“Time is on my side” -Five Valuable Words for Investors

The four most expensive words in the English language are “This time it’s different,” according to Sir John Templeton from his “16 rules for Investment Success” published in 1933. The most valuable five-word antithesis to this may be “Time is on my side,” famously covered by the Rolling stones a few decades later in 1964.

“This time is different” is a ubiquitous phrase with over 15 billion google search results. Yet it could be extrapolated in two different ways when it comes to human behavior and market history. To paraphrase Sir Mick Jagger, “you can’t always get what you want, but If you try sometime – you find overtime – you may get what you need.”

Human Behavior

Saying “this time will be different” could mean that you expect a future bubble not to burst or that every crash will lead to the final apocalypse. This maxim also goes along the lines that “those who fail to learn from the past are doomed to repeat it.”

Both statements seem to be true about our tendency to believe we won’t make the same mistake again and that somehow what’s occurring in the present is completely unique for the market and economy to recover. It’s a form of self-delusion and, sometimes, mass-delusion, and it has been a major contributing factor to many of our worst financial disasters and personal losses.

Perhaps this time is ALWAYS different, as every crash is unique like a snowflake, but this time is NEVER different as studies show investors continue to get very emotional with their savings from ominous headline news to severe market swings and end up making poor short term decisions such as going to cash at exactly the wrong time.

When volatility hits and “you can’t’ get no satisfaction,” perhaps tune- down the Armageddon headline news and tune- up some Stones if you are properly diversified.

With fear, we seem to forget we are investing for a time frame of perhaps many decades into the future and end up making dysfunctional short-term moves. Knowing the past bear markets as well as their swift rebounds (as we saw over the past six months as America slowly reopened) (see below) are both key to staying calm and disciplined.

The COVID19 led crash and man-made recession from the quarantine is truly a unique black-swan event. Unlike prior crashes, this existential event from China hit the world hard like an unplanned nuclear disaster, as we saw in Fukushima initiated by the 2011 Tōhoku earthquake and tsunami.

COVID19 may truly be a “book-end” event, meaning that it started with a pandemic and will hopefully end with a vaccine. Yet, as we mentioned in many past blogs, the quarantine may forever change work, education, retail, travel, sports and entertainment.

Jon here. For long-term, disciplined investors, there is no “sympathy for the devil” or queasy stomachs for investors when faced with turbulence ahead. The answer to uncertainty and market volatility isn’t to jump in and out of the market. Instead, it’s to stick with a well-balanced, “all-weather” diversified portfolio that can weather current and upcoming storms.

