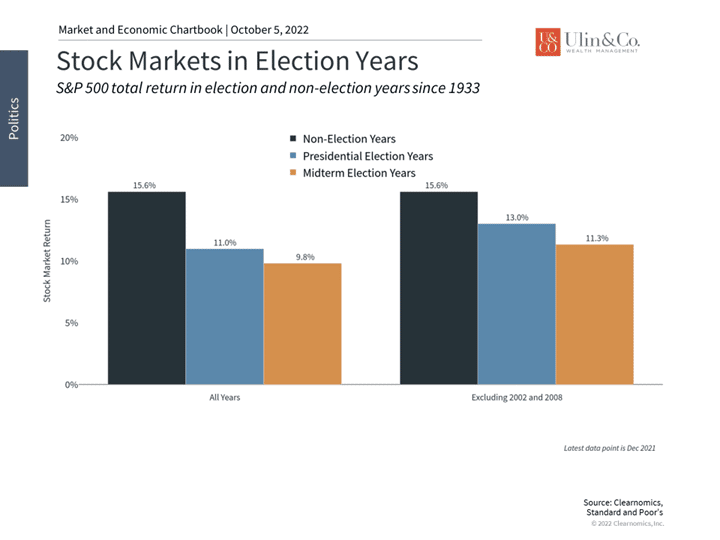

- The midterm elections have not been a major driver of markets this year

The factors that have driven markets this year are mostly independent from the fact that it happens to be a midterm election year. Some investors worry about these years since they tend to have somewhat lower expected returns. However, going back to 1933, history shows that these returns are still extremely positive on average. Other factors such as the economy and where we happen to be in the market cycle have mattered much more.

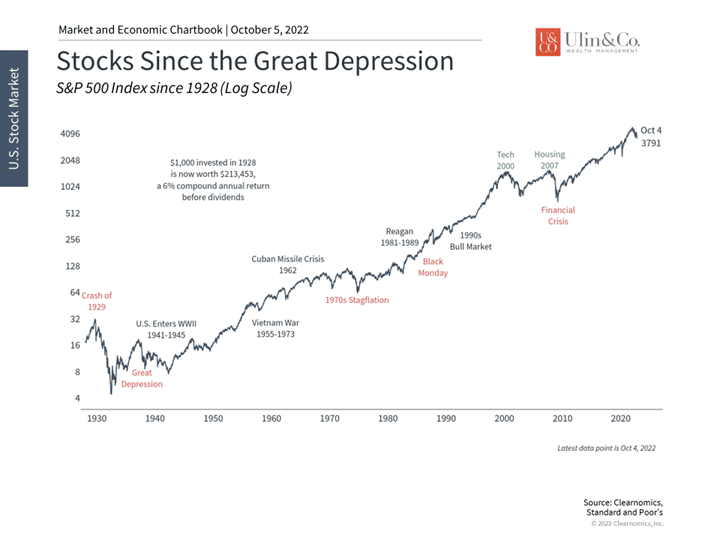

- Investors should continue to focus on the long run

If history teaches us anything, it’s that fighting the urge to overreact to short-term events is one of the keys to long-term investor success. This chart shows the S&P 500 index going back to before the Great Depression. The fact that the market trends upward over time and follows the path of economic growth is clear. Along the way, there were countless major historical challenges to overcome from wars to bear markets. When zoomed out, these look like blips compared to the gains investors achieved over years and decades.

The bottom line? The ongoing bear market is challenging and unpleasant. However, it is no reason for investors to lose sight of their financial goals. In fact, those investors with the discipline and patience to take advantage of opportunities will likely be rewarded in the long run. Improving stock market conditions could be ahead for Q4 and going into 2023 driven by midterms and bear market killers based on past historical rebounds.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetically used for illustrative purposes only and do not represent any actual investment.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment

objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.