Trump vs. Harris: Election-Proof Your Portfolio

With just days until the November 5th presidential election, the race between former President Donald Trump and Vice President Kamala Harris is tight. Amid today’s intense political divides, election-related emotions are running high. Now more than ever, it’s essential for investors to keep politics from disrupting their long-term financial goals.

While traditional polling numbers are close though lagging, political betting markets are taking center stage this election season as investors track the odds amid tight polling and high stakes. RealClearPolitics shows Trump’s victory probability ranging from 57% on Smarkets to 62% on Polymarket, while Harris had greatly led most markets as recently as late September.

America’s political divide is as intense as it’s been since the Civil Rights era of the 1960s. Major rifts also emerged during the Vietnam War protests in the late 1960s and early 1970s, and again during Watergate in the 1970s. In recent history, the 2000 Bush vs. Gore election was deeply polarizing due to the Florida recount from voting machine errors, but today’s divisions over issues like economic policy, cultural values, national security, and the role of government appear especially intense, heightened by constant media coverage and social media dynamics.

Cutting Through the Noise

The headline controversy in the Trump vs. Harris election cycle is placing greater emphasis on the integrity, quirks, personality, age and mental acuity of each candidate with vicious attack ads, more so than their proposed policies, leadership abilities and foreign policy experience. As financial advisors and wealth managers, our job is to disconnect from the noise of the election cycle and continue to work to help conserve and grow our clients’ capital over time, regardless of who ends up in the oval office.

Until last week, stock-market investors seemed unfazed by the Trump vs. Harris election outcome – until rising election jitters finally shook equities with just under two weeks to go. A sharp climb in Treasury yields since September added pressure, threatening to end this year’s record rally. Traders worry that both candidates’ policies and actions could further fuel inflation and rates while continuing to snowball the U.S. deficit.

From the recent Gallup poll, the economy ranks as the most important of 22 issues. Voters view Trump as better able than Harris to handle the economy (54%). Trump also has an edge on perceptions of his handling of immigration and foreign affairs by 10% each, while Harris is seen as better on climate change (+26%), abortion (+16%) and healthcare (+10%). The candidates are evenly matched on gun policy.

Election-Proof Your Portfolio

Markets currently face uncertainty, with no clear sense of which policies will be pursued – or implemented. A divided Congress appears to be the most likely outcome, which could be a positive for both markets and the U.S. economy. In such a scenario, major legislation that might alter the economic trajectory would be challenging to pass. While we might see modest moves on tax cuts, tariffs, or immigration policy, any changes are unlikely to be as extreme as campaign rhetoric has suggested.

The U.S. president has some authority to act unilaterally on specific issues without Congress’s approval, typically through executive orders and regulatory changes. Some examples in addition to pardons include power to initiate military actions and immigration enforcement, as well as the ability to impose tariffs and modify trade restrictions. Through federal agencies, the president can guide how regulations are enforced or modified, affecting policies related to healthcare, labor, environment, and education.

Regardless of one’s heightened emotions and impressions for either presidential candidate, our election-proof your portfolio steps involve (1) Pre- election: avoid market timing or making any significant changes to your portfolio such as “cashing out” or being overweight in any one asset such as gold or crypto (2) Pre-election: review your asset allocation and diversification strategy as related to your risk tolerance profile (3) Post-election: prepare for potentially higher inflation and higher interest rates (under either candidate) that may put stressors again on bonds, stocks and the economy. In now the third year of the bull market there may be “no landing” from the Fed with a slowing economy and snowballing U.S. debt that may lead to larger problems over time.

Emotion-Proof Your Brain

When we become emotionally charged, we become rationally challenged. A recent CNBC headline titled “How to ‘emotion-proof’ your portfolio ahead of the presidential election” perfectly sums up the state of our insanity over this year’s election cycle. In a survey by the American Psychiatric Association, 73% of people said they felt very anxious. “In times of uncertainty, which is typical around election periods, we are really prone to just absolutely destroy ourselves financially,” says one therapist.

Political science research has found that people don’t always vote in a way that reflects their policy preferences. A principal obstacle is lack of knowledge. In surveys, voters often can’t distinguish presidential candidates’ stances, even on critical issues or how policy changes may personally affect them and our nation.

Now is a good time to use your anxiety and worries to drive action by revisiting your financial planning goals while evaluating your portfolio strategy and risk profile. In other words, make sure to go and cast your vote for the 2024 elections, but don’t vote with your portfolio in one direction or the other, or make any major short term moves.

Elections vs Economy

When it comes down to it, long-term investors should be wary of claims that one candidate or another will “kill the market” or “ruin the economy.” It’s likely that this has been said about every president in modern times across 14 presidencies since 1933 (7 from each party). Looking back at the performance of the S&P 500® Index since 1928, the Schwab Center for Financial Research found that the market ended on a positive note in 17 of the past 23 presidential election years—or 74% of the time—with an average annual return of 7.1%.