Markets 2020

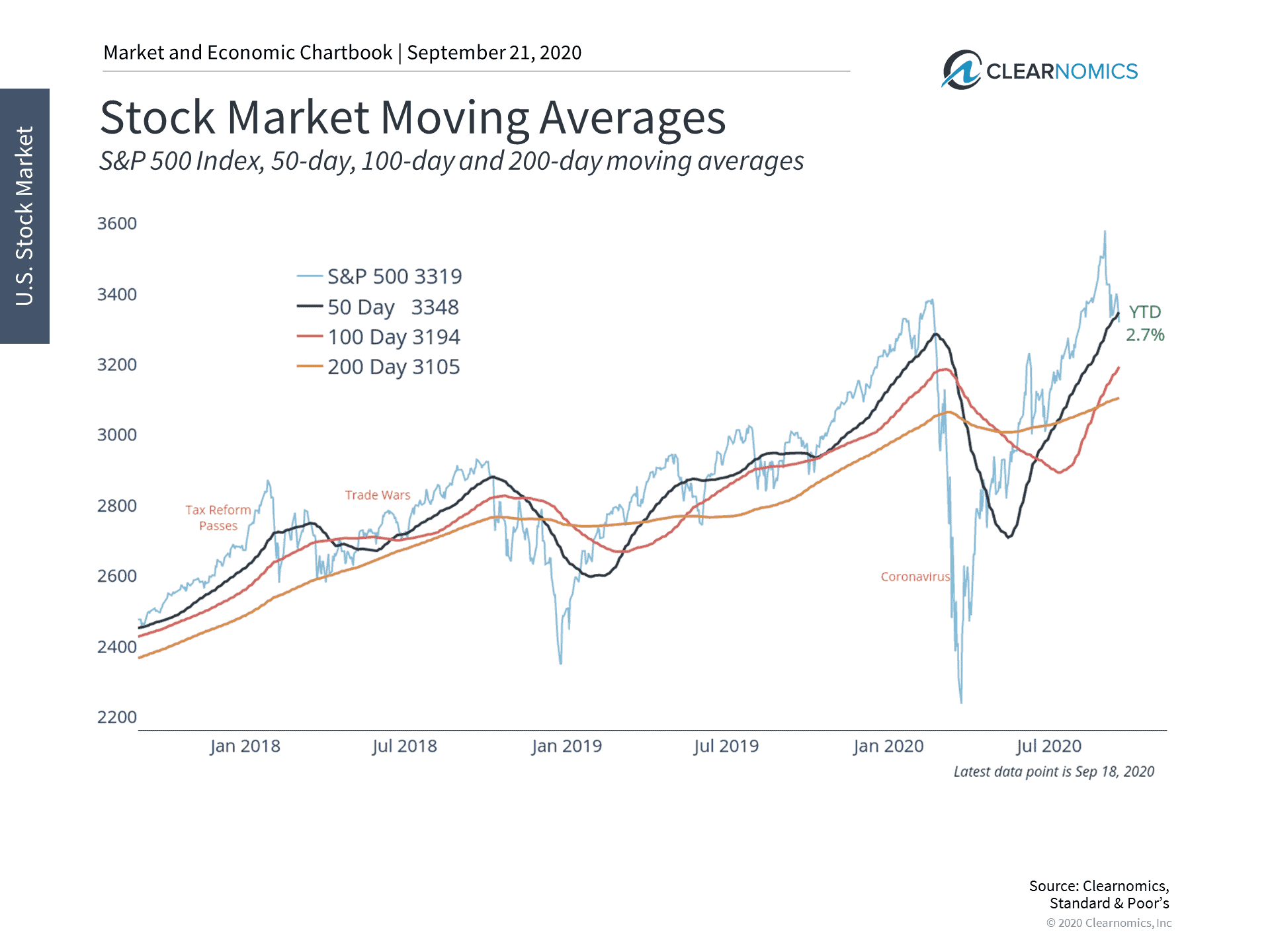

After a historic six-month rally, the stock market has fallen almost 10% from its all-time high at the beginning of September. (see below) This pullback may be the result of many factors including the on-going pandemic, economic uncertainty, tech stocks, the upcoming presidential election, fight over the Supreme Court and more.

It’s important to remember that markets are subject to periods of uncertainty with selloffs in extreme conditions fueled by humans as equally well the robot “quants” machine algorithms that are reading tweets and headline news while you were sleeping.

The recovery leading up to the recent market pullback was the fastest in history. Although the S&P 500 fell 34% from mid-February to late March, (see below) it first recovered its year-to-date losses in June and then all of its losses in August. The speed of this recovery, which occurred for many reasons including the reopening of the U.S. economy, was a surprise for many investors. Historically, recovering from a bear market decline requires 2 years or more.

This episode serves to highlight that stock market recoveries can happen quickly and unexpectedly – even as investors are still focused on the past. Perhaps the best example was the market bottom in March 2009. Few investors believed that stocks would ever recover. At best, many believed that there might be a “double-dip recession.” At worst, it would take a decade to rebuild the global financial system. With the benefit of hindsight, those with the discipline to stay invested not only benefited from the early stages of the recovery but from steady returns over the next decade despite a variety of crises.

Time is on My Side

Sound Investing truly is about your “time in the market” and not “timing” the market. This is not to say that the stock market always recovers quickly after every pullback. Instead, the point is that investors with a long-time horizon can afford to look past short-term uncertainty.

