This Time is Different? 3 Reasons to be Thankful

It’s no secret that 2020 has been a difficult year for everyone. Whether you or someone you know has been affected by COVID-19, the economic downturn due to the nationwide shutdown, heightened stock market volatility, social distancing requirements and other challenges, most people will look forward to putting this year behind them.

However, even as the pandemic rages on and uncertainty grows, there are many reasons for investors to be thankful this Thanksgiving holiday weekend. The economy is recovering, the Dow Jones market index DJIA decisively broke through a record high of 30K this week, and staying the course in one’s diversified portfolio has paid off.

There has never been a better reminder and lesson in 2020 that indulging less headline news while keeping personal feelings and predictions separate from long-term investment plans helps to best achieve financial independence. Most eloquently said by Economist Edgar Fiedler, “he who lives by the crystal ball soon learns to eat ground glass.”

This Time is Different

The four most expensive words in the English language are “This time it’s different,” according to the famous maxim by Sir John Templeton. “This time is different” is a ubiquitous phrase with over 16 billion google search results. Yet it could be extrapolated in two different ways when it comes to investing between human behavior and market history.

Perhaps this time is ALWAYS different, as every “black-swan” event and stock market crash is unique like a snowflake, but this time is NEVER different as national studies continue to illustrate year after year that individuals of all ages get very emotional with their investments at exactly the wrong time and end up greatly underperforming the markets and their own target return goals over time.

If you hear the headline news in the morning on your way to work and think “maybe I should sell everything and buy a bigger mattress,” just recognize it’s either too late or a bad decision. While COVID19 headlines may spark panic, and market swells may be substantial, they can be “counter-balanced” in a strategically diversified portfolio.

Jon here. In many instances, an investor’s portfolio “ailment” leading to financial demise may be due more to being “over-weight” in stocks or poor market timing than the COVID-19 virus headlines causing the extreme selloff. Staying invested, disciplined and diversified with one’s portfolio has been a smart approach and highly helpful to manage volatility – like wearing a face mask in public to help reduce risk.

3 Reasons to be Thankful

At the start of the year when COVID19 was discovered, it was unclear what its eventual impact would be. This naturally led to a sense of fear and even paranoia for public health officials, policymakers and investors. With limited knowledge of the virus and few tools to combat it, many parts of the country were forced to suddenly shut down despite the personal and economic consequences.

Today, 8 months after the initial shutdown orders, much more is known about how the virus spreads and how to treat the disease, with multiple vaccines in the works. Much of the country is experiencing a “second wave” and there is a still a tragic loss of human life. However, death rates have not accelerated alongside new cases, and many parts of the economy have been stable and growing throughout this period. Although we are not out of the woods yet, many of the worst-case scenarios have been avoided.

The challenge of balancing public health and economic growth is what has kept policymakers, business owners, executives and investors up at night. Fortunately, the experience since the summer has shown that much of the economy has been resilient to COVID-19 and the shutdown. Overall, GDP has bounced back at a rapid pace after a historic decline in the second quarter. Many jobs have been recovered and many businesses have adjusted to remote or socially distanced work. This is certainly a reason for investors to be thankful as outlined in our three charts of the week:

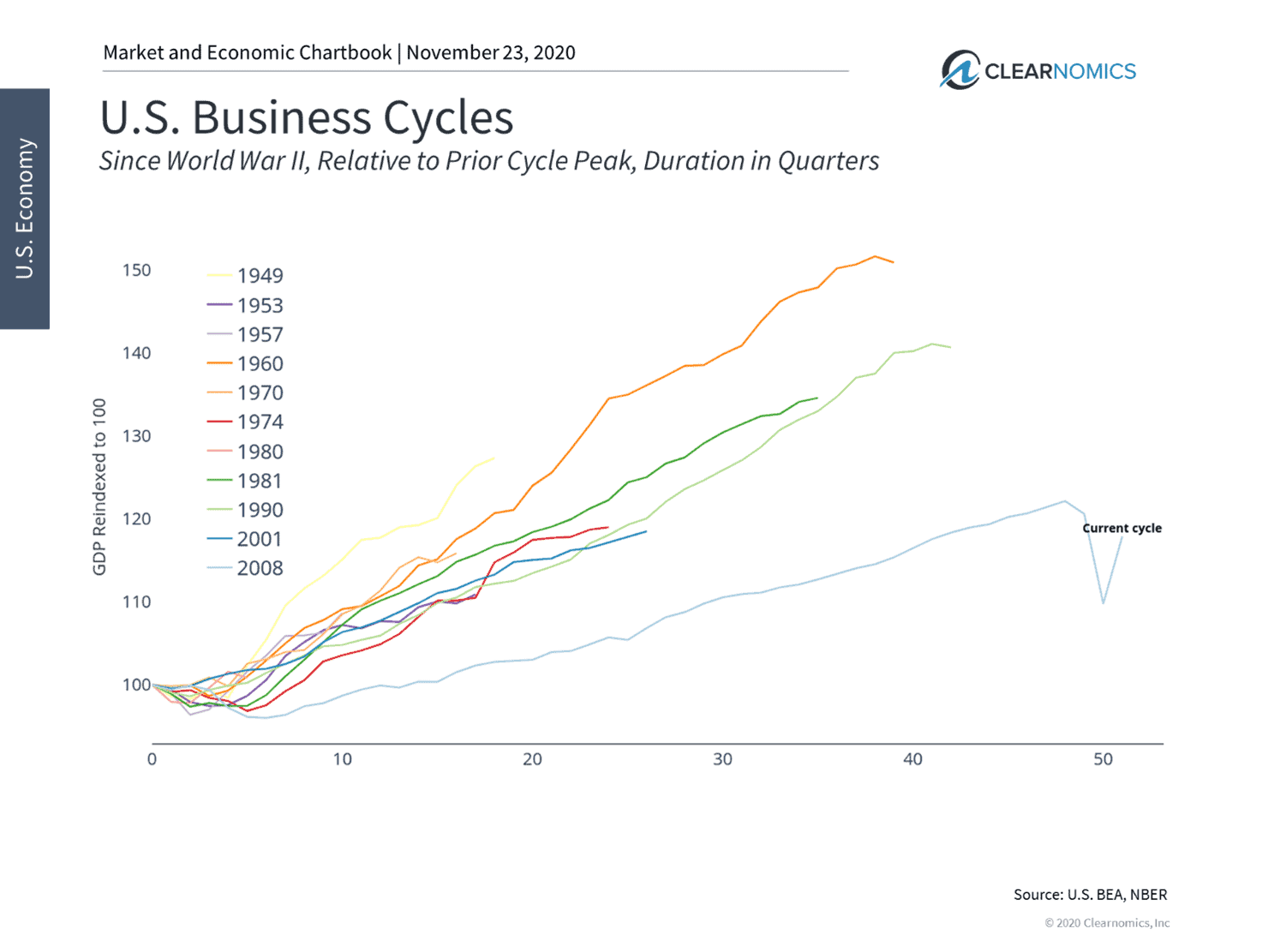

U.S. Business Cycles

In particular, the top market concern was that the shutdown would result in a downward spiral in activity and credit as the dominos began to fall. This was the case during the Great Depression when slowing growth was compounded with tightening credit conditions and poor fiscal and monetary policy. The stock market’s sudden decline earlier this year anticipated this possibility.