Of the six presidential election years that coincided with down markets, most had obvious explanations. In 1932, the country was in the midst of the Great Depression; in 1940, the world was on the brink of war; in 2000, the tech bubble burst; and in 2008, markets suffered a fallout from the financial crisis. In other words, market performance in those years likely had little to do with the presidential election or political party affiliations.

Where to invest

As both candidates’ policies are likely to stoke inflation, interest rates and deficits, we are more focused on adjusting our client’s portfolio allocations on these parallel economic outcomes over time, rather than getting steered by emotional opinions in the short run. Still there are nuances on where to invest – whether a Harris or Trump presidency.

We strongly caution against mixing portfolios and politics. While trying to pick political winners is futile, working to “crystal-ball” election investments in your portfolio may be equally ineffective. Some investors are asking us on “what the best Harris or Trump sectors or stocks may be,” or telling us they are working to “cash out and instead sit on the sidelines” from their own research.

More than a few investors we spoke to recently are greatly concerned about the direct potential impact of policy changes (such as on income, estate and capital gains taxes along with healthcare, that will affect middle- and upper-class Americans) which if either party won a house and senate majority could be issues to keep an eye on. From a high level, it may be possible that under a Harris Presidency (if not much changes from the past administration) renewable energy and infrastructure (industrial) sectors may benefit, while under Trump, infrastructure, traditional energy (oil, coal), financials, technology, defense and aerospace sectors may excel.

As we do not promote market timing or stock picking, focusing your energy on executing and maintaining a diversified “all weather” portfolio – no matter who wins the White House in November -may be a more disciplined and less stressful way to proceed.

How Presidential Elections Impact Wall Street

With the late unveiling of policies, both candidates have some investors concerned about how each policy platform might impact the economy and financial markets. As with all elections, the perceived stakes are high, and with greater political polarization in recent years, emotions are running as hot as ever. In this challenging environment, consider the following points to help stay on track with your investing goals.

The economy is in the spotlight leading up to the election

Political issues undoubtedly play an important role in our daily lives, influencing everything from our tax bills to industry regulations. This heightens the importance of elections, since they are how we can express our preferences for a range of social and economic policies. However, it’s important for investors to vote at the ballot box and not with their portfolios. History emphasizes the importance of separating our personal views from our investment and financial decisions.

When viewed through a long-term investment lens, presidents often receive too much credit (and blame) for economic conditions. Most times the major events during a Presidents tenure are more of a coincidence than a result of their actions or policies. The true drivers of long-term economic performance are the underlying business cycle trends, which are far more powerful and long-lasting than any single administration’s policies. And, over time, business cycles are what drive investment returns and wealth creation.

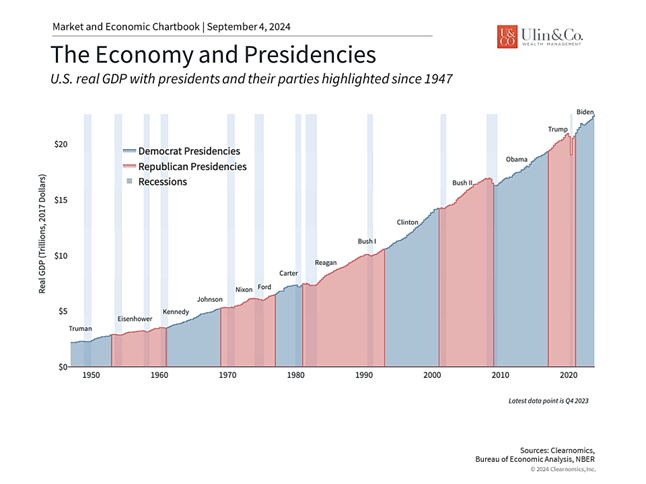

This is highlighted by the accompanying chart (above) which shows the level of the country’s gross domestic product, a measure of the size of the economy, since World War II. There have been a dozen business cycles and recessions over this period, including the recent pandemic crash, the 2008 global financial crisis, and the 2000 dot-com bust.

These were the result of both external shocks to the economy as well as trends that had little to do with who was in control of the White House from Clinton in the late 90’s to Bush in the early 2000’s. The globalization, information technology revolution, and expansion of financial markets that took place over these years played far greater roles. The overall pattern is clear: the economy has grown steadily over the past eight decades across both political parties.

Consumers are the central focus this election season

As the candidates’ policy platforms continue to unfold, understanding this bigger-picture context is important. This is not to say that economic policies do not matter, just that investors should not overreact to the results of any individual election or a specific policy.

In fact, it’s often the economy that impacts elections, and not the other way around. This is especially true because the two candidates’ platforms are naturally backward-looking, focusing on what households have experienced over the past few years. For instance, according to a recent poll by The Economist/YouGov, 24% of Americans rank “inflation/prices” as the most important issue, followed by “jobs and the economy” at 13%. This is not surprising given the recent market and economic swings due to inflation, interest rates, and Fed policy.

