Mid-Year Market Outlook – Top 5 Issues

The COVID19 pandemic driven market crash and subsequent rebound over the past year is another wake up call of how catastrophic events seem to tie financial and non-financial events together with a reach affecting people across the planet, well beyond Wall Street. Impulsive reactions to a major market or black swan economic event in the short term can end up being of greater harm and consequence to your portfolio and long-term plans than the actual incident itself.

Uncommon Events are Becoming More Common

Former Wall Street trader and finance professor Nassim Nicholas Taleb’s book “Fooled by Randomness” describes a “black swan” event as an occurrence that 1) is beyond normal expectations that is so rare that even the possibility that it might occur is unknown, 2) has a catastrophic impact and 3) is explained in hindsight as if it were actually predictable.

Black Swan events are becoming more frequent rather than being a rarity, from the dot.com crash (2000), 9/11 Terrorist Attacks and Afghanistan War (2001), Iraq War (2003) China SARS Virus (2003), Global Financial & housing Meltdown (2008), Fukushima Nuclear Disaster (2011), Crude Oil Crash (2014), China Black Monday (2015), Zika Virus (2016) and most recently the COVID19 Pandemic (2020).

For more than a century, diversified portfolios have helped create and conserve wealth for those who have stuck to their plans despite fear and uncertainty by employing an ongoing, repeatable investment process and sticking with it. Helping to ensure short-term pessimism is not at the expense of long-term optimism is a major key to successful investing over time.

Where We’ve Come Over the Past Year

2021 has been a historic year for the economy and stock market. Economic activity is recovering at a once-in-a-lifetime pace as businesses expand and consumers spend. Financial markets are grinding higher with many major indices generating double-digit returns year-to-date, despite shifts in sector leadership. Inflation, which has been subdued for decades, is heating up. The pandemic rages on in parts of the world, but signs of recovery are spreading too.

If the best guidance for long-term investors last year was to focus on the light at the end of the tunnel, today the economy has already cleared the tunnel. In fact, it’s likely that, in the second quarter, U.S. GDP broke through previous peaks reached in 2019. Many economic indicators, from manufacturing PMIs to retail spending, are at levels not seen in a generation.

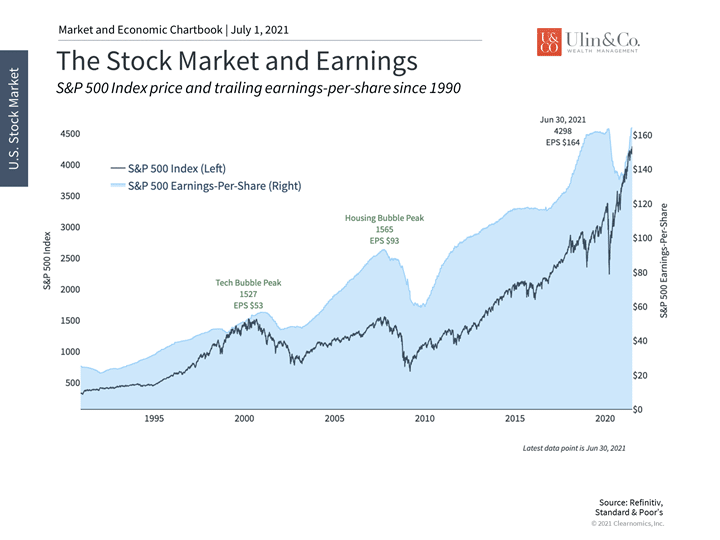

This is even more true of the stock market which has been anticipating a full recovery since last year. S&P 500 earnings-per-share have returned to pre-pandemic peaks and are expected to grow at a breakneck pace over the next year. While valuations have been stretched to almost dot-com era levels, growing earnings could continue to keep the bull market healthy. (see below) Rising interest rates and commodity prices, while tricky for bonds and inflation, have helped a variety of sectors including financials, energy and materials.

While the comparison to pre-pandemic levels is natural, the market is already looking further down the road. Consensus expectations are that the economy will hit a new gear as the business cycle continues forward. The pent-up demand in spending on both goods and services could be met by a further ramp up in new hiring activity by businesses large and small.