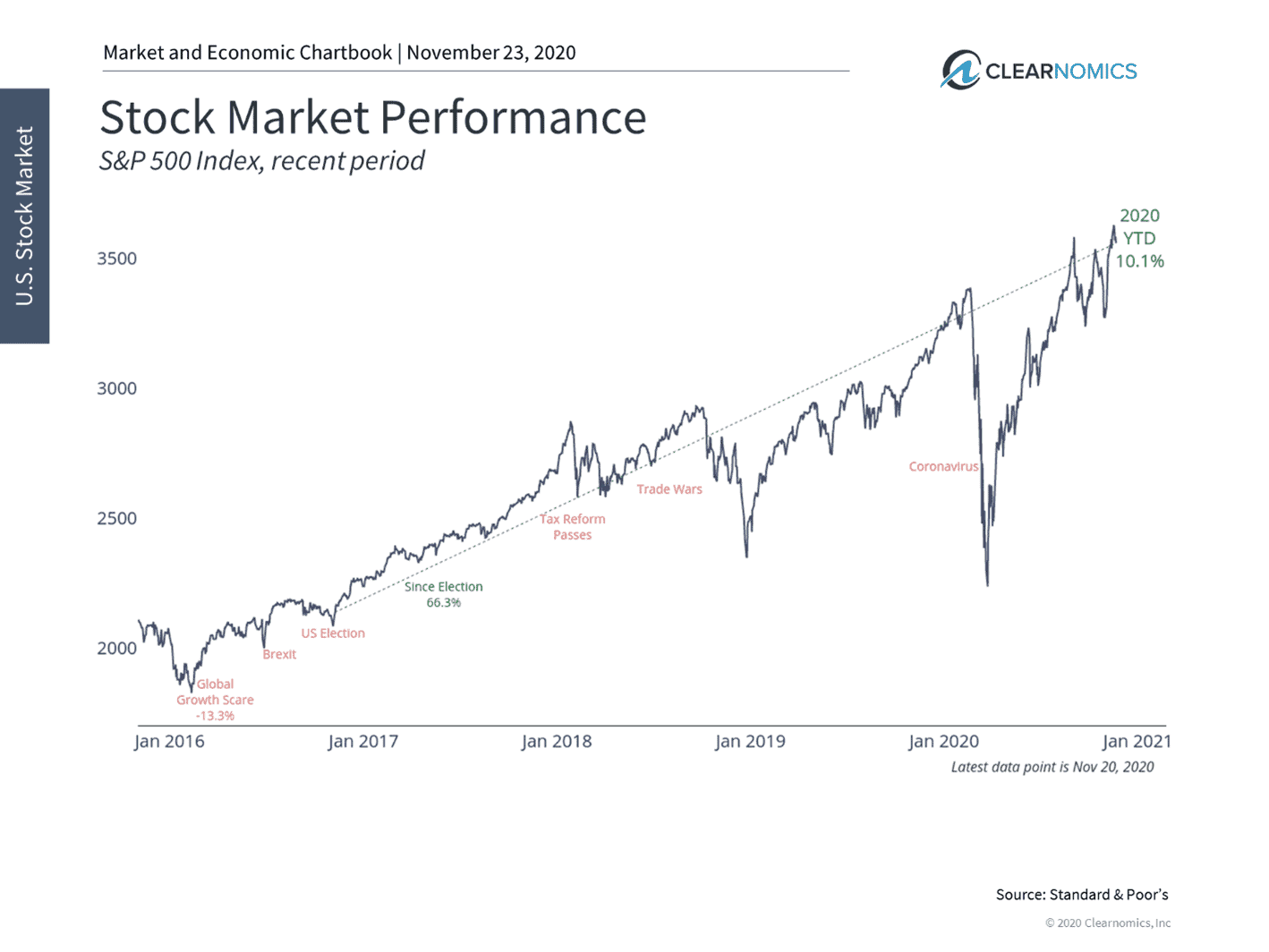

Fortunately, this outcome was avoided as the economy proved resilient, Congress passed the CARES Act, and the Fed activated emergency stimulus measures. So, while it appeared that the stock market recovery was “out-of-sync” with the economy, many investors were reacting to the stabilization in economic growth. The fact that the stock market has gone on to reach new highs is another reason for investors to be thankful.