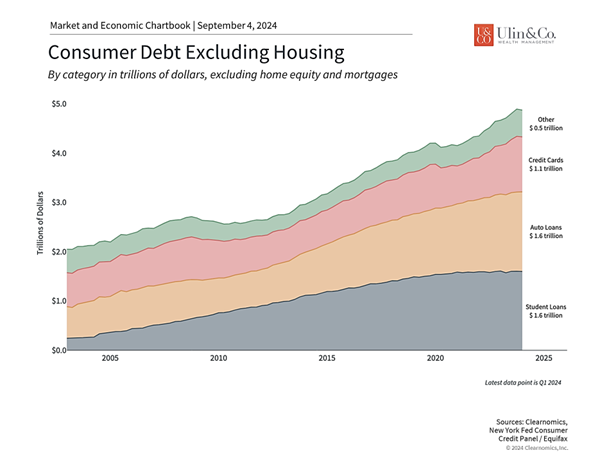

Even though inflation pressures have eased significantly, and the economy is strong by many measures, very few consumers feel confident in the economy or their financial situations. This is largely because consumer debt has risen dramatically, as shown in the chart above. Total non-mortgage consumer debt has more than doubled in the last 20 years across Democratic and Republican presidencies. Credit card debt is at record levels while student loan and auto loan balances are increasing at their fastest rates since 2003.

This is why President Trump and Vice President Harris have both built their economic platforms around consumers. Despite the many social differences between the two candidates, there are broad similarities between their economic proposals. Both focus on the cost of living across grocery bills – including the cost of bacon, bread, and ground beef – prescription medication, and housing. In recent weeks, both candidates have also agreed on expanding child tax credits and not taxing tips. Politically, it makes sense that both candidates are speaking to those who feel “left behind” given the economic turmoil of the past few years.

Taxes and the deficit are also in focus

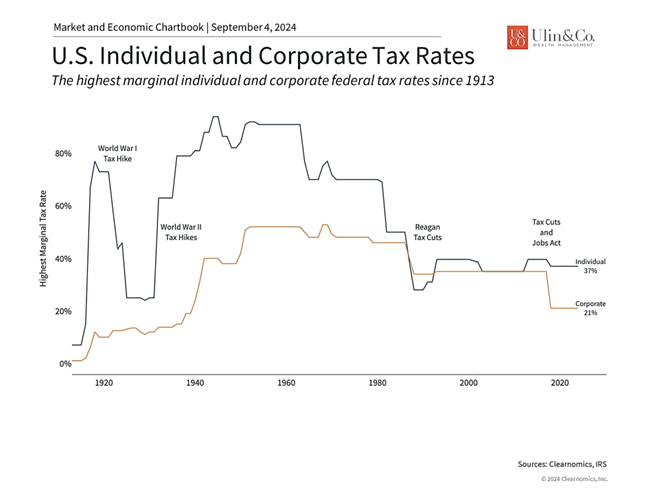

As expected, there are also differences in key areas like taxes and the policy tools each candidate would use. Trump, for instance, is in favor of extending his administration’s tax cuts and potentially lowering corporate tax rates, while Harris has focused mostly on tax credits for middle- and lower-income Americans while raising taxes (capital gains tax and estate tax) for the upper class.

Make sure to keep an eye on the Trump Tax Cuts and Jobs Act (TCJA) of 2017 that introduced sweeping changes including reduced individual tax rates, increased standard deductions, and expanded child tax credits. These provisions are set to expire at the end of 2024, and if they revert to pre-2018 levels, the effect may be felt across a broad swath of taxpayers, not just the top 1%.

If Vice President Harris takes office and allows the TCJA to expire next year, the impact could extend to middle- and upper-middle-class Americans. Estimates suggest up to 90% of taxpayers could see tax increases on marginal tax rates, a standard deduction reduction and reduced child tax credits. A smaller percentage of Americans may be affected by the estate tax exemption amount expected to be greatly reduced.

Despite the perceived differences between the two parties, many policies often stay in place during transitions of power, and the changes that do occur tend to be incremental. In many ways, this is a feature of our political system since it takes broad support to enact new policies, even when the president’s party also controls Congress. For instance, the Reagan-era tax cuts have remained largely intact for decades. Similarly, many of the Trump administration’s tariffs, which were controversial at the time, have remained in place under the Biden administration.

Of course, tax cuts and credits need to be paid for somehow – either through lower spending in other parts of the federal budget, greater tax receipts, or rising debt levels. These receipts can either occur through higher tax rates in the future or through faster economic growth.

Unfortunately, since government spending tends to only rise, recent history shows that the likely result will be higher government debt now at nearly $35.8 trillion and increasing nearly $3 trillion per year under both parties. Higher tax rates are also a concern among many investors, especially because individual tax rates are still quite low by historical standards. This emphasizes the importance of proper tax planning, ideally with the help of a CPA or tax professional, along with a trusted advisor, as investors look toward retirement.

The bottom line? While many investors are nervous about the impact of the presidential election cycle of Harris vs Trump on the economy and markets, history shows that presidents often receive too much credit and blame for long-term economic outcomes. Investors should vote at the ballot box and not with their portfolios in the coming months.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.