White Collar Tech Recession

The recent economic headlines du jour are now questioning whether the snowballing tech and finance layoffs are the start of a white collar tech recession that may lead to darker recessionary times as companies adjust to slowing sales and profitability. Many mega-tech names are in the news for massive layoffs including Meta, Amazon, Twitter, Microsoft, Salesforce and Google. This topic is very personal to me and our clients, having designed and run workplace financial education programs in South Florida for regional locations of IBM, Microsoft and Sprint, to start-ups – going back two decades.

These layoffs may not be an ominous sign that the sky is falling or that we may have a repeat of the Great Recession of 2008, but a strong, unsurprising signal that the Fed’s goal to cool off the job market and an overheated economy appears to be working, albeit in moderation. The job market is still robust. U.S. unemployment rate fell to 3.4%, the lowest level since 1969 as economy continues to create new jobs.

US employers in January announced over 100,000 job cuts, the most since 2020 with the tech sector making up close to half of that, according to data compiled by Challenger, Gray & Christmas, Inc. This is a swift reversal from small and large tech companies going on a hiring spree to keep up with unprecedented demand fueled in part by people spending more time at home, flush with cash since the 2020 quarantine. While the number of job cuts may sound significant, consider that most companies only cut about 2%-10% of their workforce and that there are some 165 million people in the U.S. working across all job sectors.

White Collar vs Blue Collar – Where to Invest

As noted in Forbes (11/21/22) “Tech Layoffs,” the idea behind a white-collar recession is that they’re much easier jobs to downsize right now from tech to banking. Companies like Meta and Amazon are able to streamline their headcount and reduce focus on certain units without impacting their core business and sales.

This cutback is more difficult in blue collar industries. These types of roles directly impact the output and revenue of a company. If you lay off a bunch of construction workers, construction projects won’t be finished on time. If you sack half your truck drivers, goods won’t get shipped.

How should you invest if the white-collar recession gets worse? You could pick stocks, funds or sector indexes that focus on blue-collar industries, such as automakers and manufacturing companies while going lower in tech and finance white collar companies and industries. Or for the sake of your own stock picking skills and sanity, simply create a diversified portfolio to cover all your bases rather than try to make predictions.

Tech Jobs are Abundant

From an investing perspective, the tech fallout over the past year was not really a tech-wreck on the level of the Y2K dotcom crash fueled by thousands of startup companies going bust like the sock puppet mascot of pets.com going down in flames. But is in fact a white collar tech recession that will take time to sort out.

Jon here. Even with extensive layoffs fueled by tech companies focused to chainsaw down costs, many of our skilled and experienced tech clients in their 40’s, 50’s and 60’s are maintaining their current jobs from management or sales to programming or finding a new position in a lateral move.

The innovation of tech into most industries with major disruptions in exciting new sectors from DNA sequencing and medical research, robotics, energy storage, electric vehicles, cybersecurity, and artificial intelligence, to blockchain are still in need of qualified tech workers. It’s like a repositioning from FAANG to innovation.

Compared to the dotcom era, today’s tech companies offer a bit more real products and services that provide tangible value, and many of them are doing so at extremely high profit margins. The crypto crash and other blockchain fiascos may be a bit still in its infancy stages like tech in Y2K and had significantly more layoffs this year.

How Jobs and Spending Affect The Economy

Whether the white-collar recession spills into the broader economy is the subject of debate among investors and economists. With markets already expecting a mild recession in 2023, consider the following points when investing through 2023.

The economy has slowed over the past year

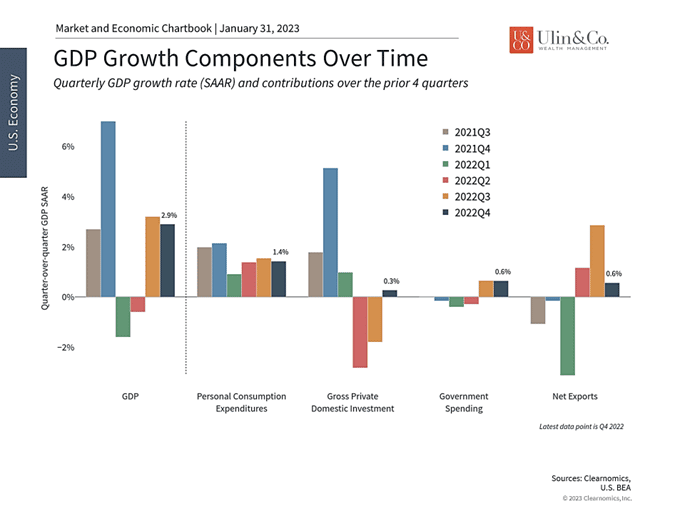

There is no doubt that the economy has slowed from the rapid post-pandemic pace that fueled overexpansion by companies and, arguably, overconfidence. Recent GDP data indicates that the economy grew 2.1% in 2022 compared to 5.9% the year before.

From a macroeconomic perspective, this is the result of the usual culprits that have dampened the mood of consumers and businesses: inflation and Fed rate hikes. This has hit the category of residential fixed investment especially hard as the housing market adjusts to higher interest rates. Similarly, consumer spending slowed at the end of last year with retail sales figures declining 1.1% in December and personal consumption expenditures, which are adjusted for inflation, falling 0.1% in November and 0.2% in December.