Stock Market Performance

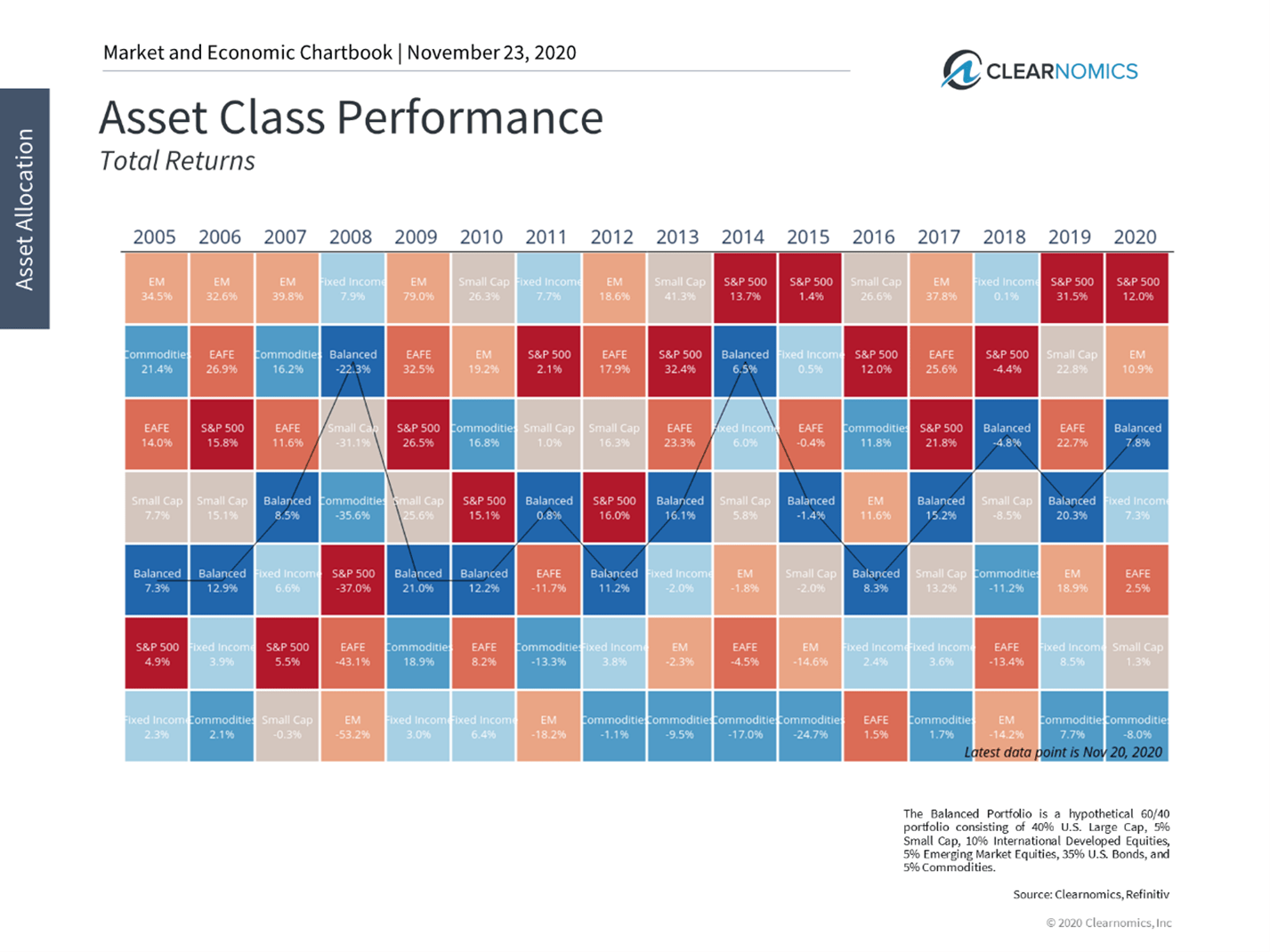

2020 has been further proof that staying patient, invested and diversified are the best ways to manage uncertainty – even when it involves a once-in-a-century pandemic. Balanced portfolios (see below) helped investors to ride out the storm during February and March, and then helped to capture upside during the subsequent rally.

Asset Class Performance

The bottom line? While this time is always different and there will no doubt be challenging times ahead, disciplined investors can take solace in the fact that they persevered through a tough year from health to financial setbacks. Keeping one’s personal fears and concerns separate from long-term plans is still the most important principle to help achieve financial independence over the long run.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.