As the recession and recovery have been unusual by historical standards, there are reasons to believe that diversified portfolios can do well, even with the uncertainty of inflation and rising interest rates. Below are five investor concerns and insights that can help keep questions in perspective as part of our 2021 mid-year economic and market outlook.

Top Five Investor Issues

1 Has the economy fully recovered?

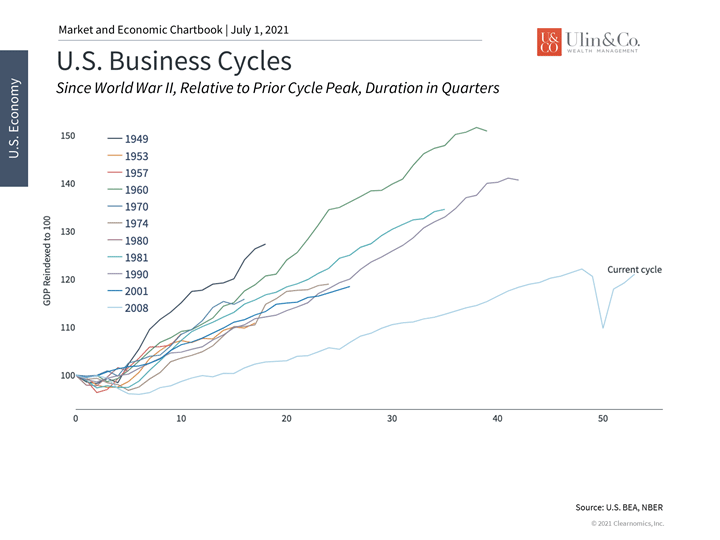

The U.S. economy, measured by GDP, had already recovered to within 1% of its pre-pandemic peak at the end of the first quarter. All signs point to an economy that achieved new highs in the second. From industrial production to retail sales, nearly all gauges of economic activity show signs of strong growth. Of course, this is expected during the early stages of a recovery and reasonable investors should expect the pace to slow somewhat.

2 Are stocks still attractive?

The economic recovery has directly translated into a recovery in corporate profits. S&P 500 earnings-per-share are also back to pre-pandemic levels which helps to make valuations levels more attractive. Like GDP, consensus estimates are for earnings to grow at a healthy pace over the next 12-24 months.

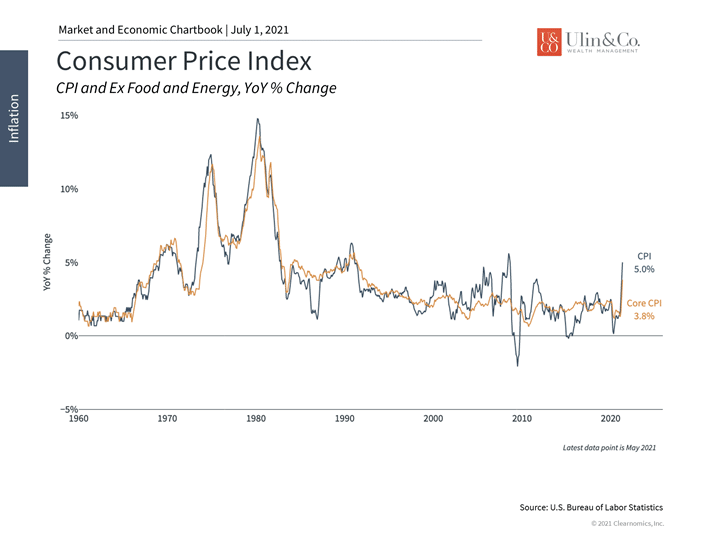

3 Will inflation overheat?

One red flag has been rising inflation which is often a sign of an overheating economy. The fact that price pressures have generally been subdued since the early 1980s has made it all the more important for investors to understand the risks to their portfolios.

However, it’s also important to understand what is driving inflation today. First, the recovery is naturally pushing prices higher compared to mid-2020. Second, supply and demand disruptions have occurred across industries but should eventually clear. Third, the Fed continues to keep monetary policy loose and the government is stimulating the economy while adding to the over $5 trillion in pandemic relief with new economic and infrastructure bills.