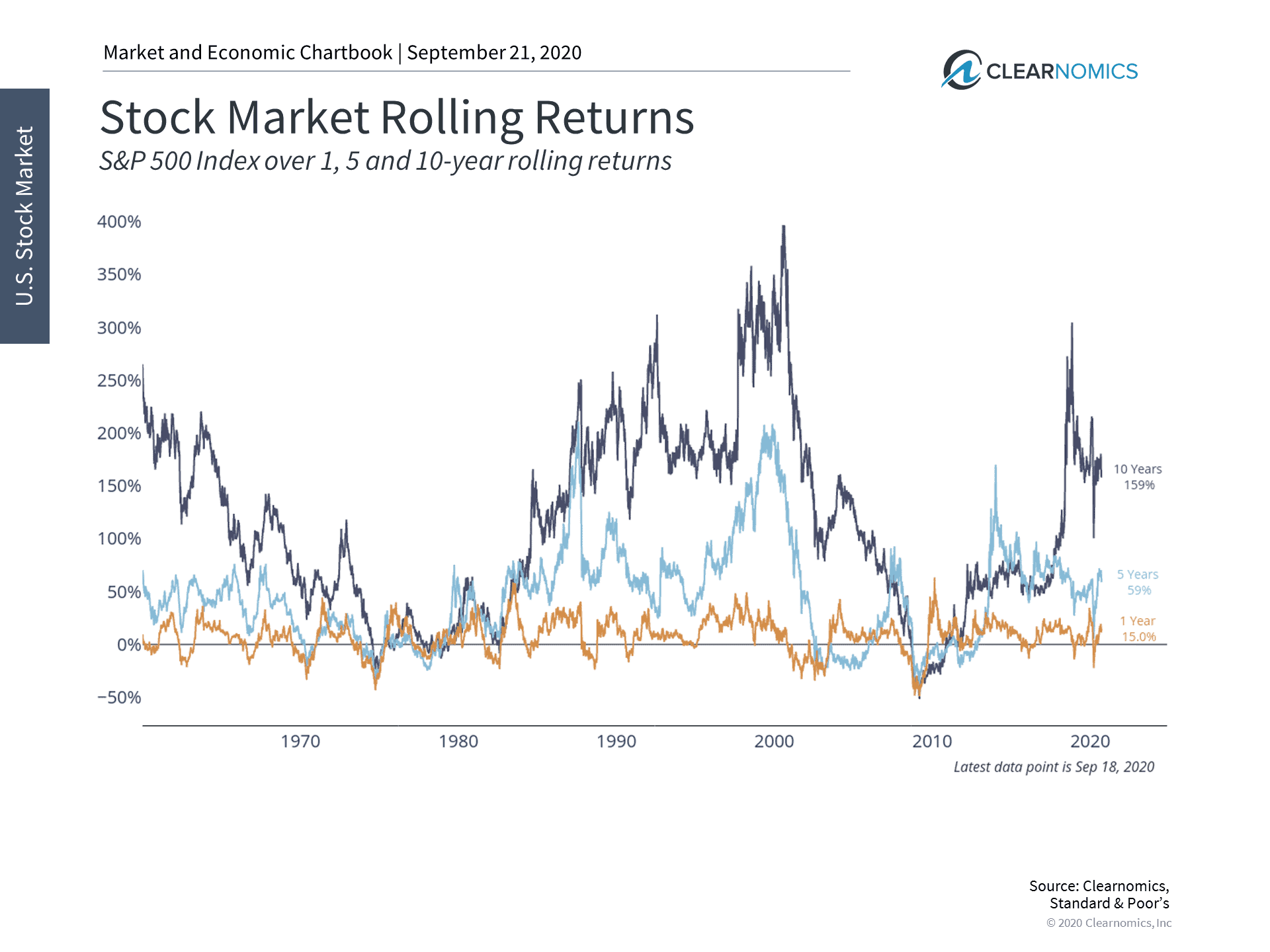

Investors who focus only on one-year rolling periods will find that the stock market is quite often negative. Extending that horizon out to five years improves the odds immensely. Over ten-year horizons, there are only a handful of times since the Great Depression when the stock market was underwater. Over twenty-year horizons, there are exactly two periods: the Great Depression and the Global Financial Crisis. (see below) Holding a properly diversified portfolio of stocks and bonds improves the odds further.

