Wars to Wall Street

From an unpleasant 2018 to a fantastic 2019 for the U.S. and global markets, to discussions of a trade-war to an actual world-war, don’t let headline news or recency bias drive your portfolio decisions. Market timing driven by greed and fear can be the fool’s errand for long term investors.

This past week had a major escalation in Mideast tensions. Oil prices climbed and the Dow Jones futures sold off Tuesday night as two Iraqi bases with U.S. troops came under rocket attack by Iran as retaliation for the U.S. airstrike that killed the top Iranian military commander.

Wars

Overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session. Sustained, yet decelerating corporate profits, low unemployment, mild inflation, low interest rates and an accommodative monetary policy globally may not put an end to the almost 11-year-old bull market due to geopolitical crises. In fact, historically, war has may lead many times to increased jobs, industrial production, inflation and economic growth.

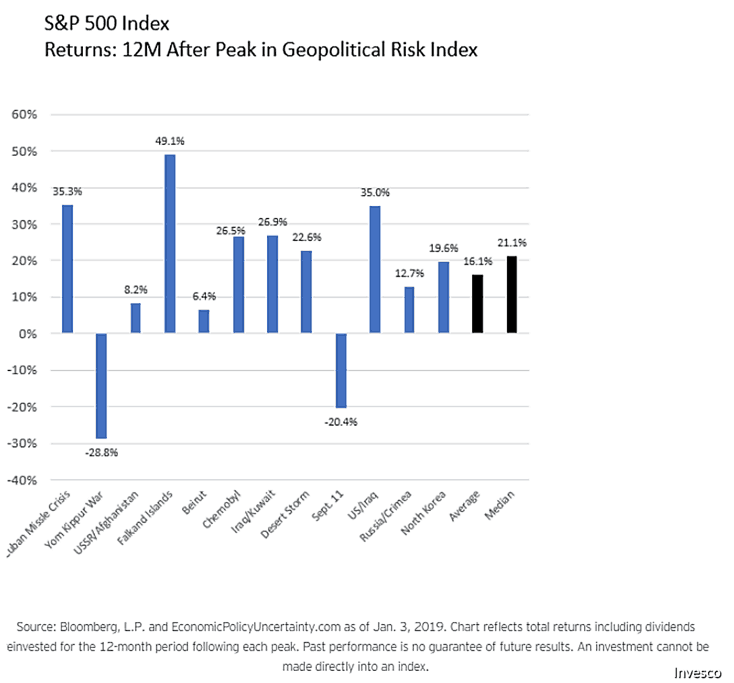

A review of 20 major geopolitical events going back to World War II indicate that stocks had fully recovered losses within an average of 47 trading days after an average maximum drawdown of 5%, according to a CFRA study. In fact, market returns, on average, have been positive 12 months after spikes in economic uncertainty, as measured by a widely followed Geopolitical index (see below)

In uncertain times, investors should remember that stock market swings are normal and expected. Just over the past ten years there have been numerous geopolitical events which rattled markets for weeks or months. These include nuclear threats out of North Korea, Russia’s annexation of Crimea, and instability in parts of Latin America including Venezuela, Argentina and Chile. Despite strong stock market returns, none of these issues have truly been resolved.

Even oil prices in the USA have been a bit more resilient to geopolitical events and price swings from the rise of fracking over the past decade, which has dramatically lessened our dependence on imported oil, and with it, our sensitivity to supply disruption. In 2018, for example, only about 11% of the oil the U.S was imported – the lowest level since 1957. Of that, our biggest supplier, by far, is right next door: Canada

Trade Wars

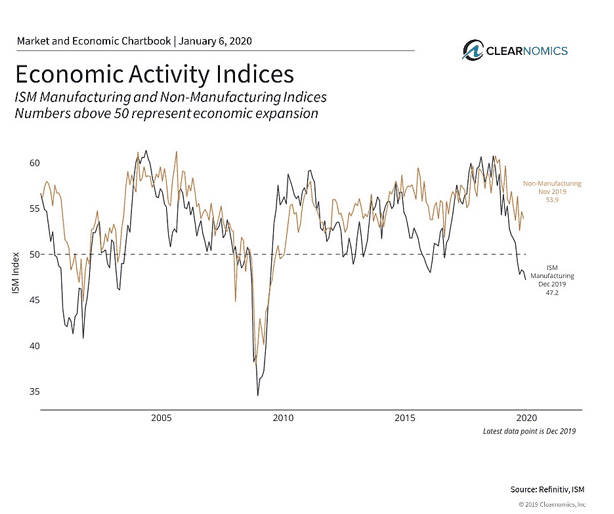

In the long run, markets can stabilize if the economy and fundamentals are strong. This is why the most important new data for the economy and markets last week was the ISM Manufacturing index which fell to its lowest level since June 2009 (see below.)

Much of the manufacturing decline is the result of the U.S.-China trade war and its follow-on consequences. The tariffs imposed last year by both sides reduced U.S. manufacturing demand and shifted production to other countries. Now that an interim “phase one” trade deal has been agreed upon and is scheduled to be signed on January 15, manufacturing activity could recover but perhaps only slowly.

While manufacturing only makes up about one-tenth of the U.S. economy, this decline is also indicative of a larger deceleration. Non-manufacturing activity is still expanding, but at a slower pace, as shown by the ISM Non-Manufacturing index below.

The point for investors is that while the economy is still generally healthy, economic growth has been slowing for some time. After all, we are nearing the eleventh anniversary of this historic business cycle, and it’s unrealistic to expect an aging expansion to grow at the same breakneck pace forever.

At the moment, investors are hoping that factors such as a trade deal with help speed up economic growth globally – a return to the “global coordinated growth” experienced in 2017.

There are many factors which may affect future growth such as the U.S. dollar. A strong dollar tends to hurt growth because it reduces the competitiveness of our exports. The dollar has been strong for quite some time due to the overall stability of the U.S. economy. With other regions stabilizing, a slightly weaker dollar may help the economy.

Below are two charts discussed:

1 Manufacturing activity continues to slow

U.S. manufacturing continues to decline. The December reading of the ISM Manufacturing index is the fifth consecutive reading below 50 (i.e. showing that manufacturing activity is shrinking) and the lowest level since 2009. In contrast, non-manufacturing activity is still expanding, just at a slower pace.

While many are hoping for a swift global growth recovery, long-term investors should continue to set realistic expectations and focus on how they diversify their portfolios and navigate global economic changes and geopolitical events through 2020.

2 Geopolitical events have not damped returns over time

The bottom line? No one can predict how an Iran war would affect the world or oil prices – and the markets may not respond the way you would assume. While we cannot control world events or compete against volatility issues on the street caused by algorithms and quant traders, we should focus to control our own behavior and not panic with our investment strategy based on short term headline news.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.