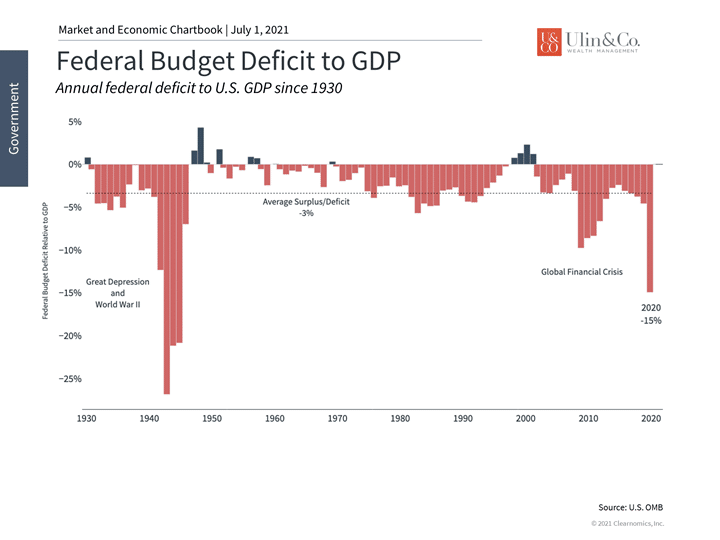

4 How big is the government deficit?

Government emergency spending over the past 18 months pushed the federal deficit to levels not seen since the Great Depression. However, this is typically what happens during economic crises and times of war. As the economy recovers and emergency stimulus is no longer needed, the deficit should improve as a percentage of GDP.

While many investors would prefer that the government run balanced budgets or generate surpluses for a rainy day, this seems unlikely. Instead, it’s important for investors to not overreact in their portfolios to short-term government spending.

5 Will the Fed end the party?

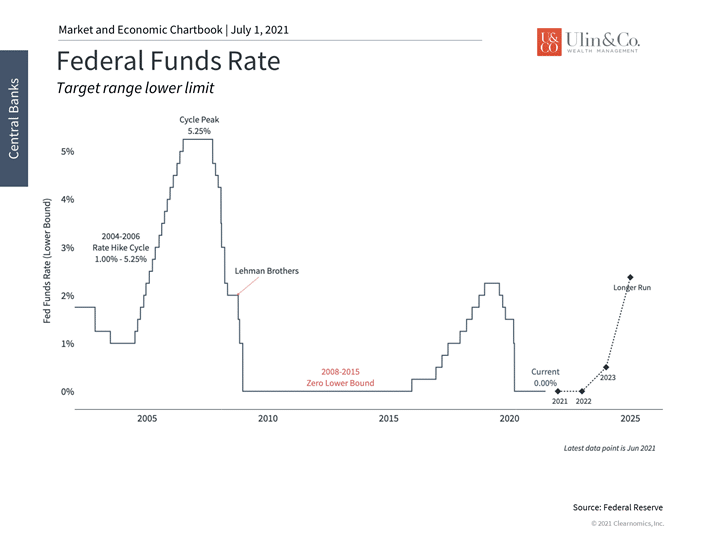

With the economy fully recovered and inflation rising, many are expecting the Fed to begin “tapering” its balance sheet expansion as a first step before then raising short term rates. The Fed’s latest projections show that they expect rates to begin rising in 2023 – at least a year and a half away.

Of course, this could begin much sooner if the data continues to heat up more. Still just the announcement 8 years ago in the summer of 2013 by then Fed Chair Bernanke of just the “intent to taper” its bond buying program, caused a widespread investor “taper-tantrum” bond sell off while pushing up long term rates and pushing many bond indices in the red for the year.

The bottom line? Behavioral biases in your brain triggered from existential events can often lead to poor investment decision making and contribute to significant underperformance over time. This indicates that having a disciplined money mindset and investment process in place are both equally important to help grow your savings over time and to stay on track.

While the first half of the year as the economy briskly rebounds from the complete pandemic world shutdown in 2020 was historic by many measures, investors should stay optimistic, balanced and diversified as we enter the next phase of the business cycle.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.