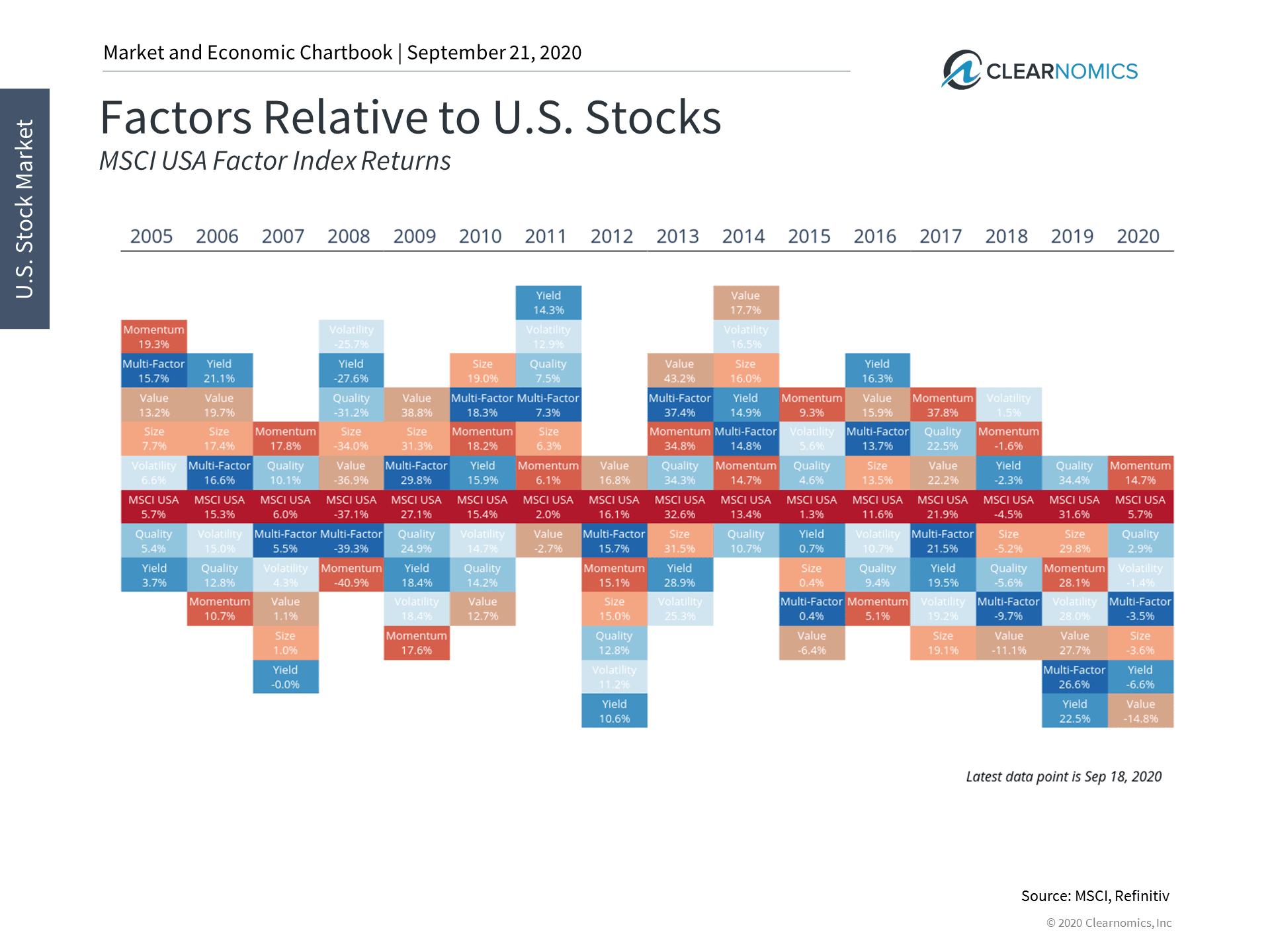

Under the hood, this year in particular has been driven by one important factor: momentum. (see below) Although the term “momentum” can take on different meanings, it’s usually the idea that stocks or groups of stocks that are rising might continue to rise. It’s clearly been the case that certain stocks performed well throughout the COVID-19-induced economic lockdown and then continued to do so. The momentum factor has risen almost 15% this year, compared to the value factor which has fallen by the same amount.

However, just like the overall market, factor performance can turn on a dime. Another benefit of long-term investing is not having to go all-in on a single factor, sector, style, or other subset of the market. Over time, diversified portfolios with tilts toward attractive areas can benefit from the ebbs and flows of many parts of the market. Trying to time the market due to short-term events or periods of turbulence can just as often backfire.

Thus, investors ought to remain disciplined and focus on the long-term recovery in markets and the economy. Below are three charts that highlight the importance of staying invested amid today’s uncertainty.

1 Stocks have fallen from their recent all-time highs

The stock market recovered quickly from its bear-market decline earlier this year. In fact, the S&P 500 accelerated as momentum and growth stocks outperformed. The market has since pulled back but this is neither unexpected nor unwelcome for long-term investors.

2 Historically, longer perspectives improve the odds of success

Investors who focus on longer time horizons often have better chances of success. Over one-year timeframes, the stock market is in the red quite often. However, this improves dramatically over five-year horizons. Those who can look even further – to ten or twenty years – without worrying about day-to-day or week-to-week volatility have historically done much better.

Momentum has driven the markets this year

The stock market has been driven by momentum stocks this year, a fact evident to anyone who has followed tech stocks and other industries that have done well in the wake of the COVID-19 pandemic. However, factor performance can change over time. It’s more important that investors stay focused on their financial plans rather than chase returns or overreact to short-term pullbacks.

The bottom line? Investors should continue to stay disciplined rather than overreact to recent market events.

For more information on our firm please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.