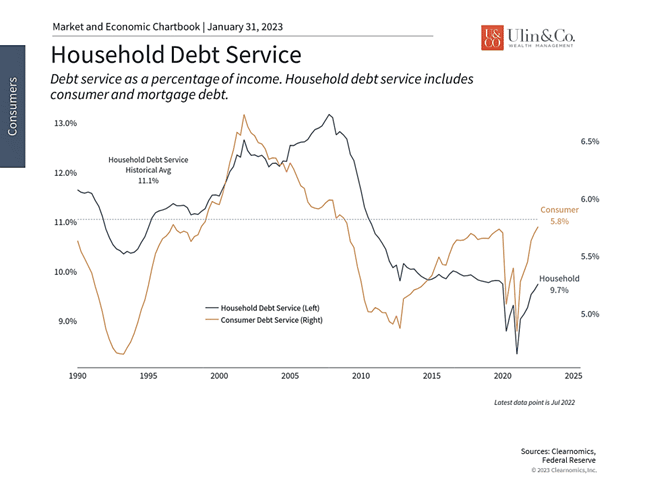

Consumer spending both impacts the job market and is impacted by it. Strong consumer spending drives top-line revenue growth for businesses and creates incentives to expand. Technology and consumer sectors in particular benefited from these trends over the past few years as households spent their pandemic savings and stimulus checks, while also taking on more debt. This fueled rapid hiring activity and led to record job openings and strong wage gains.

The reversal of these trends as households reduced discretionary items, including on personal computers and home furnishings, is why these sectors are now experiencing layoffs, even though staffing levels are still generally higher than they were beforehand. Large tech companies are laying off thousands as we discussed above. Outside of tech and finance jobs, companies such as Dow, 3M, Hasbro, Wayfair and many others have announced similar job cuts.

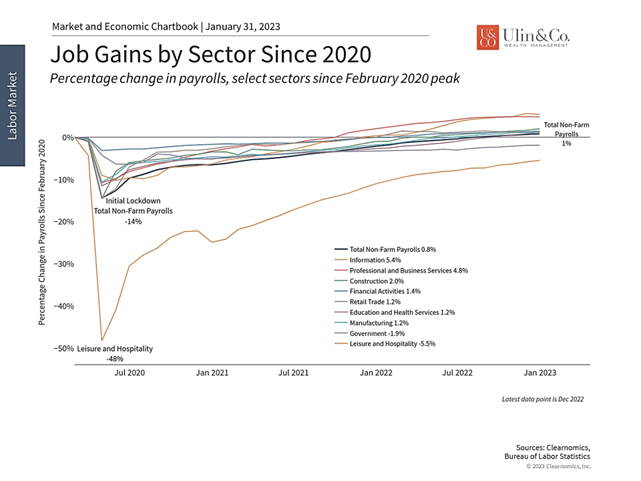

Job gains have slowed with sectors such as Information experiencing layoffs

While layoffs are never pleasant for individuals or companies, investors need to maintain a broad perspective to best understand how they might affect markets. Whether these layoffs have a domino effect on the rest of the economy depends on whether they are only the result of over-hiring in specific industries, or due to broader economic trends such as slowing growth and the Fed’s battle against inflation. Consider the following three key factors.

First, these layoffs which number in the hundreds of thousands, while large in isolation, are a drop in the bucket compared to the overall economy which added 4.5 million net new jobs in 2022, 6.7 million in 2021, and averaged 2.3 million each year in the decade leading up to the 2020 recession (US DOL). Similar to the early 2000s tech bubble, the economic impact has been isolated so far even if it’s had a large impact on specific sectors. In this sense, current layoffs represent a “white-collar recession.” Areas such as manufacturing and even leisure and hospitality have not yet been subject to similar job cuts.

Second, while it’s still too soon to say for certain, there are signs that the rest of the economy can remain healthy. Although GDP slowed in 2022, growth was robust in the second half of the year. Inflation has been easing over this same period, increasing the likelihood that the Fed pauses its rate hikes later this year. And while many expect flat GDP growth in 2023, few expect anything worse than a mild recession.

Household debt is growing

Third, consumer confidence has suffered due to high prices but is now recovering. Whether this continues will depend largely on the debt loads that many households are facing amid higher mortgage rates and signs that delinquencies may be rising in areas such as auto and personal loans. Still, debt levels are nowhere near levels that led to the 2008 financial crisis.

Ultimately, recessions and layoffs are a natural part of the economic cycle. These are times when workers, especially those with advanced training and highly specialized skills, are re-allocated to where they are valued the most. Specifically, areas like tech that may have overexpanded in recent years will continue to see workers change companies and even industries, eventually reaching a new equilibrium. Just as it has across history, this sets the stage for future growth.

The bottom line? While the layoffs coined as a massive white collar tech recession are challenging for individuals, investors should maintain balance as the effects of overexpansion within sectors and higher interest rates across the economy play out. History shows that these periods often set the stage for future business cycles.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor. White Collar Tech Recession

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.